Introduction

Nowadays, the organizations and businesses tend to use the unified accounting system to ease the principles of reporting standards and determine the rationale for the results. In this instance, International Financial Reporting Standards (IFRS) is the accounting transactions and reporting criteria, which were introduced by International Accounting Standard Board to ease the international operations and ensure their compliance with the legal system (Alexander, Britton, & Jorissen, 2007).

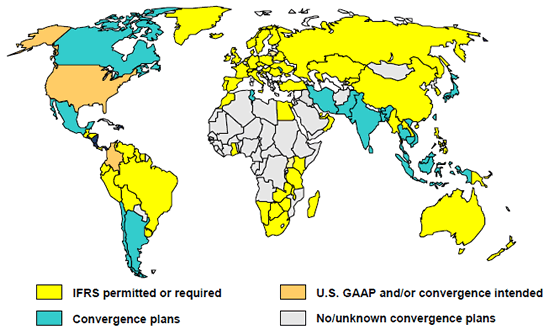

The coverage of IFRS concepts is present worldwide, as it is one of the most understandable and easy-to-use accounting principles currently present (Alexander et al., 2007). Meanwhile, the utilization of the notions and principles of IFRS is compulsory for Turkey, Australia, Brazil, Canada, and the members of the European Union (Guerreiro, Rodrigues, & Craig, 2014). However, the United States of America uses its own accounting framework, GAAP, which differentiates it from the rest of the world while causes some difficulties in international transactions (Guerreiro et al., 2014). Despite the initial positive intentions of IFRS, its theories have been under the vehement discussion due to the complexity of its principles and the existence of the negatives outcomes and consequences of the issue.

Consequently, the primary goal of the paper is to determine the understanding whether IFRS is an applicable and systematized approach to ensure the relevance and legal compliance of the accounting principles. In this case, the advantages and disadvantages of IFRS are discussed while using practical and theoretical dogmas and discovering the accounting system from practitioner and scientific perceptions. Furthermore, a comparison with GAAP is critical attribute to determine the beneficial nature of IFRS and its concepts, and expert opinion is provided as a basis for understanding. In the end, the conclusions are drawn to summarize the primary findings of the paper and determine the nature of IFRS is advantageous for the accountants, governmental authorities, and companies.

Brief Discussion

Initially, IFRS was meant to unify the accounting reporting concepts and eliminate the confusion associated with the representation of the documentation (Alexander et al., 2007). Furthermore, it was established as one of the approaches to accumulating the development of the international trade, as the unity of the reporting standards eases the presence of FDIs and global exchange of goods and services (Alexander et al., 2007).

It remains apparent that the initial introduction of the system was positive, as the existence of a plethora of the financial reporting standards while operating in the foreign market causes complication to the exchange procedures and selling opportunities. The unified nature of IFRS accounting principles ensures the presence of the extended possibilities for the external operations while having a positive influence on the understanding of the organizational value while comparing it with the other companies.

Nonetheless, the complex nature and flexibility of the international accounting principles have been under a vehement debate while decreasing the adoption of IFRS in the various countries around the world (Cai, Rahman, & Courtenay, 2008).This matter could be stated as one of the critical sources of the problems, which affect the organizational profitability and solvency (Nouri & Abaoub, 2014). It remains evident that the active utilization and adoption of IFRS are often viewed as one of the sources of issues with the deterioration of the efficiency of the earnings management while creating difficulties in obtaining income and optimizing the financial procedures (Cai et al., 2008).

Meanwhile, it provides the financial authorities with the extended variety of freedoms and alternatives related to decision-making while being one of the drivers for the rising possibility of manipulation of the accounting and financial statements (Nouri & Abaoub, 2014). These controversies are the primary reasons for the development of the parties with dissimilar viewpoints about the efficiency of the system and its compliance with the legal concepts.

Furthermore, another fact which questions the positive implications of IFRS is depicted by the situation that the United States of America continues to use GAAP in spite of its insignificant scope worldwide (Lam, 2015). In this case, the reasoning for the continuation of the usage of the gap has a vehement connection to the issues mentioned above, as they have a tendency to weaken the position of IFRS in the global business environment. It could be stated that the current existence of GAAP system is the primary threat to IFRS due to the presence of the supporters of the American accounting standards and reporting principles.

Based on the factors depicted above, it could be said that positive nature of IFRS has been under a vehement discussion, as it is unclear whether it simplifies the accounting procedures and reporting principles. It could be stated that the existence of gaps while positively affecting the quality of interactions in international business emphasizes the contentious and debated nature of IFRS, which requires a profound assessment of its conceptualizations, applicability, and efficiency. The subsequent analysis of the accounting system advantages and disadvantages will assist in understanding of the actual functioning of IFRS. Meanwhile, the comparison of the principles of IFRS with GAAP has a positive influence on the profound assessment of the principles and decision-making drivers of the initial accounting system.

Advantages of IFRS

As it was mentioned earlier, it is vital to determine the beneficial and advantageous impacts of IFRS, as it will contribute to the understanding of the advantageous effect of the selected accounting principles on the management of the global and national economies. It remains apparent that this analysis and assessment is critical due to the possibility to discover the positive nature of the set accounting concepts. It could be said that the evaluation of the advantages has a beneficial impact on the understanding of the functioning and conceptualization of IFRS while highlighting its beneficial influence on the organizations and companies.

It could be stated that one of the advantages is the minimization of confusion while using different reporting standards and diverse countries and regions. Nowadays, the global trade is one of the most important attributes of the modern business world, and the unified nature of the accounting standards lessens the complications associated with the global exchange of goods and products (Ramanna & Sletten, 2009).

In this case, the companies around the world are able to engage in buyer-seller relationships freely without spending significant amount of time on transferring and translating information from one system to another. It could be concluded that this aspect contributes to the rising priority of the usage of IFRS due to its unifying nature and ability to find the ways to share the financial information between various countries.

Furthermore, the application of the unified set of the reporting principles contributes to the differentiation and ranking of the companies depending on their indicators such profitability and liquidity ratios (Ball, Li, & Shivakumar, 2015). It could be said that this approach is achievable with the assistance of the prioritization of transparency as a key value of IFRS (Ball et al., 2015). In this case, this matter contributes to the compliance with the well-established legal system while revealing the financial statements to the general public and competitors, and this problem has connection with the possibility of ranking of the companies in the modern business world.

In the context of the presented advantage, it could be concluded that this feature of IFRS has a beneficial impact on the sufficient evaluation of the companies before the acquisition, takeovers, and mergers, and it eases the assessment of the firm’s assets, liabilities, and overall profitability with the assistance of the financial statements.

Another aspect, which can be viewed as a benefit, is the fact IFRS uses principles-based concept, and this aspect contributes to the existence of the rational decisions and logical conclusion to be applicable in the particular contexts (Guerreiro et al., 2014). It could be stated that the presence of this aspect is advantageous for the company’s flexibility, as these features have a positive influence on the decision-making process due to the availability of a vast range of alternatives associated with the financial representation of the data. Meanwhile, it could be concluded that this characteristic of the international accounting system has a positive effect on the profitability of the organization due to the possibility to select the right strategies for the financial choices while being a critical attribute in the constantly altering business environment (Guerreiro et al., 2014).

In the end, based on the factors provided above, it could be said that IFRS tends to bring unity to the accounting procedures and ease the financial transactions between different countries while having a beneficial effect on the development of the global trade. Meanwhile, it contributes to the understanding of the company’s position in comparison to the rivalry firms in the industry due to the prioritization of transparency in IFRS. Lastly, it provides the flexibility to the decision-making due to its principle-based approach. A combination of these factors emphasizes that IFRS serves its beneficial purposes, as it tends to provide favorable conditions for the cultivation and development of the aspects of global trade while complying with the constant alterations of the business environment.

Disadvantages of IFRS

Nonetheless, the drawbacks have a tendency to be present and are associated with the lack of recognition in the modern business world. In this case, the initial goal of this section is to determine and evaluate the presence of disadvantages, which can take place as a consequence of the implementation of IFRS. For instance, the United States of America currently uses GAAP as a key accounting system for reporting, and this matter is the primary reason for the elevation of the barriers for the foreign companies (Lam, 2015). It remains apparent that differences in GAAP and IFRS tend to exist while causing negativities to the company’s functioning, as the transfer or conversion from one system to another is a costly procedure. Lastly, the presence of several accounting frameworks creates the difficulties in the flow of the global transactions, but IFRS still has leading positions in the world (see Figure 1).

Despite the fact that the flexibility was mentioned one of the advantages previously, its concepts can be related as a disadvantage due to the elevated possibility of manipulations of the accounting and financial statements, which can be used in one’s favor (Nouri & Abaoub, 2014). It could be said that the critical adverse attribute of this matter is the legal nature of the manipulations as the presented alterations could be referred to as the gaps of IFRS.

In this case, IFRS is highly criticized for these matters, as it is a primary cause of the complication while understanding and applying the concepts of accounting. In this case, it is critical to provide the specific examples of the manipulations, which tend to occur in the business world on the regular basis to understand the drawbacks of IFRS with the assistance of the examples. One of the instances of the manipulation with goodwill while taking advantage of IFRS accounting principles, as this financial instrument is critical for the portrayal of the firm’s value during mergers and acquisitions (Sakakibara, Uchino, & Ueno, 2010). This issue creates a wrongful perception about the acquired organization while increasing the vulnerability of interactions and sufficient planning of the actions in future.

Furthermore, it was revealed that the compulsory transfer to IFRS has an adverse effect on the profitability of the organization while comparing to the application of the national accounting standards in the past (Nouri & Abaoub, 2014). This matter was depicted while observing the financial changes in the French organizations, as the application of this system increased the transparency and affected adversely the revenues and profits (Nouri & Abaoub, 2014). It could be stated that the switch to IFRS has an adverse influence on the earnings management while creating difficulties for the development of the organization and its efficiency.

Additionally, the expensive nature of the application could be regarded as another drawback, as for SMEs, the implementation of IFRS is vehemently expensive (Harper, Leatherbury, Machuca, & Phillips, 2012). Consequently, in this case, the small and medium firms, which are required to switch to IFRS, will experience a substantial loss of profits due to the increasing intensity of costs associated with the establishment of IFRS. The costly application of the accounting system questions its universality while increasing the vulnerability of the small companies and becoming one of the reasons to prioritize the usage of another system.

It could be said that despite the positive intentions of IFRS, the accounting system tends to have drawbacks, which questions its stability and applicability in different situations. The high costs of implementation, high possibility of manipulation, and non-global coverage causes complications to the international trade while defining a necessity to consider these matters of paramount significance and improve the overall quality of the organizational functioning.

These attributes have to be vehemently considered due to their correlation with the current lack of implementation of IFRS principles in the modern world. Lastly, these drawbacks of the accounting system could not be underestimated while establishing and introducing new policies to improve the quality of the procedures and minimize the occurrence of the wrongful actions such as fraud and manipulation of the goodwill to portray the company from the positive angle.

IFRS and GAAP: Expert Opinion

Despite the clear assessment of IFRS as a separate accounting system and the evaluation of its pros and cons, a comparison of this accounting standards to GAAP will contribute to defining the rationale for the criticism and emphasis on the particular benefits. In this instance, this assessment will assist in understanding the justification for the lack of desire of the United States of America to switch active usage of IFRS on national and international basis.

Firstly, the criticism of both accounting frameworks has to be provided to enhance the understanding of the presence of the debate about the efficiency of GAAP and IFRS. Speaking of GAAP, it principles are often criticized and often referred to as the primary cause for the development of crisis in the United States of America (Bratton, 2004).

The auditors and other accounting specialists tend to depict that GAAP’s guidance and rules are outdated, and the current shortage of rubrics is present due to the inability to adapt to the constant modifications of the business and global trade (Bratton, 2004). It remains apparent that the existence of this drawback questions the universal application of GAAP in the international context while underlining the necessity to modify the existent accounting concepts.

Speaking of IFRS, as it was emphasized previously, its applicability and concepts are vehemently discussed in the business world. Nonetheless, some experts refer to the fact that the criticism of IFRS occurs due to the lack of the profound understanding of the concepts while causing the development of the misconception about the beneficial functioning and efficiency of IFRS (Danjou, 2013). It is apparent that this matter underlines that misunderstanding of the principles and framework might take place, and the constant analysis of the principles is a necessity.

One of the primary differences is the basis of different philosophies, as IRFS relies on the principles during the decision-making process while GAAP system strongly follows rules (Pounder, 2009). Consequently, GAAP has well-developed principles and dogmas while offering a particular mechanism for the decision-making and critical thinking processes. In this case, this matter could be considered as one of the adverse consequences of GAAP, as it eliminates the flexibility of the system, but it decreases the possibility of the manipulations.

In the context of IFRS, the presence of litheness has a positive impact on the decision-making alternatives and opportunities while accumulating an increase in the misuse of the accounting principles (Wright & Hobbs, 2010). As it was mentioned earlier, this attribute could be regarded as one of the drawbacks and advantages of the accounting system simultaneously. On the hand, GAAP’s ability to strictly follow the rules increases its reliance while the utilization and application of IFRS enhance the possibility of the options.

Another example is the differences in the reporting standards, as, for instance, the LIFO inventories are not applicable under IFRS while GAAP allows the reporting of these concepts (Delaney & Whittington, 2010). It remains apparent that these matters tend to cover other concepts such as valuations and reporting of cash flow (Delaney & Whittington, 2010).

In the context of IFRS, the availability to make alterations could be considered as one of the substantial drawbacks, as the subsequent modifications might have an adverse impact on the financial portrayal and image of the organization. Meanwhile, changes to written down inventory are prohibited under GAAP while IFRS contributes to the understanding that the variations can be made even after the overall reporting (Delaney & Whittington, 2010). It remains evident that the availability of the inventory deviations underlines the flexible nature of IFRS while depicting GAAP’s rules-based basis simultaneously.

Based on the comparison provided above, it could be revealed that both of the accounting systems (IFRS and GAAP) have their own drawbacks and disadvantages due to the particular issues associated with their application. In this case, it could be said that reliance on different philosophies is the primary definer of the existence of changes in IFRS and GAAP, as this matter defines their levels of flexibility and presence of manipulative nature.

Conclusion and Recommendations

In the end, it could be said that the research paper provided a clear understanding of the application and definition of IFRS while determining its coverage and description of the concepts. Meanwhile, it was depicted that the concepts of IFRS tend to be under the vehement discussion due to the complex nature of the system and a significant number of the nuances, which have to be considered before the utilization of the concept. Meanwhile, the issues with IFRS were reflected and portrayed with the assistance of the lack of adoption of these accounting principles and dogmas in the world due to the adverse influence on earnings management.

It could be stated that the primary advantages are associated with transparency, easiness of the decision-making during acquisitions and mergers, flexibility of the application of the principles of the system, and increased availability of the international trade. Despite a substantial number of advantages, IFRS has a tendency to have drawbacks, which are related to the absence of the universal application of the concepts in different countries, availability of manipulations of financial data, and costly implementation for SMEs. In this case, the revealed disadvantages could be discovered as a basis for the development of the new policies, which has a beneficial impact on the IFRS’s compliance with the legal principles and contribute to increase in scope of the coverage of the assessed accounting principles.

Furthermore, the comparison of the principles of IFRS with GAAP revealed that the differences tend to exist due to the different perceptions of accounting, values, and reporting standards. In this case, primary difference is the decision-making philosophies, which has a critical impact on the flexibility of the reporting systems. It could be highlighted that GAAP’s rules-based concepts have a positive effect on the elimination and control of the financial manipulations, as no changes are allowed after the written-down.

Meanwhile, the principles-focused nature of IFRS concepts increases the flexibility and increases the alternatives of the decision-making processes, but its suppleness upsurges the occurrence of the manipulations and fraud. It could be said that this dissimilarity is the critical determiner of the inability to distinguish between the beneficial natures of each reporting standards approaches, as both of the frameworks have their own pros and cons associated with the international functioning, global transaction, and international coverage.

As for the recommendations, it could be said that the principles and concepts of IFRS have to be improved to ensure the compliance with the legal principles and decrease the possibility of financial manipulations. In this case, some of the principles of GAAP have to be borrowed and adapted in the context of IFRS, as this implementation of this novelty will contribute to declining of the percentage of the financial manipulation. One of the solutions to this issue is the proposal of the restrictions to the particular actions of IFRS. It remains evident that this matter will decrease the flexibility, but this innovation will enhance the compliance of the reporting standards with the law. It could be stated that a particular attention has to be paid to the possibility to make changes after they are written down, as the occurrence of this issue is the primary source of manipulations.

References

Alexander, D., Britton, A., & Jorissen, A. (2007). International financial reporting and analysis. Stamford, CT: Thompson Learning.

Ball, R., Li, X., & Shivakumar, M. (2015). Contractibility and transparency of financial statement information prepared under IFRS: Evidence from debt contracts around IFRS adoption. Journal of Accounting Research, 53(5), 915-963.

Bratton, W. (2004). Rules, principles, and accounting crisis in the United States. European Business Organization Law Review, 7(36), 6-35.

Cai, L., Rahman, A., & Courtenay, S. (2008). The effect of IFRS and its enforcement on earnings management: An international comparison. SSRN Electronic Journal. Web.

Danjou, P. (2013). An update on International Financial Reporting Standards (IFRSs). Web.

Delaney, P., & Whittington, R. (2010). Wiley CPA examination review, outlines, and study guides. Hoboken, NJ: John Wiley & Sons.

Guerreiro, M., Rodrigues, L., & Craig, R. (2014). Changing from a rules-based to principles-based accounting logic: A review. Australian Accounting, Business, and Finance Journal, 8(2), 110-120.

Harper, A., Leatherbury, L., Machuca, A., & Phillips, J. (2012). The impact of switching to International Financial Reporting Standards on the United States businesses. Web.

Jnet: Accounting systems in the world. (2009). Web.

Lam, H. (2015). Why does U.S. continues to use GAAP and will it ever converge to IFRS. Web.

Nouri, Y., & Abaoub, E. (2014). Accounting manipulations and IFRS: Evidence from French companies. International Journal of Economics and Finance, 6(11), 1916-1928.

Pounder, B. (2009). Convergence guidebook for corporate financial reporting. Hoboken, NJ: John Wiley & Sons.

Ramanna, K., & Sletten, E. (2009). Why do countries adopt International Financial Reporting Standards? Web.

Sakakibara, G., Uchino, S., & Ueno, T. (2010). Accounting for goodwill and manipulation. Web.

Wright, C., & Hobbs, S. (2010). Impact and implications of IFRS conversion or convergence. Bank Accounting & Finance, 21-28.