“Financial Stability in the UAE”

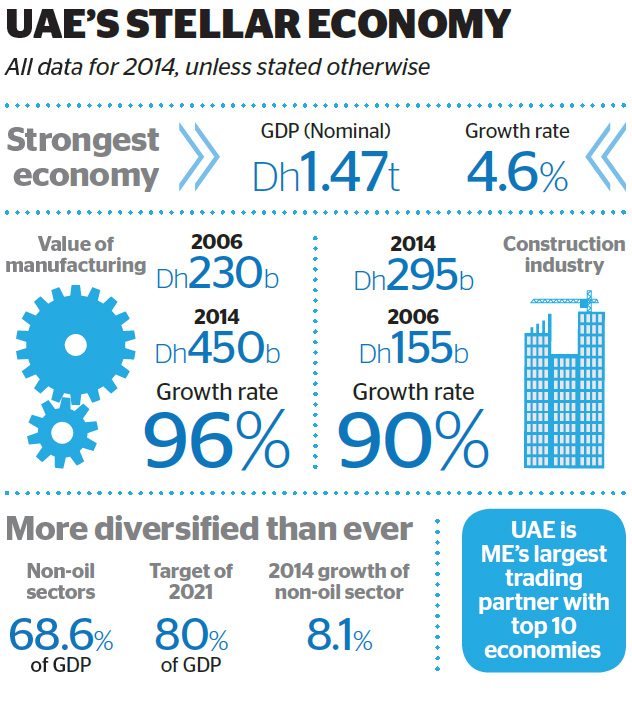

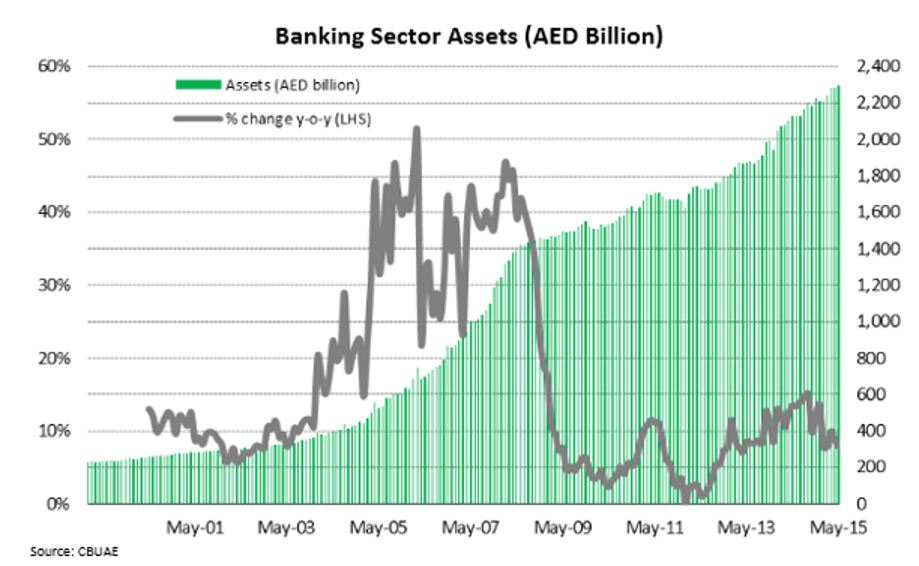

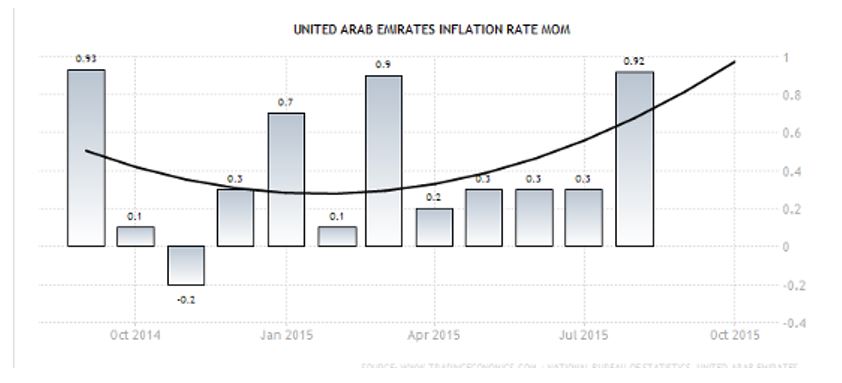

The global financial crisis of 2008/09 led to a slump in the UAE economy in 2009. Since then, the economy has recovered and has recorded near zero inflation rates as highlighted in the recent Central Bank of the UAE financial stability review, which has also informed diversification strategies for the economy (Khaleej Times Para. 1-4). A strong UAE banking sector has been the key factor affecting stability in the country. Banks are highly capitalized (Bouyamourn, “UAE Needs to Boost Islamic finance sector’Stability With More Regulations, IMF says” Para. 1-3). They have a high capital adequacy ratio of 19% as measured in December 2013 with the similar year being 21% (Augustine Para. 3-5).

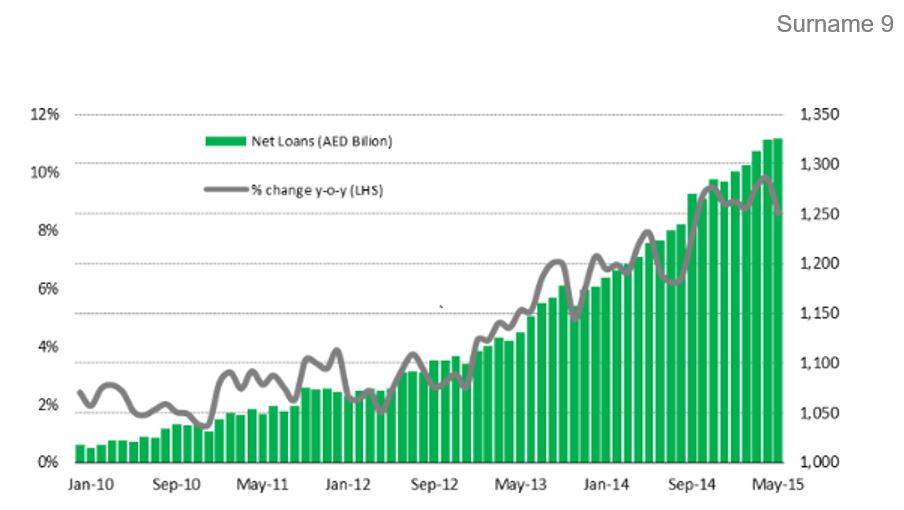

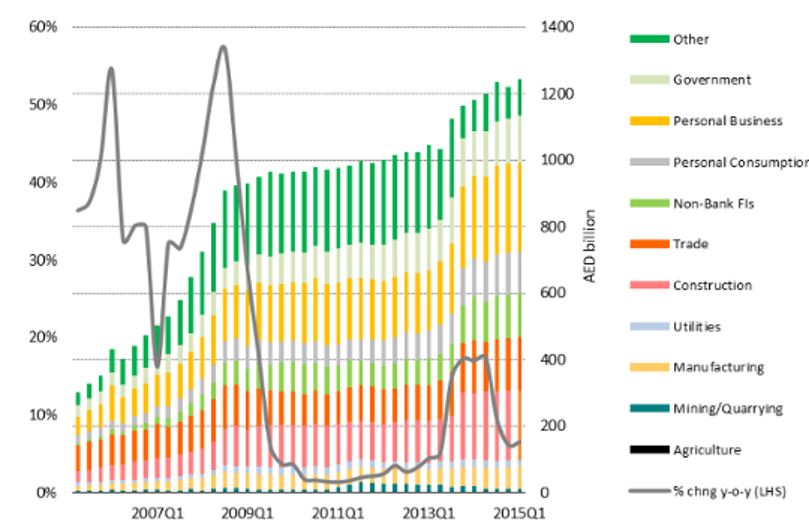

Currently, the UAE has 23 local banks and 26 foreign banks. The banks have 957 branches between them. The UAE Central Bank is a supportive regulator while the government and the public sector have been enjoying financial strength because of hydrocarbon revenues and because of their strategies and policies for sound financial and economic growth. These conditions have satisfied investor interests in the last decade. Since 2013, oil prices have been shifting, and the strength of the government and the public sector has reduced but pegging has helped with interest rates (Nagraj Para. 1-3). However, the main indicators for stability like loans, deposits, and non-performing loans have been improving in their respective numbers. The areas that are at risk of instability include Central Bank foreign exchange reserves, loan to deposit ratios, banking system liquidity and public sector deposits.

The interpretation of the financial and banking sector of the UAE is that it is stable and safe from global financial markets turbulence. The majority of the sector’s banking deposits are by residents and the government or public entities. Besides, loans are also to local businesses and individuals. Therefore, the key dynamics affecting profitability and ability to comply with the UAE central bank regulations are within the control limits of the banking sector. Meanwhile, the central bank has a comfortable foreign exchange reserve that will cushion the AED against extreme volatility.

Possible consequence of UAE government decision to move away from pegging the Dirham to the Dollar

Pegging of the Dirham to the Dollar implies that the value of the Dirham is affected by changes in the value of the Dollar. The good thing with pegging is that it gives everyone a quick way to determine the value of a service or good in dollars and Dirham by multiplying or dividing the quoted value by a number. The current pegging is Dh 3.672 for the Dollar (Alshaali Para. 2). The following section analyzes specific outcomes of pegging the Dirham to the Dollar and abolishing the peg. In each case, the present case is reviewed with its pros and cons then the alternative case is presented. At the end of the section, an overall interpretation is given to a move to remove the peg of Dirham to the Dollar.

Trade Deficit

Given that the Dollar is stable with a predictable and slow appreciation and depreciation, it influences stability in trade. While it cannot eliminate trade deficit, it helps to avoid opportunistic exporting, importation, and overall speculation activity in the market. An unpegged dirham would be volatile given the changes in oil prices globally and variation in imports for the UAE. It would likely lose value faster as more activity in the UAE economy promotes the importation of materials. Currently, the construction industry is one of the most active in the economy and is a major importer of materials and service.

An unpegged dirham would lead to reduced value for exports based on its weak valuation, assuming that export volumes remain the same. On the other hand, the value of imports would be rising, and, therefore, lead to increase costs as the economy grows. In the end, the trade deficit will widen with a strengthening of major global currencies like the U.S. dollar and Euro.

Inflation Rate

In the current arrangement, the UAE Central Bank must defer to the U.S. Federal Reserve when deciding on the interest rate. High-interest rates increase the cost of borrowing in the domestic economy and help to reduce inflation. Balancing the rates is the main way to affect inflation. However, that is the case for the U.S. economy. For the UAE, tackling inflation is through other means like a direct intervention in economic activities (Bouyamourn, “Managing Inflation in the UAE is a Matter of Matching Supply and Demand” Para. 1-3). Using interest rates in the UAE to tackle inflation would lead to widening deficits in the valuation of the Dirham against the Dollar, and that would be very costly to the Central Bank.

The option is unavailable as long as pegging continues. The current inflation rate in UAE is determined by existing demand and supply factors in specific sectors. The government through its ownership of economically active organizations such as construction companies, transport companies, and banks can affect inflation indirectly by matching the supply of goods and services with demand. Besides, the government has even opted to use price controls to limit inflation such as reducing ceiling prices for foodstuffs during Ramadan to limit food-related inflation (Bouyamourn, “Managing Inflation in the UAE is a Matter of Matching Supply and Demand.” Para. 10-11).

In a free dirham regime, the government would rely on interest rates. According to the review done in part A of this paper on the stability of UAE financial sector, the country enjoys near zero inflation rates. The main reason is that the government is using price controls and is intervening in markets through sale and purchase or development of assets to meet demand and supply dynamics. In an unpegged regime, it would have to responds to both demand and supply inflation pressure in the domestic economy as well as inflation caused by currency pressures on the dirham that are dependent on value and volume of imports and exports. The likely outcome would be a rise in inflation rate and a volatile inflation rate compared to the current stable one. The changed outcome will be that the movement will have more power of changing inflation rate, but this does not mean it will stabilize the rates.

Economic Growth

The current growth of the economy is affected by exports, which affect government funds for investing in the economy. Strengthening oil prices will immediately cause economic growth when the peg exists. Moving away from the peg would lead to reduced economic growth. Although the country will gain from cheaper exports that eventually cause an increase in export volume, it will also face a challenge of attracting capital for growth. Its domestic purchasing power is not as big as the U.S. The economy depends on one export commodity priced in dollars and the current appetite for imports would be unsustainable with a weak dirham.

The purchasing power of locals will also suffer as the dirham loses value against the dollar leading to poor economic returns for local investments. An increase in the prices of oil may better the country’s economy, but the country remains prone to environmental forces. In the end, economic growth will reduce as investor shy away from high-risk caused by the unpredictability of most economic indicators.

Financial Stability

When pegging exists, the UAE government and central bank have to follow the U.S. monetary policy. The biggest benefit of pegging to the U.S. dollar has been stability. Extension of the peg dynamics to the Dirham ensures that it remains as stable as the Dollar against other currencies. Businesses and individuals can always convert Dirham to Dollar before changing the dollars to other currencies at a fairly stable and predictable market rate. For financial operators like banks and other financing or investment institutions, the UAE economy becomes predictable in terms of performance on securities in its markets because investors and analysts can easily transfer circumstances and outcomes of dollar-based securities in markets across the world to the Dirham-based ones.

Conclusion

The UAE economy remains one of the most integrated into the global economic system in comparison to other Arab economies. This paper’s assessment shows that the economy is very stable, and the financial stability of the UAE can be interpreted as a strong banking sector anchored on sound regulation and risk appetite. On the other hand, the paper looks at possible outcomes of removing the current peg of the Dirham on the Dollar. The outcome will be unfavorable to the economy in the long-term. It will negatively affect the financial stability of the country and cause a spike in inflation rates that will likely become volatile.

References

Alshaali, Abdulnasser. “Pros and cons of dirham’s peg to the dollar“. 2015. Gulf News. Web.

Augustine, Babu Das. “Financial indicators point to the systemic strength of UAE banks“. 2014. Gulf News. Web.

Bouyamourn, Adam. “Managing Inflation in the UAE is a Matter of Matching Supply and Demand.” 2015. The National Business. Web.

—. “UAE Needs to Boost Islamic finance sector’Stability With More Regulations, IMF says.” 2015. The National. Web.

Khaleej Times. “UAE set to diversify economy more: Shaikh Mohammed“. 2015. Web.

Nagraj, Aarti. “UAE Dirham Will Remain Pegged to US Dollar – Central Bank.” 2014. Gulf Business. Web.

Appendices

Appendix 1: UAE Banking Sector Assets

Appendix 2: UAE Banking Sector Net Oustanding Loans

Appendix 3: UAE Loans to Residents by Economic Activity

UAE Inflation Rate Month on Month Forecast

Appendix 4: Additional details

Appendix 5: Infographic of UAE financial stability