Executive Summary

Research is vital for businesses in the current era, where companies are extremely efficient. It requires a slim competitive edge to survive in a modern business environment that can only be discovered or achieved through scientific research methods. This paper focuses on the UAE business context to find a case where a business failed to survive in the market due to failing to conduct ample research. More specifically, Taco Bell was chosen; the company entered the UAE foodservice industry in 2008 in Dubai, in the iconic Dubai Mall. However, after just four years in the market, they would exit the market. This can be confusing at face value since the fast-food market in Dubai is huge and American companies fair relatively well. Examples of the companies that have thrived in the UAE market include McDonald’s. Taco Bell is a subsidiary of PepsiCo’s Yum Brands; it is ironic that Taco Bell failed in Dubai despite the successes of other Yum brands such as KFC and Pizza Hut. The only conclusion is that they failed because they did not conduct research about the taste preferences of the target market. The research to determine these failures was carried out using secondary data and through a process of elimination to get to the conclusion. Recommendations have been offered that would have rectified the situation. It was recommended that the company customize its products to the tastes of the local market. The company could also have stayed longer to give the customers a chance to love their products.

Introduction

Taco Bell is an American fast-food chain founded in 1962 in Irvine, California, by Glen Bell. The company specializes in Mexican-inspired foods such as tacos, quesadillas, burritos, and nachos. Taco Bell serves an average of 2 billion customers worldwide as of 2018, with a network of more than seven thousand restaurants (Taco Bell, n.d.). The company operates these locations as independent franchises. PepsiCo took over Taco Bell in 1978 that later forked its restaurant division into Tricon Global Restaurants, that later became Yum! (Taco Bell, n.d.). Taco Bell is the fourth largest fast-food chain in the United States and has sales surpassing those of Wendy’s and Burger King.

The United Arab Emirates (UAE) has become a major commercial center globally and in the Middle East. Specifically, Dubai, Abu Dhabi, and Sharjah have recently emerged as important business centers even for internationally recognized brands. In this vein, Taco Bell saw an opportunity and established operations in November 2008 in the iconic Dubai Mall (Geeter, 2019). Yum! Foods intended to replicate their success in the US in the UAE, but this did not happen since, after four years, they closed all their locations in Mall Dubai, MIRDIF City Centre, and City Deira and completely exited the Emirati market.

Taco Bell’s failure in Dubai was a shock move since American food chains are quite popular in the UAE; these include McDonald’s and KFC. However, Mexican-style foods did not enjoy similar success. This paper will look at the case study of Taco Bell attempting to make inroads into the Emirati fast food market and failing because it failed to conduct sufficient research about taste preferences in the target market.

Literature Review

According to Benshosan (2016), Taco Bell has a peculiar business model that does not place focus on providing good food but instead focuses on feeding people quickly and cheaply. A study conducted showed Taco Bell’s customers do not mind waiting up to five minutes in line but exceeding that had the effect of exponentially increasing perceived waiting times. For this reason, speed is of necessity for Taco Bell’s customers. Another critical factor in Taco Bell’s business strategy is affordability since their target market is young people in their twenties.

Taco Bell outsources the cooking of its meats to suppliers. They typically purchase 290 million pounds of beef each year and are integrated with other Yum brands such as Pizza Hut and KFC (Benshosan, 2016). They are therefore well-positioned to maintain low costs from suppliers and make demands. According to their CEO, the company has been reduced to assembling and delivering (Benshosan, 2016). According to Benshosan (2016), there are 112 Pizza Hut outlets in the UAE and 151 KFC locations, all of which are part of the Yum! Conglomerate.

Restaurant Data

Table 1: Restaurant data

Figure 1 displays restaurant data in the UAE between 2018 and projected results for 2022. Restaurants are divided into four categories: ice cream parlors, coffee and tea shops, full-service restaurants, and fast-food restaurants. Ice cream parlors had 42.2 million USD in 2018 while being projected to generate 35.4 million USD in 2022. Coffee and tea shops had 705 million USD revenue in 2018, while 2022 projected revenues are 584.5 million USD. Full-service restaurants generated 1949.5 million USD in 2018 with 2341 million USD in 2022 projected revenues. On the other hand, Figure 2 shows various amounts of money customers are willing to spend in different GCC cities.

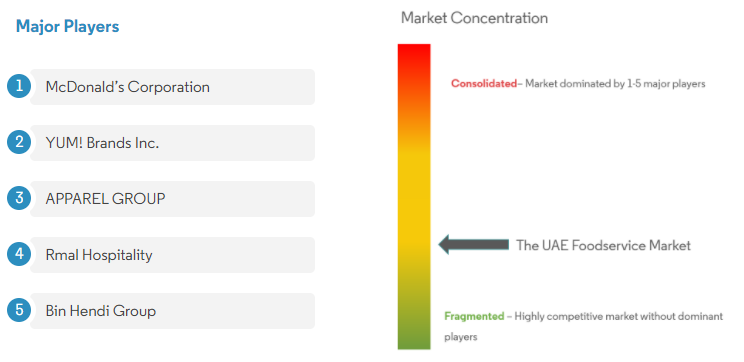

Figure 3 shows the major players in the foodservice industry, with McDonald’s topping the list. The other players in descending order are Yum! Group, APPAREL Group, Rmal Hospitality, and Bin Hendi Group. According to (Top challenges, n.d.), one of the major challenges faced by restaurants in the UAE is that the market is saturated. Another factor is that the landscape has high operating costs while the market is not so large: the population of the UAE is not very large.

The Mexican Cuisine

According to Valerino-Perea et al. (2019), the Mexican cuisine has become popular especially in the US. Before the 1960s, one could hardly find tacos or enchiladas outside of Mexico. This trend has changed dramatically over the years, with Taco Bell and Chipotle becoming leading foodservice chains in the US. According to Valerino-Perea et al. (2019), some factors that have contributed to this boom include the mechanization of tortilla production and the incorporation of Mexican agricultural products into global commodity chains. There has also been a cultural shift in Mexican ethnic stereotypes. In addition, there has also been a tremendous increase in the Hispanic population in America to about 12.5 million in 2013 (Harwood, 2020). This increase in population has partly led to the popularity of the cuisine in the US.

Analysis

In the early 2000s, Dubai was experiencing an economic expansion that was in part because of a construction boom of various megaprojects such as the Palm Islands. In November 2008, Dubai Mall was launched despite a two-time delay; at the time, it was the biggest mall in the world. Taco Bell had planned to capitalize on this by opening the first store in the mall. According to a CNBC report (Geeter, 2019), the first response was great as there were regular queues. From the literature review, it has been noted that Dubai has a high concentration of fast-food restaurants and can be described as saturated. It, therefore, requires state-of-the-art innovation for a business to have a competitive edge.

From the data shown in Figure 1, the UAE foodservice industry is segmented into four categories: ice cream parlors, coffee and tea shops, full-service restaurants, and fast-food restaurants. The data shows that ice cream parlors are not very popular in the UAE. The most popular segment is shown to be fast-food restaurants, in which the Taco Bell problem lies. The data shows that fast-food restaurants accounted for 58% of the market share in 2018, and the number is projected to increase to 60% by 2022. This shows that Taco Bell did not fail because of the lack of fast-food customers in the UAE.

The second dataset represents the average spending on casual dining among various cities in the Middle East. It has been indicated that Dubai, Doha, Jeddah, Abu Dhabi, Riyadh, and Kuwait each reported 135, 135, 67.5, 108, 67.5, and 66.4 AED, respectively. Taco Bell had chosen Dubai as their pioneering location of choice, coinciding with the opening of the iconic Dubai Mall. This data is sufficient to conclude that the location was not the problem and that, indeed, Taco Bell’s failure was not the problem.

From Figure 3 above, the data indicated that the top-performing food service companies in the UAE are McDonald’s, Yum! Brands, Apparel Group, Rmal Hospitality, and Ben Hendi Group. This data indicates that American brands are quite popular in the UAE. Moreover, Yum! Brands such as KFC and Pizza Hut were already doing well, which indicates that Taco Bell was looking forward to capitalizing on this trend. As a matter of fact, as of 2019, KFC operated 151 franchises in the UAE, while Pizza Hut operated 112 outlets. This further demonstrates that the problem was not the unpopularity of Yum! Brands.

The analysis proved that American brands are quite popular in the UAE and that even sister brands to the Yum! A conglomerate is still popular; a further analysis would need to be carried out to get to the root of the problem. Even in America, Taco Bell and other Mexican brands such as Chipotle are but an acquired taste owing to socio-cultural shifts in America. The customers in Dubai did not taste Mexican cuisine and were not given ample time to develop it. As has been observed in the literature review, one of the biggest challenges in the restaurant industry in the UAE is high rental cost; it would therefore be difficult for a brand to have to wait years before entering profitability.

Taco Bell can adopt various business research techniques if it were to re-enter the UAE market. According to ElQuliti and Elalem (2018), the typical feasibility study of establishing a restaurant involves developing the type of restaurant needed and collecting data on the restaurant industry. Typically, the viability study has the following subcategories: business strategy, market study, technical study, site and location selection, social environment study, and economic study (ElQuliti & Elalem, 2018). The market study will analyze the factors surrounding demand and supply and information about competitors. The technical study will examine the required machinery, production capacity, raw materials and inputs, and human resource configurations. Based on quantitative data, a location will be selected, and the impact of the business on the environment analyzed. The economic part deals with resources needed to run the business as well as the project’s economic performance indicators.

Recommendations and Conclusion

The data and analysis have demonstrated that Dubai is a lucrative market for restaurants and has attracted brands from all over the world to try and corner the market. Figure 1 shows that the fast-food category of the restaurant industry in the UAE accounts for over 50% of the entire restaurant industry and is still growing. The market is saturated with global brands, necessitating extensive research before establishing a footprint in the country. Taco Bell did not conduct the research that would have showed them that the local population was not accustomed to the Mexican-inspired cuisine.

The first recommendation for Taco Bell if they were to re-enter the market would be to customize their products. Dubai has a complex demographic since a majority of the residents are expatriates. It is estimated that over 50% of the population is of Indian origin; besides these immigrants, the local population is predominantly Muslim, which calls for compliance with Islamic food laws (Harn, 2017). The company has no shortage of R&D resources since they are a subsidiary of PepsiCo.

Another recommendation for Taco Bell is to take longer and give the local population a chance to acquire a taste for Mexican cuisine. Even in America, where the brand has been so successful took decades to develop, and still, part of the success can be attributed to a rise in the Hispanic population in America. It cannot be so said in the UAE, where such a route is practically impossible because of proximity factors. One is left to wonder what the results would have been had Taco Bell stayed in Dubai for a little longer as they marketed their cuisine. Interestingly, Taco Bell did fail before, but this time in China, where they exited in 2008 but later rejoined the market and became successful. In the age of the internet, brand growth can happen at exponential rates.

This paper focused on the application of research methods to address a business issue in the UAE context. More specifically, the paper dissected the case of Taco Bell, an American fast-food chain that ventured into Dubai but exited the market after four years due to failure. The literature review covered the restaurant scene in the region where it was discovered that the UAE has a wide- albeit saturated – fast-food market. It was also observed that American restaurant chains are popular in the country, with McDonald’s being the most popular. Yum!, which owns the Taco Bell chain, is also quite popular operating brands such as KFC and Pizza Hut, which are still available to this day. Because of the availability of the fast-food market and the success of Yum! sister brands, the only conclusion was that the problem lay with the Taco Bell product, which is the Mexican cuisine. It was concluded that the failure of the venture in the country was due to insufficient research of the target market.

References

Benshosan, A. (2016). 3 things you shouldn’t order from taco bell—According to employees. Eat This Not That. Web.

ElQuliti, S. A., & Elalem, A. G. (2018). Feasibility Study for Establishing a Restaurant in Jeddah. American Scientific Research Journal for Engineering, Technology, and Sciences, 40(1), 143–167. Web.

Geeter, D. (2019). Taco Bell failed in Dubai—Here’s why. CNBC. Web.

Harn, J. (2017). An introduction to the UAE’s history with India. Culture Trip. Web.

Harwood, L. (2020). How Hispanic and Asian populations influence US food culture. The University of Arizona News. Web.

Taco Bell. (n.d.). Web.

Top challenges faced by the restaurant industry in UAE and how to overcome them. (n.d.) The Restaurant Times. Web.

Valerino-Perea, Lara-Castor, Armstrong, & Papadaki. (2019). Definition of the traditional Mexican diet and its role in health: A systematic review. Nutrients, 11(11), 2803. Web.

UAE foodservice market – growth, trends, covid-19 impact, and forecasts (2021—2026). (n.d.). Web.

UAE: Restaurants sales value by outlet 2018-2022. (n.d.). Statista. Web.