Sales revenue is the primary financial resource used when carrying out an organization’s activities. One of the key assumptions for most forecasters is that the past serves as an important key to future behavior. The reasons for making forecasts are the uncertainty of the future, the need to coordinate the activities of an economic entity, and the optimization of consequences. The regression analysis method allows researchers to consider a number of factors (parameters) that condition some economic value and establish the analytical form of this relationship (Lawrence & Klimberg, 2021). In contrast to traditional methods, the dependence of the market value of the eighth company on several factors (net income, net assets) is established, provided that the model’s coefficients are determined based on the companies’ data.

The regression coefficients are calculated on the assumption that the observed changes in Y are due to changes in X, but in reality, they are only partly caused by changes in X and partly by variations in Y. The smaller the variance of X, summarized in the standard deviation, the more likely the relative influence of the randomness factor in determining the variances in Y, and the more likely that the regression analysis will give inaccurate results. The coefficient is determined by multiplying the value of s by the size of the class intervals λ, if they were found using variation series or correlation tables. The regression coefficient can be calculated by bypassing the calculation of mean square deviations. In this case, the correlation coefficient is equal to the geometric mean of the regression coefficients. The latter characterize only a linear relationship and are accompanied by a plus sign for a positive relationship and a minus sign for a negative relationship.

Correlation analysis aims to examine the quality of the connection of two or more random variables. The task of regression analysis is to plot the relationship between the mathematical expectation of random variables and one or more non-random variables. This type of analysis is based on the cause-and-effect relationships between variables.

Correlation analysis looks at the relationship as synchronicity, while regression analysis examines the relationship as dependence. Causal models are used when the independent variables (x) are known in advance or are easier to predict than the dependent variable. Time series prediction is constructing a model to predict future events based on known past events, predicting future data before it is measured. It differs from a causal model in that the independent variables are unknown.

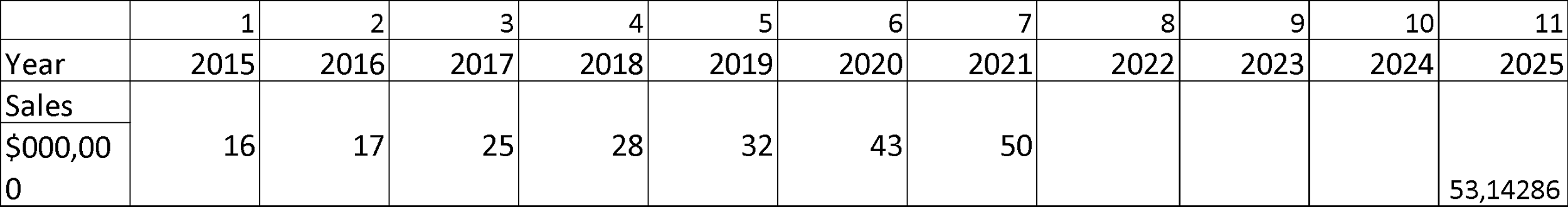

The results of predicting the company’s annual revenues for the year 2025 are shown in the table. The linear trend equation has this form – y(x)=a+bx, where:

- y is the sequence of values we are analyzing (e.g., sales by months);

- x is the number of the period (ordinal number of the month);

- a is the point of intersection with the y-axis on the graph (minimum level);

- b is the value by which the next value of the time series increases.

In this case, the value 11 was taken as x, the value a is 16, and the value b was calculated automatically.

Table 1: Forecasting the sales for 2025

Reference

Lawrence, K. D., & Klimberg, R. K. (2021). Advances in business and management forecasting. In K. D. Lawrence (Ed.), Optimizing resources to better forecast future (p.p. 7–13). ProfitsEmerald Publishing Limited.