Introduction

For more than three centuries, companies have affirmed their role in creating strong economies for the advancement of human societies. However, people still doubt whether they have good intentions in addressing the political, economic, and social issues affecting societies in today’s globalized world (Vranceanu 2014; Hart & Zingales 2017). Different pieces of literature that have investigated the role of ethics in the corporate field highlight these concerns (Jennings 2014; Davies 2016).

Based on the existing doubts regarding the motivation of companies to engage in international trade, there has been another discussion regarding whether companies should pursue their profitability interests at the expense of ethical concerns, or whether they should only engage in activities that societies consider “morally acceptable” (Davies 2016; Sheldon & Daniele 2016). This debate stems from the assumption that ethics and profitability are often at odds with one another.

Relative to this view, one group of people believe that the pursuit of profit cannot be done ethically, while another one believes that businesses should be primarily ethical and pursue their profitability goals only when it is “morally acceptable” to do so. This paper does not support either of the two views; instead, it demonstrates that businesses can pursue profits and still be ethical at the same time. However, before providing reasons to support this claim, it is first important to understand the differences in views between people who support profitability goals and those who advocate for ethics.

Support for Profits at the Expense of Ethics

The debate surrounding profitability and ethics is characterized by arguments made by managers who support the need to pursue profits at the expense of ethical goals and those who emphasize the need to observe ethical standards before profitability (Ferrell & Fraedrich 2016). Those who support the need to prioritize profitability goals over ethics argue that organizations primarily exist to cater to the interests of their shareholders, which is centered on profit maximization.

Therefore, by embracing the profitability philosophy (increasing revenues and minimizing expenses), companies are doing what their shareholders expect of them and that is to achieve the highest return on investments. This reason explains why some shareholders often replace managers who fail to achieve high levels of profitability. This action is supported by the common definition of “good performance” in the corporate field, which is profit maximization (Vranceanu 2014; Hart & Zingales 2017). In such a context, companies often ignore ethical principles in their decision-making processes. Therefore, it makes no sense for a manager to compromise an opportunity to make a profit by being ethical.

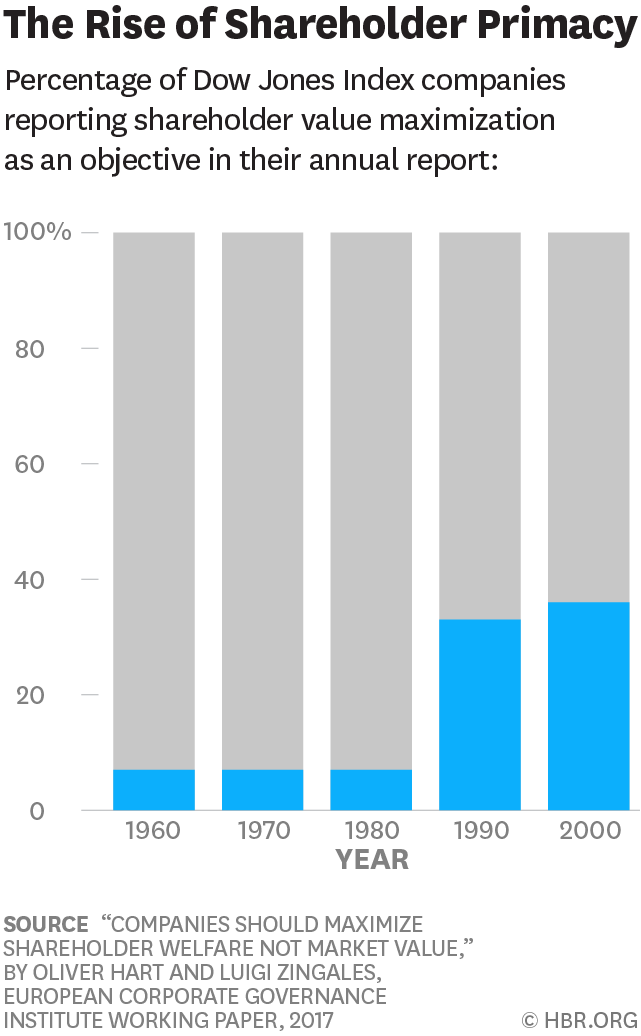

Researchers have linked the philosophy of profit maximization with the concept of shareholder primacy (Hart & Zingales 2017). Shareholder primacy is the general commitment by managers to prioritize shareholder interests at the expense of all others in their decision-making processes. Studies that have investigated managers’ attitudes show that many business executives support shareholder primacy (Hart & Zingales 2017).

For example, figure 1 below shows an increase in the number of managers who support shareholder primacy (the pursuit for profit) between 1960 and 1980. This is because the percentage of corporate leaders who preferred profitability in ethics was below 20% (Hart & Zingales 2017). However, after 1990, a sharp increase in the percentage of managers who practice shareholder primacy increased from 7% to 38% (Hart & Zingales 2017).

Based on figure 1 above, people who support the profit-making model of corporate governance consider their arguments as practical and measurable because they strive to meet the common purpose of starting a company, which is to make a profit. Thus, people who believe that businesses can only be for-profit often condone ethical violations to maximize shareholder values. Researchers, such as Rogers (2017), support this view by arguing that business executives should prioritize the protection of a business’s bottom-line. The quest to maximize shareholder value is accentuated by Friedman’s classic 1970 statement, which says, “the sole social responsibility of a business is to increase profits” (Scerri 2019, p. 131).

Support for Ethics at the Expense of Profits

Although scholars rarely dispute the need to increase business profitability, some of them have a different school of thought, which is premised on the need for businesses to be ethical, and not necessarily profitable (Halbert & Ingulli 2014). These scholars share a similar view with those who propagate the view that profitability should be upheld at the expense of ethics because they both believe that profitability and ethics are independent of one another (Skorin-Kapov 2018).

People who argue that ethics needs to be upheld as a core tenet of business practice suggest that it is pointless to make a profit if doing so is unethical. In other words, they encourage businesses and managers to assess the cost of making profits because it is not worth maximizing financial gains if such a strategy is predicated on immoral practices (Storchevoy 2017). Companies that fail to adhere to ethical principles suffer financial damages after litigation.

This is why several firms have been sued for abating unethical business practices (Carroll & Buchholtz 2014). Others have suffered serious reputational damages, which have eroded their credibility. For example, Nestle suffered significant financial losses by engaging in unethical business practices in its overseas operations (Perritt 2017). Particularly, the Swiss company was sued for abating child labor practices in foreign countries (Perritt 2017). Figure 2 below explains the company’s behaviors because business executives rank low on ethics.

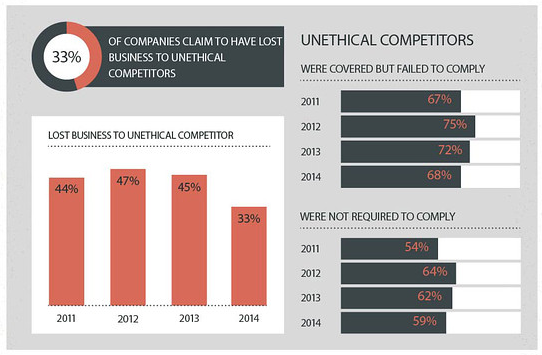

Poor ethical standards have also been reported in organizational behavior because figure 3 below demonstrates that in 2014, 33% of companies lost business because of their competitors’ unethical practices (Elliot 2014). In 2013, 2012, and 2011, the percentages of businesses that suffered from unethical practices were 45%, 47%, and 44%, respectively (Elliot 2014).

Broadly, figures 2 and 3 above show that business executives are among professionals who do not consider ethical considerations as an important part of their decision-making processes. In fact, according to figure 2, nurses significantly outperform business executives in making ethical decisions (81%, vs. 15%) (Haggerty 2018). Overall, the support for ethics at the expense of profitability is highlighted in the stakeholder approach of corporate governance. It argues that the sole responsibility of businesses is to meet the interests of all its stakeholders (Cooper 2017).

Discussion/Analysis

The problem with the profit-centered view of corporate management is the one-track definition of success. In other words, it advocates for the financial quantification of business performance. However, a firm’s behavior needs not to be defined in this manner because, although earning potential is important for the survival of businesses, their success needs to be quantified within the larger framework of social responsibility.

In other words, organizations exist to serve people and not the other way around where people serve businesses. Therefore, ethics exist to protect society from the “excesses” of commerce. Stated differently, if firms only pursue profits at the expense of ethics, they would be undermining the society that supports them in the first place. Consequently, failing to observe business ethics is counterproductive. Concisely, if businesses only focus on financial success, they would be embracing a limited perspective of corporate performance because firms do not only exist to make a profit (Hart & Zingales 2017).

Sheldon and Daniele (2016) deem the profit-making objective as traditional. Consequently, a more sophisticated version of success has emerged, which suggests that businesses should focus on three Ps, which are people, processes, and products (Kolko 2014). Therefore, managers need to make sure that their pursuit of profit is ethical because their stakeholders are not only investors or employees but also customers and society.

Relative to the above view, several researchers have pointed out that pursuing profits and observing ethical principles is beneficial to companies (Sheldon & Daniele 2016). For example, Arend (2014) says that companies, which merge both profit and ethical goals, enjoy a greater market share and profitability compared to those that only safeguard their profit motive. The success of such companies emanates from the belief that organizations should not only make profits but also “do the right thing.”

Therefore, firms that observe this principle are rewarded through increased profitability and market share. This support for a balance between profitability and business ethics was highlighted in the quest for universal health coverage in America when the Clinton Administration failed to ratify a set of laws that would increase health insurance premiums on employers. At the time, there was concern that high tax rates would increase the cost of doing business, thereby undermining the success of small businesses altogether (Ghosh, Ghosh & Zaher 2011).

However, this reasoning was flawed because most critics failed to understand that an injured employee was more productive than an uninsured one. Therefore, they failed to account for the increased profitability businesses would enjoy if they balanced their profitability and ethical goals. This example demonstrates that if businesses respect ethics, they would not experience low levels of profitability. In other words, both profit maximization and ethical goals can be promoted at the same time. The formative assessment for this paper appears in the appendix section.

Conclusion

The debate regarding business profitability and ethics has formed the basis for this study. The general view regarding profits and ethics is premised on the understanding that moral codes and ethics impede profit maximization. However, in this paper, it is established that profits and ethics are compatible because both goals could coexist in corporate management. As managers think of blending their ethical and profitability goals, they need to develop new capabilities that would meet both interests.

Particularly, they need to formulate policies that do not negate either aspect of ethical or profitable growth and instead remain committed to observing the duality of both objectives. In the future, there will be a need for organizations to balance three identities characterizing modern firms: the human function, economic function, and social function. Therefore, through a stakeholder-oriented model, managers should adopt a balanced view of profitability and ethics because to support business success.

Reference List

Arend, RJ 2014, ‘Social and environmental performance at SMEs: considering motivations, capabilities, and instrumentalism’, Journal of Business Ethics, vol. 125, no. 1, pp. 541-561.

Carroll, B & Buchholtz, A 2014, Business and society: ethics, sustainability, and stakeholder management, 9th edn, Cengage Learning, London.

Cooper, S. 2017. Corporate social performance: a stakeholder approach. Taylor & Francis, London.

Davies, P. 2016. Current issues in business ethics. Routledge, London.

Elliot, N. 2014. Is ethics winning in business? Chart points to that trend. Web.

Ferrell, O & Fraedrich, J. 2016. Business ethics: ethical decision-making & cases.. 11th edn, Cengage Learning, London.

Ghosh, D, Ghosh, DK & Zaher, AA. 2011. ‘Business, ethics, and profit: are they compatible under corporate governance in our global economy’, Global Finance Journal 22, no. 2, pp. 72-79.

Haggerty, M. 2018. Business ethics. Web.

Halbert, T & Ingulli, E. 2014. Law and ethics in the business environment, 8th edn, Cengage Learning, London.

Hart, O & Zingales, L. 2017. Serving shareholders does not mean putting profit above all else. Web.

Jennings, M 2014, Business ethics: case studies and selected readings, 8th edn, Cengage Learning, London.

Kolko, J 2014, Well-designed: how to use empathy to create products people love, Harvard Business Review Press, Boston, MA.

Perritt, A 2017, Employment law update, Wolters Kluwer Law & Business, London.

Rogers, D 2017, Decide to profit: 9 steps to a better bottom line, Select, Books, Inc., London.

Scerri, A 2019, Postpolitics and the limits of nature: critical theory, moral authority, and radicalism in the anthropocene, SUNY Press, New York, NY.

Sheldon, P & Daniele, R (eds) 2016, Social entrepreneurship and tourism: philosophy and practice, Springer, New York.

Skorin-Kapov, J 2018, Professional and business ethics through film: the allure of cinematic presentation and critical thinking, Springer, New York.

Storchevoy, M 2017, Business ethics as a science: methodology and implications, Springer, New York, NY.

Vranceanu, R 2014, ‘Corporate profit, entrepreneurship theory and business ethics. business ethics’, A European Review, vol. 23, no. 1, pp. 50-68.

Appendix

PM501 Formative Assessment Name:____________ GUID:___________

Organise Thematic Notes

Thematic Notes: Organise your Ideas into themes.

First, note down key arguments from the source material and write them in the correct column below. Include any critical comments and citation e.g. (Spencer, 2007, p34).

Then highlight your notes according to the theme. (You can make this table larger if necessary)

Essay question:

Reformulate thesis and identify which ideas will be discussed in turn and write topic sentences

Planning your essay: Use your thematic notes to reformulate your thesis

Closely examine your notes above. What argument follows from your evaluation of the important ideas?

Rewrite your thesis below. Make sure it answers the essay question.

My Reformulated Thesis: This essay will argue that ethical business is integral to the future sustainability of businesses.

Planning your essay: Identify main ideas to be discussed in your essay. Read your thesis again, what are the important ideas you will discuss in your essay?

Note these below

The main sub-topics I will discuss in my essay are:

- The decline of shareholder primacy

- The shallow nature of a profit-centred corporate governance strategy

- The need to balance profitability and ethical concerns in business

Planning your essay: Write a topic sentence for each MAIN BODY PARAGRAPH in your essay

A topic sentence should introduce the idea and your opinion. Make the table bigger if required.