Introduction

Financial statements are reflects the degree of performance of a certain industry; they are also used for comparison of companies, sectors, or industries. International financial reporting standards require companies to make periodical financial statements that can be utilized by stakeholders when decisions. Ratios are used to analyse the financial strength of a business; when comparing two or more companies in the same industry, they are effective tools (International Accounting Standards Board and International Accounting Standards Committee Foundation, 2009). Generally there are two categories of ratios; balance sheet ratios and income statement ratios. Financial statements can be used to measure the level of profitability, efficiency and liquidity ratios. The Australian apparels industry has a number of players engaging in varying trade; businesses with similar sources of income can be compared using financial ratios (Fridson and Fernando, 2002).

Reject Shop Ltd has over 192 retail outlets where it sells discounted merchandise products; it was registered in Australian Stock Exchange in June 2004. Country Road Ltd is an ASX (Australia Security Exchange) registered company that deals with sale of household merchandise; its core line of business is designing, whole selling, retailing and home wares, clothes, other apparels and any other related accessory. The two companies are operating in the multiline retail; the similarity in trading line makes ratios effective performance comparison tool.

Profitability ratios

These are ratios that interpolate how a company is able to convert sales into profit; under the ratio, the trend of the company will be crucial as well as the rate at which gross profit is trickled down to net profit; the following ratios are used for the analysis:

Gross Profit Margin

The ratio is calculated as follows:

Gross profit ratio = (Cross profit / Revenue) * 100

(Atrill and Jenner, 2009).

Country Road in 2009 and 2010 recorded a gross profit ratio of 58.96% and 58.16% respectively, although the rate is in the same margin of about 58%, the company shows that its cost of sales relative to the sales made where increased.

Reject Shop Ltd in 2009 and 2010 recorded a gross profit ratio of 46.14% and 46.95%, although the rate is almost in the same margin of about 46%, the company shows that its cost of sales relative to sales where decreased; this can likely be a show of a company that is trying to improve its profit margin. When using the ratio to compare the two companies, it is evident that Country Road Ltd has a higher operating margin than Reject Shop; this can be an indication of a company that will have a higher net income (Helfert, 1997)

Net Profit margin

Net Profit margin is calculated using the following formulae;

Net Profit before Tax

Net Profit Margin Ratio = _____________________

Net Sales

In 2009 and 2010 Country Road Ltd had 6.42% and 4.85% the ratio shows that the company has more expenses than it had in 2009; there is two way of looking that the change, may be the company was inefficient or there were some projects that incurred revenue expenditure that were charged in the trading account. In case the revenue expenditure was income generating, then the income that can be attributed to them should be seen in the accounts. The record of net profit follow the same trend with gross profit however the rate of decrease of net profit is much higher than the expected rate (Michael, 2006).

In 2009 and 2010 Reject Shop Ltd has 6.91% and 6.95% record in net profit margin; the rate shows some stability in the company where the deviation is not that substantial’s. Something worth noting is that the ratio seems for follow the gross profit margin recorded in the company. This is an indication that the business is maintaining its level of efficiency and an increase in gross profit margin translates to a similar increase in net profit margin.

When using the ratio to compare the two companies, Reject Shop Ltd have an upper hand, it seems to have a constant efficiency and consistency in its profitability (Weygand, Kimmel and Kieso, 2010).

Return on equity

The ratio is calculated as shown below:

ROE = (Profit After taxes / Equity) *100

The R.O.E. in 2009 and 2010 of Country Road Ltd are 20.87 and 14.57% respectively; the rate shows a decreased rate; when suing the rate, it shows the rate at which owners equity are used to make profits for the company. In this case the reduced rate shows that the company has a higher inefficiency; its shows the rate at which owners capital are yielding profit keeps decreasing.

In the case of Reject Shop Ltd, the R.O.E. for 2009 and 2010 are 48.14% and 45.30%, the rate shows that the company equity production is lower in 2010 than it was in 2009, this is an indication that the company is suffering from a certain rate of inefficiency that was not able to utilize owners equity more effective in 2010 like in 2009.

When comparing the two companies, it is evident that in both years, the rate of return for Reject Shop is much higher than the rate recorded by Country Road; actually they are more than double. The above observation is an indication that Reject Shop is a better manager than the case of Country Road Ltd.

Assets Turn over

This ratio measures the amount of sale that is derived from a unit measure of assets in the company. A higher rate shows effectively utilized assets; it is calculated as follows:

Assets Turn over = Revenue / Assets

In 2009 and 2010, Country Road Ltd had the ratio as 2.42 and 2.88, the ratio indicate that the company in 2008 was able to use their assets better than they did in 2009. In Reject Shop, the ratio was 4.29 and 3.51 in 2009 and 2010 respectively; the ratio show that the company was inefficient in 2010 than it was in 2009; the decrease is substantial. The decrease or increase in both the companies can be attributed to a change in either pricing strategy or marketing styles.

When using the ratio to compare the two companies, the rate is higher at Reject Shop Ltd and indication that the company was more efficient in using their assets than the case was with country road Ltd.

Return on assets

The ratio shows the amount of net profit before taxation that can be attributed to a unit measure of asset, the ratios is calculated as follows:

Net Profit before Tax

Return on Assets = ________________________

Total Assets

In 2009 and 2010, Country Road had 15.53% and 13.97% respectively; the change in rate indicate that the company was able to use their assets better in 2009 than they did in 2009, this is a show of inefficiency in the company.

In Reject Shop, the rate of return on assets were 29.66% and 24.46%, they are has reduced for the period an indication that the company was less effective in 2010. When using this ratio to compare the two companies, it is evident that Reject Shop is using its assets better than country is doing.

Efficiency Ratios

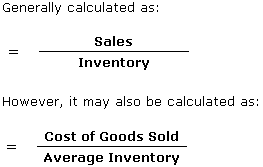

Inventory Turnover (times)

The ratio is used to calculate the number of times sales in have overturned the inventories, it is calculated as follows:

In 2009 and 2010, Country Road ltd had 97 and 87 days respectively; the rate decrease in 2010 can be an indication of a better stock management and wise purchasing or it can be from loss of business and reduced sales. When interpolated with net profit margin which reduced, the decrease can be only because of decrease in sales. In reject Shop, the rate of turnover is 65 days and 74 days in 2009 and 2010 respectively; this indicates that the company had higher sales to stock turnover. When this rate is compared with the results given by the net profit turnover, then it shows that the company had increased sales.

Debtors Turn

The ratio is used to show the quality of debtors that the company maintains; when the rate is low, it shows that the company has high rate of collection and thus better debtors.

In the case of Country Road, the rate was 3 days in 2009 and 6 in 2010, this shows that the company collection rate had reduced; this shows some rates of inefficiency. in the case of Reject Shop, the rate is nil, this shows that the company sell in cash; the policy of selling in case is an important policy as it assists a company avoid chances of bad debts.

When comparing the two using the rate, then it is better the company that sells in cash as it is unlikely to have bad debts (Fridson & Fernando, 2002).

Creditors turnover (Days)

The ratio indicates how well a company is able to manage its creditors; the lower the number of days the better the creditors management.

In country Road Ltd, the number of days is 69 and 61 days in 2009 and 2010, this is an indication that the company has had an improved creditor’s management system. In Reject Shop ltd, the rate is 26 and 30 days; this shows that the company management of creditors is becoming inefficient; however the same can be attributed to better creditors who are offering a large number of days before payment a factor that can increase the company’s liquidity.

When comparing the two, it’s evident that Reject is able to settle its credit faster than Country Road, this an indication of a better managed business (Helfert, 1997).

Financial stability

Current ratio

The ratio measures the rate at which a company can meet its financial obligations when they fall due; it is recommended that coverage of 2 is healthy, it’s calculated as follows:

Total Current Assets

Current Ratio = ____________________

Total Current Liabilities

(Bill and McKeith, 2009).

In 2009 and 2010, neither of the company had a healthy rate; this was an indication that both companies are suffering from liquidity. The situation is worse in Reject Shop limited in 2009 as it indicated that the company could not meet the financial obligations when they fell due.

Quick Ratio

It calculated as follows:

Quick Ratio = ( Current assets – inventory (stock) / Current liabilities

In 2009 and 2010, neither of the company had a healthy rate; this was an indication that both companies are suffering from liquidity; neither of the company could meet its financial obligations when they fell due (Haka, Williams, Bettner and Carcello, 2008).

Debt Asset Ratio (total debt)

The ratio is calculated as:

Debt total assets = Total debt / Total assets equities

In Country Road, the rate is 47.7% and 34.37 in 2009 and 2010 respectively this is an indication that the company is aggressively paying its debts; this is a positive move but care should be taken not to reduce the investments rate.

In Reject Shop, the rate is 58.92% and 51.51% in 2009 and 2010 respectively; this is an indication that the company is paying its debts constantly.

Debt Equity Ratio (total debt) = Total Liabilities / Shareholders Equity

(LIBBY, 1975)

In Country Road, the rate is 88.94% and 52.37% in 2009 and 2010 respectively this is an indication that the company is aggressively paying its debts; this is a positive move but care should be taken not to reduce the investments rate.

In Reject Shop, the rate is 143.4% and 159.8% in 2009 and 2010 respectively; this is an indication that the company is adding more debts.

Times Interest earned

Interest earned = Interest before interest charges tax / Interest before interest charges

Both companies show that they can have high interests cover; Country Road rate is at 186.49 and 30.24 in 2009 and 2010; although the rates are higher than those recorded by Reject Shop for the same period, in 2010 the rate fluctuated sharply (Anthony, Hawkins, and Merchant, 1999).

Additional or Other information relevant to your report

There was need to compare the results of the two companies with the rate at which the industry average is; other than in liquidity ratios and net profit ratios, the companies are operating above the rate (Nobes, 1997).

Limitations

Some ratios indicated results that would have been interpolated in two different ways; in such cases the report was only left to assume the situation on the ground; such ratios include net profit ratio and debt ratios.

The comparison was made on the companies alone; there was no industrial rate, thus comparison with the general rate prevailing in the economy was not possible.

Finally, published reports do not have full information of a company; some information that affects the operation of a company but is not reflected in published reports. Such information includes a company’s brand name, goodwill, or any other special matter that can work for the worse or better of the company (Barry & Jermakowicz, 2010).

Recommendations

As a potential investor, it is more advisable to invest in Reject Shop; this is because the company has shown consistency in performance. In Reject Shop, a change in gross profit is reflected in the net operating profit while in the case of Country Road it was not reflected. The management efficiency is higher in Reject Shop; the rate at which assets and equity are used to derive income to the company is more than double the rate of Country Road. With an efficient management team, an investor can be assured of future financial gains. When it comes to interest cover of the companies, although Country Road has higher rate of cover, there had been sudden fall in 2010, this should warn potential investors. Debtors and creditors management is better at Reject Shop than in Country Road; this affirms the efficiency of management as indicated by return on assets/equity.

Despite the recommendations made above, it would have been more important to have the industry’s rates to compare with the rates recorded by the companies; in that case, investors would have been advised more appropriately. Both companies need to check their liquidity ratios as neither of them seems to have the potential to meet its financial responsibilities when they fall due.

References

Anthony, R., Hawkins, D. and Merchant, K.,1999. Accounting: text and cases. Boston: McGraw Hill.

Atrill, M. H. and Jenner. W.,2009. An Introduction: Accounting 4. New Jersey: Pearson.

Barry, J. And Jermakowicz, K. ,2010. Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. New York: John Wiley and Sons.

Belverd, E.and Powers, M. ,2010. Financial Accounting. New York: Cengage Learning.

Bill, C. and McKeith, J.,2009. Financial Accounting & Reporting. New York: McGraw.

Fridson, M. , & Fernando, A..(2002). Financial Statement Analysis: A Practitioner’s Guide. New York: John Wiley.

Haka, F., Williams, R., Bettner, M. and Carcello, J., 2008. Financial & Managerial Accounting. New York: McGraw-Hill Irwin.

Helfert, A., 1997. Techniques of Financial Analysis: A Modern Approach. Chicago: Richard D. Irwin, Inc.

International Accounting Standards Board and International Accounting Standards Committee Foundation.,2009. International Financial Reporting Standard for Small and Medium-sized Entities. New York: Kluwer.

LIBBY, R. ,1975. Accounting Ratios and the Prediction of Failure: Some Behavioral Evidence. Journal of Accounting Research, 13(1), pp.150-161.

Michael, P. ,2006. Advanced Accounting: Concepts & Practice. Issues in Accounting Education, 21(1), p. 69.

Nobes, C.(1997). Introduction to financial accounting. New York: Cengage Learning.

Weygand, J., Kimmel, P. and Kieso, A., 2010. Financial Accounting: IFRS. Illinois: Northern Illinois University.