Situation

Luckin Coffee, often referred to as Luckin, one of China’s most prominent coffee corporations in the country, was under the radar of the United States Securities and Exchange Commission, the Chinese Securities Regulator, and China’s State Administration for an accounting scandal or rather fraud. Precisely, Luckin falsified its bank statements and fabricated its financial performance in an effort to lure in more investors and generate a significant amount of funds (Wang, 2020). The organization, on countless occasions, failed to disclose its accurate revenues and expenses and also received generous investor money through false bank statements. Furthermore, earlier investigations into the scandal revealed that the organization failed to maintain sufficient internal accounting controls or even maintain accurate financial records. The CEO, coupled with multiple other employees in top organizations, were accused of abusing their power. They were well aware that Luckin’s financial records and statements were deceptive and misleading (Jiayu & Yuan, 2021). The scheme involved different stakeholders such as vendors, funding companies, and third-party shell companies to fabricate costs, profits, and expenses. The investigations spanned from April 2019, when the US Securities and Exchange Commission opened an investigation on Luckin’s true financial performance, to December 2020, when Luckin was obligated to pay $180 million in settlement charges to funders for fraud and accounting irregularities.

Problems

A Review of Luckin’s Coffee Fraud

Muddy Waters Research, one of the best short-selling companies globally, received an anonymous report filled with compelling evidence of Luckin’s allegedly fraudulent conduct. Muddy Waters posted the report on its Twitter account, which detailed how the organization fabricated its financial performance through coupon sales, inflated revenue, and redemptions (Pen et al., 2022). This report caused a massive sensation in the capital markets, causing Luckin’s stock price to plummet by more than 24% in a single day, and closed down at 10.47% (Jiayu & Yuan, 2021). Following further investigations, Luckin succumbed and confessed fraud, which led to a subsequent delisting from the National Association of Securities Dealers Automated Quotation (NASDAQ) – a global electronic marketplace for trading securities.

Problems Raised

One of the major problems caused, especially from an ethical perspective, was the abuse of powerful corporate positions by Luckin’s heads to misrepresent the company and engage in accounting fraud in efforts to mislead investors and funding companies to their own advantage (Wang, 2020). These positions include the board of directors, the audit committee, both internal and external auditors, and senior management. Furthermore, Luckin’s Chairman and largest shareholder, Lu Zhengyao, was involved in previous fraud cases, including the China Auto Rental company that was engaged in fraudulent conduct such as burning money to fight price wars and borrowing cash then listing them as dividends to cash out (Jiayu & Yuan, 2021). It was not difficult to pinpoint the lack of morality within the organization’s top management. Furthermore, China’s Development status requires organizations to be transparent in both leadership and finances (Zhang, 2020). Another problem emerging from the scandal is the avoidance of regulations. Generally, huge listed corporations with large fluctuations tend to attract the attention of regulators, but those with relatively stable performance do not attract the attention of regulators. In the case of Luckin, financial fraud to fabricate financial performance was the company’s safe bet to avoid getting the attention of regulators.

Lastly, another major problem evident emerging from the scandal is both weak internal and external supervision. From an internal perspective, the board members and other respective shareholders did a poor job of evaluating the performance of Luckin in-depth, especially given that Luckin was substantially overstating its revenue by margins of up to 45% and expenses up to 24% (Jiayu & Yuan, 2021). Furthermore, some employees were in on it as they opened multiple shell companies to take advantage of the fraud involving coupons. From an external point of view, the Chinese government should have been keen on supervision, given Luckin chose to be listed in the US while operating in China. This move should have been analyzed in-depth, given the intensified US-China tensions where the US has been heavily targeting Chinese companies for delisting from NASDAQ and US stock markets (Mark, 2021).

Research Question: Following Luckin’s scandal, what penalties should organizations found committing accounting fraud be subjected to?

Methodology

With the combination of primary and secondary sources, we will retrieve information about companies that underwent a similar fraudulent case and how they were able to fix their situation. Using primary sources, we will gather statistics about Luckin and compare them to other companies such as Wells Fargo, one of the top business scandals, which is still operating today. We will analyze the consequences given to companies involved in fraudulent activity and their outcomes using statistics. Did the consequences positively impact the company in the long run or negatively impact them? Following the primary source research phase, we will turn to secondary sources, such as the New York Times to consider readings from scholarly articles, books, and documentation by experts who analyzed companies’ fraudulent activity and outcomes. An article by Cowley (2020), titled “Wells Fargo Chief Visits Capitol Hill, Promising Reform”, provides information about Wells Fargo that would be beneficial to compare Wells Fargo to Luckin’s situation. Following that, we will use both the primary and secondary sources to determine if any solutions we offered for Luckin were previously completed. If so, we will analyze their results and effectiveness.

Solutions

An audit committee and the entire finance department have an obligation to apply the code of ethics. The committee needs to guarantee that an organization acts honestly. In addition, they should not be swayed by their relationship with upper management or share prices. In the case of Luckin, however, the audit committee liaised with top management and chose to remain silent on the matter. The committee also failed to alert the board of ongoing accounting fraud and the resultant implications. In this regard, the committee lacked competency, objectivity, and above all, integrity. For this reason, the entire audit committee and the responsible parties, including the chairpersons and other managerial heads, should be laid off if found guilty after internal investigations. The committee should also be subject to financial consequences; they should be obligated to pay a significant amount in fines because their actions led to substantial losses for the organization and the investors. Furthermore, Zhu et al. (2021) note that structural changes in the case of Luckin would have prevented or reduced the risk of fraud. These changes would create an environment where transparency would foster.

Another effective solution to such fraudulent cases involves using modern technologies to detect accounting fraud. These detection methods heavily rely on the types of data used for financial fraud, classified into three categories: quantitative structured data (tabular data), diverse semi-structured data, and complex unstructured data (Zhu et al., 2021). In the case of Luckin, Zhu et al. (2021) note that Muddy Waters Research was working with complex unstructured data to analyze store traffic videos, among other digital information. Zhu et al. (2021) propose the use of modern technological applications such as Artificial Intelligence (AI), precisely graph neural networks, due to their capacity for heterogeneous data analysis. By detecting fraudulent activities early, Luckin would have been in a prime position to address the problem before it exploded. This solution can be further complemented by equipping auditors with more fraud detection training, which would help them spot improper and suspicious transactions early.

Lastly, there is a need for enhancing the regulator’s powers of enforcement. This move could help expedite the investigation process and minimize the resulting negative implications of fraud. This solution can be further complemented by introducing stringent regulations, including hefty fines and the possibility of a company being delisted from NASDAQ and other markets. With respect to penalties, Jiayu and Yuan (2021) note that based on Securities Law on March 1, 2020, China’s Securities Regulatory Commission imposes only 600,000 Yuan worth of fines for fraudulent behavior of listed companies. When compared to fraud gains, such penalties are mere peanuts. In fact, Jiayu and Yuan that Lu Zhengyao, the main fraudster of the organization, was fined only 100,000 Yuan, which cannot be equated to the millions accrued from the fraud.

Evaluation

There are many solutions to solve Luckin’s fraudulent activity, considering each’s pros and cons and trial and error. It is important for anyone who contributed to Luckin’s fraud to be held responsible. This includes the audit committee, chairpersons, managerial heads, and employees who knew about the unethical actions and did not speak out. The appropriate consequence for them would be to be laid off from their position and be obligated to pay a significant amount in fines. This solution is essential because, in the long run, any employee who thinks about committing fraud will rethink their decision. They will know the severe consequences that lie ahead, such as sacrificing their jobs and facing financial obligations. A fundamental limitation of this solution is that the investigation may not find all the people who have contributed to the fraud; a few may slip and never be discovered nor face any consequences.

Another solution is incorporating modern technology to detect accounting fraud. There are many technologies and techniques today, such as Artificial Intelligence, that will assist in determining fraudulent activities early on. According to Applications of artificial intelligence in business and finance: modern trends (2021), there are many successful fraud detection techniques used by society and the government, including data mining, neural networks, machine learning, and pattern recognition (Garg et al.). Companies, such as Luckin, should be equipped with strict auditors with more fraud detection training to spot any misleading or inconsistent information. By having and knowing the effectiveness of such technologies, employees will ensure that all the information inserted in accounting platforms is accurate to avoid any further consequences. However, any technological platform has limitations or challenges. For example, Artificial Intelligence may flag many actions that do not coincide with its coding, even if it is not actually fraud. With the consistent flagging, auditors may think it is another false flag, causing the situation to be overlooked and not analyzed entirely. However, it is better to have more flags and keep checking them to ensure accuracy rather than an action not being detected at all. An alternative solution to this is when a false flag occurs, it should be reported, and the Artificial Intelligence should be modified to avoid future similar defects. There is only room for improvement in technologies, and by fixing technological bugs, Artificial Intelligence will be significantly beneficial.

Implementing and enforcing other consequences is also an essential solution for a company that commits fraudulent activity. The government should enhance the regulator’s enforcement power by delisting companies involved in such actions from NASDAQ and other markets while also demanding additional fines to be paid. Many companies accumulate revenue from the stock market exchange; therefore, by ensuring that any company that does not comply with the regulations be delisted, many companies will avoid any fraudulent activity. They will not want to risk their primary source of revenue and be subject to financial consequences. Companies will want to follow the rules and regulations to avoid any loss, whether that is obtaining a bad reputation, failing business, or facing any financial penalty.

However, a limitation is that some companies have a significant contribution to the markets, that delisting them will drastically affect the market. As a solution for the limitation, the government should still give companies significant financial consequences to ensure they are compensated for their actions while giving them a short period to fix the problem. If they fix the problem, refrain from any additional fraudulent activity, and pay the assigned fines, they will be allowed to remain in the market. However, if any company fails to follow those procedures, they should instantly be delisted. In conclusion, every solution contains pros and cons; however, the efficient and effective solution is one whose advantages outweigh the disadvantages.

Contribution of each business field

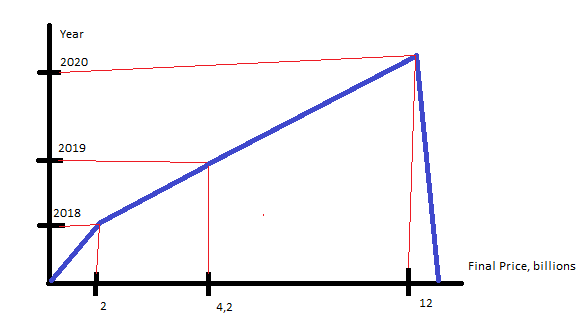

In order to see certain changes and their nature, it is necessary to illustrate the growth of the company with a graph.

It shows the price of the company Luckin Coffee, which grew rapidly every year. If back in 2018 the total value of the company was $2 billion, then in 2020 it was estimated at $2 billion (Fortune Editors, 2020). It is necessary to consider in more detail how such changes affected the economic sphere of business. After the identification of fraudulent schemes, the company’s securities left the market, but this situation affected many areas of business. For example, due to the fact that such a system became known, the approach to calculating the value of a company has changed in such a way that it has become impossible to come up with information about income. In addition, financial systems have become subject to strict control through corporate governance practices. Finally, the Securities and Exchange Commission recommends that business strategies be implemented in such a way that they comply with the rules and abroad.

In terms of design management, there were also dramatic changes, since the entire management system had to be changed. The fact is that, if such a situation is assumed, it can be concluded that the current system of corporate governance is either inefficient or self-serving. In turn, both have a detrimental effect on the business, so it is necessary to introduce financial authorities, such as the accounting department. Delegation of authority to specialists will help control the financial side of business activities and eliminate the possibility of deception in the field of corporate value. In addition, all data will be official and potentially verifiable in order to prevent the development of fraudulent schemes.

References

Cowley, S. (2020). Wells Fargo Chief Visits Capitol Hill, Promising Reform. New York Times, 169(58629), B3.

Fortune Editors. The biggest business scandals of 2020. Fortune. Web.

Garg, V., Aggarwal, S., Tiwari, P., & Chatterjee, P. (Eds.). (2021). Applications of artificial intelligence in business and finance : modern trends. Apple Academic Press. Web.

Jiayu, Z., & Yuan, T. (2021). Case study of luckin coffee financial fraud based on theory of fraud risk factors. Academic Journal of Business & Management, 3(11), 37-41. Web.

Mark, J. (2021). Dispute, A. delist or not delist. Atlantic Council. Web.

Peng, Z., Yang, Y., & Wu, R. (2022). The Luckin Coffee scandal and short selling attacks. Journal of Behavioral and Experimental Finance, 10(3), 1-16.

Wang, Q. (2020). Cost of the accounting scandal of Luckin Coffee to multiple aspects and the influence under current economy and pandemic time. The Atlantic Press, 2(155), 172-176.

Zhang, L. (2020). China’s corporate governance development and ESG evaluation. An updated version of this working paper has been submitted and is under review for the EMI report.

Zhu, X., Ao, X., Qin, Z., Chang, Y., Liu, Y., He, Q., & Li, J. (2021). Intelligent financial fraud detection practices in post-pandemic era. The Innovation, 2(4), 1-12.