Company Overview

General Electric Company (GE) is an American multinational founded in 1892 with headquarters in Boston, Massachusetts. The company is one of the largest industrial giants in the world. It has many divisions such as aviation, power, healthcare, renewable energy, digital industry, venture capital and finance, and additive manufacturing (Gryta & Mann, 2020). The company was ranked 33rd largest in the US in the fortune 500 in gross revenue in 2020 (Gryta & Mann, 2020).

In 2011, GE was in the top 20 of the US’s most profitable companies, but the situation has changed since then. GE had total assets of 253.542 billion dollars as of 2020 (Gryta & Mann, 2020). The company had $75.62 billion in revenue, an operating income of $5.197, and a net income of $5.23 billion (Gryta & Mann, 2020). GE also had total equity of $35.55 billion (Gryta & Mann, 2020). These are staggering figures that illustrate the might of GE.

GE has many divisions that engage in a wide range of services; its power segment offers products and services related to the energy sector, such as gas and steam turbines, power generation services, and generators. The renewable energy division concentrates on wind turbines, hydroelectric power solutions, offshore wind turbines, hardware and software solutions, high voltage equipment, and blades for onshore and offshore turbines (Gryta & Mann, 2020). GE’s aviation division provides aeronautical products and services such as aircraft engines, turboprops, maintenance, repair services, overhaul services, parts replacement, additive machines, and engineering services (Gryta & Mann, 2020).

Its healthcare division is involved in healthcare products such as digital imaging, patient monitoring, digital solutions, diagnostics, biopharmaceutical, drug discovery, and performance enhancement solutions. The capital division is involved in leasing and financing of aircraft, engines, and helicopters and providing financial and underwriting services. GE has had problems over the past decade and has done considerable restructuring, including appointing a new CEO and selling some of its segments to generate cash.

Graphical Representations of DataA Scatter Plot of Stock Highs Against Time

The above scatterplot was obtained by copying ‘Date’ and ‘High’ columns to a separate sheet for organizational purposes; after copying and highlighting the data, it revealed a box at the bottom right corner with chart options. On the Charts tab, the ‘more’ option was clicked followed by the XY Scatter option. The action created a scatter plot with Excel’s default settings, but adjustments could be made. For example, since the lowest value in the dataset was 5.66, the minimum for the vertical axis was adjusted to 4. The chart above shows an uptrend in GE’s stock price having increased from last year’s lows.

A plot of Low vs. Time

The above scatterplot was obtained by copying ‘Date’ and ‘Low’ columns to a separate sheet for organizational purposes. After copying, the data were highlighted, which revealed a box at the bottom right corner with options for charts. On the Charts tab, the ‘more’ option was clicked, and the XY Scatter option was chosen. The action created a scatter plot with Excel’s default settings, but adjustments were made on minimum figures for the vertical axis. The data above shows an uptrend in GE’s stock price from last year.

Histogram for Adjusted Daily Closing

The first step was to select the adjusted close column into a separate sheet (not necessary, just organizational). A minimum and maximum values were calculated from the data using Excel’s max and min formulae. The next step was to create the bins arbitrarily from the min and max values. Data analysis on this histogram was obtained by opening the downloaded excel document then copying the adjusted close column of the data to a separate sheet. Excel’s min and max functions were used to obtain the maximum and minimum functions from the data; this helped estimate the correct number of bins to be used.

After using discretion to arbitrarily estimate the bins, the histogram was calculated using Excel’s data analysis toolpak by clicking on the Data tab; on the analysis group, the Analysis group was clicked, histogram option selected and clicked OK. After clicking OK, a window appeared giving the option to enter the input range, the bin range, and the output range. These options were entered accordingly. The label box was also checked, and chart output was also checked, then OK was clicked. The graph shows a right-skewed distribution of GE’s adjusted close. This means that the adjusted close is not normally distributed.

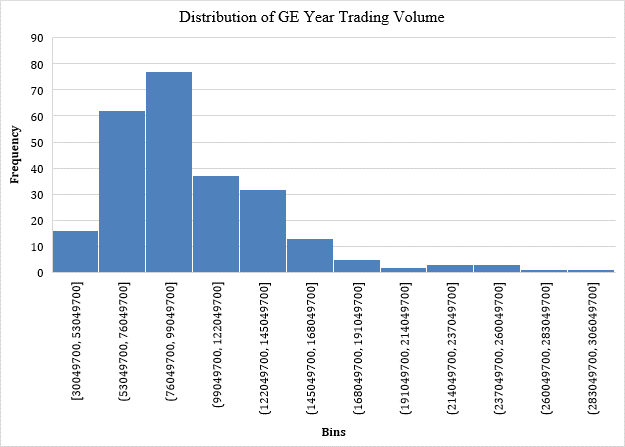

Histogram Showing Distribution of GE’s Trading Volume

Data analysis on this histogram was obtained by opening the downloaded excel document then copying the trading volume column of the data to a separate sheet. Excel’s min and max functions were used to obtain the maximum and minimum functions from the data; this helped estimate the correct number of bins to be used. After using discretion to arbitrarily estimate the bins, the histogram was calculated using Excel’s data analysis toolpak by clicking on the Data tab; on the analysis group, data analysis was clicked, histogram option selected and clicked OK.

After clicking OK, a window appeared giving the option to enter the input range, the bin range, and the output range. These options were entered accordingly. The label box was also checked, and chart output was also checked, then OK was clicked. The above result shows a right-skewed distribution of GE’s 1-year trading volume; this is because the bins with maximum frequency are concentrated on the left, leaving a lot of outliers on the right. The chart shows that GE’s trading volume is not normally distributed.

Descriptive Statistics

GE’s Descriptive Statistics Adjusted Close

Table 1: GE stock’s year adjusted close descriptive statistics (“General electric company (Ge) stock historical prices & data,” n.d.)

The data above was obtained by opening the excel file of the downloaded company data and copying the adjusted close data to a separate sheet. After copying the data, Excel’s data analysis toolpak was used to calculate the descriptive statistics by clicking the data tab, then clicking on data analysis, and choosing descriptive statistics. After clicking, a window popped with options for ‘input range,’ labels, and the varieties of outputs available. Summary statistics option was clicked and then OK. The process gave quite many result values, including kurtosis and skewness; mean, mode, median, and standard deviation were selected as shown above in the table. The above data shows that adjusted close has a close to symmetrical distribution because the three measures of central tendency, mean mode and median, are close to each other; this means few outliers that would have skewed the mean.

GE Stock’s Volume

Table 2: GE stock’s year trading volume descriptive statistics (General Electric Company (Ge) Stock Historical Prices & Data – Yahoo Finance, n.d.)

The data above was obtained by opening the excel file of the downloaded company data and copying the volume data to a separate sheet. After copying the data, Excel’s data analysis toolpak was used to calculate the descriptive statistics by clicking the data tab, then clicking on data analysis, and choosing descriptive statistics. After clicking, a window popped with options for ‘input range,’ labels which were entered accordingly. Summary statistics output option was clicked and then OK. The results obtained were too many, including kurtosis and skewness; mean, mode, median, and standard deviation were selected as shown above in the table. The table gave way more results than the ones represented above, such as skewness and kurtosis.

References

General electric company (Ge) stock historical prices & data (n.d.). Yahoo finance. Web.

Gryta, T., & Mann, T. (2020). Lights out: Pride, delusion, and the fall of General Electric. Houghton Mifflin Harcourt.