Introduction

Increased technological advancements and the growing importance of large organizations have increased the importance of understanding firm-owner relationships. Proprietary and entity theories have played a pivotal role in defining firm-owner relationships. The proprietary theory sees no distinction between a firm and its owners but the entity theory recognizes this distinction (Goldberg 1980, p. 116). Though the controversy surrounding the proprietary theory will be explained in later sections of this study, the theory is known to give a lot of authority to business owners (a phenomenon that is highly disputed in today’s business environment).

The entity theory was first developed by William Patton (Goldberg 1980, p. 117). Contrary to the proprietary theory, the entity theory views businesses and their owners as two different entities. The theory views business assets as belonging to a firm, and in the same measure; it allocates a stake on business assets to creditors. The entity theory also views equity accounts as subject to the wishes of equity holders (and not stockholders). As opposed to the proprietary theory which allocates net income to proprietors, the equity theory allocates net income to equity holders. This allocation is however done when all claims have been settled. Furthermore, the entity theory suggests that no portion of a company’s income should be distributed to capital providers until all dividends are declared (and the company’s interest payments are due). Goldberg (1980) explains that, “In measuring income, both interest and dividends represent distributions of income to providers of capital. In its pure form, the entity theory would therefore preclude deduction of either interest or dividends from revenue, when calculating income” (p. 167). Based on the above understanding, this paper explains the strengths, weaknesses and limitations of the propriety and entity theories. Their characteristics will be analyzed within the framework of how the two theories influence the accounting framework in the United Kingdom (UK).

Strengths of the Proprietary Theory

Though the proprietary theory is not widely used (or accepted) in today’s accounting spheres, its application is evident in certain types of organizations. Partnerships and small businesses are just a few examples of organizations where the proprietary theory is adaptable. Its adaptability is accepted here because the control of the business owner(s) is usually strong for partnerships and small businesses. It is therefore inevitable to include the interests of the business owners in the computation of business accounts because the revenues or assets of the business are normally the proprietor’s. The proprietary theory is also deemed to be a realistic account of today’s accounting practices and businesses. Contrary to the entity theory which draws no relationship between the business owner and the business; the proprietary theory shows the relationship between businesses and their owners by acknowledging that, business owners depend on their businesses for their livelihoods (Goldberg 1980, p. 117). For instance, people start businesses with the aim of making profits and getting a livelihood out of it. This is the realistic account of today’s businesses. The proprietary theory acknowledges this situation.

Weaknesses and Limitations of the Proprietary Theory

Though the proprietary theory is focused on presenting a realistic view of accounting, it is mainly limited by the fact that, most accounting practices are focused on the company’s image to outsiders, and not insiders (business owners). For instance, it is difficult to implement the proprietary theory in public limited companies because they are supposed to post their financial records to the public. The focus on business owners is therefore undermined in this respect, and similarly, it is difficult to derive the relationship between businesses and their owners. The proprietary theory also fails to exhibit a sense of business continuity because it attaches a lot of importance to business owners. From this understanding, it is difficult to show a sense of business continuity if the business owner is absent. For instance, the separation of businesses from their owners is a strong framework for guaranteeing business continuity because different managements can run a business without influencing the businesses negatively (due to the transitions) (Keshav Lal CPA 2005).

Strengths of the Entity Theory

The entity theory draws the distinction between businesses and their owners. It does so by explaining where the distinction in business and personal interests start. This distinction is a strong area of competence for the entity theory because people are normally known to have conflicts of interests by perceiving businesses to be personal ventures. When such conflicts occur, it is difficult to know what actions affect the business and which ones do not. In this regard, the entity theory stipulates the distinction between a business and its owner, thereby securing business and personal interests, without letting any concept affect the other (Goldberg 1980, p. 117). This distinction prevents any conflict of interest.

The entity theory is also known to support the expansion of businesses into different departments and geographic locations. The expansion of a business is regarded as a function of the delegation of authority from a central location (from the business owner). This function is contrary to the proprietorship (or entrepreneurship) type of business because there is a strong connection between the owner and the business which limits business expansion. In today’s business environment where organizations are increasingly spreading their operations to new locations, the entity theory aligns business expansion strategies because Keshav Lal CPA (2005) explains that, the entity theory allows for the increase in business scope. Keshav Lal CPA (2005) further explains that, businesses which adopt the entity theory have a better chance of “expending business, securing debts, attracting investors, retaining professional setups, engaging professional management, promoting and achieving new ideals and expanding their activities to global levels” (Keshav Lal CPA 2005, p. 3).

Weaknesses and Limitations of the Entity Theory

A major limitation of the entity theory is its weakness in defining creditor-owner relationships. Most critics observe that, the owner-creditor relationship is unrealistic (Word Press 2011). This criticism is founded in the fact that, creditors and shareholders should not be treated equal just because they provide capital to a business. Critics observe that, it is impossible to build a realistic accounting theory based on the argument that creditors and shareholders should be treated equally.

The entity theory also assumes that, owners and their businesses are two different entities (whereby the latter is just a devise). Furthermore, the entity theory suggests that, there should be no relationship between a business and its owner. However, this assertion is not practical because owners and their businesses have a strong relationship which is based on the fact that shareholders often expect dividends (or rewards) from the company.

Considering most companies are subject to fraudulent activities and erroneous transactions, the entity theory fails to provide a sense of accountability to the real perpetrators of such crimes. For instance, the entity theory suggests that companies should be managed by executives and board of directors but considering these management groups are humans, they are prone to errors and frauds. Since the entity theory perceives companies to be their own legal entities, it is difficult to allocate blame to individuals if they embezzle funds. In this regard, it is also difficult to guarantee the recovery of funds from the real embezzlers because the entity theory stipulates that a company and its owners are different entities (Word Press 2011).

Application of the Theories in Today’s Accounting Practices

Proprietary theory

The implication of the proprietary theory in the accounting practice is that, financial statements should be prepared according to a business owner’s preferences. Moreover, the theory suggests that, profits should be distributed to business owners and not the business. The proprietary theory also tries to derive a changing relationship between assets and liabilities (over a definite period of time). Focus is therefore laid on the absentee owner (in the formulation of accounting statements) because business owners and firms are perceived to be virtually identical. In this regard, there is a strong correlation of the proprietary theory with the net income (Schroeder 2010). The net income influences several financial variables like dividends and different measures of wealth. These variables also have a strong influence on the computation of historical wealth and the determination of current costs in the balance sheet.

Most large organizations do not apply the proprietary theory. However, the concept of the theory is normally witnessed in many financial books (of large organizations). For instance, the concept of “income” in most large organizations is derived from the proprietary theory (Schroeder 2010). The treatment of interest and income taxes (according to the proprietary theory) is always according to the stockholder’s interest and not according to the providers of capital. Here, it is always noted that, a company’s profit is always computed according to the stockholder’s worth. The entity theory would assume that company profits should be computed according to the company’s worth.

Furthermore, concepts such as dividends per share and earnings per share are borrowed from the proprietary theory. The adoption of equity accounting for non-consolidated investments (where a firm’s share of non-consolidated subsidiaries is added to the net income) is normally a borrowed practice of the proprietary theory. In this analysis, it should be noted that the proprietary theory recommends that a company’s subsidiary income should always be computed as part of the company’s main income (Schroeder 2010).

Entity Theory

The application of the entity theory in today’s accounting practice is mainly witnessed in large organizations (Word Press 2011, p. 1). Its application is normally envisioned in the formulation of accounting techniques and terminologies. For instance, the use of the Last in First out (LIFO) concept of stock taking is a borrowed concept of the entity theory. This adoption can be compared to the First in First Out concept (FIFO) because LIFO is a correct valuation of owner’s equity. Also, the perception of revenues as products and goods and services as revenues is also part of the entity theory because the entity theory emphasizes on a strong sense of accountability to all equity holders.

The formulation of consolidated statements is also part of the entity theory (Schroeder 2010). This principle was first documented by Professor Maurice Moonitz in his 1942 edition of the book, “The Entity Approach to Consolidated Statements” because he emphasized that, companies often consolidate their business entities according to the principles of the entity theory (Schroeder 2010, p. 484). He made this assertion from the observation that there were few theories which showed signs of inconsistencies and contradiction. Moonitz’s main aim was to derive one formula for consolidating company equity records (using one theoretical framework). The focus on consolidated financial books was meant to be the evaluation of an entire business worth. From this analysis, there was a strong articulation that a company’s subsidiary and original entities should resonate with majority and minority shareholder needs (Schroeder 2010).

Part of the characteristics defining the entity theory (when analyzing consolidated statements) are found in Schroeder (2010) where it is explained that a business’s fair-value should always be allocated to its parent and subsidiary companies (in equal measure). In this assertion, the fair-value should include minority shareholder values and minority interests in subsidiary companies. These values should also be assumed to be the minority interests in minority shares of subsidiary equity (Schroeder 2010). For example, in computing goodwill, the parent company is allocated such costs.

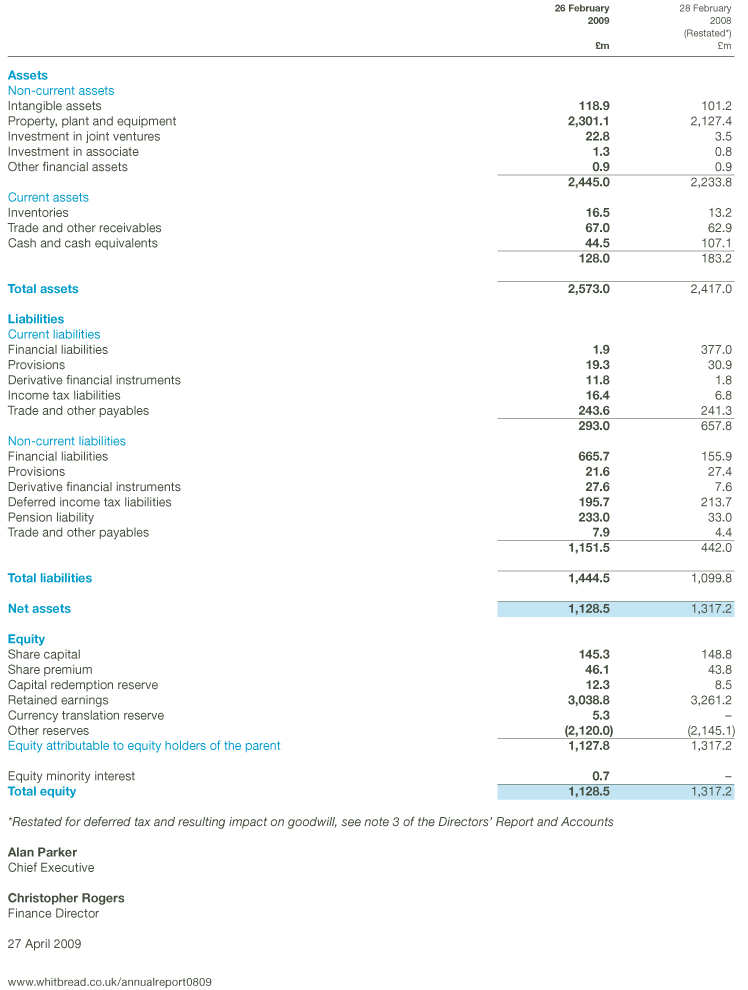

Goodwill is a unique adaptation of the entity theory because FASB and IASB note that, goodwill should be included in accounting practices (according to the framework of the entity theory) (Schroeder 2010). In reference to accounting for business combinations, FASB and IASB also recommend that, the acquisition method is appropriate for computing the acquisition of assets and the accumulation of liabilities (in the balance sheet) (Schroeder 2010). The best representation of the entity theory was witnessed in the legal tussle pitting Salomon vs. Salomon. In this case study, it was established that, the business was a separate legal entity from its owners and therefore, its owners were not liable for damages (Word Press 2011). From this legal representation, it is now an accepted accounting practice for unsecured creditors to claim compensation (from a liquidating company) before any shareholders are paid. This analysis is normally different for partnerships or sole proprietorships where there is no legal distinction between the business owner and the business. The balance sheet computation of assets being equal to liabilities is also an excerpt of the entity theory. In this analysis, the substitution of one type of capital for another is an inconsequential action because debt and equity providers are normally seen to cancel out. The blue lines highlighted in the following balance sheet show this balance in capital substitution for a UK company named, Whitbread.

The focus on correct value assertion (based on the focus of correct equity valuation by the equity theory) is also part of the entity theory. This focus has formed the framework for organizations which try to report true values of assets and liabilities by including intangible values such as depreciation and goodwill. In this regard, the entity theory has reduced the reliance on historical costs as a core focus of accounting (Word Press 2011).

Conclusion

This paper highlights the differences between the entity and proprietary theories based on how they contribute to accounting. Weighing the two theories, we see that the entity theory is the opposite of the proprietary theory because it advocates for the separation of business owners and their businesses. The proprietary theory does not recognize this distinction. Comprehensively, the entity theory has contributed to present-day accounting of assets and liabilities while the proprietary theory has mainly contributed to the formulation of accounting concepts.

References

Goldberg, L. (1980) An Inquiry Into The Nature Of Accounting. London, Ayer Publishing.

Keshav Lal CPA. (2005) Separate Legal Entity. Web.

Schroeder, R. (2010) Financial Accounting Theory and Analysis: Text and Cases. New York, John Wiley and Sons.

Whitbread. (2009) Summary Consolidated Balance Sheet. Web.

Word Press. (2011) International Financial Accounting and Theory. Web.