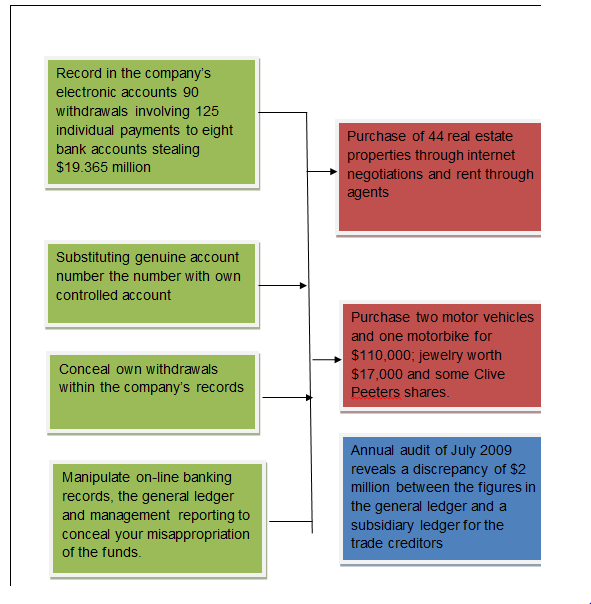

In the above figure, it is assumed that Sonya Causer invested the funds immediately after he misappropriated them. The annual financial audit that revealed that there was a variation in the creditor ledgers and their subsidiary accounts indicated a discrepancy of $ 2 million while in an actual sense more money had been lost. This reveals the fact that forensic audit; though being substantive is also susceptible to the margin of errors which are in some instances of material amounts. This analysis diagram above (figure1) shows rent enjoyed from the property bought with the stolen money but does not shed light on the exact amount of rent benefits.

Twenty questions that I would ask Sonya Causer if I was investigating the fraud and their Justification

In the investigation of fraud, certain elements must be ascertained for a conduct to be termed as a fraud offense. These qualities may include the affirmation of instances of theft, obtaining property by deception, gaining a financial edge using deception, use of false accounting, and the falsification of accounting documents. The following twenty questions will be vital in ascertaining whether the conduct of Sonya Causer qualified as fraud and whether he perpetrated the alleged crime.

Who are the beneficiaries of the 90 withdrawals involving the 125 payments to eight bank accounts as indicated in the company’s electronic accounts? Are you in a position to provide a list of these individuals under their specific banks?

This question will enable the fraud investigator to establish whether Sonya Causer conducted a false accounting crime that entails altering or concealing a manipulated accounting record. This question will also enable me as an investigator to know whether the accountant paid the money withdrawn to the creditors of the company or not. The record of the accounts beneficiaries with their banks stated will enable in tracing the deposit to the banks that receive them alongside the account owners.

In which banks do you own an account? What are your full names in these accounts and in which year did you open the account?

This question will enable me to trace whether there is any money that has trickled from the company account to Sonya Causer. It will also make it possible to trace instances of substituting employees’ or creditors’ genuine account numbers with their own and siphon the money in the guise of making payments for the firm. Based on the fact that an accounting crime has the nature of the accused concealing or giving false information, this question will help to establish whether Sonya Causer obtained money from Clive Peeters through deception. Also, it will help establish whether the company made some losses on account of Sonya Causer and whether such losses were intended.

What are your roles and duties as the Clive Peeters Senior Financial Accountant? What is the scope of your authority? Who do you report to in your line of duty?

As a senior officer in a position of authority, Sonya Causer is in a position of trust. As such, he exposes the firm to the losses that may emanate from the breach of trust bestowed on certain employees. It is ethically and morally expected that employees of companies should act with the interests of the company at heart (Stafford, 2005, pp. 101-104), but this is not always the case. Hence, this question will seek to establish the degree of trust bestowed upon Sonya Causer so that if he has betrayed the trust, he will be liable for the crime. This also helps to whether his day-to-day operations are supervised by any officer or to establish the strength of the internal controls and whether they are complied with.

Do you have an up-to-date debtor’s account? Is the debtor account in agreement with the sales control account?

Fraud in organizations in most cases is associated with areas where cash is involved (Swartz, 2004, p. 11). This can be explained by the quality of cash as the most liquid asset. In most cases, the collection of accounts receivable from the debtors provides a loophole for the accounts to misappropriate cash inflows of the firm. This is usually done through lading where accountants may spend the receipts of the current period and defer their recording to a future date when they receive other cash flows.

Is the creditor’s account updated? Does the creditor’s account agree with the purchases account?

A Firm’s creditors account maintains a record of all the individual accounts payable for a certain reporting period. The maintenance of the account can expose the firm to a risk of embezzlement of finances by accountants through falsified payments. A financial crime, which is an element of fraud, has an element of taking undue financial advantage from the firm. Accountants may pay creditors that never existed or exaggerate the figures to benefit from such dishonesties. This may extend to giving false information to lenders of finances to obtain loans. The creditor’s account should be in agreement with the purchase control account in the instance where there are no frauds and in cases of any discrepancies, the variation should be reconcilable.

Is the general ledger in order? Does reflect the total sum of the firm’s transactions?

The purpose of the general ledger is to act as a book of original entries and capture all the transactions as they take place. In addition, any distortions and deletions may indicate instances of possible fraud being covered (Wells, 2002, p. 22).

What property do you own and when did you acquire them?

Similar to government entities, the need for employees to declare their wealth is becoming apparent in the private sector. Tracing the date of acquisition of major property and assets helps an investigator to link the company out flows with the employees’ acquisitions. For instance, Sonya Causer made huge investments in the period that the Clive Peeters was experiencing difficulties. A correlation may exist between the loss of firms’ finances and the personal gains of employees especially the accountants.

Do you have an up to date payroll record?

An up to date payroll ensure that the current list of employees is maintained. This helps to eliminate chances of ghost employees. Accountants have the potential of creating falsified documents such as manipulated payrolls. The investigator should establish whether the internal control is capable of detecting fraud such as dummy workers (Tyburski, 2004, p. 10).

Do you maintain an up to date asset register?

An asset register ensures that a firm maintains an updated stock of their assets. The role of an investigator is to ascertain whether these assets exist or not. The valuation of the assets and the method of disclosure are crucial in detection of fraud. An accountant could maintain a record of assets that do not exist giving a loophole for fraud.

Which areas of the company transactions that the Sonya Causer responsible for authorization?

An employee is not supposed to authorize a document that he has prepared (Singleton, Singleton, Bologna & Lindquist 2010, p. 156). Documents should be verified by a few individuals who are not responsible for preparing them. An instance where Sonya Causer prepared a document and authorized them would depict a sign of weak internal controls.

How are the processes of carrying transactions broken down? Are they conducted by the same person?

One way is alleviating fraud level in the accounts department is by the segregation of duties into small interrelated procedures which are undertaken by various personnel. This makes collusion more impractical in an accounting environment hence, reducing cases of fraud.

How often do you conduct cash account reconciliation?

Bank reconciliation helps to control embezzlements of funds because variations between the cash at hand and the cash at bank should be explained. Bank reconciliations should be done as often as possible to mitigate fraud.

What is your role in relation to the management of the petty cash account?

The management of petty cash is also crucial in a firm. The liquid nature of the cash may attract pilferage of funds from the kitty. The kitty should be checked regularly and ascertain whether the cash at hand agrees with the recorded amount.

Who counter checks the completed pay roll before and after payment of wages?

The payroll should be checked before and after the payment of the salaries and wages and ensure where all the employees have signed it. Any unsigned gap should be interrogated. The officer in charge of counterchecking should be different from the one who prepared it.

Who authorizes the rent received?

Authorization of any receipt including rent is necessary for fraud monitoring and detection. If a firm collects unauthorized funds, it may pose an opportunity for the money that are not accounted for.

How often does the accounts department practice rotation of duties?

Rotation of duties ensures that one employee is not responsible for dealing with one are or transaction permanently. Failure to rotate offers chances for employees to detect any loophole in the system and capitalize on it.

Does the senior management take routine checks or do you check the work of your juniors without notice?

The level of monitoring of the accountant by the top official determines whether they engage in fraud or not. Spontaneous checking of the books of account makes accountants to avoid fraud because the fear being discovered. If Sonya is the most senior financial accountant without anyone to check his work, this may create opportunities for fraud.

What controls do you have to monitor goods dispatched to customers?

Fraud may originate from poor controls in the dispatching of goods. Good control measures in the stores ensure that sold goods are invoiced appropriately and that the quantity dispatched matches with records.

How often do you go for leaves, which was in charge of your duties?

One of the controls of a firm in mitigating the level of fraud especially in the accounts department is giving accountants periodic leaves to allow time for evaluation of the books by other parties. If Sonya causer has never gone for a leave, this may be an indication of an opportunity to breed fraud.

Who authorizes the receipt of interests’ income and insurance premiums?

Certain firm incomes such as interests and premiums should be authorized by the board of directors. Instances where the company receives money with the right authorization may open opportunities for fraud.

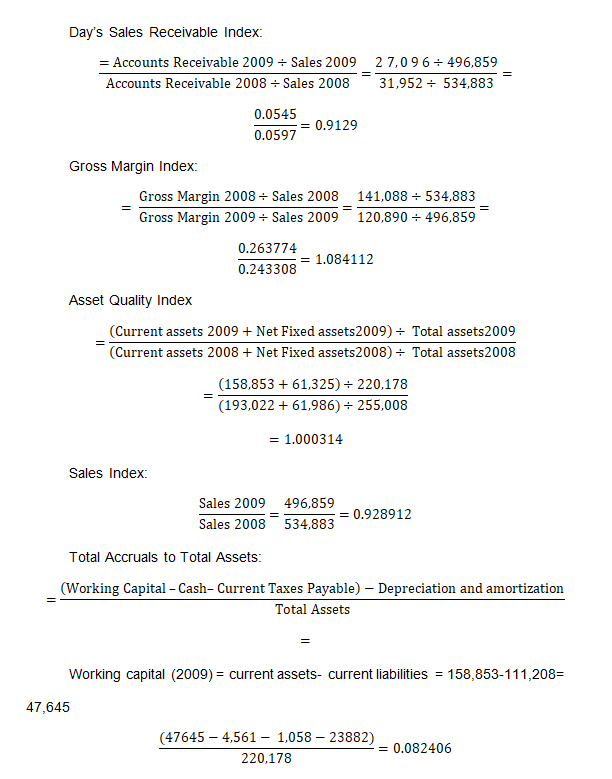

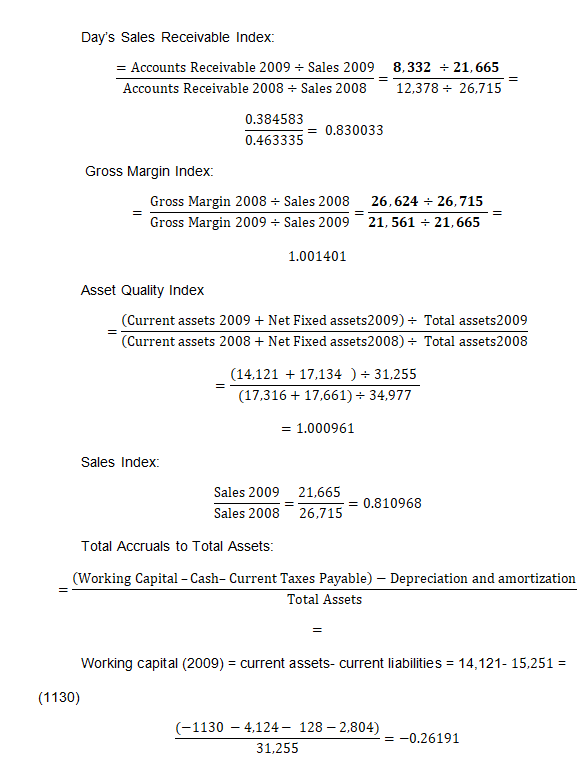

Benish Ratios for Clive Peeters for the FY 2008 and 2009 (Note 1)

The Day’s sales receivable index is close to 1 hence it is not manipulated. The asset quality index is close to one and not manipulated. The sales index shows that the figures are not manipulated. The total accruals to total assets figure is more than 0.018, hence there could be some manipulation in one of the components of the index.

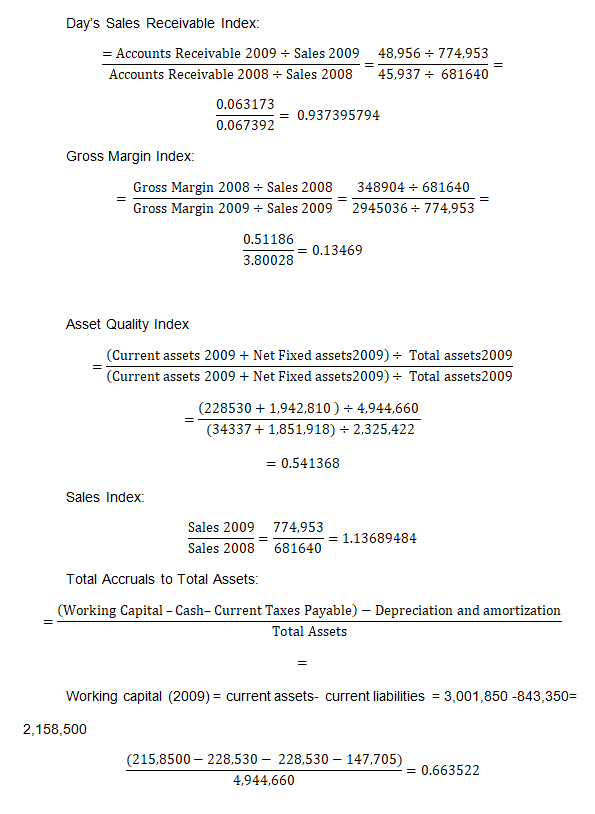

Benish Ratios for Washington H. Soul Pattinson and Company Limited for the FY 2008 and 2009 (Note 2)

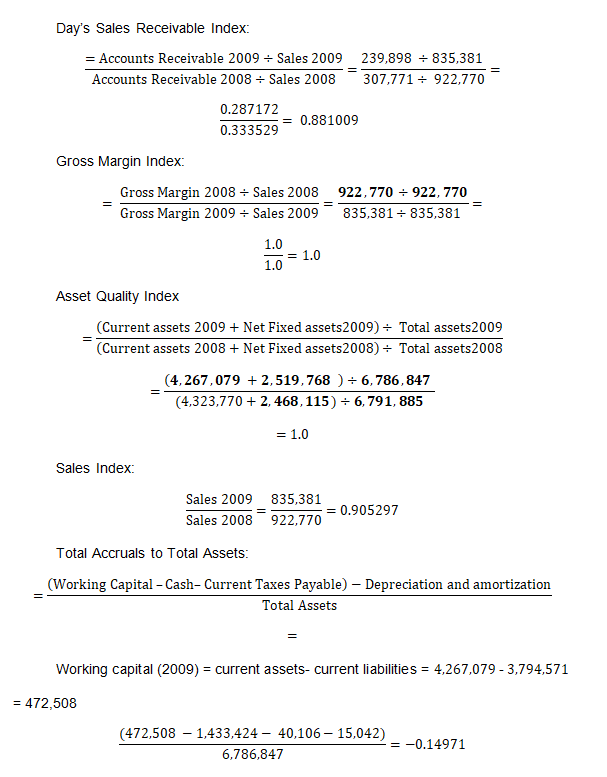

Benish Ratios for ASX Limited for the FY 2008 and 2009 (Note 3)

Benish Ratios for Altium Limited and Controlled Entities for the second half of FY 2008 and 2009 (Note 4)

I do not believe that the fraud contributed to the collapse of Clive Peeters. The amounts misappropriated by Sonya Causer are proportionately low when compared to the cash flows of the firm. Though the accused misappropriated $ 19 million, the company’s cash flows are way higher than this amount and therefore does not warrant the collapse witnessed latter. My opinion is based on the assumption that the magnitude of the fraud reported is accurate. There is a possibility that the accused could have embezzled a bigger amount.

Bibliography

- Note 1: Clive Peeters Limited Annual Report 2009(ABN 52 058 868 018). Web.

- Note 2: Washington H. Soul Pattinson and Company Limited Financial report 31 July 2009 (A.B.N. 49 000 002 728). Web.

- Note 3: Australian Securities Exchange 2009 Annual Report (ABN 98 008 624 691). Web.

- Note 4: Half – Year Report 31 December 2009 for Altium Limited and Controlled Entities (ACN 009 568 772). Web.

References

Singleton, TW, Singleton, AJ, Bologna, GJ, & Lindquist, RJ. 2010. Fraud Auditing and Forensic Accounting, 4th edn, Wiley, New York.

Stafford, A. 2005. “Privacy In Peril”, PC World , pp. 1-5. Web.

Swartz, N. 2004. “U.S. states disagree about online access to court records”, Information Management Journal , vol. 38, no. 3. Web.

Tyburski, G. 2004. Introduction to Online Legal, Regulatory, and Intellectual Property Research, South-Western Pub, Ney York.

Wells, JT. 2002. “Occupational Fraud: The Audit as Deterrent“. Journal of Accountancy, pp. 1-5. Web.