Corporate frauds have been occurring since centuries now and it has resulted in several economy collapses with the severity of fraud scandals increasing on a daily basis. United States and places other first world nations have been very strict with their legal policies etc. and have been refined over time. Yet some of the frauds committed in the past have been so well-planned and effectively executed, that even detecting them became difficult.

The Sarbanes-Oxley Act of 2002 was passed on July 30th, 2002 as a result of several major corporate and accounting scandals. This act is also known as SOX or Sarbox. Another name for it is Public Company Accounting Reform and Investor Protection Act of 2002. Corporations such as Enron, Adelphia, WorldCom, Peregrine Systems and Tyco International proved to be the starting point of a need for a new law to protect the shareholders who lost millions when the share prices collapsed in the market due to these scandals. Furthermore these actions dissolved investor confidence in the national securities markets. Hence, Sarbox came into being to protect the shareholders and prevent corporate fraud.

The purpose of this act is to establish improved benchmarks for all the public and not private, company boards, accounting firms and even their management operating in the United States. The total of the eleven sections of this Act comprises of criminal penalties, corporate board task accountability, auditor independence, corporate governance, internal control assessment, and improved financial state.

In order to make sure that this Act was a success, Securities and Exchange Commission (SEC) and the corporate sector collaborated so that they can formulate rules for complying with the Sarbanes-Oxley Act of 2002. A new agency called the Public Company Accounting Oversight Board (PCAOB) was introduced under this Act which functioned as a quasi-public agency. The role this company is to act as auditors for all accounting firms and is responsible for supervising, regulating, scrutinizing and disciplining them.

Although, ethical training is one of the few measures that can be taken to avoid such situations in the future, but they do not always work. Some employee with unethical values deep down would not be affected by such trainings as his thinking and planning will remain malicious. However, those with already good values do get these values reinforced by such sessions and can prove to be beneficial for them (Singleton, King, Messina & Turpen, 2003).

People who are not interested are further irritated by such sessions because to them, it is pure ‘fluff’. The reason why they are causing fraudulent activities is money, thus they retaliate by believing that those who are privileged don’t understand the situation the poor are in and why it is essential to do something that is even unethical to make ends meet. Thus, these acts such as SOX are important to track performances and identify any frauds made instead of sessions, because those who are in need of money will go to any extent to gain some extra fortune.

The balance and the income statement can actually be very useful detectors of frauds if they are studied closely, and more importantly, if they are properly compared to the previous years’ statements. When employees usually in the finance and accounting department steal money for their own personal usages, they tend to cover it up by showing fake or overstated expenses in the income statement (Harrington, 2005). The easier way of doing that is to add this amount to the expenses items already being recorded. This way it becomes very difficult to find out which amount was overstated to identify fraud.

However, if we study the income statement trends in comparison to the previous year’s expenses, any sudden and sharp increase in the expenses should be taken into consideration unless one is aware of certain activities that might have caused the increase in expenses. For example, the salaries should almost be the same for both years unless 10 or so new employees have been hired or some employees have been promoted. If not, one should check why the amount has increased.

Secondly, cash in the balance sheet is usually the item frauds are committed with because cash is with the company only and no other records, like the bank statement for bank accounts, is available. Therefore, if the cash balance suddenly goes either really high or really low, it means there is some problem. People overstate it to make the company look like one of the prosperous and lucrative to deceive investors. Some people understate it to make the profits look low and thus have lower taxation claims. Apart from that, if employees steal money, they mostly take it from the cash amounts thus sudden fall in cash should also be checked.

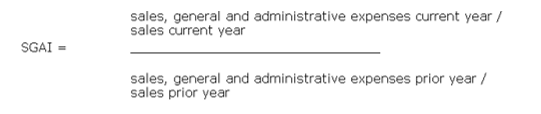

Accounting ratios are usually used to calculate the growth and decline of the companies. There are various ratios used for various purposes but there are also some ratios that can be particularly used to detect fraudulent activities in the company. An article written by Cynthia Harrington in 2005 states, “The ratios measure sales growth, the quality of assets and gross margins, the progression of receivables versus sales, and that ratio of general, and administrative expense. The probability of earnings manipulation goes higher with unusual increases in receivables, deteriorating gross margins, decreasing asset quality, sales growth, and increasing accruals.” This means that the sudden and extremely sharp and noticeable differences in these components can show that there is something wrong with the records. One of the ratios, “Sales, General and Administrative Expenses Index” can be used to determine whether fraud is being committed or not: The formula is:

When the sales are rising and the expenses do not rise in a relatively equal proportion, there is some fraud expected since expansion of sales goes hand in hand with selling expenses. That is, if the sales are rising too faster than the expenses, the production should be checked properly for any unusual activities because when the sales and production rises, the cost of production/expenses should also technically rise. Thus, if sales, general and admin expenses current year/sales current year is below 0.5, it is a matter of concern.

References

Harrington, C., (2005) Formulas for detection: Analysis ratios for detecting financial statement fraud. Fraud Magazine. Web.

Singleton, T, King, B, Messina, FM, Turpen, RA, (2003) Pro-ethics activities: Do they really reduce fraud? The Journal of Corporate.