Introduction

There are many textbooks to rely on while the education process, still, not each source is reliable and interesting for students. This paper aims at evaluating one source used during a particular course grade: the textbook Financial Management: Theory and Practice by Eugene Brigham and Michael Ehrhardt is chosen to be evaluated. With the help of four different assessments, it will be possible to define whether the chosen source is appropriate or not.

Fry Readability Formula

Three different passages from this textbook are taken, and the readability level of each will be determined by means of a number of steps. With the help of Fry’s formula, the grade level of the textbook will be identified. The chosen system of evaluation is a reliable source of information due to which student interests and possibilities may be united with teacher expectations. The identification of the grade level helps to define the goals and steps to be taken by students.

Passage One

“The market price is the stock price that we observe in the financial markets. We later explain in detail how stock prices are determined, but for now, it is enough to say that a company’s market price incorporates the information available to investors. If the marker price reflects all relevant information, then the observed price is also the fundamental, or intrinsic, price. However, the investors rarely have all the relevant information. For example, companies report most major decisions, but they sometimes withhold crucial information to prevent competitors from gaining strategic advantages. Unfortunately, some managers deliberately mislead investors by taking actions…” (Brigham & Ehrhardt, 2008, p. 8)

Number of words: 100.00

Number of sentences: 6.00

Number of syllables: 197.00

The average number of syllables: 1.97

Average number of words per sentence: 16.67

Passage Two

“Growing companies must acquire land, buildings, equipment, inventory, and other operating assets. The debt markets are a major source of funding for such purchases. Therefore, every manager should have a working knowledge of the types of bonds companies and government agencies issue, the terms that are contained in bond contracts, the types of risks to which both bond investors and issuers are exposed, and procedures for determining the values of and rates of return on bonds. A bond is a long-term contract under which a borrower agrees to make payments of interests and principal, on specific dates, to the holders.” (Brigham & Ehrhardt, 2008, p. 157)

Number of words: 100.00

Number of sentences: 4

Number of syllables: 164

The average number of syllables: 1.64

The average number of words per sentence: 25.25

Passage Three

“Although it would be nice to reconcile these problems and to measure project risk on some absolute scale, the best we can do in practice is to estimate project risk in a somewhat nebulous, relative sense. For example, we can generally say with a fair degree of confidence that a practical project has more or less standalone risk than the firm’s average project. Then, assuming that stand-alone and corporate risk are highly correlated, the project’s stand-alone risk will be a good measure of its corporate risk. Finally, assuming that market risk and corporate risk are highly correlated, a project with…” (Brigham & Ehrhardt, 2008, p. 440)

Number of words: 100.00

Number of sentences: 4

Number of syllables: 159

The average number of syllables: 1.59

The average number of words per sentence: 25.50

After the three passages are evaluated separately, it is time to calculate the average rate of the texts and identify the grade level of the textbook chosen that is observed in the Fry graph.

The average number of sentences: 4.6

The average number of syllables: 173.3

Using the Fry Method and three randomly chosen passages from the textbook Financial Management: Theory and Practice, the grade level is identified (15). The results are determined by the long words used by the author of the book, this is why this book is by the students of universities who are specialized in the sphere covered in the textbook.

Cloze Procedure

The peculiar feature of Cloze Procedure is its possibility to define whether the chosen material is suitable for the group of students or not. With the help of this test, it is possible to make students be involved in what they have to read, make some predictions about their future work, think and analyze critically information got. These tests also help teachers to comprehend whether they have managed to choose the appropriate material for students. The abilities of the two sophomores are under evaluation.

The text is as follows:

“If the pension asset is less than the pension liability then a defined benefit plan is said to be underfunded. When a company with an ______ pension plan goes bankrupt, the ______ obligations are assumed by the ______ Benefit Guarantee Corporation, a ______ agency that is implicitly ______ by the U.S. government, ______ means taxpayers. When many ______ are underfunded, a very ______ possibility exists that you, ______ a taxpayer, will have ______ bail out the system. ______ too that limits exist ______ the payments to each ______ , so if you are ______ paid and your employer ______ bankrupt, you will also ______ a loser. How does ______ time value of money ______ into all this? To ______ the connection, suppose a ______ pension assets are initially ______ equal to its liabilities, ______ then interest rates ______. As you will see, ______ interest rates cause the ______ value of liabilities to ______. Simultaneously, the future earning ______ of the pension assets ______ probably be reduced, ______ the company increases its ______ contributions the plan will ______ underfunded. This is exactly ______ happened during the early ______. Interest rates fell, pension ______ became underfunded, companies that ______ having operating problems were ______ to meet their funding ______, and as a result ______ companies failed. This is ______ one of the many ______ of the time value ______, but keep the pension ______ example in mind as ______ go through the chapter.” (Brigham & Ehrhardt, 2008, p. 38-39)

The correct words which have to be put in this text may be found in the chosen textbook by Brigham and Ehrhardt, pages 38-39.

The results of the test were rather predictable due to the already used Fry model. The first student scored 50%, and the second student scored 56%. It means that both students are at their Instructional level and are in need of clear and illustrative instructions from tutors. The results achieved at the end of the Cloze procedure are similar to those of the Fry’s assessment as the level of the chosen textbook is advanced and required much work to be done by students and their tutors.

The discrepancies between the Fry and Cloze outcomes may be explained. The point is that background of both students is high indeed, and they are aware of some facts and material. Still, the readability level of the book is 15 (Fry’s results), this is why it is not always possible to understand the essence of the book. Still, the achievements of both students prove that it is possible to work with this textbook only with some tutor’s assistance.

General Textbook Readability Checklist

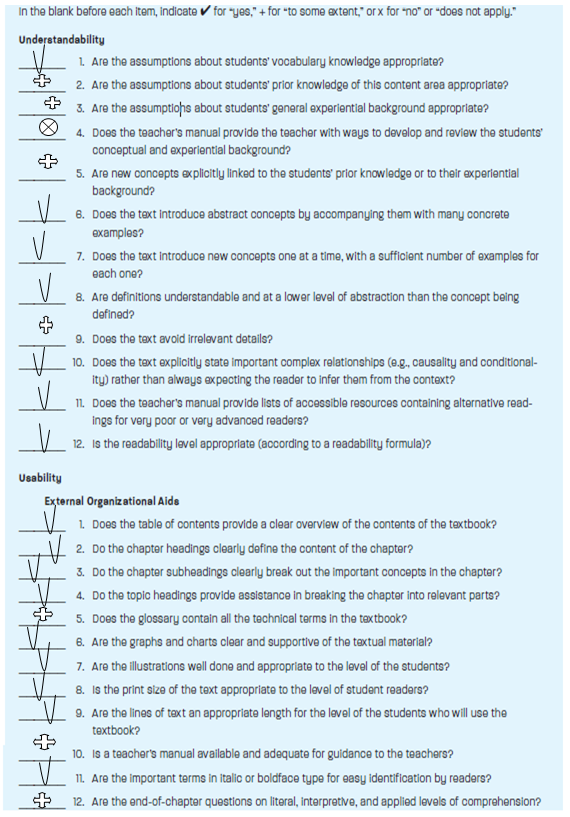

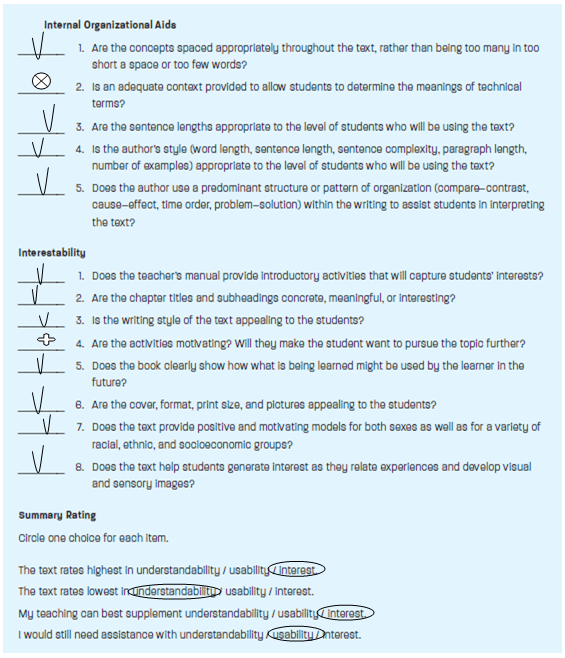

To comprehend how the text under analysis may be accepted and understood by students and used by teachers, it is possible to use the evaluation method based on the results of General Textbook Readability Checklist and compare the results got with those got from the two above-mentioned evaluations. The chosen checklist is the frequently used adaptation of the Readability Checklists offered by Irwin and Davis at the beginning of the 1980s.

The results of this evaluation are as follows: the text under consideration is considerate. It means that the authors of the book try to evaluate a number of factors to meet the reader’s expectations: the authors’ purpose is satisfied in the book, and each passage seems to be a meaningful part of the project. Still, not much attention is paid to experiential backgrounds, the authors focus on theoretical basics as the level predetermined by the Fry graph is high enough.

The text is considerate as, in its sort, it fits students’ prior knowledge and helps to study new material with minimum cognitive efforts spent. Finally, from the aspect of the text interestability, the chosen textbook contains a number of interesting and appropriate tables, illustrations, and formulas which help students understand better the information required.

In general, the chosen textbook rates high in the aspects of understability, usability, and interestability. The only disadvantage of the text under analysis is that the authors find it appropriate to use a number of complicated words the meanings of which are not always clear to the students with their background knowledge. Still, the results achieved after the evaluations using the Cloze Procedure and Fry graph are similar to those using the Readability Checklist.

FLIP Strategy

FLIP is the acronym that stands for four integral notions: friendliness, language, interest and prior knowledge. The main purpose of the chosen strategy is to involve the reader into the textbook and evaluate the chosen source level of difficulty. To succeed in this kind of evaluation, a certain passage is chosen from the book Financial Management: Theory and Practice on page 44. Several questions have been posed to three students; their answers have been evaluated, and the results are offered in the table:

During this kind of evaluation, it is very important to explain the students that their answers will not influence their grades as the main purpose is to understand the readability of the text. The chosen paragraph contains less unknown complicated words in comparison to those chosen for Fry and Cloze evaluations, still, new information is offered to the reader.

Evaluation of the Results

All the above-mentioned assessments are considered to be powerful means to comprehend whether the chosen textbook Financial Management: Theory and Practice is appropriate for students. In general, the scale meets the vast majority of the needs set. It was discovered that the students are able to evaluate the information offered, still, lack of experience and poor theoretical backgrounds deprive some students of abilities to grasp the material quickly. The teacher benefits considerably from the activities taken: it becomes clear how students may treat the assignments when there are no grades established; understanding of the material to rely on is possible; and finally, some students’ needs and expectations are defined, so that this knowledge may be applied in practice.

Conclusion

In the fact, the book under consideration is reliable enough to be used as the textbook during the classes. The main point is that a tutor has to take participation in the explanations of the material as well as identify students’ abilities in regard to the sphere chosen. Financial Management: Theory and Practice is a good source to be assessed in future, and in spite of the fact that the authors make use of complicates vocabulary sometimes, the students are able to comprehend the material and use it during their education. The illustrative examples, tables, formulas with explanations, and a number of practical assignments provided should become a helpful means for students to grasp the basics of financial managements and its role in everyday life.

Reference List

Brigham, EF & Ehrhardt, MC. (2008). Financial Management: Theory and Practice. Mason, OH: Thomson Higher Education.