For more than five years, CKL has been a leader in the fishing industry. Its current plan to expand market operations through acquisitions is likely to change its risk management profile. Preliminary research on the business idea shows its promise in expanding the company’s market outreach. Therefore, acquisition is a viable strategy for increasing its market presence and competitiveness. This paper investigates the implications of this strategy proposal on CKL from a risk management perspective.

Issues

The findings of this proposal align with CKL’s strategic and business plan of market expansion because it minimizes the risk associated with the strategy. In this document, CKL’s risk management plan will be analysed from three angles – risk rating, prioritization, and control.

Financial Implications

Implementing the recommendations outlined in this document will have far-reaching financial implications on CKL’s operations. Nonetheless, the expected additional expenditure of business expansion is included in the company’s current budget. It is contingent on the operationalization of a new business acquisition plan. The cash flow implications of this strategic plan are positive because successful market expansion is expected to generate additional revenue for CKL.

Risk Analysis: CKL Risk Profile

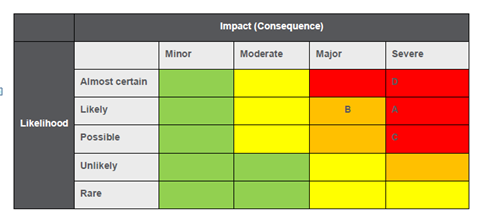

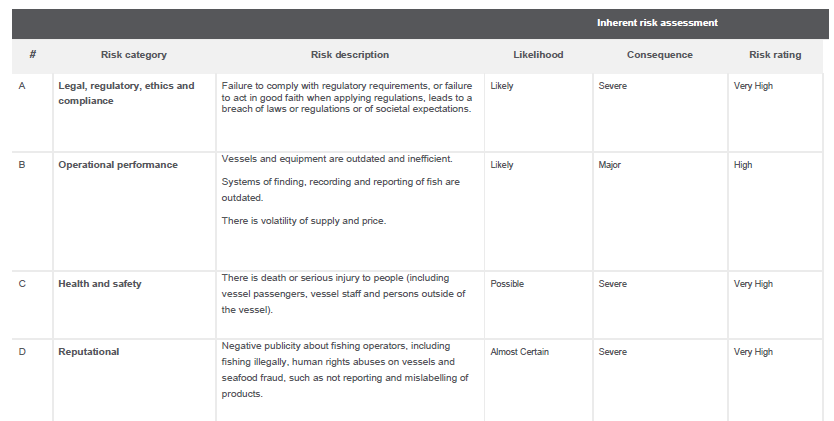

As highlighted above, the first area of risk analysis in this review relates to the risk ratings of CKL highlighted in appendix 1. The framework sufficiently covers various risk profiles due to its use of four, as opposed to three, levels of risk impact assessment. These four levels are “minor,” “moderate,” “major,” and “severe.” Analysts commonly use three levels of impact analysis, including “mild,” “moderate,” and “severe” (Jalilvand and Moorthy, 2022). Therefore, the four level of analysis adopted by CKL provides more detail to the company’s risk assessment analysis. This approach provides an intricate level of risk analysis for the company as it provides a basis for reviewing communication and risk monitoring activities, which are essential to risk reporting (Course Materials, Chapter 4). This multipronged scale of analysis provides an in-depth comprehension of the possibility that a specific peril would be injurious to the firm’s activities.

Risk Prioritization

In this section of the analysis, risks affecting CKL are examined according to the residual risk assessment framework highlighted in Appendix 2 of this document. Given the details surrounding residual risk advantages outlined in the framework, “category D” emerges as the most critical area of assessment for CKL because it is the only risk category with a potential “severe” consequence on CKL’s operations. This risk category needs to be prioritized to improve CKL’s reputation as it expands its market outreach. The process requires the company to maintain open and transparent systems of communication (Massanari, 2018). Additionally, it needs to set up mechanisms for addressing potential concerns or questions that local community members may have about its operations.

Change of Controls

Changing the risk management controls affecting CKL’s operations would help to address some of the above-mentioned challenges affecting the company’s risk management operations. Particularly, redefining the scope, context, and criteria of the firm’s risk evaluation framework would mitigate the above-mentioned problem. This strategy can be operationalized by redefining the focus area for applying the risk management assessment process of the company (Course Materials, Chapter 2). As highlighted in this report, sustaining CKL’s social activities should be prioritized as an important area of risk management. Particularly, social issues relating to local community development and environmental awareness need to be optimized in this part of the strategic development process. These core areas of operation have been traditionally ignored in past risk assessment reports (Koster, Vos and Schroeder, 2017).Key elements of this new area of risk needs to be redefined to restructure CKL’s management process to reflect the proposed change.

A new risk assessment framework ought to be developed to reflect the above-mentioned changes. Table 1 below shows the new proposed risk management framework that factors in the local and social operations of CKL as part of its core management activities.

Table 1. Proposed Risk Management Framework (Source: Developed by Author)

The above-mentioned risk controls account for some of the changes to the risk management profile highlighted in this study. Particularly, the inclusion of the social risk category is new to CKL’s implementation plan. It has been ignored in the past company’s risk management profile because of its low impact on operations. However, subject to the current risk assessment profiles highlighted in appendices 1 and 2 of this document, the impact factor for this risk category has been heightened to 4/5 to reflect its importance to the company’s operations.

Opportunities to Acquire Charter Business

According to Appendix B of CKL’s risk register, four risk categories are defined. They include operational performance, health and safety, and reputational risk. If CKL acquires the new business, it is likely to affect the risk profiles of each of the four categories mentioned above. So far, according to the risk register of all the four categories of risk defined above, all the risk profiles either have a “high” or “moderate” impact on the severity of occurrence scale. The new business acquisition plan is likely to increase the impact of three risk categories – operational, performance, and reputational (Massanari, 2018). This outcome is possible because the proposed acquisition is likely to increase the operational, performance, and reputational expectations of CKL (Suša Vugec, Tomičić-Pupek and Vukšić, 2018). The health and safety tenet of the risk register is likely to be least affected by the acquisition plan because this requirement is standardized across the new and old business.

Additional Risk Categories

Two relevant risk categories that should be included in the above risk assessment plan include strategic and financial risk. Strategies risk is defined by the development of decisions or occurrence of events that have an impact on an organization’s ability to run its operations (Massanari, 2018). Alternatively, financial risk is defined by the ability of an organization to redirect its monetary resources towards pursuing activities that deprive its core business success (Jalilvand and Moorthy, 2022). Therefore, in the context of the current case study, this financial risk is relevant to CKL’s business operations because its proposed acquisition could demand high financial resources that usurp the potential of the organization to finance other activities.

Ethical Challenges of Risk Management

The ethical risk of a company refers to the ability that its operations affect the ethical integrity of its operations. Two main types of ethical risk are likely to affect CKL – inaccurate reporting and the protection of corporate information. Inaccurate reporting is associated with the fiduciary duty of companies to provide reliable data to investors and other stakeholders (Andersson and Ekelund, 2022). This type of risk could affect the financial performance of a firm because its manifestation attracts penalties and fines from authorities (Bell and Wynn, 2021). To mitigate this risk, CKL should employ a network of internal controls using financial software to flag errors before they affect the integrity of the entire system. Alternatively, privacy and confidentiality concerns are ethical issues that are likely to affect the disclosure of corporate secrets. This risk emerges from the likelihood that company secrets could be disclosed in the proposed acquisition process. The main remedy for this ethical risk is training personnel to identify and mitigate risk (Course Materials, Chapter 8,). The decision to refrain from engaging in unethical behaviour demonstrates one’s conviction, consciousness, and responsibility to engage in acceptance behaviour.

Catch Tracker Syste

The catch tracker system is intended to create transparency in the management of fishing activities and improve compliance to existing laws. Two risks associated with the adoption of this mobile software involve the possible relaying of inaccurate data and information theft risk. The first category of risk is associated with the transfer of misleading data to authorities, which could be used as a basis for lawsuits or penalties. Mitigating this risk requires the installation of a verification mechanism that will ensure all information sent on the mobile application is reliable. A third party entity may be be recruited to undertake this function (Andersson and Ekelund, 2022). Alternatively, a time lapse may be introduced to create room for corrections or amendments between the times of information generation to usage. These measures are likely to improve the reliability of data sent across the Catch Tracker system.

The second risk category related to the use of the Catch Tracker System concerns information theft. It concerns the ability of competitors to steal data relating to CKL’s daily products and use it for competitive purposes (Maier, Laumer and Weitzel, 2021). The data obtained from the Catch Tracker system creates room for this breach to occur because it forces the ship operators to send data about the day’s catch to a central authority that is out of the company’s systems. The lack of autonomy of such data once it leaves the company’s systems creates the risk outlined above.

Mitigating the risk that data theft could occur requires a robust assessment of CKL’s IT security infrastructure that underpins the company’s operations. Particularly, the company’s management needs to obtain guarantees from authorities that the data sent to their facilities will be received via a secure connection (Course Materials, Chapter 6). They should get guarantees that it will not be shared with other persons or companies outside of the regulatory system. This security system is expected to prevent unauthorized access of data.

Corporate Governance and Compliance

Companies are expected to adhere to the laws and regulations governing their jurisdictions of operation. The proposed findings of this report demand that CKL improve its internal risk management systems to detect errors before they occur. At the same time, the company needs to comply to the rules and regulations governing mergers and acquisitions in their respective markets (Elamer, Ntim and Abdou, 2020). Key Performance Indicators (KPIs) that could be used to monitor progress include stakeholder participation, profitability, and business reputation.

Recommendations

Prioritizing CSR as a core area of risk management should be prioritized by CKL. This is due to the company’s risk registry and analysis reports, which indicate that this risk is “severe” and has a “very high” impact on the company’s operations. Its importance to CKL could be explained by the growing attention people have given environmental concerns in corporate management (Ahmadi-Javid, Fateminia and Gemünden, 2020). These developments have created a trend in the corporate management scene where the impact of firms is critical to their success and business reputations (Zaby and Pohl, 2019). Based on this trend, the current investigation encourages CKL’s management to integrate CSR as a core tenet of the company’s risk management profile.

Management Responsibility

This report is developed in consultation with the Chief Financial Officer of CKL. It is intended for presentation to the Board of Management.

Signatures

Chief Executive Officer ………………………………….. Sponsor ………………………………………………

Reference List

Ahmadi-Javid, A., Fateminia, S. H. and Gemünden, H. G. (2020) ‘A method for risk response planning in project portfolio management’, Project Management Journal, 51(1), pp. 77–95. doi: 10.1177/8756972819866577.

Andersson, S. and Ekelund, H. (2022) ‘Promoting ethics management strategies in the public sector: rules, values, and inclusion in Sweden’, Administration & Society, 54(6), pp. 1089–1116. doi: 10.1177/00953997211050306.

Bell, K. and Wynn, L. (2021) ‘Research ethics committees, ethnographers and imaginations of risk’, Ethnography, 5(2), pp. 1-12. doi: 10.1177/1466138120983862.

Elamer, A. A., Ntim, C. G. and Abdou, H. A. (2020) ‘Islamic governance, national governance, and bank risk management and disclosure in MENA countries’, Business & Society, 59(5), pp. 914–955. doi: 10.1177/0007650317746108.

Jalilvand, A. and Moorthy, S. (2022) ‘Enterprise risk management maturity: a clinical study of a U.S. multinational nonprofit firm’, Journal of Accounting, Auditing & Finance, 6(1), pp. 231-242. doi: 10.1177/0148558X221097754.

Koster, M., Vos, B. and Schroeder, R. (2017) ‘Management innovation driving sustainable supply management process studies in exemplar MNEs’, Business Research Quarterly, 20(4), pp. 240–257. doi: 10.1016/j.brq.2017.06.002.

Maier, C., Laumer, S. and Weitzel, T. (2021) ‘IT management and change at an energy firm: a teaching case on strategic alignment and business process management’, Journal of Information Technology Teaching Cases, 11(1), pp. 48–61. doi: 10.1177/2043886920935897.

Massanari, A. L. (2018) ‘Rethinking research ethics, power, and the risk of visibility in the era of the “alt-right” gaze’, Social Media and Society, 4(2), pp. 1-11. doi: 10.1177/2056305118768302.

Suša Vugec, D., Tomičić-Pupek, K. and Vukšić, V. B. (2018) ‘Social business process management in practice: overcoming the limitations of the traditional business process management’, International Journal of Engineering Business Management. doi: 10.1177/1847979017750927.

Zaby, S. and Pohl, M. (2019) ‘The management of reputational risks in banks: findings from Germany and Switzerland’, SAGE Open, 3(1), pp. 563-570. doi: 10.1177/2158244019861479.

Appendix