Globalization of Financial Markets and Economic Stability in the UAE

Introduction

In the recent past, there has been a steady rise in financial flow across borders worldwide. The main reason behind this is that institutional investors and other financial agencies, such as banks, have expanded their operations geographically (Bucur 75). Consequently, they act as intermediaries through which funds can be channeled from lenders to borrowers. The availability of multiple lending institutions across the world has offered borrowers an opportunity to access a wide variety of credit facilities. Today, individuals, organizations, and even governments can shop for loans across the globe at favorable terms. To this end, they can access low interest rates. Globalization of financial markets and banking also allows for borrowing in foreign currency. Today, bonds and stocks can be issued in international capital markets. Equity can also be sold to foreign companies.

Globalization of Financial Markets and Banking

A number of factors have contributed to the globalization of financial markets and banking. Advances in computer and information technologies are the main contributors to the shift (Bucur 75). It has made it possible for participants and regulatory authorities at the national level to obtain and process information needed to assess, manage, as well as monitor financial risks. At the same time, pricing and trading of financial instruments has been made easy. As a result, the pace of financial flow across national borders has increased. The advanced information and computer systems have also allowed for reliable storage of data touching on global financial markets and banking. As a result, the confidence of participants has been boosted.

Over the past few years, there has been a rise in the globalization of national economies. Economic activities, such as physical investment, production, and consumption, take place in different regions and countries (Bucur 75). Today, nations across the world share production activities. For example, mechanical and electronic parts manufactured in one country can be assembled in another and later shipped to other regions for consumption. Multinational companies also produce goods and services to be consumed globally.

To undertake their activities in an efficient manner, these businesses acquire or merge with other companies. Governments across the world have resorted to the lowering of barriers associated with international trade. The move has helped to raise cross-border flows.

Today, global financial markets and banking systems are composed of a complex framework of global institutions, economic actors, as well as legal agreements (Bucur 76). Together, these stakeholders facilitate the flow of financial capital internationally for the purposes of financing trade and investments. The growth of international financial markets and banking has, over the decades, necessitated the establishment of central banks in nations across the globe. Intergovernmental organizations and multilateral treaties have also been established to regulate the international markets (Talley 2).

As a result, transparency has increased. Consequently, the world economy is becoming increasingly integrated financially following the liberalization of capital accounts and increased deregulation.

Governments and other stakeholders have put in place various measures to enhance the stability of global financial and banking systems. Participants have to contend with variations in national and regional needs. In the past, some nations have engaged in activities intended to stop unconventional financial policies within their jurisdiction. At the same time, others are in the process of expanding the scale and scope of their financial policies.

The main challenge facing governments and other regulators in achieving these objectives entails instituting macroeconomic policies that are sustainable. As such, they can improve the stability of their markets. When they do this, countries are able to survive market sensitivities without losing investors and their capital to stronger and rival markets. According to Talley, the failure of a government to align its interests with international regulations on financial markets and banking is the major cause of economic instabilities (2).

Factors behind Economic Globalization and Financial Stability in the UAE

The UAE has established itself as a banking and financial hub in the Middle East (Grira 1). Its financial markets have performed considerably well compared to other economic giants in the region, such as Bahrain and Beirut. Dubai and Abu Dhabi, some of the Emirates making up the UAE, have acquired the status of international financial and banking centers. The development has greatly contributed to financial stability in the region. The two Emirates have a vast and highly developed communication and financial infrastructure. As a result, the rate of financial flow in the country is high.

As of 2011, there were 23 local commercial banks in the UAE (“Sectorial Overview: Banking & Finance” 3). The institutions operate approximately 768 branches within the country. The UAE also has 28 foreign banks with 110 outlets. The large number of banking institutions has increased the flow of financial capital in the region. In addition, there were 24 financial companies in the UAE as of 2011. At the time, the country also had a total of 22 investment agencies (“Sectorial Overview: Banking & Finance” 3). In addition, there were 119 money changers licensed to operate in the country. Together, they owned 628 branches within the UAE.

Political stability in the UAE has also contributed to the country’s financial development. According to Grira, the region appears to have recovered from the recent international financial crisis (3). Over the years, the government has strengthened the financial markets (Grira 2). Political instability in the Middle East and parts of Africa has further strengthened the UAE’s financial and banking systems. Most of the financial instruments operating in and out of the region go through the UAE.

Consequently, the country is becoming increasingly financially stable. However, its dominance in the region is being challenged by other nations, such as Qatar and Israel. Their growth into banking and economic hubs in the region will reduce the rate of financial capital flow in the UAE. Investors will have alternative markets. As a result, the financial stability of the nation is set to reduce considerably in the future.

The UAE’s economy has also grown significantly. It expands by about 6 percent per annum (“Sectorial Overview: Banking & Finance” 4). In 2011, the value of the total assets owned by UAE commercial banks was estimated to be $452 billion. The country’s asset-to-GDP ratio at the time was approximately 137 percent (“Sectorial Overview: Banking & Finance” 4). The ratio signifies a fast growing economy with a stable financial system. Financial institutions in the UAE have been able to boost their liquid asset ratio.

At the same time, they have grown their distribution networks. As a result, they have been able to increase the rate of flow of financial instruments in and out of the UAE. At the same time, they have expanded their trade volumes. Their loan-to-deposit ratio has also declined to 86 percent (“Sectorial Overview: Banking & Finance” 4). As such, the volume of profits used to service debts is reduced (“The UAE’s House Prices are now Falling” 4).

To further stabilize its financial markets, the UAE has established a number of regulatory authorities. One of them is the Central Bank of the UAE (CBUAE). The institution ensures that players in the financial markets are stable (“Sectorial Overview: Banking & Finance” 6). The regulator has the power to introduce different policies to ensure that this is achieved. For example, the CBUAE’s rates tend to change from time to time to ensure that financial institutions operating within the country remain stable. The Emirates Securities and Commodities Authority (SCA) is another such agency. It is charged with the responsibility of drafting policies and regulations that are aimed at protecting investors. The regulator is also expected to ensure that capital markets in the country remain profitable.

Consequently, the confidence of investors in the UAE financial markets and banking systems has risen. Dubai Financial Services Authority (DFSA) acts as the regulator of banks that are registered with the Dubai International Financial Center (DIFC). The body is charged with the responsibility of assessing risks associated with financial services offered by member organizations (“Sectorial Overview: Banking & Finance” 6). It also seeks to supervise the activities of these financial institutions in relation to compliance, counter-terrorism financing, as well as anti-money laundering schemes. The regulator has restored the confidence of investors in the Dubai financial systems, making it a leader in the region.

The Impacts of Delinking the Dirham from the Dollar

In 1997, the CBUAE pegged the Dirham to the US Dollar. One US Dollar was to be equivalent to 3.6725 Dirham (Kassem 3). However, in the recent past, there have been calls to ‘de-peg’ the Dirham from the Dollar. However, the CBUAE has refused to bow to pressure. It cites a number of negative effects of such a step. A move by the government of UAE to de-peg the currency from the US Dollar would have far reaching impacts on trade deficit, inflation rates, economic growth, and financial stability.

Impacts on Trade Deficit

The deficit is used as a measure of negative balance of trade. It is a common term in international trade. It indicates that the value of a country’s imports exceeds that of its exports. A move by the UAE government to move away from the Dollar would most probably result in a rise in the country’s trade deficit. The reason behind this is that the shift would most likely make the Dirham vulnerable to market fluctuations. Consequently, its value will depreciate against other world currencies. Pegging the Dirham to the Dollar ensures that the country’s currency remains strong even amidst fluctuations in the price of crude oil (Kassem 4).

The development averts financial instability in the UAE. The depreciation of the Dirham as a result of de-pegging would most likely lower the purchasing power of the UAE’s economy. As such, the amount of imports that would be purchased using a given amount of cash would decrease. As a result, the country will be required to spend more to buy goods that it is unable to produce. Consequently, the value of imports will rise.

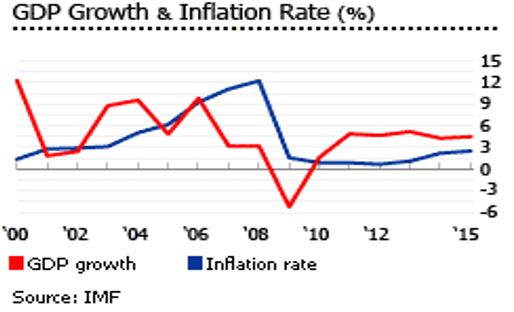

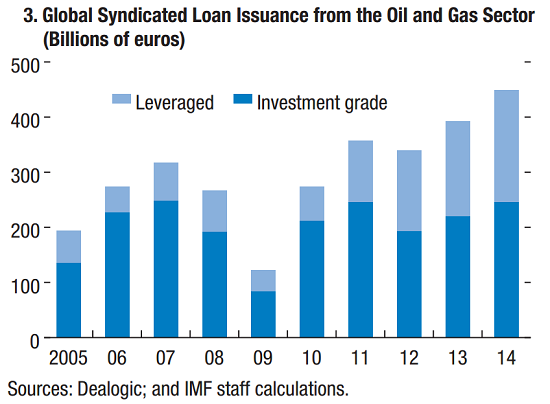

The value of the country’s exports, on the other hand, would most probably decline as a result of the decision to move away from the Dollar. The reason for this is that market fluctuations and a decline in oil prices will lead to the depreciation of the UAE currency. A decline in oil prices will reduce the returns made by players in the oil and gas sector (refer to Appendix 1) [Talley 5]. Some of these traders are forced to take up loans to finance their operations. Currently, oil comprises about 60 percent of the country’s exports (Kassem 6).

With the falling oil prices across the globe, a move to de-peg the Dirham from the Dollar would lead to low returns for exports. The reason for this is that oil is valued in terms of the Dollar. Depreciation in the value of the Dirham will mean that the country’s currency would weaken against the Dollar. The value of exports would decline. As a result, trade deficit would rise since the value of imports would exceed that of exports.

Effects on Inflation Rates

Inflation refers to the sustained rise in prices of goods and services within a country over a given period of time. It leads to a reduction in the volume of products that can be purchased using a given unit of currency. Subsequently, there is a reduction in the value of the currency. The unit of account within an economy experiencing inflation also tends to decline. Currently, the inflation rate in the UAE is 4.53 percent (refer to Appendix 2) [“The UAE’s House Prices are now Falling” 44]. The value is the highest to be recorded in the region since 2009. However, the country’s inflation rate is considerably low compared to that of other countries across the globe. The main reason behind this is that the country has pegged its currency, the Dirham, to the Dollar. The link helps the economy to avoid imported inflation. The reason is because the Dollar is more stable compared to most of the other currencies in the world.

As such, financial markets in the UAE have remained stable. Imports and exports are carried out with reference to the value of the Dollar.

A move by the UAE government to de-peg the Dirham from the Dollar would lead to a rise in inflation rates within the country. The main reason for this would be the depreciation of the nation’s currency. Changes in the international financial market and banking industry would interfere with the economy’s unit of accounts. The weakening value of the Dirham against other world currencies would also result in imported inflation. As such, a given unit of currency would buy few imported goods and services.

Analysts estimate that a move to de-peg the currency from the Dollar would result in a sharp rise in inflation rates within a few quarters of the financial year. The rates would rise from 4.53 percent in July 2015 to between 6 and 7 percent by the end of the year (“The UAE’s House Prices are now Falling” 47). The levels would rise steadily over the years as the Dirham depreciates in value. Pegging the currency to the Dollar would avert such a situation. As such, the CBUAE should not de-peg the country’s currency from the Dollar. Consequently, the regulator will maintain the existing financial sustainability.

Impacts on Economic Growth

Economic growth refers to a rise in the inflation-adjusted value of goods and services in a particular country over a given duration. It is measured as a percentage of the rate at which the real GDP increases. It is mainly as a result of increased efficiency in production. At the same time, it can be described as a rise in the capacity of a country to produce. Technological advancement and increases in capital stock are some of the major causes of a rise in productivity. Globalization of financial markets and banking is the main contributor to increasing capital stock within a particular economy (Bucur 76). The reason is that it facilitates the flow of financial instruments from one country to another. At the same time, it allows entrepreneurs to acquire capital from lenders at low interest rates.

The de-pegging of the Dirham from the Dollar would expose it to market fluctuations (Alshaali 2). As such, the UAE’s currency would no longer be shielded from the effects of declining oil prices. Consequently, the amount of revenue generated from the exportation of this product would reduce. The result is that the economy would grow at a slower rate. The resulting devaluation of the Dirham would also increase the risk of investing in the country’s financial markets. Consequently, most of the investors operating in the country would flee to other markets considered to be more stable. Lack of new capital investments would further slow down economic growth. The parties willing to risk investing in the economy’s financial markets would charge high interest rates for their activities in an attempt to shield themselves from the potential threats associated with the fluctuations (Alshaali 4).

High interest rates increase the cost of borrowing. Most of the businesses within the country would, as a result, desist from taking up loans to finance their operations. Consequently, most of them will stagnate.

Effects on Financial Stability

The UAE has enjoyed more than a decade of financial stability. One of the major reasons behind this is that the country has had a stable currency. A nation’s currency is its means of exchange. Its value determines the performance of the country in global financial markets. Fluctuations in this component often results in instabilities in the financial markets. The same case is witnessed in the banking sector. The decision by the CBUAE to peg the Dirham to the Dollar has resulted in financial stability in the nation. The main reason behind this is that the Dollar is considered to be the de facto currency across the globe. Strong monetary policies adopted by the US government have made it possible to maintain the stability of the Dollar (Kassem 2).

Pegging also ensured that the value of the UAE currency remained constant. The nation’s purchasing power has remained high even amidst the drop in oil prices. By pegging the value of the crude oil to the Dollar, the country has been able to shield itself from fluctuations in global prices.

A move by the UAE government to de-peg the Dirham from the Dollar would expose the country’s currency to fluctuations in the global financial markets. The result is that the country would no longer be able to shield its financial and banking systems from risks in the international market. Consequently, the financial stability of the nation would be lost. Since the value of the Dirham would no longer be constant, fluctuations would occur, which would weaken it against other currencies (Kassem 3). As a result of fluctuations in oil prices across the globe, the nation would face financial instability. At the same time, the value of the Dirham would continue to decline. Due to this, most investors would desist from investing in the country for fear of losing their capital. A decline in the rate of economic growth and flight of investors would worsen the financial instabilities.

References

Alshaali, Abdulnasser. Pros and Cons of Dirham’s Peg to the Dollar. 2015. Web.

Bucur, Crina. The Globalization of the Banking Sector: Evolutions and Predictions. 2012. Web.

Grira, Fathi. UAE Financial Markets ‘A Bridge between East and West’. 2014. Web.

Kassem, Mahmoud. Economists See no Reason to Scrap US Dollar-Dirham Peg. 2014. Web.

Sectorial Overview: Banking & Finance 2013. Web.

Talley, Ian. Threats to Global Financial Stability are Rising, the IMF Says. 2015. Web.

The UAE’s House Prices are now Falling! 2015. Web.

Appendices

Appendix 1: UAE’s Global Syndicated Loan Insurance from the Oil and Gas Sector

Appendix 2: GDP Growth and Inflation Rates in the UAE