Basel III is a sequence of adjustments to the prevailing Basel II structure. The capital appropriateness guidelines of Basel I and Basel II did not effectively apprehend risks modeled by bank disclosures to transactions such as securitizations, products and repurchase pacts or take into account the general risks linked with the build-up of leverage in the financial organism. Furthermore, Basel I and II concentrated on capital only, with no universally approved quantifiable standards for liquidity necessities. This paper discusses credit risk, market risk, liquidity risk, strengths and weaknesses of Basel III and possible refinements.

Credit Risk

Credit risk occurs as bank borrowers might not be ready or capable to accomplish their contractual requirements. This notion and aspects of credit risk administration procedure is present in the Basel Committee’s document on values for the evaluation of a bank’s administration of credit risk (Duffie & Singleton 2003). The document addresses working in a sound credit granting course, establishing a suitable credit risk atmosphere, upholding a proper credit management and guaranteeing adequate direction over credit risk (Best Practices for Credit Risk Disclosure n. d).

Initially, risk measured through the theoretical sum. A multiplier of 8 percent established regulatory capital. Conversely, this method disregarded deviations in default probability (Statman 2006). The Basel Committee, in 1988, formed broad groups of risk classes, with every class having allied weights; these weights became extremely simplistic and frequently overrated or undervalued the true risks (Crouhy et al. 2001). Extra risks formed on balance sheets involuntarily as both low and high high-grade corporate bonds acquired similar ratings (Statman 2006). Since low-grade bonds present elevated spreads, banks augmented lending to lesser grade corporate, in order to create elevated takings in relation to the related regulatory capital. Securitized assets, which are lopsided sheet items, did not receive consideration. So as, to tackle these issues, Basel II surfaced.

Basel II tries to change relative measures into absolute. So as, to back the revolution course, the Basel II establishes four forces of credit risk including probability of default, exposure, maturity and loss given default (Bhatia 2005; Linsley & Shrives 2005). However, since Basel II fails to recognize relationships amid these drivers, Basel III fails this gap (Bhatia 2005).

Basel III analyzes credit risks in clusters and considers relationships amid default probabilities (Madigan 2010). However, prevailing methodologies to evaluating credit risk connected with a bank’s resources, namely the standardized method, the basis internal ratings based method, and the cutting-edge internal ratings based method remain complete under Basel III. The homogeneous method emphases on a counter party’s credit rating to govern the credit risk of that counter party. The second and third methods regulate the contrivance for designing the three variables which are used in calculating the credit risk constituent of capital prerequisite for organizations, namely: loss given default (LGD), exposure at default (EAD) and probability of default (PD). Under the homogeneous method, PD and LGD are merged into the premiums recommended by Basel II, whereas prearranged credit alteration aspects are used to analyze the exposure at default. The basis internal ratings based method permits the bank to use internal rating reproductions to calculate PD, whereas LGD and EAD involvements are provided by the bank’s supervisory body.

The radical internal ratings based methodology permits a bank to compute all three variables using internal prototypes, though the procedures used in the prototypical must be approved with the supervisory body (Banks et al. 2007). The Basel Committee establishes that mark-to-market losses prompted by the deterioration of creditworthiness, short of nonpayment, of a counter party were not precisely replicated.

Consequently, Basel III now obliges the use of strained inputs in evaluating credit risk and increased capital to be held to replicate mark-to-market losses related with weakening in a counter party’s credit worth in relation to OTC results. A stressed VaR quantity will now take a 12 month period of substantial financial stress and losses (Basel Committee on Banking Supervision 2009). In addition, there will also be a fresh incremental risk charge functional to trading locations where losses prompted by, characteristically an evaluations relegate of an issuer would be apprehended (Allen & Carletti 2006).

Under Basel III, risk-weighting must only be functional to the loan equivalent amount of a bank’s plagiarist disclosure to counter party, which is indomitable by achieving out the parties’ derivatives disclosure to each other (Basel Committee on Banking Supervision 2010b). These incentives improved netting by banks, which inspires them to ensure their consensual OTC derivatives are centrally blank.

Basel III demands banks to raise the Tier I capital of RWA by 4%, from Basel II, to 6% and common equity by 2% to 4.5% (Madigan 2010). Besides, Basel III establishes extra capital buffers including a flexible countercyclical buffer, with the aim of permitting national supervisors to require up to a new 2.5% of capital in phases of lofty credit expansion and a 2.5% compulsory capital conservation buffer. Besides, Basel III establishes two mandatory liquidity ratios and at least 3% leverage ratio (Madigan 2010). The Net Stable Funding Ratio obliges the obtainable sum of constant funding to surpass the required quantity of steady funding over a whole year era of absolute stress. Conversely, the Liquidity Coverage Ratio obliges each bank to grasp adequate, premium liquid resources to face its sum net cash flows above 30 days (Madigan 2010).

The new Basel capital principles are an advance for Lehman Brothers. Over the years, regulators employed extremely slack descriptions of what forms capital, while computing their capital ratios. Regardless of numerous fresh tables on Tier 1 capital and risk-weighted assets, the straight cap at 33-to-1rigid is the sole novel leverage regulation from Basel, implying that Basel III would create lots of space for the wild risk-taking trend, which led to the decline of Lehman Brothers.

So as, to moderate risk of failure on default, Credit Support Annexes (CSA) is structured to guarantee derivative dealings with counter parties (Basel Committee on Banking Supervision 2004). These CSAs are considered, when establishing the internal credit risk restrictions for derivative counterparties (Heffernan 2005). A one mark enduring, or short term ranking downgrade, would consequence in the Group having to; either place collateral or get a Guarantor for the changes it gives to its secularization mediums, with the quantity of collateral requiring to be posted being reliant on the period and valuation and the changes (Saunders, & Cornett 2006). The following table reveals the potential credit exposures and the gross positive fair value of derivatives contracts held by Northern Rock as at 31st December, 2010 (Northern Rock Plc 2010).

Table 1

Market Risk

In Basel II, market risk capital requirements and interest rates for the trading book are computed under the internal models approach or the standardized measurement method (Caruana 2010). Capital requirement is a function of the Value‐at‐Risk (VaR) metrics, under the internal models approach. The instigation of VaR is as a conventional methodology for measuring market risk is an ingredient of the development of risk administration. The use of VaR expands from its original use to credit risk (Campbell 2010; Contreras 2010). Historical simulation and Monte Carlo simulation are among the methods of calculating VaR (Best Practices for Credit Risk Disclosure n. d.). Historic simulation technique for computing VaR is easy and shuns a number of the drawbacks of the correlation technique.

The technique of historical simulation gives a straightforward execution of complete valuation. Simulated market conditions form through adding to the foot case the frequent transformations in market variables in the definite historical time phase (Soros 1994). Historical simulation supposes that what ensues over a particular historical phase represents the set of feasible future condition. The technique entails gathering the group of risk factor transformations over a historical phase, such as, day after day transformations over the previous ten years (Pengelly 2010). This creates a distribution of group values, or equally, a distribution of modifications in group value from the present value.

Historical simulation does not demand any distributional supposition, as the settings for calculating VaR restricts to those that takes place in the historical model. Monte Carlo simulation may tackle this drawback of historical simulation. This technique is extremely supple and potent, as it considers all non-linearities of the set value in relation to its principal risk factor, and integrates all pleasing distributional traits like time changeable volatilities (Pengelly 2010). Nevertheless, these methods are extremely costly (Vojtek & Kocenda n. d.).

The market risk capital requirement, under Basel III, requires extra details on the computation of a long‐term incremental risk charge, a stressed, long‐term capital requirement, a comprehensive risk capital requirement and a risk charge (Caruana 2010). The summation of the initial capital requirement and these extra requirements is deemed the new market risk capital requirement under Basel III.

Northern Rock Bank has functioned under the Basel 2 structure since the beginning of the year 2010. This structure comprises three pillars, which cover diverse features of capital constancy and sufficiency (Butler 1999). The first pillar defines quantitative conventions to compute the minimum capital needed, by a corporation, to guarantee its capital is adequate to cover latent losses arising from its actions (Basel Committee on Banking Supervision 2006). This is computed in reference to three main risks, including operational risk, market risk and credit risk. The second pillar concerns the internal capital sufficiency practices within the corporation, and covers risks outside those enclosed in the first pillar. The third pillar gives public revelation of a firm’s risk and capital place, providing qualitative data on risk control and management, and quantitative information on capital and risk, as computed under the first pillar (Mishkin 2007).

Basel III establishes a compulsory capital conservation buffer, a flexible countercyclical buffer and an extra capital buffer. Besides, Basel III establishes two mandatory liquidity ratios and a 3% leverage ratio (Hull 2007).

Liquidity Risks

The Liquidity Coverage Ratio (“LCR”) is anticipated to quantify a bank’s capability to access funding for a 30 day period of severe market stress. Banks will be obligatory to have a ghettoized stock of extremely liquid and unfettered assets, which are at least equal to its predictable net cash outflows for a thirty day period during a time of severe liquidity pressure.

Basel III sets out difficult formulations for formative net cash outflows, the denominator of the LCR, which encompass the increment of cash influxes and depletions to regulate net cash outflows (Caruana 2010). The Basel Committee also embraces a conformist methodology to the handling of credit amenities (Basel Committee on Banking Supervision 2010a). Banks will not be capable to embrace as a cash inflow their capability to allurement down on any credit or liquidity facility outlines allowed by another bank, yet banks are prerequisite to don a 100% draw down of devoted credit and liquidity facilities approved to other banks for the tenacity of manipulative cash outflows (Basel Committee on Banking Supervision 2010c).

This is a lengthier term essential ratio that covers a bank’s entire balance sheet, as well as certain off-balance sheet obligations (Bessis 2006). Steady funding bases include Tier 1 and Tier 2 capital. Basel III gives several steady funding sources different weighting, to be used in calculating the accessible amount of steady funding (Basel Committee on Banking Supervision 2010a).

Impact

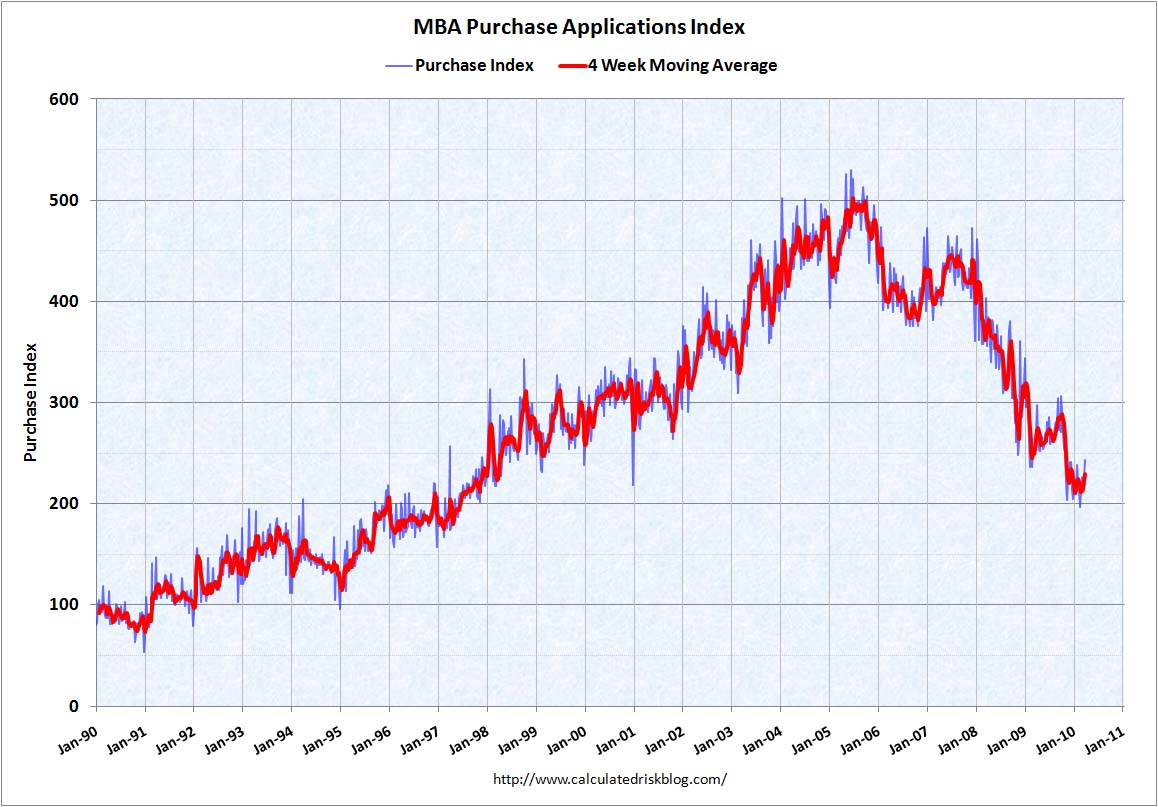

Passivity with the newfangled liquidity quotients is likely to be the utmost perplexing feature of Basel III enactment for many banks. To confirm passivity, the Basel Committee endorses that banks and their controllers regularly gauge each bank’s pledged maturity disparity, attentiveness of funding, available tangential assets, and ability to satisfy liquidity ratios in all appropriate currencies. Northern Rock is a UK bank whose fall in 2007 symbolized the global financial crisis. Ahead of the Credit Crisis market shock stage, reduced interest rates motivated margin lending and short term borrowing, which were adjusted every day (Song 2008). Although this made a debt overhang concern, the elevated heights of liquidity in the market let banks roll over long term dedications. The following figure depicts the situation as from January 1990 to January 2011.

As demonstrated in figure 1 the initial shock to prices happened as in 2007. During this phase, demand for assets became depressed. This progressed until the end of the year. In the course of that phase, common assumption was that the economy would recuperate and continue in an exorbitant way. Nevertheless, the liquidity funding stage of the Credit Crisis appeared soon after in the Credit Crisis Cycle and attained the maximum point at the last part of 2008. The figure below demonstrates that situation.

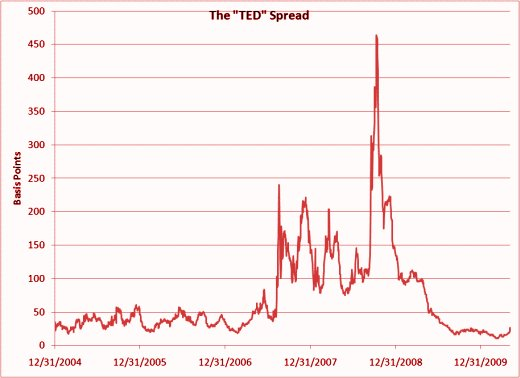

As shown in figure 2, throughout the credit catastrophe, the TED spread broke the record of 300 Basis Points by over 150 percent.

Possible Future Refinements to Basel III

The above suggestions are articulated to be the final avowal of the Basel Committee on certain concerns. Conversely, the Basel Committee has not hitherto finalized its exertion on Basel III and has branded trading actions, as well as, large disclosures as regions that merit further thoughtfulness. These regions are not entirely covered in the Basel III outline. Further effort will also be completed on provisional capital and SIFIs. Moreover, the new quotients especially the new liquidity quotients may be modified centered on the outcomes of scrutiny and observing course. Even to the level that the procedures are established, they will need to be executed by national supervisors. It remains to be comprehended how this is to be completed.

The presentation of Basel III to SIFIs: The Basel Committee has engaged the opinion that SIFIs should be prerequisite to embrace more capital than any other financial establishments. Late this year, the Basel Committee, is anticipated to issue an approach for evaluating which organizations are systemically significant. The Basel Committee is also projected to comprehensive by the mid of 2011 a study of the level of extra capital that SIFIs ought to hold. This could be in the formula of an obligation to grip extra mutual impartiality between 1-3% of RWAs. The Basel Committee is similarly bearing in mind what firmness ability is suitable for SIFIs. The G20 has acknowledged liquidity supplements, snugger large disclosure constraints, imposes and operational procedures as areas for further consideration. Each country will have some tractability in executing these ideologies of Basel III, which may tip to imbalanced treatment of SIFIs in diverse authorities.

Strengths and Shortcomings of Basel III

Basel III is a prospect as well as an encounter for banks. It can offer a firm basis for the subsequent expansions in the banking segment, and it can guarantee that past considerations are eluded. Basel III is fluctuating the way that banks report the managing of peril and finance. The new system pursues much superior incorporation of finance and peril management roles. These will perhaps enterprise the merging of the tasks of CFOs and CROs in providing the intentional intents of the business. Conversely, the espousal of an extra laborious governing stance might be hindered by reliance on numerous data silos and a separation of controls amid those who are accountable for finance and those who manage peril. The fresh prominence on risk management, which is intrinsic in Basel III, necessitates the outline or progression of a risk management structure that is as healthy as the prevailing finance management frames. As well as being a supervisory organization, Basel III in many ways offers a structure for accurate enterprise risk management, which comprises casing all risks to the industry.

Basel III merges micro- and macro-prudential reforms to deal with both institution and organization level risks. These micro prudential reforms represent the strengths of Basel III. There is a noteworthy raise in risk coverage, with a focus on parts that were most challenging throughout the crisis, including counterparty credit risk, trading book exposures and securitization actions. There is, as well, a primary tightening of the description of capital, with a key emphasis on common equity. This symbolizes a shift from intricate hybrid instruments, which did not show to be loss absorbing during the crisis. Basel III establishes requirements that all capital mechanisms must absorb losses at the spot of non-viability. Basel III also introduces international liquidity principles to deal with long-term and short-term liquidity mismatches, a leverage ratio to act as a backstop to the risk-based structure and enhances Basel II trading and securitization actions.

The establishment of macroprudential aspects into the capital structure, in Basel III, includes principles that encourage the upsurge of capital buffers in normal times, which can be used in times of stress, and clear capital conservation regulations to avoid the inapt distribution of capital. The leverage ratio, in Basel III, has structure-wide benefits through preventing the extreme upsurge of debt across the banking structure during times of boom. Regarding the pool of liquid assets, Basel III rules seek to encourage transformation in behavior. They endeavor to make spurs to decrease risky liquidity profiles. In Basel II, banks did not value liquidity suitably all over the firm. Hence, correcting risk organization deficiencies will consecutively enhance liquidity profiles.

In conclusion, prevailing methodologies to evaluating credit risk connected with a bank’s resources, namely the standardized method, the basis internal ratings based method, and the cutting-edge internal ratings based method remain complete under Basel III. Consequently, Basel III now obliges the use of strained inputs in evaluating market risk. Basel III sets out difficult formulations for formative net cash outflows, the denominator of the LCR, which encompass the increment of cash influxes and depletions to regulate net cash outflows. The issue with the structure of liquidity in Basel II is that risk was viewed as a secondary need for banks. In addition, it was an alternative for supervisory imposing, not the rule and local directors had a flexible choice to impose a charge for liquidity. So as, to refine the Basel III structure, further effort will be completed on provisional capital and SIFIs.

References

Allen, A. & Carletti, E. ( 2006) ‘Credit risk transfer and contagion’, Journal of Monetary Economics, 53, pp. 89-111.

Banks, E., Glantz, M., & Siegel, P. ( 2007) Credit derivatives: techniques to manage credit risk for financial professionals. New York, McGraw-Hill.

Basel Committee on Banking Supervision (2004) International convergence of capital measurement and capital standards: a revised framework. Basel, Basel Committee on Banking Supervision.

Basel Committee on Banking Supervision (2006) Basel II international convergence of capital measurement and capital standards: a revised framework, Basel, Bank for International Settlements.

Basel Committee on Banking Supervision (2009) Strengthening the resilience of the banking sector: a consultative document, Basel, Bank for International Settlements

Basel Committee on Banking Supervision (2010a) Basel III: a global regulatory framework for more resilient banks and banking systems, Basel, Bank for International Settlements.

Basel Committee on Banking Supervision (2010b) Basel III: a global regulatory framework for more resilient banks and banking systems, Basel, Bank for International Settlements

Basel Committee on Banking Supervision ( 2010c) Guidance for national authorities operating the countercyclical capital buffer, Basel, Bank for International Settlements

Bessis, J. (2006) Risk management in banking. Chichester, John Wiley & Sons, Ltd.

Best Practices for Credit Risk Disclosure (n. d.) 2011. Web.

Bhatia, M. (2005) ‘Credit risk measurement: understanding credit risk’, Gtnews. Web.

Butler, C. (1999) Mastering value at risk: a step-by-step guide to understanding and applying VaR. Harlow, Pearson Education Limited.

Campbell, A. ‘What does VAR mean in 2010?’ Risk magazine 1 April. Web.

Caruana, J. (2010) Macroprudential policy: could it have been different this time? Basel, Bank for International Settlements.

Causal Capital (n. d.) Basel III – thinking about liquidity risk differently part 1. Web.

Contreras, P. (2010) ‘Is VaR a useful tool in volatile markets?’ Risk magazine. Web.

Crouhy, M., Galai, D & Mark, R. (2001) Risk management. New York, McGraw-Hill.

Duffie, D. & Singleton, K.J. (2003) Credit risk: pricing, measurement, and management. New Jersey, Princeton University Press.

Heffernan, S. (2005) Modern banking. England, John Wiley & Sons Ltd.

Hull, J. C. (2007) Risk management and financial institutions. New Jersey, Pearson Prentice Hall.

Linsley, P.M. & Shrives, P.J. (2005) ‘Transparency and the disclosure of risk information on the banking sector’, Journal of Financial Regulation and Compliance, 13 (3), pp. 205-214.

Madigan, P. (2010) ‘When market and credit risk collide’, Risk Magazine. Web.

Mishkin, F.S. (2007) The economics of money, banking, and financial markets. Boston, Pearson Education.

Northern Rock Plc (2010) Pillar 3 disclosures. Web.

Pengelly, M. (2010) ‘Operational risk’, Risk magazine. Web.

Saunders, A. & Cornett, M. (2006) Financial institutions management: a risk management approach. New York, McGraw-Hill.

Song, H. (2008) ‘Reflections on Northern Rock Plc: the bank run that heralded the global financial crises, Journal of Economic Perspectives, 23 (3), pp.101–119.

Soros, G. (1994) The alchemy of finance: reading the mind of the market. New York, John Wiley & Sons.

Statman, S, ( 2006) ‘Guide to credit risk measurement’, Gtnews. Web.

Vojtek, M. & Kocenda, E. (n. d.) Credit scoring methods. Web.