Legitimacy Issues

To begin with it is necessary to point out that the issues of Legitimacy and legitimacy theory are often regarded as the generalized perception that the actions of an entity (which is a company, firm, corporation etc) are desirable, or appropriate within some constructed system of norms, values, beliefs, and definitions. Originally, the theory of legitimacy is one of the most widely used areas in the spheres of accounting. Nevertheless, there is deep skepticism within various researchers which discuss the insights into the voluntary disclosures of cooperative information.

The key problem of the legitimacy theory is that it is often used rather loosely, especially in the context of our understanding of the accounting disclosure issues. Nevertheless, it can not be regarded as a problem of the theory, as this observation may be applied to a range of accounting theories and to a range of the theories from different spheres of business. This is not a problem of the theory itself, and the Failure to adequately specify the theory has been identified by Delfgaauw (2000), who observed that “Many researchers employ the term legitimacy, but few define it”. Cohen and Lori (2006) comment that “As the tradesmen of social science have groped to build elaborate theoretical structures with which to shelter their careers and disciplines, legitimating has been a blind man’s hammer.”

As for the issues of legitimacy theory in small business, it is necessary to emphasize that small business generally pays few attention to it, nevertheless, it closely focuses on the matters of social factors in the context of legitimacy and on the matters of how job applicants’ individual preferences affect recruitment. From this point of view Bell (2002) emphasizes the following: “From this perspective, effective recruitment practices allow individuals to see congruence between individual preferences and organizational attributes. Dimensions such as recruiter characteristics, recruitment message (e.g., realism, favorability, and content), and recruitment timing have received mixed support for influencing recruitment success. However, while clearly important, this perspective ignores the role that societal norms and values play in shaping the preferences and actions of individuals.” From this point of view, the issue of whether the organizational and structural recruitment success is impacted by the recruitment strategies and practices and their coincidence with the institutional norms and regulations of behavior which exists within a population remains largely unanswered, representing a second potential gap in the extant recruitment literature. This is generally explained by the institutional powers and their impact on newly created and small enterprises, which often constrain the range of permitted activities, the very understanding of the effects that social factors may have on employment is particularly pertinent for small companies. Williamson (2000), in his turn, emphasizes that “theory, deals with how organizational structures as a whole (capitalism for example, or government) have gained acceptance from society at large. Within this tradition, legitimacy and institutionalization are virtually synonymous. Both phenomena empower organizations primarily by making them seem natural and meaningful”. Consequently, in terms of accounting studies, which are represented within the preliminary considered time frames, the current business surrounding, entailing the capitalist arrangement and democratic government are generally taken as a static context within which the research is situated. (Waskan, 2002) This assumption would require to be thoroughly considered for a longitudinal research of any essential extent.

From the point of view of the business issues, it is necessary to emphasize that the matters of legitimacy are often viewed and conceptualized as the type of resources, which any enterprise or organization should obtain from the surrounding environment. However, Tsang (2001) claims that rather than regarding legitimacy as something that is exchanged among institutions, legitimacy is better conceived as both part of the context for exchange and a by-product of exchange. Legitimacy itself has no material form. It exists only as a symbolic representation of the collective evaluation of an institution, as evidenced to both observers and participants perhaps most convincingly by the flow of resources. These resources must have symbolic import to function as value in social exchange. But legitimacy is a higher-order representation of that symbolism – a representation of representations. Corporations try to manage their legitimacy issues as this management is aimed to help to ensure the inflow of capital, labor and consumers necessary for feasibility. It also prevents regulatory activities that might happen in the lack or absence of legitimacy and prevents product boycotts or other troublesome actions by external participators. By mitigating these possible issues, organizational legitimacy offers managers a degree of autonomy, aimed to decide how and where business will be conducted”. (Cohen and Lori 2006). From this point of view, researchers of these issues require moving away from attempting to assess legitimacy, and instead concentrate on evaluating it in terms of the resources that stakeholders offer. As Bell and Greg (2008) claim: “Rather than engage in the further development of entirely abstract constructions of the legitimating process, researchers should investigate the flow of resources from organizational constituencies as well as the pattern and content of communications”. Anyway, the legitimacy theory is often regarded as a way to incorporate the enterprise disclosures. Nevertheless, the realization and research of this theory should be researched as something more complicated, basing on the developments within the accounting literature and beyond, for deeper understanding of essential principles of the legitimacy processes. This is the only way to fully realize the wide range of disclosures which should be thoroughly examined. The attained skills and knowledge will then be applied for providing better and even more useful information on the decisions taken by the stakeholders of the company. Thus, the society has an opportunity for better and deeper control of the way the resources are distributed.

Voluntarily Disclosures

This chapter will analyze and compare the data by two Australian companies, engaged in the agricultural sphere. These are the ABB Grain and Australian Agricultural Company Ltd. (AAC). As for the voluntary disclosure, these companies can not be regarded as the closed corporations, as they eagerly provide data in the reports and overviews.

ABB GRAIN is regarded as the leading Australian company with a multi-faceted operation and international business links. The company is mainly engaged in accumulating grain from all grain growing regions across Australia, and trades in all grain commodities. ABB’s supply chain strength entails storage, handling and logistics, and also providing a number of value adding services. This comprises an essential network of sales and export shipping terminals in South Australia and the eastern states of Australia, including joint ownership of Australian Bulk Alliance (ABA) with Japanese trading company Sumitomo.

As for the openness of the information, which the ABB prefers to disclose, it is necessary to mention that this is the info of various kinds, nevertheless, the provided information is not full, though, the company is not obliged to provide the full range of business data.

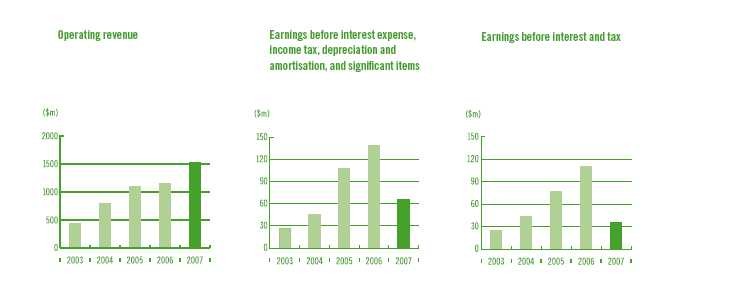

The financial reports of the year 2007 provide the following information:

ABB Grain’s malting division, Joe White Maltings, is one of the world’s largest producers of malt with the capacity to produce more than 500,000 tons per annum. The eight malting plants strategically positioned across Australia include the largest malthouse in the southern hemisphere, situated in Perth (WA).

BB has a policy of returning 65% of company profits to shareholders as dividends. For the year ended 30 September 2007, ABB paid a fully franked interim dividend on 4 July 2007 of 5 cents per B-Class share, and a fully franked final dividend on 21 December 2007 of 5 cents per ordinary share.

It is claimed that shareholders should preserve all remittance advices and statements closely linked with dividend payments for taxation aims. Shareholders may receive dividend payments directly or with cheque. Further information on these dividend payment options is restricted, as it is a part of consumer relations strategy. Originally, this kind of information is rather useful for the thorough and multi-angle analysis of the company, however, some useful data is not available, as the company prefers to keep it confidential.

AAC

In comparison with the ABB, which prefers disclosure of the information in visual form, and sometimes tables, managers of AAC prefer textual data, however, it looks more detailed. AAC also prefers not to disclose some points of its business performance, such as the details of the strategies and internal financial data, however, the information on the financial flows is more detailed:

Total Revenue in 2007 was $250 million, an increase of 25% on the previous year. Net cattle revenue rose to $133 million from $118 million in 2006. In 2007 we have continued the pursuit of excellence in safety in an industry that faces particular challenges and a measure of our achievement is demonstrated by an ability to reduce the cost of our workers compensation premiums.

Net profit after tax decreased from $10.1 million in 2006 to $3.6 million in 2007. It should be noted that the prior year result was significantly enhanced from the sale of Wrotham Park and associated tax benefits. Whilst cattle prices plunged during the year (which affected cash profits), a late rally in December, due to better rainfall in southern Australia resulted in cattle values rising to similar closing levels of 2006. A cattle herd valuation increment was $0.5 million in 2007 compared to a decrement of $17.3 million in 2006.

Operating overheads for the year rose by 23% to $208 million, a rise of $40 million. The significant factor for the rise was the increase in wholesale beef overheads from $75 million in 2006 to $105 million in 2007 which underpinned the rise in revenues.

Findings

From the position of the disclosed information and the issues of the legitimacy theory it is necessary to emphasize that legitimacy as the approach towards accounting can not impact the wish of the company to disclose the information. Originally, this information may be regarded as confidential, and it is the volunteer decision of any company to disclose it. On the other hand, the concealing of real incomes may be regarded as the violation of taxation law. Thus, the tax service is free to publish the information on the incomes and financial flow of any company. So, the companies prefer disclosing this information themselves, thus they may protect it with copyright and insure form distortion of the information. Thus, AAC provided the following information:

- sales revenue increases 36% for our branded beef/portion control business from $78 million to $106 million;

- calving percentages up to 74% from 71% last year;

- focus continues on high value markets with an increase of Wagyu breeders by 5,000 head;

- AAco Wagyu is now being enjoyed in more than 400 restaurants in the USA through the Greg Norman Signature Wagyu Program and the Darling Downs Wagyu brands.

This info is not confidential, and is often regarded as the published communication with the competitors. Few of these facts are of huge importance for the tax inspectorate, nevertheless it may be used by other companies for comparing the activities within the agricultural sector. It should be emphasized that such comparison is of great importance for the market researchers, as it helps to evaluate not only the activities of the company, but also the allover sector, and even evaluate the position of the company which prefers not to publish such data at all.

If the legitimacy issues are regarded as the resources, as it was stated above, the disclosure of such information helps companies in attaining the reputation of fair market actor, consequently, it is regarded as the defining factor in the case of some legislative problems. The fact is that, this reputation increases trust to the company within current and potential customers, as well as among partners, and increases respect among competitors.

Disclosures often contain the information on the market condition and the circumstances, which form the marketing strategy of the company. As the strategy itself is never disclosed, these pieces of information are frequently used by experts to evaluate and forecast the further strategy innovations and undertakings. Thus, ABB issued the following facts on the Grain market situation:

- Further diversification and expansion

- 1m tons of third origin grain traded

- Successful freight trading

These facts emphasize the difficulties that company was obliged to face. It signifies the fact that it is the successful player of the market, and there is no necessity to fear for its future. This conclusion will be consolatory for the customers and partners. Though, this fact is not related to legitimacy, it is a kind of business ethics, the observation of which is the integral part of fair competency, which closely relates legitimacy practice.

Finally, it should be claimed that the issues of legitimacy theory and the disclosure of business information, as well as the openness of the sources are not linked directly, however, the disclosure itself is the reaction for some legislative issues. Thus, the disclosure is aimed to assist in maintaining positive reputation, trust and respect among other market actors, and, surely maintain good relations with the legislative bodies, which regulate business sphere of the society.

References

- AAC. 2007.

- AAC. Operational Review.

- ABB. 2007.

- Bell, Duncan S.A. “Language, Legitimacy and the Project of Critique.” Alternatives: Global, Local, Political 27.3 (2002): 327

- Bell, R. Greg, Curt B. Moore, and Hussam A. Al- Shammari. “Country of Origin and Foreign IPO Legitimacy: Understanding the Role of Geographic Scope and Insider Ownership.” Entrepreneurship: Theory and Practice 32.1 (2008): 185

- Cohen, Jeffrey R., and Lori L. Holder-Webb. “Rethinking the Influence of Agency Theory in the Accounting Academy.” Issues in Accounting Education 21.1 (2006): 17

- Delfgaauw, Tom. “Reporting on Sustainable Development: A Preparer’s View.” Auditing: A Journal of Practice & Theory (2000): 67.

- Tsang, Eric W.K. “In Search of Legitimacy: The Private Entrepreneur in China.” Entrepreneurship: Theory and Practice 21.1 (2001): 21

- Waskan, Jonathan. “De Facto Legitimacy and Popular Will.” Social Theory and Practice 24.1 (2002): 25

- Williamson, Ian O. “Employer Legitimacy and Recruitment Success in Small Businesses.” Entrepreneurship: Theory and Practice 25.1 (2000): 27.