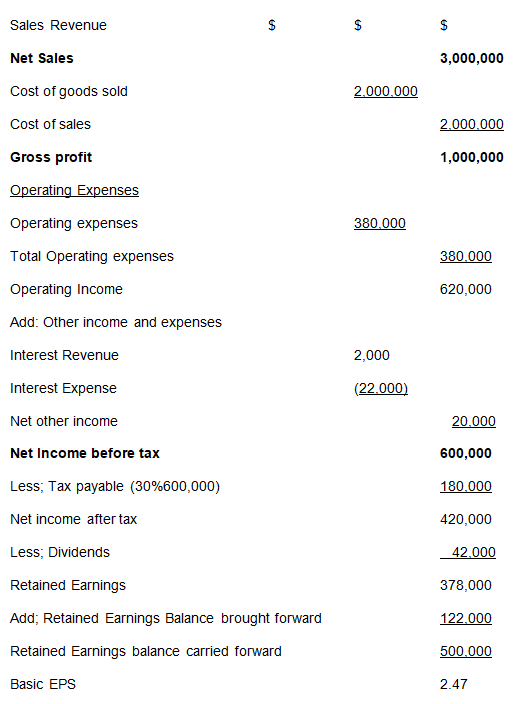

The multiple-step format of preparing financial statements is more detailed as compared to the single-step method. This method also provides information about ration analysis to the shareholders or the users of these accounts. In this case, the financial accounts of Kyle’s Lawns Inc will appear as follows.

Kyle’s Lawns Inc

Income Statement. For the Year ended November 30, 2005.

Workings

EPS is the amount of money as a return an investor gets from holding on a share of a company. EPS is calculated by dividing the retained earnings of a particular company in a particular period by the number of outstanding ordinary shares of stock in that period. In the above case, Kyle’s Lawns Inc has retained earnings of $378,000 and 150,000 ordinary shares. Therefore, the EPS is calculated as follows;

EPS = Retained Earnings

No. Of outstanding ordinary shares

= 378,000/150,000= 2.47

This means that for every 1 share held by an investor there has been an earning of $2.47 per share.

Statement of retained earnings

Statement of retained earnings shows the capital and reserves of a company and how it has fluctuated during a particular period. It shows whether there has been an increment or reduction. The users of financial statements would always want to acquaint themselves with this information so as to tell whether the company has its reserves growing or declining. In the above case Kyle’s Lawns Inc’s statement of retained earnings will appear as follows;

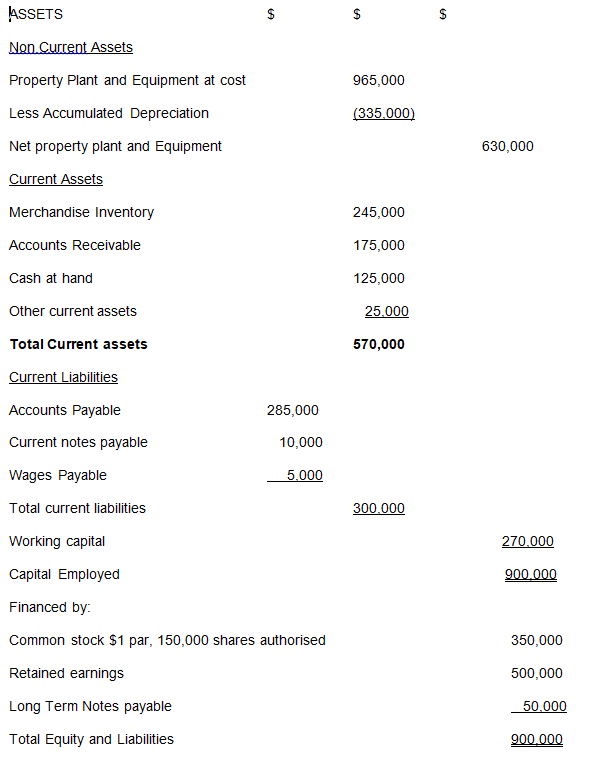

Balance sheet

A Balance Sheet is a statement that shows a company’s financial position at a particular date. It is normally prepared at the end of a financial period. In the above case Kyle’s Lawns Inc’s balance sheet will be prepared as follows.

Kyle’s Lawns Inc. Balance Sheet. As at November 30, 2005.

Ratios

The asset turnover ratio shows how a company has used its assets to generate sales. It is calculated as follows;

Asset Turnover ratio = Total Sales /Total Assets

3,000,000/1,200,000 = 2.5

If this ratio is high it is an indicator that this company is using its assets to achieve optimal results. In this regard this company has performed very well.

The accounts receivable ratio is the ratio of a company’s credit sales over its average accounts receivable and calculated as;

Accounts receivable ratio = Credit Sales/Average Receivable

= 3,000,000/(191,000+175,000)/2 = 16.39

Assuming that all sales are on credit the debtors’ turnover per year is very good for this company.

The average accounts receivable collection period is the ratio that shows how many time in year the company collects its accounts receivable and it is calculated as;

Debtors collection period = 360/Debtors’ turnover

= 360 /16.39 = 21.96

This means that the debtors of this company take averagely 22 days to pay up.

Current ratio is the ratio of a company’s current assets over its current liabilities; it is calculated as below;

Current Ratio = Current Assets/Current Liabilities

= 570,000/300,000= 1.9

This means that for every $1 owed by the company there is $1.9 to pay it up when it falls due.

The quick ratio is normally calculated for companies that may have difficulties in turning it stock into cash. This is calculated by leaving the stock value out in computation of current ratio as follows.

Quick ratio = Current assets – Stock/Current Liabilities

= 570,000 – 245,000/300,000= 1.08

This means that for every $1 debt owed by the company at this date, it is able to 1.08 times of that debt when it falls due.

Interest earned ratio is the ratio of profit before interest and tax over the interest expense of the company and is calculated as follows;

Times interest Earned ration = Earnings before interest and tax/Interest Expense

= 600,000/22,000 = 27.27

The higher the ratio the better of is the company since this shows that the company has the ability to pay it interest expense.

Generally this company Kyle’s Lawns Inc is financially sound and it is able it meet its obligations when they fall due. It is therefore a low risk company for its shareholders.

Depreciation

Depreciation is the loss of value of an asset over it useful economic life. Depreciation is calculated by dividing the cost of an asset over its useful economic life or multiplying the cost of the asset by its rate of depreciation. In case the asset has a residual value, this residual value is subtracted from the cost of the asset. In the case of J.T Company the depreciation of its stumping machine is calculated as follows;

Depreciation = Cost of asset – Residual Value/Useful economic life

= 480,000 – 40,000/5yrs = $88,000

The depreciation is recorded as follows with the depreciation expense we debit the depreciation account and credit the provision for depreciation account.

At the end of two years it means that the company shall have recorded a depreciation of 2 years which is (88,000*2 = 176,000). With this figure of accumulated depreciation we will debit the provision for depreciation and credit the asset disposal account. Then with the disposal value of $350,000 we will debit the bank or cash account and credit the disposal account. There is a gain on disposal of $46,000 from the disposal of this asset therefore with the gain on disposal we debit the disposal account and credit the profit and loss account.