Getting a personal retirement plan will in most cases seem to be a hard nut to crack and very steep to maneuver. However, preparing for retirement will involve climbing only two steps. A retirement plan is very critical and plays a major role in achieving the very retirement. The two steps involved in the planning are known in retirement calculation terms as one ‘today’ and two as ‘tomorrow’. The first step which is ‘today’ in retirement planning insists on a clear understanding of where one stands in terms of finances. It will also entail having clarity on the current situation on finances to be in a position to plan the retirement properly.

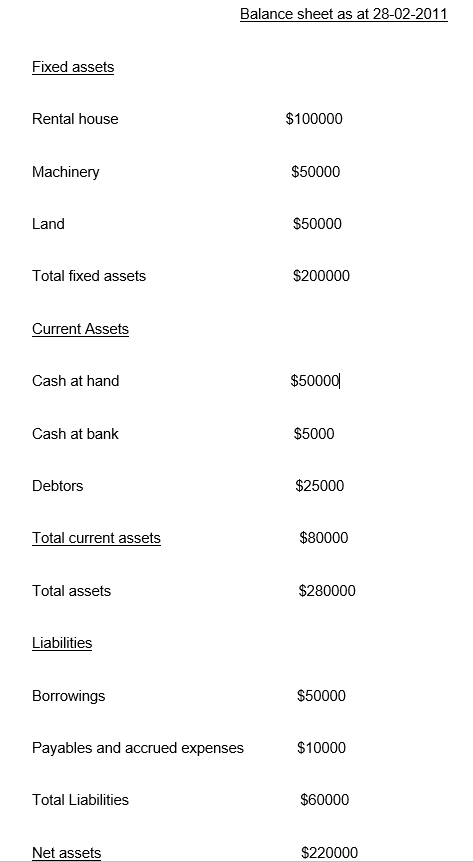

This will involve a balance sheet for the household just like is the case in a business venture. The balance sheet shows the assets, liabilities or debts, income, and also expenses. This balance sheet for the household will give you the current network, the rate of doing the savings, and more importantly the details on the rate of spending (Hicks 2010).

The second step in retirement is all about ‘tomorrow’. This step is taken after one has analyzed and knows his status financially at the current time. This will involve answering the questions on what it is that you are stepping into by opting to retire. This step is all about getting answers on the future or tomorrow part of the retirement plan, the amount that is needed for the retirement, and also making a budget for retirement.

In making the budget emphasis has to be given to calculating the expenses for retirement annually. Some of the expenses that can be incorporated include those on food, clothing, gas, vacations, housing, cable, phone, and health insurance. The annual budget to be spent on retirement has to be established before the retirement time to be able to create a retirement plan. Once the question on the spending per year during the time for retirement is known, then the two steps have been followed in retirement planning (Hicks 2010).

After the two steps have been undertaken then a retirement plan can be created. There are key fundamental questions that have to be answered in the plan for a person who is going to retire. One of the questions is how much in terms of savings is needed for retirement.

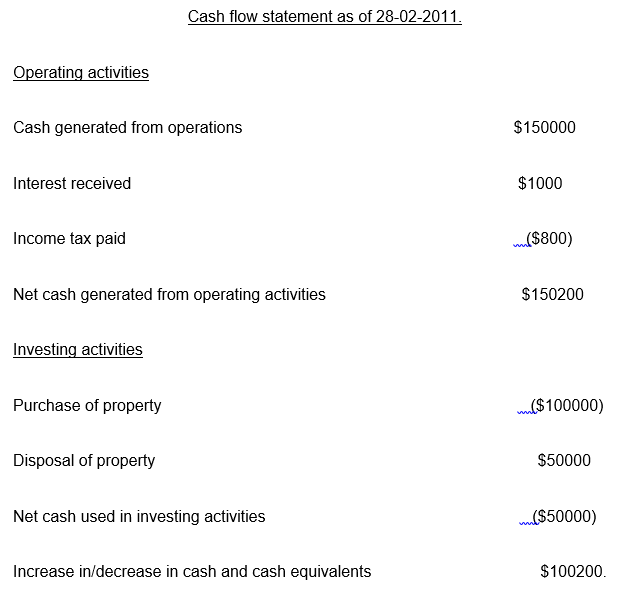

The second one is how much in monetary terms you are going to spend during retirement? The solution to those fundamental questions is a function of the amount of money and other non-monetary assets one has today in savings and the much-needed tomorrow for spending. Below is a sample of the latest balance sheet and cash flow statement for retirement planning. The plan follows a choice made to retire in two years and indicates such a possibility through calculations (Hicks 2010).

The balance sheet and the cash flow statement are for the last year running from February 2010 to February 2011. The estimate of the earnings/salary per year is assumed to be $50000. The retirement savings are then calculated following the rule which is internationally recognized at between 70% and 80% of the total earnings per year. The rate here is then taken as 72% of the earning per year which translates to $36000.Taking care of inflation and the time value for money which is estimated at a rate of 3%, then the savings have to be done at a higher rate than the 72% which now translates to 75% and the amount then becomes $37500 as the savings per year for retirement (Hicks 2010).

The monthly salary is also pegged or assumed to be $4166 after $50000 is divided by twelve months. Before retirement time, there is a need for a good plan on how to do it. If well planned then it’s possible to have other sources of income other than social security like the case seen in the above balance sheet and income statement where there are other income sources such as cash from operations and even property disposal.

In calculating the savings for retirement in this case and using 72% of my monthly earnings which is $4166 the savings translates to $2999 per month for savings. Since I have chosen to retire in the next two years then the retirement savings is $2999*24 which gives $71976. Savings can also be calculated as the networth which is $220000 plus the retirement budget every month which is $2999.

The figure obtained which is $222999 is added to the money obtained from the pension and the social security which is $1000 assumption per month and the total income for retirement will be $223999. Since this figure is positive then am eligible to retire anytime from now comfortably. My expenditure for retirement since I am retiring in two years is calculated as $ 220000 which is the net worth from the balance sheet plus the monthly income from the pension plan or the social security which is $1000. The amount of $221000 will be a retirement expenditure (Hicks 2010).

The use of 401k is a retirement plan, which is usually made available by the employers so that the eligible employees can make their salary reduction and contribute on basis of pretax or post-tax is also possible. Those employers can be able to make what they call the non-elective way of contributing to the 401k plan on eligible employees’ behalf. A 410K plan is quite a reliable retirement money form since it is built through the money belonging to the employee.

The reliability is strengthened by the fact that nobody can take away the share belonging to the contributor. Employers will in many times provide the match for the employer and is stated mostly at a maximum of 4.5% of the salary at its current form. So for my retirement plan, I assume a 6% interest rate and will have to do 12 payments in a year for the next 2 years until I retire. The 6% rate is assumed to be a true reflection of the stock markets fluctuations. The formula for my 410 plan is given below.

410 plan=FV (nper, rate, pv, pmt, type)

Rate –this is the interest rate in terms of months

Nper-investment term also in months

Pmp- represents contributions per month which are own and employers too.

Pv- the amount currently in my account

Type-optional and represents the payment at the end of the month (1) or the start of the month (0).

So for the case of this retirement

410 plan=Fv ((0.06/12)*12*2*(-5000)*(-187.47) = $112482.

Where 0.06 is the rate in % per month, 24 is 12months multiplied by the two years to retirement, $50000 in negative and represents the PV and is the amount at the bank as shown in the balance sheet. The contributions per month represented as pmt is given negative 187.47 which is 4.5% of the monthly salary by the employer and the employee. In conclusion, the available approaches to retirement planning have a lot of loopholes. They are financially inaccurate and are not environmentally sustainable and therefore can lead to flawed retirement plans. This is why the calculations in this plan are based on consumption assumptions (Hicks 2010).