Introduction

Tony Fernades and Dato Kamarudin Meranum founded AirAsia in 2001 to offer quality services at affordable prices. The Airline was started in Malaysia due to failing government ownership; thus, it was sold for one Ringgit plus the trailing debt (Verity et al., 2016). Fifteen years later, What started as a two-liner carrier company has grown to one of the largest low-price carriers in the Asian region (Lumpur, 2022). In addition, the investors have been able to expand their portfolio into other ventures, including Tune Money, Tune Talk, Tune Hotels, Tune Sports, Tune Protect, Tune Labs, Epsom College Caterham Carts, and Tune Studios (Verity et al., 2016). This paper will analyze a case study on AirAsia and Tune Group’s strategy using Ansoff’s matrix and Porter’s generic strategy.

The Ansoff Matrix

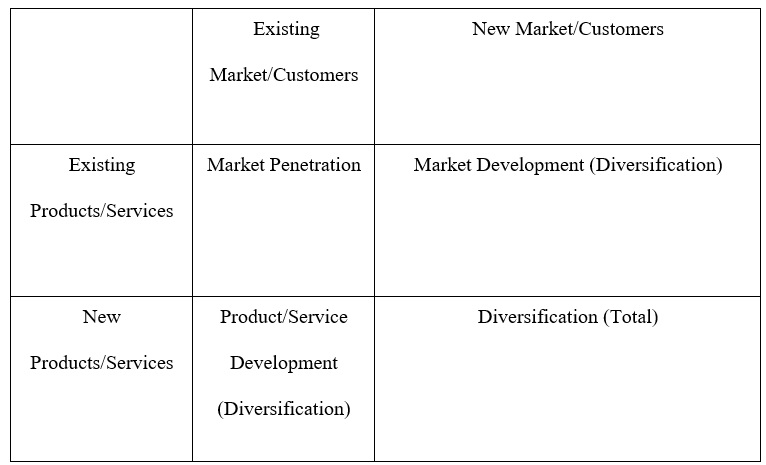

The Ansoff Matrix was first introduced in 1957 by H. Igor Ansoff and later published by the Harvard Business Review. The matrix is rather helpful for stakeholders who want to identify the risks involved with various growth strategies. It comprises four segments: market penetration, market development, product development, and diversification (Duck, 2020). AirAsia used intensification and diversification strategies to expand its operations. Intensification strategies include Market penetration, Market development, and product development, as demonstrated in the Ansoff matrix (Sridharan, 2019). In addition, the company used both concentric and conglomerate strategies.

Market Penetration

Market penetration is the least risky strategy in Ansoff’s matrix, and it involves selling an existing product in a familiar market. AirAsia used product development, market development, and diversification to penetrate the market, as shown below.

Market Development

Market development involves taking the existing products into new markets and expanding the customer base. This step includes research and development to determine the needs of the new market and how the existing product can service them (Wright, 2022). One of the strategies that Fernandes used was product differentiation to enable their airlines to enter the international market. When AirAsia noticed that it could expand to other markets such as Europe, it had to develop a differentiated product because these trips required larger Airbuses with more luxury. Thus, to differentiate the international market from the domestic market, Fernandes came up with AirAsiaX, which was dedicated to the foreign market (Verity et al., 2016). This strategy enabled each Airline to work independently, making it more manageable.

The other strategy he used was creating new customer segments. One of the main advantages of customer segmentation is that it allows entrepreneur to understand their customers better (Zhao, 2020). Thus, since the customers expected AirAsia to offer affordable long-haul services to the new markets, he had to segment the customers and fulfill their needs. To achieve this, Fernando’s introduced low-price international flights; however, they had an option of luxury with an added cost (Verity et al., 2016). This ensured that consumers who wanted to travel with the basic AirAsiaX flight with no additional luxury would be catered for (Hanlon, 2021). In addition, customers who wanted to travel in luxury and at a relatively lower price were accommodated on the flights.

Thirdly, Fernandes used mergers and partnerships to advertise the company to new markets. Being a football fan, he partnered with Manchester United to have their planes painted in the red and white color on top of having their superstars such as Christiano and Rooney images on their planes. Fernandes sponsored the EPL referee kits to get recognition in the foreign market, a method of advertising his products to the new market segment (Singh et al., 2021). These strategies enabled AirAsia to find new markets for their existing products.

Product Development

Product development is when an existing business seeks to develop new products to meet the needs of an existing market. One of the methods he used was business loyalties. This is whereby customers were invited to take their points on purchases made with AirAsia. This method was introduced to promote the use of underutilized routes, generate new revenue, and increase passenger loads on flights. This shows that the Airline understood that the existing market had new needs and thus modified its products to suit them by introducing loyalties.

AirAsia’s second strategy was to make the Airline more convenient in service delivery. It introduced new services such as pick and drop-off services, cargo carrier services, and hotels close to their destinations that could accommodate guests. These products were all introduced in existing markets to enhance customer experience (Iheanachor et al., 2020). Thus, AirAsia to achieve more growth through the introduction of new products to existing markets.

Diversification

This strategy is used to grow business by developing new products in new markets. It is the riskiest strategy in the Ansoff matrix because it involves trying new products in a new market; thus, the probability of success is not guaranteed (Johnson et al., 2017). There are two diversification methods: concentric and conglomerate diversifications. AirAsia applied the two strategies differently to grow its presence in the Asian market and other affiliated markets.

Concentric diversification is horizontal strategy firms use to expand to include similar products to an existing business. In forward diversification, it came up with new ventures related to its previous products, such as Tune Hotels which started to offer accommodation to guests. This is a service related to the company’s initial offering because it supports the company (Le, 2019). Tune hotels were located in safe places, close to the airports, and were low-priced to match the company’s low-price strategy (Verity et al., 2016). Tune money was invented to cater to consumer value and pay royalties and insurance at a lower price (Verity et al., 2016). In addition, it was intended to offer direct financial services to potential customers through the Tune group website. This shows that the group used other affiliate services to enhance the products offered by AirAsia, which was a good horizontal diversification strategy.

The second strategy used conglomerate diversification strategies involving a company entering a new untapped market. This is where a company moves into new industries they are unfamiliar with (Le, 2019). AirAsia used mergers and acquisitions to get into new industries. For instance, to start Tune Talk, a telecommunications company, AirAsia partnered with Celcom Axiata Berhad, the oldest communications company in Malaysia, to provide the services. The company provides affordable call rates nationwide, free personal accident insurance, and loyalty points.

Another example is Tune Sport, where Fernandes introduced Tune Sports because of his love for sports. He had a significant stake at Queen Park Rangers, a football club based in London (Verity et al., 2016). In addition, he partnered with a French Company, Renault, in making formula one cars. Tune Sport showed that venturing into a new industry was riskier because the business failed after a series of legal battles between AirAsia’s Caterham Road Cars and Lotus Racing (Verity et al., 2016). However, the company utilized the opportunity appropriately and gained popularity in the UK by sponsoring the Manchester United Club. The table below shows the differences between concentric and conglomerate diversifications and their properties as applied above in the text.

Porter’s Generic Strategy

Porter’s Generic Strategies were introduced by Michael Porter in 1985 when he wrote his book “Competitive Advantage: Creating and Sustaining Superior Performance concerning business strategy.” In this text, Porter suggested three main generic strategies which can be used by a business to gain a competitive advantage (Ali & Anwar, 2021). These include cost leadership which involves minimizing operational costs to offer lower prices, differentiation which means making unique products, and focus, which is either based on cost focus or differentiation focus.

Cost Leadership

AirAsia Airlines uses cost leadership to provide customers with best-value or low-cost services. However, in general, the cost leadership strategy should be used with differentiation to bring exemplary results (Johnson et al., 2017). In addition, cost leadership depends on various factors such as economies or diseconomies of scale, operation costs, linkages with distributors, research and development, availability of labor, and product modification (The Economic Times, 2019). In addition, cost leadership is effective in a business when there are a large number of buyers who are price sensitive.

AirAsia applied a cost leadership strategy in their model because they utilized some of the above factors. The first factor was the exploitation of economies of scale, whereby the flights rely on the high number of passengers to make profits (Loh, 2021). The Airline ensured low operation costs by sourcing labor locally, which enabled them to get affordable labor. However, the Airline could not run without slight modifications to the products; thus, it scrapped some services such as excess luggage, meals on the flight, and other ancillaries to ensure they lower the operating cost. Finally, AirAsia relied on its price-sensitive customer base to achieve a competitive advantage (Verity et al., 2016). Fernandes knew that most people used their services because they were relatively cheaper, and although some competitors tried lowering their prices, they could not sustain it for a longer period. Thus, AirAsia was left to exploit this opportunity, gaining a wide customer base.

Differentiation Strategy

All the strategies used by producers offer differentiation; however, what determines their significance is their ability to be duplicated by competitors. The most effective differentiation strategies are those competitors cannot easily duplicate (Lucidity, 2021). A good differentiation strategy allows a buyer to develop a product that earns them customer loyalty and may include features such as engineering design, product performance, superior services, or the price.

AirAsia relies on low, competitive prices as its differentiation strategy. This method is unique from competitors and distinguishes the Airline from others. In addition, the method is not easily copied because it cannot be sustained for a long time by the competitors (Johnson et al., 2017). Once they try to duplicate the low-cost strategy, it does not last for long; hence they can not gain customer loyalty. The other way AirAsia uses differentiation is by product development. The Airline has come up with unique products supporting products such as Tune Hotels and Loyalties which enable the consumers to be loyal to the brand (Verity et al., 2016). Although these product developments may seem simple and easy to copy, they are capital intensive and require a large customer base to run efficiently. This shows that AirAsia has successfully differentiated itself from other airlines which offer similar services.

Focus Strategies

A focus strategy method is essential in gaining a competitive advantage when the consumers of s specific product have varying and specific references. This strategy is further subdivided into two: cost leadership and differentiation strategy. Either way, focus strategies concentrate on consumers with specific needs and wants (de Bruin, 2021). Thus, in this case, a business is made to produce products with a lower cost structure or unique features that match the specific consumer needs (Khairani et al., 2021). If a business decides to focus on cost, they are supposed to produce a product generally accepted at a lower price, giving the consumer a benefit in the niche market. Concerning differentiation focus, a business prioritizes previously ignored needs and wants and satisfies those needs (Opinaldo, 2022). AirAsia focused on the specific needs of international customers and provided tailored products, which include: super-sized baggage, AirAsia courier, inflight food, charter flights, and others (Verity et al., 2016). However, these came at a higher cost to cater to differentiated services.

Conclusion

AirAsia, started from scratch by Tony Fernades and Dato Kamarudin Meranum, has seen significant growth over the past two decades. However, this can be attributed to its good application of business growth strategies. The analysis shows that the business effectively utilized the Ansoff Matrix model and Porter’s generic strategies. The accurate application of these strategies has led to significant business growth from a single Airline company with two aircraft to an empire of different ventures.

References

Ali, B. J., & Anwar, G. (2021). Porter’s generic competitive strategies and its influence on the competitive advantage. International Journal of Advanced Engineering, Management and Science, 7(6), 42–51. Web.

de Bruin, L. (2021). Porter’s generic strategies explained with examples | B2U. B2U – Business-To-You.com.

Duck, P. (2020). IBS Americas – International business school – Americas. IBS Americas.

Hanlon, A. (2021). The Ansoff Model | Smart Insights. Smart insights.

Iheanachor, N., Umukoro, I. O., & David-West, O. (2020). The role of product development practices on new product performance: Evidence from Nigeria’s financial services providers. Technological Forecasting and Social Change, 120470.

Islami, X., Mustafa, N., & Latkovikj, M. T. (2020). Linking porter’s generic strategies to firm performance. Future Business Journal, 6(1). Springeropen.

Johnson, G., Scholes, K., Angwin, D., Regnér, P., & Whittington, R. (2017). Exploring Strategy (11th ed.). Pearson.

Khairani, A., Asrie, P. D., & Lailatul, F. R. (2021). Implementation of Porter’s Generic Strategies in Indonesian airlines industry during Covid-19 pandemic (Case Study: Garuda Indonesia and AirAsia). Scholar.ui.ac.id; IEOM Society. Web.

Le, H. (2019). Literature review on diversification strategy, enterprise core competence and enterprise performance. American Journal of Industrial and Business Management, 09(01), 91–108.

Lim, S. (2020). How low-cost airline AirAsia is transforming itself into a publisher. The Drum.

Loh, C. (2021). AirAsia posts record loss for the final quarter of 2020. Simple Flying.

Lucidity. (2021). Introduction to Porter’s Generic Strategies | Resources | Get Lucidity. Getlucidity.com.

Lumpur, K. (2022). AirAsia Group is now Capital A. Airasia Newsroom.

Opinaldo, N. (2022). Porter’s Generic Strategy: Explained with examples. gitmind.com.

Peterdy, K. (2022). Ansoff Matrix – Overview, Strategies and Practical Examples. Corporate Finance Institute.

Singh, P., Sinha, R., A/P Nagenthran, Y., Teoh, K. B., Yong, H. Y., Wijaya, S. H. I. W., Aryani, D. N., Singh, H., Das, A., & Dabeer, S. L. (2021). Factors affecting the revenue of air Asia Berhad during the COVID-19 pandemic. International Journal of Accounting & Finance in Asia Pasific, 4(2), 58–72. Web.

Sridharan, M. (2019). Ansoff Matrix: Understanding firms’ growth options. Think Insights. Web.

The Economic Times. (2019). Definition of Cost Leadership | What is Cost Leadership ? Cost leadership meaning – The Economic Times. The Economic Times.

Verity, J., Jenkins, M., & Rajwani, T. (2016). AirAsia and the Tune Group: Diversifying across industries. Cranfield School of Management.

Wang, H., & Li, B. (2021). Environmental regulations, capacity utilization, and high-quality development of manufacturing: an analysis based on Chinese provincial panel data. Scientific Reports, 11(1), 19566.

Wright, T. (2022). The Ansoff matrix helps organizations to grow. Www.cascade.app.

Zhao, X. (2020). Marketing segmentation in consumer product industry. E3S Web of Conferences, 218(6), 01027.