Case Study of Real Options

A case study of the Sample and Rother oil field developments illustrates where real options analysis can be used to add value to a field development decision process. Traditional methods such net present value (NPV), simple interest, and internal rate of return (IRR) do not take into account the uncertainty of variables that may exist in the future and so are inadequate for making a good investment decision particularly in large projects. Real Options Analysis (ROA) is a useful tool for making investment decisions, taking into account uncertainty and building flexibility in the system. ROA often deals with projects that do not have a lot of historical statistics, for example, a new oil field development. The application of real options makes use of risk to add value to a project and therein lays its potential benefit for a field development decision process.

In oil field developments, investment decisions are usually based on NPV returns calculated for a given oil price premise which varies from company to company. However, this method is conceptually flawed because it assumes a particular line of development for a project and only includes the possibility of failure into the generally projected value for the project. That probability of failure is carried as a discount rate, which in itself can be difficult to assign a value since the discount rate typically is adjusted for the level of risk associated with the project.

Because of these reasons, the traditional methods for making investment decisions are not as effective in an oil field development project where several uncertainties exist.

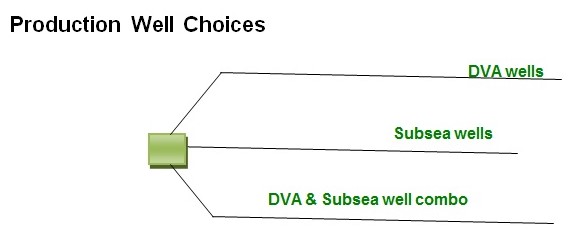

Capacity flexibility looked at include the choice of what type of facility to build and the number of wells to drill and complete – For example, drilling and completing mostly platform wells, also known as direct vertical access wells (DVA) to a single structure, or alternatively having fewer DVA wells but more sub sea wells tied-back from other nearby fields.

Many uncertainties exist in the oil industry: in oil prices, in oil and gas reserves in the ground, in geological and reservoir structures and more. These uncertainties must be considered and weighed when making decisions regarding the future of any project. The application of ROA makes use of risk to add value to a project and therein lays its potential benefit for a field development decision process.

A process of six steps is used to help clarify what the facts are, what uncertainties exist, what decisions need to be made, and the approach that is taken using real options to maximize the expected value based on the decisions made. Trigeorgis suggests the following six steps (23):

- Identify the facts, uncertainties, and decisions to be made

- Break decisions up into a decision hierarchy (i.e., organizing and ranking decisions) to better focus on the problem

- Identify the options based on the problem focus derived from the decision hierarchy

- Create decision tree through calculation of the value of rigid design

- Create decision tree through calculation of the value of building in the real options

- Make final recommendation based on selection that maximizes collection of value matrices given the decision criteria.

Identifying the facts, uncertainties, and decisions to be made

Though it is easy to assume that the project team already knows what the facts are as well as the key uncertainties, it is not always clear to everyone what key decisions need to be made to progress the project. Therefore, listing these points down in a simple table is a very easy straightforward way to ensure everyone understands what is being done. The table below shows a list of the main facts, decisions, and areas of uncertainty that existed in the project.

Categorized issues

Step 2: Breaking decisions up into a decision hierarchy to better focus on the problem

The top section of the decision hierarchy triangle relays how policy decisions will be made. The stakeholders clearly want three things to be done: 1) a decision to be made on how the field will be developed based on which option offers the highest expected value, 2) the development of at least one of the fields, and 3) having first production within four years from the time the second.

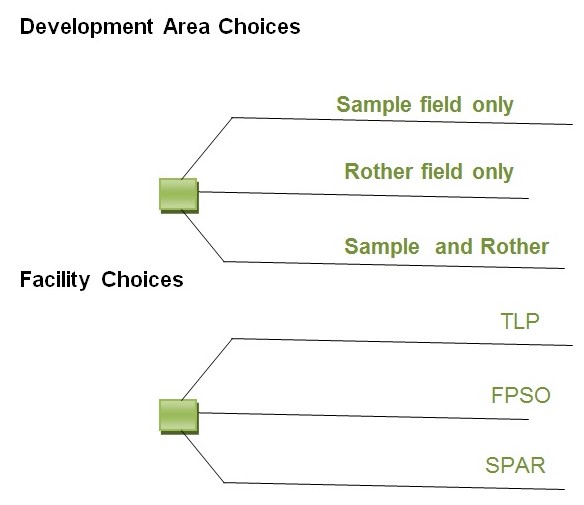

The mid-section of the triangle focuses on decisions yet to be made. This is where real options have the greatest value. Those decisions to be made include what area(s) to develop that is the Sample field, the Rother field or both fields. The mid-section also focuses on what type of facility to put in place and the capacity to construct for, which in turn depends on the area of development. The types of wells to put in place, as well as the number of wells, and whether to build flexibility into the system are other key decisions that need to be made (Trigeorgis 34).

Identifying the Options

Options are identified based on the problem focus derived from the decision hierarchy. The development choices are broken down into development area, facility and production wells. In this case, these choices include drilling and completing a set number of wells now, or building in the flexibility to do so at a later time. Another choice includes building in flexibility to the facility in order to expand it at a later time.

Decision tree diagram can be created through calculation of the values for rigid design and the value of building in real options. The development choices include what area(s) to develop, what facility to develop with as well as the type of production wells to utilize. Two choices are on hand for developing the Rother field: TLP with 5 DVA wells, or TLP with 8 DVA wells. Using the most likely reserves case for the development design and assessment, the expected value of this development choice may be calculated. The most likely or expected case of reserves for the Rother field is may be calculated and be used to make a decision on the future (Trigeorgis 67).

Works Cited

Trigeorgis, Lenos. Real Options in Capital Investment: Models, Strategies, and Applications. Westport, CT: Praeger/Greenwood, 1995. Print.