Introduction

The development and application of management information systems in the formulation of company decisions has become a crucial facet of every organization, especially in the face of the ever-changing technological and demographic patterns in the twenty-first century. This discussion identifies various effects of management information systems on decision-making in the financial sector. Emphasis is laid on the existing relationships amongst management information systems, decision making, and employee performance. The essay will further provide insight into the timeliness, usefulness, and accuracy of the information issued by the management to ensure effective decision-making. Its scope will entail a review of the literature on the application of management information systems in decision-making. This information will be obtained from various journals and articles and case studies of real-world examples in the banking industry. It provides analysis, discussion of the case, personal views, and reflective thinking on the topic. The essay aims at discussing the current state of management information systems and their role in decision-making in the banking industry.

Literature Review

Various surveys have been conducted to analyze the impact implementing the management information systems in the improvement of the financial transactions. The route to competitiveness in any investment requires the management to execute robust systems that increase productivity while improving the quality of service delivery. In the banking industry, an information system is crucial due to the tremendous growth of well-informed customers (Power 350). The complexity and nature of information in the banking sector are gradually becoming the order of the day as a result of the ever-increasing management problems such as the limited use of on-screen systems amongst the staff and customers. Besides, there is an overdependence on the use of the information systems in the delivery of services. Therefore, the information needed should be accurate, timely, and relevant to meet the needs of the clients (Power 350). Various studies that were conducted to investigate the prevalence of using information systems showed that over 70-percent of the world’s financial institutions have implemented automated banking. In regards to the highlighted need of information, the researcher reviews the literature on the management information systems in two steps. The first stage will entail a discussion on the application of management information systems in the banking industry. The second step will entail the integration of such technology in decision-making processes.

Classes of Information Systems

Various categories of classifying information systems have been documented. One of such classifications includes the transactional information systems that process data. This category enables the users to collect and process the day-to-day transactions of an entity. This type of information system is relevant to the operational level of management that deals with purchases, payrolls, payments, registrations, and exchange rates among others (Power 350). Another category is the management information system that provides reports concerning the organization in a predetermined format. The MIS ensures that the managers are well-equipped with skills of planning, controlling, and monitoring of activities. The reports are given in weekly, monthly, or yearly basis. They contain the analysis of budgets, financial reports, salaries, and inventories among others (Power 350). The third category is the decision support system (DSS) that enables users to make the correct choices. The system is only used to provide essential information to support the decisions made in an organization. The DSS is majorly used by managers and other users in accessing information from the data warehouse (Power 350). An expert system is also a program of decision-making ensures the reduction in knowledge and expertise besides simulating the activities of specialists to those employees with less know-how. The system works with artificial intelligence technology in the delivery of information (Power 350).

Others include the office automated systems that ensure the ease of workflow and communication among employees irrespective of where they are located. This system manages documents through software such as Microsoft office, scheduling and communicate through video conferencing, voicemails, and electronic mails among others (Power 351). Lastly, personal and workgroup information systems are designed to meet the needs of the users. Furthermore, they increase the productivity of the team (Power 342).

Management Information Systems and Decision-Making

Management information systems are crucial in organizational planning, monitoring, foresting, and controlling of activities that are performed with a view of accomplishing its goals. This information must be contained in computer software as well as the network systems (Johnson, Mathias, and Ivar 96). Such technology has ensured that companies become flexible in the management of resources thereby limiting repletion and redundancy in operations. They improve the coordination of virtual teamwork among others. Therefore, proper planning in the structure and architecture has been crucial in ensuring that the maximization of benefits that comes with information systems (Johnson, Mathias, and Ivar 96).

Various studies have revealed that mobile devices and other wireless communication gadgets have helped in the faster extension of information systems to ensure that all human conditions are fully supported. The pace of the day-to-day activities in the banking industry has also been increased in terms of speed and accuracy (Johnson, Mathias, and Ivar 96). In the current business world, the existence of personal computers has ensured easier access to information, especially to small business or teams that are virtually managed at the global level. The use of information system has been further increased due to the use of internet through the World Wide Web systems. This situation has been essential owing to the interlinking mechanism that is created by the WWW network (Johnson, Mathias, and Ivar 96).

Nowduri asserted that the MIS provides a platform for excellent decision-making; hence, it plays a critical role in ensuring that managers make the right resolutions in the management processes (6). It is indicative that the management information systems affect the decision-making process directly in various entities through the alteration of the manner and frequency in which information is shared amongst the decision makers (Nowduri 6). The transformation of the role of information technology in businesses has been seen to be dependent on technology. This state of affairs has been confirmed by Power stated that policymaking was crucial in the management of businesses, especially the operational aspects that focus on improvements, selection of new opportunities, and scope of operations in the entity among others (349).

Merging the Theoretical Concept of the MIS Usage and Practical Application in Banking

The current banking systems apply a concept of the online banking system that is computer-based. Various components that are required to run such systems include computer hardware and software, networks, data management techniques, and converters of the data into useful information among others (O’brien and Marakas 13). Through the usage of the MIS, businesses in the banking sectors gain competitive advantage. Such organizations operate as both real-time and online basis (O’brien and Marakas 13). Managers must find a balance that exists between information technology and behavioral characteristics of people to ensure effective and efficient application of MIS to meet both strategic and tactical objects (O’brien and Marakas 13).

Combination of MIS Systems in Management Decision Processes in Banking

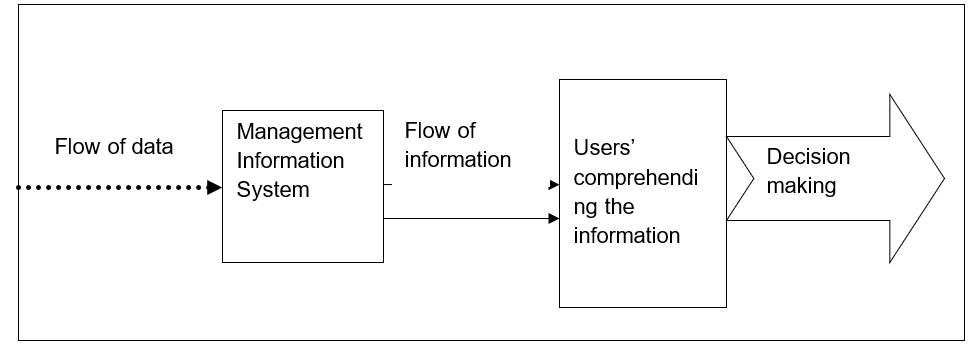

Source: (O’brien and Marakas 11)

Various resources required in the management decision-making using the MIS system include the mode of reporting, decision support, and experts to guide the managers who do not understand such technology. The model lays emphasis on the purposes of MIS in the support of operational and managerial decisions in the banking industry (O’brien and Marakas 13). This scenario is made possible if all the levels of management are involved from the executive through middle management to the lower supervisors. The MIS is majorly used to transform data that can be easily used as information in making correct decision; hence, it can be represented in a systematic flow diagram as indicated below.

MIS Concepts

The MIS has identified the context of information in terms of electronic data that is processed and carries out transaction processing functions besides recording factual data. Reporting systems on management that ensure the scrutiny of operational activities of the entity provide summaries of information and feedback for the management (O’brien and Marakas 13). MIS further takes a technological and management of socialization to ensure that people and data are interlinked. The quality of the formulated decisions using the MIS is influenced by the source of information, analytical tools, and the role of Information Technology (O’brien and Marakas 13). It implies that when MIS is used in the decision-making processes, it provides a platform people and information are linked together. For example, MIS ensures that information on experiences at various management levels is shared to sustain the competitive advantage since it positively affects decision-making. This situation promotes the quality of the services given (O’brien and Marakas 13). Lastly, the MIS applies a concept that independently monitors the instructions in a system. This technique ensures a clear course of action to keep the system in control at all times. Therefore, managers ought to consider these concepts when deciding on operation plans and data storages among other activities (O’brien and Marakas 13).

Lebanese Case

Overview of Lebanon Banks

Lebanon was hit hard by the civil war between 1975 and 1990. As a result, its infrastructural development has been poor. The available facilities are also outdated. The country’s banking sector was the worst hit by the civil war. For this reason, it has not fully developed the information technology system (Charbaji and Mikdashi 80). The Lebanese banks found it necessary to implement the current technology in their systems of financial transactions. The enactment of the IT was not only in the banking sector but also in other sectors that required improved productivity, cost reductions, and provision of high-quality services in an attempt to satisfy the consumer needs (Charbaji and Mikdashi 80). These activities were also done with a view of maximizing profits to promote the overall development of the banking industry. The bankers also faced competition at the global level; hence, an improvement in technology was a sure way of overcoming such challenges (Charbaji and Mikdashi 80).

Financial institutions such as the Allied Business Bank, BLOM, Universal Bank and British Bank of the Middle East have been using telebanking and ATM points in the country to compete in the market effectively. Robust MIS systems were required by such banks to promote the management decision-making process (Charbaji and Mikdashi 80). Although such tremendous improvements have been realized, several banks in this nation still have challenges such as the implementation of the infrastructures and powerful management among others (Charbaji and Mikdashi 80).

Stages of Development of Banks in Lebanon

Several banks in Lebanon initiated the construction of databases to ensure proper internal operations. These databases were normally controlled from a central warehouse (Charbaji and Mikdashi 80). Despite the fact that the management of information takes a similar route from the beginning, most banks in Lebanon have followed different processes to ensure the development of the financial systems. For example, Charbaji and Mikdashi reveal that the institution implemented the management information system with a view of improving the delivery of financial services (80). Other banks such as the Ban K Audi purchased online information system to ensure real-time network that offered wide-ranging banking services to the top management, middle managers, business analysts, and end users (Charbaji and Mikdashi 80). These days, the financial organizations have opted to embrace advanced methods of conveying information owing to improved technology together with globalization. Besides, the minimization of costs reduction of costs has led to the reorganization of the banking system to ensure increased profits (Charbaji and Mikdashi 80). To conclude, the need to integrate new technologies such as ATMs and telebanking among others in financial transactions have promoted the use of current technology. This situation has increasingly led to the development of the MIS in the banking industry (Charbaji and Mikdashi 80).

Adoption of the MIS in the Banque du Libanetd’outre-mer (BLOM) in Lebanon

Most banks in Lebanon are currently experiencing technologies with state-of-the-art facilities, high-quality computerized services, and extensive modes of communication technology to enhance their off-site funding systems more appealing. These banks serve both corporate and retail customers who require quick disposal of loans as well as maximization of returns from the cash balances (Charbaji and Mikdashi 80). The BLOM has categories of the MIS to ensure that functions are clearly defined and carried out in relation to the relevant departments. For example, the Customer Relation Management (CRM) system ensures that data is combined based on the experiences of the customers. The Enterprise Resource System (ERP) warrants relevant information or summary of views of the progress of the organization. The system collects and analyzes the information from other structures in the warehouse (Charbaji and Mikdashi 80).

The top managers who implement the MIS can easily monitor the whole company. Decisions are further made easier because of the actual data provided by the system that can easily be compared with the results planned as well as those of the previous periods. This situation enables the managers to anticipate the next move besides knowing the progress of the stipulated goals. Furthermore, the MIS automatically collects data from various interlinked computers to check-out centers when keyed at specific periods. As a result, routine reports can be obtained easily (Charbaji and Mikdashi 80). The top, middle, and lower management levels have realized that using the MIS ensures effective maintenance and evaluation of information used in decision-making (Charbaji and Mikdashi 80).

In the areas of productivity, the managers have successfully implemented the MIS with a view of encouraging the staff to improve the accuracy and quality of service delivery (Charbaji and Mikdashi 80). Most of the formulated decisions have ensured that the strategic goals and objectives are achieved. The management information system also offers the managers an opportunity to fortify the formulated decisions. It has also encouraged the institution’s management to establish a proper way of initiating, facilitating, and monitoring financial transactions (Charbaji and Mikdashi 80). Improved and immediate feedbacks to customers are currently realized in the BLOM bank due to the use of MIS. In addition to such benefits, the general reports, as well as periodic returns are provided on a timely basis (Charbaji and Mikdashi 80). The employees’ productivities have been increased through the following ways upon the application of the MIS. At the outset, there is accuracy in the computation of balance sheets, interest rates, and printing of schedules, receipts, passbooks, and sheets. It has also improved quick signature verifications, retrieval of transactions, and elimination of work duplication (Charbaji and Mikdashi 80).

The usage of the MIS in the BLOM Bank has further facilitated the provision of services at higher speed. This undertaking minimizes a crisis that leads to insufficiency. Another advantage of the MIS is the enhancement of competitiveness of the BLOM at the global level. The MIS has ensured that the capacity of the institution is improved. The stored information is always recalled and distributed in time to be used in decision-making. It facilitates leadership in the top, middle, and lower levels of management (Charbaji and Mikdashi 80). The MIS ensures that both the strategic and tactical decisions are made based on the data from both the internal and external sources that ensure the managers make timely and effective decisions to achieve goals.

Functions of the MIS in the BLOM

The major function of the MIS is to help managers take appropriate actions that are linked to both the strategic and tactical goals. The data obtained from the financial systems are compared with the actual statistics to gauge whether the goals are achievable. The MIS has been implemented in decision-making processes concerning various issues involving managerial functions such as operations, tactical, and strategic plans (Charbaji and Mikdashi 80). It ensures the designing and implementation of proper designs, processes, and delivery of accurate, timely, and consistent information. Furthermore, it ensures continuous gathering of relevant data that are processed, integrated, and stored in warehouses for continuous update and access whenever the management intends to make decisions (Charbaji and Mikdashi 80). Besides, the MIS in the BLOM ensures that information from the sales, call center, finance, inventory, and logistics departments are safely kept. This undertaking ensures that the managers understand their departments’ contributions to achieving the objectives of the institution. For instance, the information on the inventory and sales ensures that the managers meet the needs of the customers (Charbaji and Mikdashi 80).

Personal and Reflective Thinking

The Management and Information Systems are designed to provide a constant and smooth flow of information in the organizational decision-making. The information is computerized to improve its storage and retrieval at any given moment to ensure that the right and relevant decisions are made in the banking system (Ayadi et al. 159). This system involves various interactions with people, equipment, and procedures to collect, analyze, store, distribute, and evaluate useful information promptly. Due to the immense improvement in technology, most customers require more information concerning timely service delivery. The customers’ expectations are also seen to be increasing; hence, the bank managers must ensure that such needs of customers are met (Ayadi et al. 161).

Competitions among banks have also increased. As a result, various banking institutions are currently modifying the methods of operations and decision-making by ensuring that they maintain high competitive advantage in the business environment. The MIS has been used successfully to offer retailing services in the financial investments. This situation has been achieved due to quick service that it provides, quality of the personnel, and the range of financial gains. The MIS can manage databases that contain various services offered, classes of clients, and hours of operation among others. Various reports that the MIS provides to the management concerning services of the holder include stationary accounts, balances, payments, credit status, loan defaults and repayments, and delays that occur due to the crediting of cheques among others (Ayadi et al. 167). In addition, it provides information on services that help in promoting the business due to its ability to collect data from numerous sources for analysis and formulation of conclusions its future operations and strategies. As a result, there are immense advantages that come along with quick decision-making; hence, quality and real-time banking services are guaranteed.

Recommendations

The future trends in the banking system will further face challenges that need to be properly addressed. The basic structures constantly conflict with the products that are ever-changing. The delivery of services to customers also changes with the improvement in technology. The growing financial institutions will be probably be required to establish high-tech transactional systems that ensure close contacts with the consumers in the near future. The use of the MIS in such scenarios is recommended in the management and decision-making processes at all levels of the financial organization. The information system must further be integrated into the organizations besides ensuring that the staff is conversant with such changes to support the existing strategies.

Conclusion

The Management Information System (MIS) technology has been seen to promote quick delivery of quality services that are effective in the banking industry. This information can easily be shared in various departmental meetings or managements to help in making good decisions. Therefore, it is essential for the managers and staff to be trained in matters that concern the management information system to ensure that they perfectly understand how the MIS operates in enhancing decision-making in the banking system. A case was identified where some challenges were encountered while implementing the MIS in the Lebanese banks; hence, training is required to acquaint the staff with sufficient knowledge about the usefulness and handling of the computerized banking systems. To elaborate on the implementation of the MIS in enhancing decision-making, the perceptions of the top, middle, and lower management levels must be changed to improve their willingness to use such forms of information technology. This case applies to most micro-financial institutions that are currently embracing the use of the MIS to develop management decision-making processes.

Works Cited

Ayadi, Rym, Emrah Arbak, Sami Naceur and Willem De Groen. Determinants of financial development across the Mediterranean. New York, NY: Springer International Publishing, 2015. Print.

Charbaji, Abdulrazzak and Tarik Mikdashi. “A path analytic study of the attitude toward e-government in Lebanon.” Corporate Governance: The international journal of business in society 3.1 (2003): 76-82. Print.

Johnson, Pontus, Mathias Ekstedt and Ivar Jacobson. “Where’s the theory for software engineering?” IEEE software 5.1 (2012): 96. Print.

Nowduri, Srinivas. “Management information systems and business decision making: review, analysis, and recommendations.” Journal of Management and Marketing Research 7.1 (2011): 1-8. Print.

O’brien, James and George Marakas. Introduction to information systems. Vol. 13. New York, NY: McGraw-Hill/Irwin, 2005. Print.

Power, Daniel. Decision Support Systems: Concepts and Resources for Managers. Santa Barbara, California: Praeger, 2002. Print.