Introduction

The payback period is a capital budgeting technique that determines the number of years required to get back the initial capital outlay in a capital budgeting project. The discounted payback period is an advanced payback method since it considers the time value of money by discounting the cash flows before determining the period. The payback period gives the number of years when cash inflows will equal the initial investment. Thus, it acts as a break-even point for the investment after which subsequent cash flows represent profits on investment (CMA Learning System 2011).

Uses or applications of payback period

Just like other capital budgeting techniques (NPV and IRR), the payback period does not differentiate the cash flows. As such, it measures the cash flows.

Uniform net cash flows Example

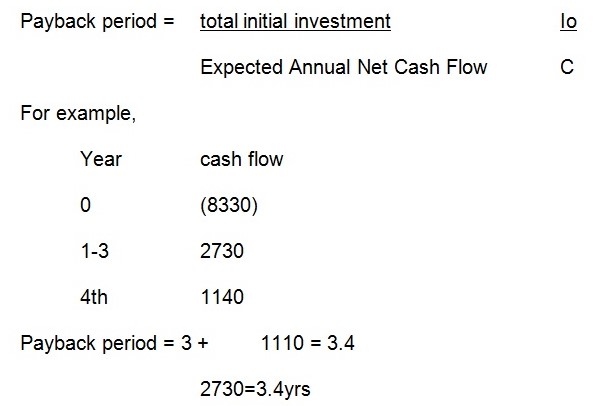

For a project whose cash flows do not depict a perfect annuity, payback years before full recovery (t) + unrecovered amount at the end of the year (i) expect cash flows in the subsequent (t +i).

Uneven cash flows

When the annual cash flows are not equal the payback period determination considers a cumulative calculation. The net cash flows are summed up to an amount equal to recouping the initial investment. Furthermore, in case the final payback falls in between a year, straight-line interpolation is used.

Payback period = Years Until full recovery + Unrecovered cost at the beginning of the last year

Cash flow during the last year

Payback method interpretation

In essence, the higher the risk of an investment project, the shorter the target payback period ought to be since it is anticipated to recoup higher-risk projects faster (CMA Learning System 2011). Shorter payback periods are considered over long payback periods. Therefore, the decision criteria applied under the concept of payback period is to accept an investment that has met the condition that the project payback period is not more than the maximum cost of recovery period set by the management. In essence, the Payback method is essential to any investment company because it is a simple measure of risk the company is exposed to through the investment. Further, the payback period method is one of the easiest to calculate and interpreted.

On the other hand, one should never be limited to determining the choice of a project using this method only, since, it ignores the cash flow beyond/after the payback. As indicated by various authors, it is not consistent with the wealth maximization principle, as it does not factor in the risk and uncertainty inherent in the real world, and also, it ignores the temporal differences in cash flows (Time value of money). At this point, it is important to note that the discounted cash flows can be used to determine payback.

Figuring in of these project appraisal techniques is derived from the fact that NPV is sensitive to discount rates, just as important as the payback period. Therefore, whenever the payback period is more than the management set decision, the project is rejected. A project can only be considered when the payback period is the same as the period set by the management or less than it. On the other hand, the higher the NPV the better the investment since net cash flow is increasing. This may lead to unreliable decisions if the rate used itself is not reliable. It assumes that all benefits/sacrifices can be expressed in monetary terms.

In selecting a range of projects, one ought to determine critically the payback period to determine if the investment can return the costs plus more cash flow as income or profits. Therefore, the decision criteria applied under the concept of payback period are to accept an investment that has met the condition that the project payback period is not more than the maximum cost of recovery period set by the management. In essence, the payback method is essential to any investment company because it is a simple measure of risk the company is exposed to through the investment.

Further, the payback period method is one of the easiest to calculate and interpret. On the other hand, one should be never limited to determining the choice of a project using this method only since it ignores the cash flow beyond/after the payback. As indicated by various authors, it is not consistent with the wealth maximization principle as it does not mention the factor in the risk and uncertainty inherent in the real world, and also, it ignores the temporal differences in cash flows (Time value of money). At this point, it is important to note that the discounted cash flows can be used to determine payback.

Advantages and disadvantages of the payback period

There are many merits of applying the payback period as a capital budgeting technique. The management undertakes the process in an easier way since the payback period is simple to compute as well as illustrate. Again, the figures produced are in terms of years, putting away the need of the management to interpret further. Rather, one can easily understand. Ultimately, the technique offers a rough measure of liquidity and risk exposure which is fundamental in the company’s investment endeavors (CMA Learning System 2011).

On the other hand, the technique presents demerits that fail to make the payback period the sole criteria in the investment decision. In essence, the method does not include the time value of money since it sums up all the cash flows without incorporating inflation, discounting, and timing. Again, the technique does not consider the flows of cash inflow and cash outflow that come in after the payback period is met. These cash flows are significant in the company’s progress while operating the project. Notwithstanding, the payback period does not give provision in measuring the profits from investment. Return on investment is critical in solving agency conflicts. Ultimately, the payback period fails to enhance the acceptance of a short period of the project at which it is targeted for the payback period to have optimal returns from the investment project.

Discounted payback period method

This advanced technique illustrates one of the shortfalls of the payback period by incorporating the time value of money. The discounted payback period is an advanced payback method since it considers the time value of money by discounting the cash flows before determining the period. The payback period gives the number of years when cash inflows will equal the initial investment. As such, the method uses present values of net cash flows as opposed to undiscounted cash flows to determine the payback period.

Discounted payback period = PV Initial outlay Io

_____________

PV Annual cash flow C

As such, the PV is estimated using the firms desired rate of return

Conclusion

Capital budgeting techniques are important in any capital budgeting process, investment decision, and budgeting decisions. The Payback period is not the only project appraisal technique that offers the ultimate solution on which investment to choose. Other capital budgeting techniques are important in the same regard. The Internal Rate of Return, Nature of Investment, the net present value (NPV), Accounting rate per return (ARR), Return on investment (ROI), Internal rate of return (IRR), Profitability Index (P1) or benefit-cost ratio (8CR).

Reference

CMA Learning System (2011). Financial Decision Making: payback and discount payback. Institute of Management Accountants.