Introduction

The stock market is the center of transactions where securities buyers meet sellers at a certain price. It is a tool for economic development. (Source Webster Dictionary)

The Saudi Arabian Market is known as the TADAWUL and is the only securities exchange in Saudi Arabia. TADAWUL was formed in the year 2001 after replacing the Electronics Securities Information System also known as (ESIS).Source (Saudi Arabia Stock Market.

According to research and reference by the stock exchange, the year 2007 was a very significant year for the Saudi Arabian Stock Market wherein a huge market capitalization was formed amounting to 1,946 Billion SR. This turn of events made it one of the biggest emerging market stock exchanges. The global meltdown of 2008 made a sharp fall in the Tadawul index which was at its lowest in the past 7 odd years.

When TADAWUL was formed there were many restrictions on share dealing and trading of a foreigner and only in the year 2008 were open to foreign investors.

The entity responsible for monitoring the Saudi Arabian Stock market is known as The Capital Market Authority (CMA).

Furthermore, in this research, we will be able to know about the trends on how Saudi Arabia Stock market began.

Saudi stock market existing regulations were only reviewed upgraded and regulated. The Capital Market Law was introduced in 2003 for restructuring the capital market in the kingdom taking advantage of the international stock and the standard market. Aside from this new regulated law, its main purpose is to protect the investor’s rights and to safe keep the reliability and confidence of the stock market.

Arab stock market is the largest market in the ARAB world. At first, this is only applicable to Saudi and GCC but this restriction changed in the year 1997and with some constraints and revision by 2006.Source Saudi Stock Market-SAMBA BANK

Saudi Market consists of 9 sectors namely financial, industrial, Consumer Goods, Consumer service, telecom, oil and gas, utilities, healthcare, Basic Materials (petrochemicals). The year 2003 is the year that Telecom was added to the market index.

Saudi’s Market Stability is being supported by the ff.

- External Demands:

This has raised hope to profitability 2009 is the year when petrochemicals increasingly sharply and ethylene by 67%.

- Domestic Consumer

Demands appear to be firming such as improve in wholesale retails and transport services.

- Global Market- continuing to work upwards.

- Oil prices continue to remain high.

Historical View of Saudi Stock Market

- February 1985- First day of stock index starting at 1000 points

- September 1986- Indexes fell down until it reached their lowest level (630.31 decreased by 37%)

- April 1992- Index keeps increasing reaching its peak of 2298 increases by 230% from the last 6 years.

- Year 20th Century- where most well-known stocks began booming to the highest level. Saudi stock market range 1250 to 2350 points

- Year 2001 to 2005 – Shares double and indexes starts from 2000 to 17000 points

- Year 2006 Saudi stock experienced rigorous crash, price index collapse and lost 65% of its value.

- Year 2007 was a major change wherein not only Saudi Nationals can invest but it made a point to open to all GCC individuals.

- Year 2008, Non-Arab Partisan can participate but with few or limited but with CMA approved and licensed intermediaries.

- Year 2009 Saudi Arabia market capitalization burst up to 313 Billion Dollars the largest among Arab World.

- The data below showcases Saudi Arabia Demographic and its economic Indicator from 2009 to 2013.

Literature Review

Most of the research on the stock market used the past to predict the upcoming or the future. Some focus on the daily basis. For example Damir (2005) researcher analyzed the US stock market during the past 25 years to predict the future of stock market prices. Based on the result he found out that political situations, volatility of international trades, and foreign exchange have significant negative impacts on the stock market prices. Other researchers such as Liu (2006) focus on the daily data of stock market price.

Historical stock data are mostly used by great majority of stock market literature for studying the relationship of share price/return and share performance. Campbell and Shiller (1988), Chiang ET. Al (1997) are a few examples. This research examined either gross indexes or individual markets.

Some researchers like Ray and Tsay (2000) and Areal; Taylor (2002) focus on the stock market volatility.

The great majority of stock market literature has investigated markets in developed countries. Sad to say this is not applicable to developing stock markets since these have unique character. Thus its purpose is to bridge the gap existing in the stock market literature. Source. Saudi Stock Review and Crisis Effect.

In his article about financial reports, mentions risks that are associated with inefficient markets (Siddiqi, 1998). He also embarks on intensive research on various aspects of the Saudi stock market.

An article by Baamir (2008) describes the Saudi stock market, also referred to as the Tadawul, as the largest in the Arab world. It goes on to give the various structures of this market. He also recognizes the initiatives that have been put in place to boost Tadawul’s foreign appeal.

Data Analysis

The Impact of 2008 U.S Financial Crisis on Saudi Stock Market

The 2008 US financial Crisis refers to a time in October and November that the U.S suffered major financial handicap that led to the collapse of several companies. The market housing in the region was largely blamed for the crisis. Housing prices are reported to have grown rapidly in the late 1990s due to a number of factors such as low-interest rates (Siddiqi, 1998).

Several countries at time, particularly the developed, were adversely affected by the collapse of the economy in the United States. This is because the US is considered the world’s economic hub. The Saudi economy, however, was not as greatly affected. It continued to function effectively. The structure of the kingdom’s economy and its sound economic conditions are some of the reasons why Saudi only felt a very little hitch during the crisis (Al-Hamdy). Saudi also boasts of countercyclical fiscal and banking system policies, as well as a conservative supervisory framework, factors that ensured it continued to record steady economic growth when the rest of the world was in trouble. During the period preceding the 2008 crisis, Saudi reportedly recorded admirable economic standings according to international standards. Its average GDP growth rate during that period was recorded at 4.4%. The kingdom’s banking sector seems to have benefitted from this impressive economic activity with its GDP growth rate increasing to 4.5% in 2008 from 3.3% the previous year. Saudi also continued to enjoy surpluses in its current account thanks to external crediting. Inflation in the kingdom is also reported to have dropped drastically by 5.47% in 2009 from 9.87% in 2008 (Alrawashdeh, 2011).

During the global financial crisis, Saudi also managed to maintain good cross-border lending rates. Saudi’s international bank deposits also recorded rapid growth between 2006 and 2008 by about 80 Billion dollars. Although the financing by international banks had maintained a steady rate in 2007, they began to taper off between 2008 and 2009 due to deteriorating global financial market conditions. There was a noticeable decrease in funding from international banks by 24 Billion Dollars between 2007 and 2009 according to the Saudi Arabian Monetary Agency. There are a few factors that are speculated to have been the cause of this decline. The major one was the collapse of the Lehman Brothers Holding Inc, which at that time was considered a main global financing firm. International banks prioritized their need to build up liquid assets, and became more reluctant to fund other emerging market banks (Alrawashdeh, 2011).

Saudi continued to register steady growth in domestic funding despite the global financial crisis. It recorded a growth of 16% of total deposits in 2008 and 10% higher in 2009. Reasons attributing to this occurrence include the increasing level of spending by Saudi during the two years, leading to more funds available to local market participants. With the kingdom now having a steady economy, it began using the opportunities that were available in the domestic economy. This was accomplished by keeping liquid assets within its economy. Another reason is the decision by several companies to reduce their investments internationally. This was brought about by the absence of suitable opportunities as well as products for investment. Uncertainties within the global financial markets were another reason for the cutbacks.

Performance of the Saudi stock market sectors and the performance of the whole stock market between 2008 and 2013

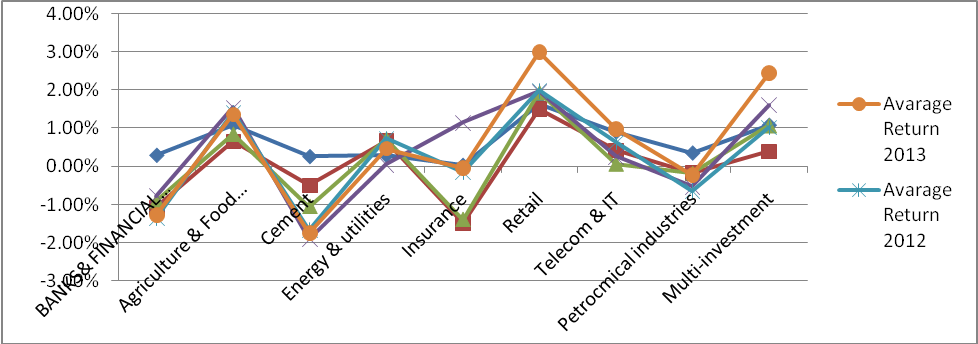

The year 2009 proved to be a difficult one for the Saudi stock exchange with several sectors registering a drop in returns in comparison to 2008. The levels decreased to figures that had been last seen in the region in 2004. The major casualty in this seems to have been the Insurance industry that registered an 84.5% decline in returns by moving from 0.03% the previous year to -1.52% in the subsequent year. Other sectors that recorded significantly high declines are petrochemicals industry at 65% decline and the agriculture and food industry at 32%. All the other sectors also registered decreases in returns in the year 2009, though not as significant as the three aforementioned sectors. Energy and utilities were the only sectors that experienced an increase in returns that year, from a percentage of 0.28 to 0.39%.

In the subsequent years coming up to 2013, there have been severe fluctuations in various sector returns in the Saudi stock exchange. In comparison to the close of 2009, 2010 brought with it increases in all the major sectors with the biggest gainer being the petrochemical industry that moved from -0.52% at the close of 2009 financial year to a close of 0.01% in 2010. Other big gainers were the energy and utilities and the insurance sector with percentage increases of 12 and 16 respectively.

2011 saw the increase in returns by sectors such as the insurance which recorded the highest at a percentage of 2.54 up from 0.01 previously. Other market gainers that year were agriculture and food industries and telecom & IT at 3.4 and 13.1 percent respectively. All other sectors recorded losses.

In 2012, the insurance sector took an opposite direction, recording the highest drop from 2.54% in 2011 to -1.29%. Following it closely was the multi–investment sector moving from 0.54% to -0.58%. The banks and financial services also moved down in percentage returns that year from 0.12 to -0.58. The agriculture and food industries decreased their returns from 0.70% to -0.14%. It was however not rainy for all the sectors in the Saudi stock market that year as some of them still recorded gains in returns. These include; the cement industry, moving from -0.86% to 0.23%, energy and utility sector, from -0.68% to 0.68%, telecom and IT increasing from 0.19 to 0.37 percentages and the petrochemicals industries gaining from -0.35% to -0.12%. The retail industries also recorded an increase, though minimal, from 0.02 to 0.03 percent.

Come 2013, fortunes changed for the Saudi stock market when a considerable number of sectors registered gains. The multi-investment was the big winner that year having moved from -0.58% to 1.42%. Other gainers include; the banks and financial industries (-0.58 to 0.08%), agriculture and food industries (-0.14% to 0.05%), the insurance industry (-1.29% to 0.10%), the retail sector (0.03 – 0.1) and the petrochemical industry (-0.12 to 0.41).

Sectors that recorded losses were; the cement industry, energy and utilities and telecom and IT with margins of 13.4%, 2.4%, and 29.7% respectively.

A line graph demonstrating these fluctuations in the Saudi stock market is as shown below.

There are ten major conclusions that can be drawn from the data collection and analysis of the Saudi stock market between the years 2008 and 2013, both years inclusive.

- The insurance sector’s best performance was back in 2008 when it closed at 84.48%. Since then the trend seems to have been deteriorating every year with only minimal increases in 2012 and 2013.

- Since closing at 69.63% in 2009, the petrochemical industry has never again seen such impressive closing returns. It reduced by almost 40 percent the following year and another 20 later. Since then its recovery has been minimal, almost insignificant.

- Perhaps the most disappointing sector in this stock market is the banks and financial institutions sector which has continued to decline steadily in subsequent years, recording its worst yet at -12.72% in the year 2011.

- The retail sector is one that has managed to record an almost equivalent return percentage in all those years as they have always ranged between 12 and 15 percent.

- The energy and utility sector is another one that has continued to record progressively poor performances in this stock market having started at 23.21 in 2009 and now down to -2.42%.

- The trend of the telecoms and IT sector, on the other hand, seems to be progressing in the positive direction since it recorded 12.56% in 2009 and now closing at 29.74% in 2013.

- Another sector that has given impressive results is the multi-investments sector having begun at a poor percentage of 21.56% and now riding on 400% and above as at closing of 2013.

- The remainder of the sectors, that is the agriculture sector and the cement sector, have proven to be extremely unpredictable following their fluctuating outcomes each passing year.

Conclusion

The financial and the petrochemical industries are considered the backbone sectors of the Saudi stock market. This is because together they account for a little under 70% of the market capitalization. The other sectors, despite having more companies registered under them as compared to the other two, still only take a little portion of the market capitalization. The Saudi stock market was in the years before 2007, only open to its nationals. However, later, in a bid to establish a Gulf Cooperation Council (GCC) common market, it opened the door to other GCC nationals, hence the impressive increase in closing returns of 2008. The Saudi stock market’s main profits are brought in by retail investors who by 2009 took up almost 90 percent of transactions

This stock market seemed to have been enjoying the numbers that were brought in by investors once it opened its door to a larger population in 2007 entering 2008 therefore while the rest of the world came down financially and economically following the global crisis, this kingdom did not feel much of the hiccup (Alrawashdeh, 2011).

In the subsequent years, however, we have continued to observe decreasing economic levels of the kingdom as it strives to hold on in the international market. The main hiccup that deters the prospects of this economy ever getting back to where it was in the past, is the continuous poor performance realized by the sectors that are supposed to be holding it together, that is the petrochemical industries and the bank and other financial industries.

References

Alrawashdeh, B. (2011). How widespread is the phenomenon of earnings management, in companies listed on the Saudi Stock Market. Interdisciplinary Journal of Contemporary Research in Business, 3(7), 1191.

Baamir, A.Y. (2008). Issues of Transparency and Disclosure in the Saudi Stock Market. Arab Law Quarterly, 22(1), 63.

Siddiqi, M. (1998).Saudi Arabia: Financial report. Middle East, 283, 27.

Saudi Stock Review and Crisis Effect.

Trading economics.com.

Source Saudi Stock Market-SAMBA BANK.

Saudi Arabia Stock Market.

Webster Dictionary.

TADAWUL.