Introduction

The industry of plastic is new relative to other materials used for packaging and construction. Nevertheless, plastic packaging seems to surround people in every industry, and its benefits are praised worldwide. Plastic as a material was invented in the early twentieth century, but the production of packaging made from different plastics started between the two World Wars (Chalmin, 2019). The popularity came to the group of materials together with the growing economic prosperity of the United States in the 1950s and the 1970s (Chalmin, 2019).

During this period, plastic production as a whole increased by 20 times – more than 25 million metric tons were manufactured, and the largest portion of these materials was intended to go toward packaging. At the same time, the type of packaging that would dominate the current market was invented. In 1968, the first plastic bottle was introduced in France, and this type of container quickly gained popularity in the US, China, and European countries.

Many factors have influenced the popularity of plastic packaging, the most important being the evolving consumer and retailer needs. From the introduction of plastics to the current day, the supply and demand have been increasing – at first quickly, then in accordance with the growing market. However, a new factor, environmental considerations, is gaining more attention among governments and individual consumers. This is a supply and demand factor that affects people’s preference for packaging as well as the final product price. The most recent circumstance, however, is the spread of COVID-19 – the impact of the epidemic has influenced the industry of plastic packaging in several contrasting ways.

Data

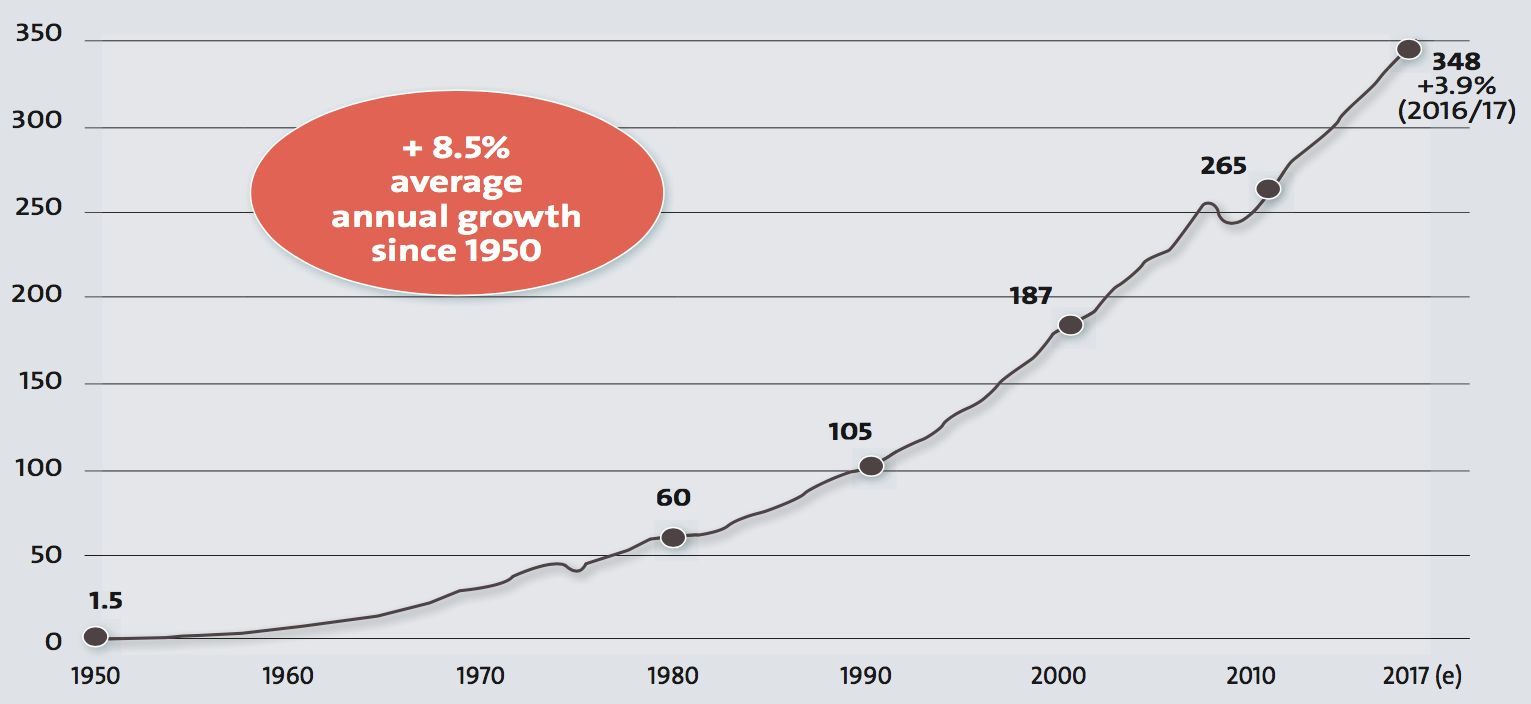

First, one can look at the history of plastics’ growing popularity. According to Chalmin (2019), plastic packaging production grew incredibly quickly between the 1950s and the 1970s. Out of the 25 million metric tons of plastic, 8 million were produced in the US (Chalmin, 2019, p. 7). However, the growth did not stop after this period, although new packaging types replaced older ones with time (Figure 1).

In 1980, this number increased to 60 million metric tons; in 2010, 187 million were manufactured; finally, in 2017, around 348 million was made (Chalmin, 2019, p. 8). In contrast to the beginning of the plastics’ popularity, China now has the largest share in the market – the country’s manufacturing plants are responsible for approximately a third of all plastics production (Chalmin, 2019). About 40% of all plastics are produced to become packaging (Chalmin, 2019). Currently, it is the largest category of all plastic goods manufactured worldwide.

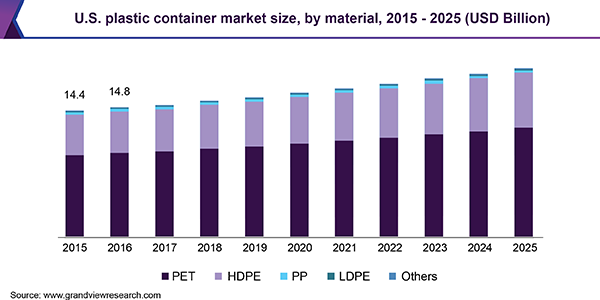

Examining the containers’ market, one can see that two specific types of plastics are the most popular – PET (polyethylene terephthalate) and HDPE (high-density polyethylene). According to one report, the PET segment accounts for more than 55% of the entire market by use (Figure 2). This material is used for plastic bottles – one of the most common plastic containers, utilized primarily for water and soft drinks. Around 70% of all drinks in these categories are packaged in PET bottles (“Plastic container market,” 2019). Moreover, by weight, plastic bottles of all types have a 75% share of the market (“Plastic container market,” 2019).

The second type, HDPE, is a preferred material in the hygiene and household cleaning supplies industries. Containers for shampoos, detergents, and similar products are mostly made of HDPE. HDPE’s compound annual growth rate is expected to be approximately 4% annually (“Plastic container market,” 2019). Apart from that, PP (polypropylene) plastics are a quickly growing category of materials used in packaging. They are mostly requested by supermarkets and food companies in need of individual customizable packaging (Chalmin, 2019).

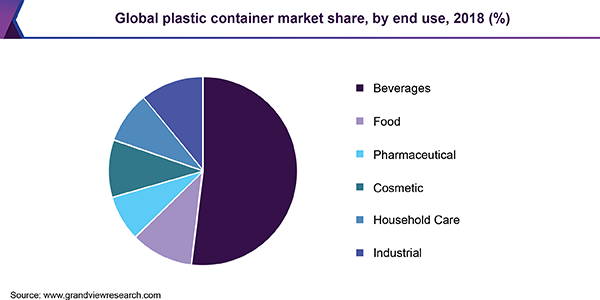

The market share for plastic containers is split into six broad categories, with packaging for beverages occupying more than half of it by end-use (Figure 3). Other industries include food, pharmaceutical products, household care, cosmetics, and industrial materials. In all of these industries, the need for packaging continues to increase. For example, cosmetics and hygiene sectors are continuously expanding in such countries as China. However, the US’s high demand for products in plastic packaging is also responsible for the increase in supply (“Plastic container market,” 2019).

In Germany and China, the two largest consumers of plastic containers, the industrial segment is expanding, thus increasing the demand for plastics. The choice of materials for retail packaging also depends on the global nature of manufacturing, since many customers now have access to international goods.

However, recent data show that the growing concern over plastic waste has put some potential restrictions on the supply of plastics. According to Beswick and Dunn (2002), the regulations on types and contents of plastics had an impact on the industry in the 2000s. For example, some countries impose restrictions on the materials for water bottles and food containers to facilitate recycling. In these states, the use of such plastics as PET is higher than other materials, as this material is non-toxic and recyclable (Klaiman, Ortega, & Garnache, 2016).

France, Rwanda, and Bangladesh have banned single-use plastic bags, and the European Union considers a ban on single-use plastics, including containers and plates (Chalmin, 2019). These changes are likely to shift the demand onto other materials, thus affecting the companies’ supply requirements.

Another recent event has shaped the dialogue around plastic packaging. During the COVID-19 pandemic, the priorities have moved away from banning single-use plastic to changing the ways in which packaging is utilized. On the one hand, 37% of companies engaged in plastic packaging manufacturing reported a decline in demand. Almost 15% of them showed that they received 80% of the usual order amount (“How is COVID-19 affecting,” 2020).

On the other hand, several other firms showed an increase in demand for plastic packaging. As McCormick (2020) notes, this change is connected to the lifting or easing bans on single-use plastic bags and packaging. Moreover, there exists a higher demand for personal protection equipment (PPE), take-out food, and online packages.

Analysis

From the introduction of plastic to the most recent years, the popularity of plastic increased significantly. Several factors can explain such high demand; first, plastic is lightweight. Before using plastic packaging, manufacturers could use glass or aluminum for packaging goods. However, glass is a heavy and fragile material, and aluminum cannot be used for all product categories.

Plastic, in contrast, is much lighter than glass, but it is resilient to damage. Therefore, it is easier to store, transport, and distribute, which likely contributed to the costs of manufacturers of all major industries. Second, the production of plastics is tied to the availability of oil, the prices of which are already negotiated between countries for other reasons. Plastics are cheap to produce in comparison to different types of packaging (Chalmin, 2019). At the same time, plastics are not water-soluble like cartons, and many types preserve food and cosmetics for longer periods of time. The variety of benefits that plastic packaging has explains the ever-growing demand.

The latest shift in the supply-demand relationship in the segment of plastic packaging is explained by peoples changing needs due to the pandemic. Some packaging manufacturers reported a decrease in demand – it is likely that their clients were engaged in businesses that had to close due to COVID-19 restrictions. For example, hospitality services could not operate for a long time, and some are still closed.

Therefore, foods and other goods packaged for hotels, restaurants, and other companies do not have the same demand for their services. Simultaneously, firms engaged in producing packaging for bottled drinks, prepared meals, fast food, online delivery, and PPE are experiencing a tremendous demand. The healthcare industry is overwhelmed with the growing number of patients; thus, more prepackaged single-use medical tools are used daily, raising the need for plastic packaging in the health sector.

Conclusion

Plastic packaging is a highly profitable commodity for the manufacturers – the demand for this material is present in all industries. Plastics are used ubiquitously, and many companies do not have any alternatives for this material, as glass, aluminum, carton, and other options have their own drawbacks. It is possible, however, that businesses will need to modify this commodity. The demand for plastic packaging may see a decline again, as the legislators will continue imposing regulations on the use of plastic in daily lives. One of the potential ideas is biodegradable plastic or organic plastic produced from plants.

However, the current influence of COVID-19 lowers the immediate risk of such legislation and makes plastic packaging highly useful to people and profitable to the industry. To increase my revenue, I would look into developing plastics that can be used in countries with strict regulations and create a recycling system to engage environmentally-conscious consumers without losing major retail and food industry clients.

References

Beswick, R., & Dunn, D. J. (2002). Plastics in packaging: Western Europe and North America. Rapra Technology Limited.

Chalmin, P. (2019). The history of plastics: From the Capitol to the Tarpeian Rock. The Journal of Field Actions, (Special Issue 19), 6-11.

How is COVID-19 affecting plastic packaging manufacturers?. (2020). Packaging Europe. Web.

Klaiman, K., Ortega, D. L., & Garnache, C. (2016). Consumer preferences and demand for packaging material and recyclability. Resources, Conservation and Recycling, 115, 1-8. Web.

McCormick, E. (2020). ‘It’s all on hold’: How Covid-19 derailed the fight against plastic waste. The Guardian. Web.

Plastic container market size, share & trends analysis report by material (PET, HDPE), by end use (beverages, cosmetic, industrial), by region, and segment forecasts, 2019 – 2025. (2019). Grand View Research. Web.