Executive Summary

Business decisions within a particular segment of a market, output, and pricing determine the components of a market structure. Hence, it is crucial to explore monopoly, monopolistic competition, oligopoly, and perfect competition when discussing market structure. In a particular market, technology, demand, and supply as well as the market structure are major determinants that affect sales and profitability.

The management of a business entity should be able to make decisions on whether the current business portfolio is worth it. Major considerations for managers include the pricing, output levels, and whether the business is sustainable and competitive.

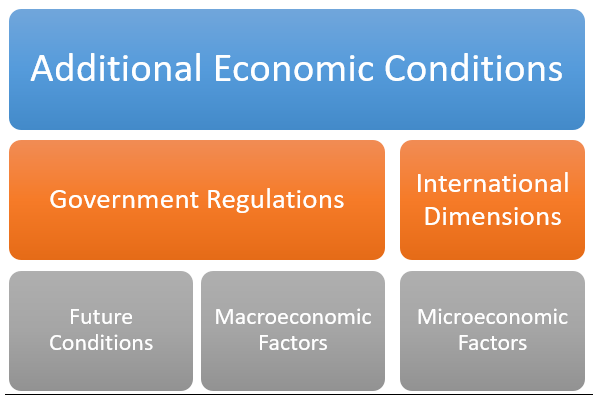

Both macroeconomic and microeconomic factors should be additionally considered by managers of firms in order to make the final decision on profitability. Future conditions, international factors, and government laws and regulations can also determine the sustainability of a business entity.

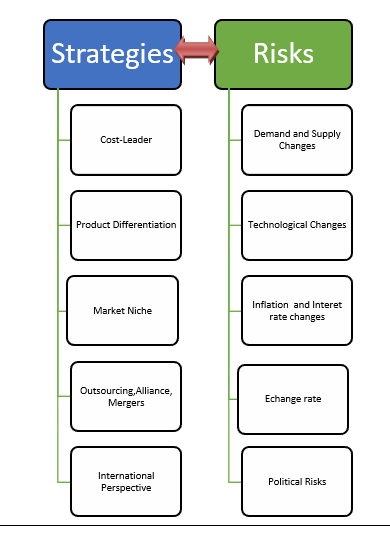

Maintaining a competitive advantage in the marketplace requires rigorous adoption of strategies that can yield positive results. These include international factors, outsourcing, mergers, alliances, market niche, product differentiation, and cost-leadership. On the other hand, these strategies usually accompany business operating risks such as unpredictable inflation rates, competition, changes in technology, and demand and supply conditions.

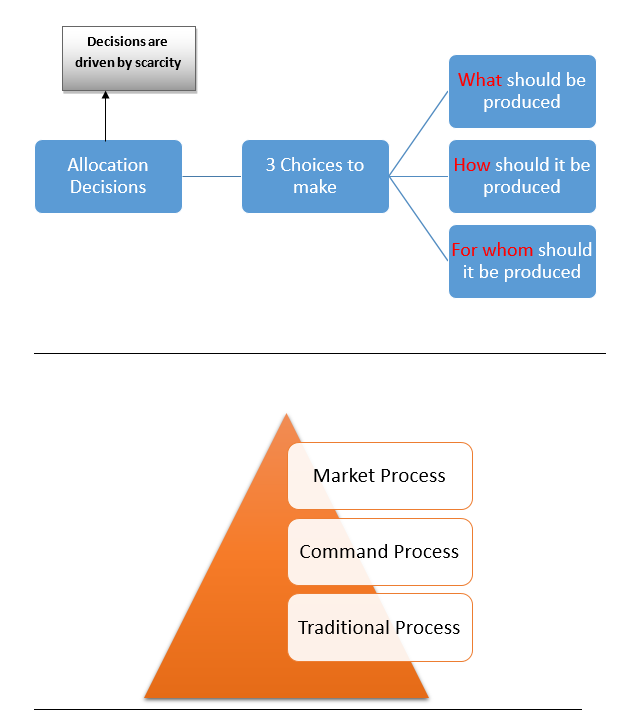

Since scarcity is a never-ending factor in any business operation, it always affects the allocation decision. Managers should inquire what a firm can profitably produce, define the process of producing it, and the target market. Finally, the market, command, and traditional processes are the three main systems that managers can use to give feedback to the questions.

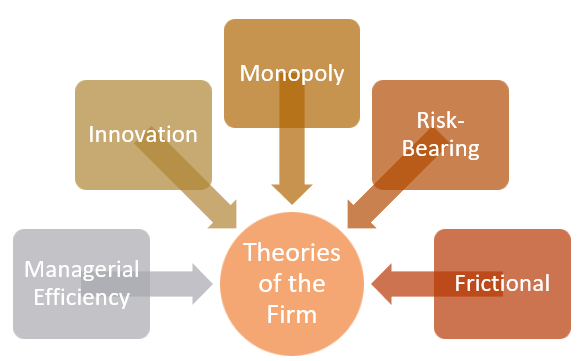

Theories of the Firm

The traditional theory argues that business organizations operate with the aim of making gains or profits. For certain organizations, this can be considered to be a fair assumption (Koch 273). Nonetheless, it cannot be an assumption for several firms.

It is perhaps vital to distinguish the various theories of profit-making in business entities. To begin with, it is expected for businesses to make ordinary profits bearing in mind that they undergo numerous risks in the course operations. In other words, entrepreneurs undergo various risks that should be compensated through normal profits.

Risk-Bearing Theory of Profit

According to this theory, risks are inevitable when running businesses and therefore should be compensated accordingly. Both effort and capital used should also be considered as part and parcel of the compensation plan.

Frictional Theory

The theory asserts that it is possible for a firm to generate either above or below normal profits. The latter scenario takes place owing to barriers to entry and exit. As a result, it becomes quite difficult for a firm to be flexible in meeting the new conditions of any given market (Stengel 253).

Monopoly Theory

Market domination is the main trigger for profitability according to the Monopoly Theory. This implies that making any significant profit is not possible if a firm lacks market dominance.

Innovation Theory

The theory asserts that innovation is a prerequisite to generate supernormal profits.

Managerial Efficiency Theory

Exceptional managerial competence is the main attribute of generating extraordinary profits.

The theories are summarized in the chart below:

Some economic pundits argue that certain organizations may prefer to sacrifice short-term gains in order to make decent profits in the future. Maximizing a firm’s value is the core reason why profitability is a major drive in business operations (Narayan 122).

The objective of maximizing the “value” of a firm goes beyond the most immediate idea of profit on short-term transactions. One must see beyond the business on a daily basis, in the medium and long term. It should be exercising to see the future flow of business. The vision that brings this value may raise very important issues to be addressed in the context of the business strategy.

A major challenge is how to take the Executive optimization decisions as they will influence the volume, times, and risks associated with the flow of expected future profits, accepted as responsible for a company’s value for shareholders.

This new business environment brings a great challenge for organizations today by responding intelligently to opportunities and threats generated by the volume and speed, increasing market, evidenced by the increase of business information cycles.

Organizations that are prepared will surely get better results and have greater chances of survival. Agility, flexibility with quality, and competence are important parameters for success (Hilletofth 205). These are essential ingredients for winning organizations.

The following are important issues that should be considered for those seeking sustainability of their businesses. These include maximizing the value of business within a business environment full of challenges, constraints, and opportunities.

- Strategic planning: Strategy as an integrated suite of choice and non-choice that will establish the positioning of the Organization within the Corporate Ecosystem must be fundamentally formulated holistically. Every initiative must be linked to strategic goals in the unfolding of planning drivers. The strategy is not something to be done in a certain period of the year, but rather an ongoing effort involving all departments of an organization (Zenger, Felin, and Bigelow 89).

- Benchmarking: Is the pursuit of best practices in the industry or service that leads to superior performance. It is seen as a positive and proactive process through which a company examines how others perform a specific function in order to improve a similar function. It is known as a systematic and continuous process of evaluation of products, services, and work processes of organizations that are recognized as representing best practices in order to compare performance and identify opportunities for improvement (Sigalas, and Economou 69). Benchmarking is one of the most useful management tools to improve business performance and achieve superiority. It is based on learning the best experiences of similar companies and helps to explain the whole process involving a great “performing” business.

- Plan Technology: The IT master plan is the establishment of foundations and guidelines that design-related needs Technologies (Decision, Information, and Automation) to ensure that the efforts made in these areas are consistent with the business strategy, policies, and organization’s objectives as a whole. The plan should provide design services that adequately respond to urgent short-term needs and long-term challenges. It should also be in the plan’s proposal to define appropriate methodologies and architectures for determining the functional requirements and processes as well as the allocation of resources necessary for its realization.

- Process Management: Organizations are made up of complex combinations of resources, policies, and rules that are interdependent and interrelated, and pursuing the same goals and performances can positively or negatively affect the outcome of an organization as a whole. The excellence of performance and business success requires that all interrelated activities are understood and managed according to a process view.

Management by the process is the management approach applied by an organization that seeks to optimize and improve the chain of its processes, designed to meet the needs and expectations of stakeholders and ensuring the best possible performance of the organization through the use of integrated systems (Canina, Palacios and Device 280).

Systems and Applications

Are software solutions supported by infrastructure designed to meet the diverse business needs extracted from the split of the Strategic Planning and Planning Directorate of Technology. These systems and applications can have a purpose to fulfill a specific area.

Works Cited

Canina, Linda, Daniel Palacios, and Carlos Devece. “Management Theories Linking Individual and Organizational Level Analysis in Entrepreneurship Research.” International Entrepreneurship and Management Journal 8.3 (2012): 271-284. Print.

Hilletofth, Per. “Demand-Supply Chain Management: Industrial Survival Recipe for New Decade.” Industrial Management & Data Systems 111.2 (2011): 184-211.Print.

Koch, Carsten. “An Ethical Justification of Profit Maximization.” Society and Business Review 5.3 (2010): 270-280. Print.

Narayan, Poornima. “Managerial Economics.” SCMS Journal of Indian Management 9.2 (2012): 122-123. Print.

Sigalas, Christos, and Victoria Pekka Economou. “Revisiting the Concept of Competitive Advantage.” Journal of Strategy and Management 6.1 (2013): 61-80. Print.

Stengel, Donald. “Aggregating Incomplete Individual Ratings in Group Resource Allocation Decisions.” Group Decision and Negotiation 22.2 (2013): 235-258. Print.

Zenger, Todd, Teppo Felin, and Lyda Bigelow. “Theories of the Firm-Market Boundary.” The Academy of Management Annals 5.1 (2011): 89. Print.