Introduction

Roper Technology, Inc. is a diverse, innovative corporation with various high-end technological affiliates in niche sectors. The group owns firms that create innovative applications, including licensed and cloud-based operating systems, and designed merchandise and solutions for a range of retailers (Reuters Editorial, 2022). The company works via four categories: application software, Networking Software and Systems, Monitoring and Analytics, and Processing Technologies (Reuters Editorial, 2022). It offers a diverse range of brands, solutions, and offerings, including college passport and electronic money mechanisms, computerized data alternatives, business software and information remedies, and pre-development applications, among many others.

Management

Roper Technologies is a multidisciplinary technology business specializing in the development and creation of software and the engineering and manufacturing of designed solutions for international niches. Roper’s branch network is reasonably extensive, as the company operates in four distinct business divisions. First, the Application Software section creates a selection of items for various businesses, including its own. Aderant, for instance, provides law firms with integrated software products for tracking matters, scheduling, invoicing, and case intervention (Roper Technologies, 2022). Therefore, Aderant has necessitated the smooth running of legal proceedings and activities within the United States.

Second, the Network Software and Systems sector offers products used throughout the design, implementation, and operation of communications networks in numerous businesses. For example, iPipeline offers cloud-based technologies to the financial institutions and medical insurance industries (Roper Technologies, 2022). Third, the Process Innovations category manufactures machinery that enables production plants to function efficiently and effectively to generate goods and services. Irrigation, electricity, food manufacturing, aviation, and general industries are end-user sectors. Lastly, Markets for Measurement and Analytical tools are found in healthcare, the maritime industry, and multiple other businesses. These programs successfully trigger, analyze, monitor, and record data to execute any procedure (Roper Technologies, 2022). These four parts are controlled by distinct enterprises that manufacture a range of items for many sectors.

Organizational Culture

The firm’s philosophy places a premium on purchasing investment and revenue enterprises. Roper then reinvests the surplus capital in firms that generate increasingly larger returns. Roper Technologies, Inc. uses a decentralization organizational culture in its operations. The decentralization system relates to a corporate culture where top managers transfer routine procedures and decision-making tasks to junior managers. As a result, this enables Roper’s upper executives to devote more time to strategic decisions. The value of a distributed culture is that it empowers Roper’s staff by giving them more liberty to make independent decisions, enhancing their feeling of superiority and creating a sense of involvement in the institution’s path. Additionally, it allows people to effectively use their acquired experience and expertise to execute some of their ideas (Bendickson et al., 2017). Motivated workers can reduce an agency’s red tape by taking initiatives to complete tasks with minimal supervisory approval (Bendickson et al., 2017). Roper’s operation has shifted from traditional primary commodities and specialized software to mature, specialist markets with significant deferred revenue due to its decentralized and Socratic cultures.

Management Style

While the firm’s companies are fragmented, Roper does not handle its holdings casually. Rather than that, Roper operates its operations in a Socratic manner and encourages decision-makers via collective management instruction. The philosophy of Socratic management is not novel as it was presented by Socrates over 2500 years in the past as a method for guiding individuals through brainstorming sessions to construct answers (Lewis & Wescott, 2017). The Socratic administration technique poses questioning techniques and delivers responses that may contradict the worker’s present knowledge of the problem Lewis & Wescott, 2017). Thus, this aids the organization’s top professionals in thinking about and comprehending the tasks at hand (Rendtorff, 2017). This management technique at Ropers Technologies, Inc. has generated novel concepts that its leaders and employees do not frequently consider. The Socratic mindset has instilled a feeling of accomplishment in Roper’s laborers as the personnel is permitted to make recommendations.

Mission

According to Roper Technologies, Inc.’s mission statement, the firm leverages its outstanding operational flexibility to transform end-market prospects into sustained profitability and cash flow to maximize shareholder value. As a result, this demonstrates how Roper’s heterogeneous company governance offers security for industrials investors (Roper Technologies, 2022). Roper’s decision to acquire asset-light technology startups in niche sectors demonstrates Roper’s flexibility to swivel as growth prospects present themselves. This mission statement is further supported by the organization’s top executive’s ability to manage the company considering its larger size effectively.

Vision

Roper Technologies, Inc.’s vision is to achieve significant and lasting profitability growth by focusing on ongoing improvement in the operating efficiency of its established markets. It accomplishes its vision by obtaining enterprises that provide elevated value-added technology, offerings, hardware items, and alternatives capable of growing and preserving cost advantages (Roper Technologies, 2022). Roper has accomplished this ambition by developing a family of market-leading specialized entities that supply designed equipment, software, and solutions to various end markets (Roper Technologies, 2022). Delivering value-added alternatives for valuable customer activities earns substantial sales volumes converted into the surplus free cash flow through efficient operational administration.

Core Values and Competency

The fundamental principles and capabilities of Roper Technologies, Inc. include collective learning, technological integration, collaboration, entrepreneurship, and a dedication to cooperation across organizational boundaries. Furthermore, Roper owns and manages subsidiaries that generate and license systems and customized solutions and services for various specialist end markets (Roper Technologies, 2022). Its vital capabilities are summarized in its four major segments that form its organizational structure.

Macro-Environment Analysis (PESTEL Analysis)

Political issues are frequently associated with the extent and form of state and central government action in the trade and commercial landscape. Roper Technologies has benefited from lower tax laws throughout the United States over the last 20 years. Consequently, profits have grown, and expenditure on research and development has increased. Rising disparities in the United States may need adjustments in tax systems. Therefore, local authorities are examining particular taxing strategies for electronic instruments and controls to limit the technology industry’s environmental impact.

Economic Factors

Economic considerations include rising prices, employment market circumstances, borrowing costs, the US economy’s productivity, household spending power, and tax levels. Due to the accessibility of underlying infrastructure in the United States, funding in constructing the core networks has expanded to enable and establish a better business climate. Roper Technologies can leverage existing infrastructure to boost the United States software industry. Additionally, Roper Technologies’ effectiveness in the United States is highly linked to the effectiveness of the US economy. During the last two decades, growth has been fueled by growing industrialization and utilizing local capabilities to serve international markets.

Social Factors

Clients in the United States place a more significant premium on functional projects than on conservative value propositions in the software industry. Roper Technologies can capitalize on this phenomenon by making technologies that improve the user experience. Media outlets are essential in changing people’s minds in the United States. Both conventional and social media are exploding in popularity in the United States. Roper Technologies can use this development to help advertise and promote its goods more effectively.

Technological Factors

Numerous sectors are being disrupted by technology, and innovation is no exception. Significant technological elements affect Roper Technologies, Inc. in the United States. Roper Technologies must constantly monitor and enhance the customer experience as performance and connectivity increase. Thus, this can significantly improve customer engagement in the Electrical Instrument and Controls market. Furthermore, modern technology continually reduces the cost of manufacturing and maintenance in the software industry. Roper Technologies’ distribution network must be restructured to provide diversity to suit clients’ requirements and pricing models.

Environmental Factors

During the last decade, corporations have recognized the importance of environmental and sustainable development considerations. Governments and social movements are increasing their pressure on businesses to comply with environmental regulations. Waste management, particularly for facilities near urban areas, has become a growing priority for firms such as Roper Technologies. The United States jurisdiction has enacted stringent regulations governing trash treatment in urban areas. As a result, recycling is rapidly becoming a custom rather than a desirable practice in the United States economy. Roper Technologies must develop measures to ensure compliance with legislation and industry standards in the technology field.

Legal Factors

Not only have information privacy rules become crucial for privacy concerns, but also intellectual property laws. Roper Technologies must determine whether or not the United States has a solid framework to safeguard against confidentiality breaches. Additionally, the level of environmental regulations and guidelines in the United States should serve as a reference for Roper Technologies’ actions, determining what the company must do to comply with those legislation and requirements.

Revenue Growth (Last 3 years)

Operational Expenses (Last 3 years)

Profit Margin (Last 3 years)

Stock Performance (Last 3 years)

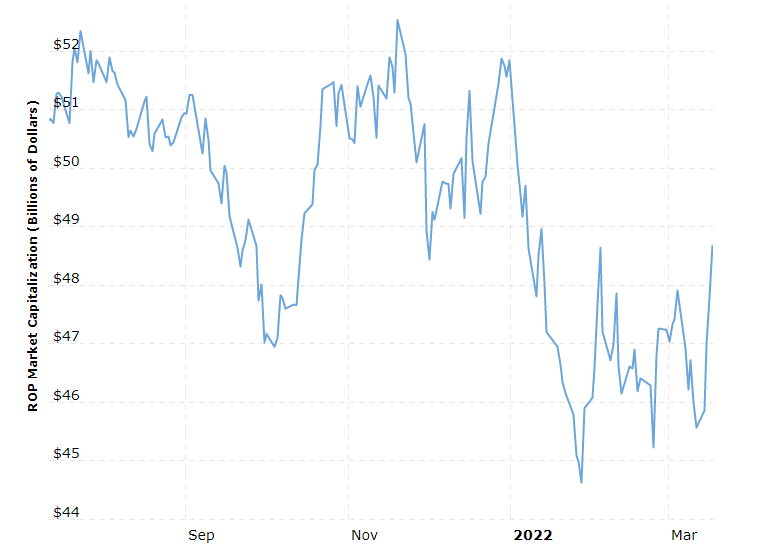

Latest Market Value

Market valuation, or current value, is the most frequently used metric for determining the size of an openly listed firm. It is determined by multiplying the current stock price by the shares issued. Roper Technologies’ marketplace capitalization is $47.08 billion as of March 17, 2022 (Roper Technologies, Inc., 2021).

Long-and Short-term Debt (Last 3 years)

Cash Position (Last 3 years)

A cash position is the sum of funds that a business, private equity firm, or bank has on hand at any given time. The cash position represents an organization’s economic stability and solvency (Radiman & Wahyuni, 2019). This position frequently includes extremely cash reserves such as deposit accounts, short-term sovereign debt, and other marketable securities additional to cash.

Liquidity Measurement Ratios (Current, Quick, Cash)

The current ratio refers to a liquidity metric that calculates a business’s capacity to meet short-term commitments. For the three months ended December 31, 2021, Roper Technologies’ current ratio was 0.78 (Roper Technologies, Inc., 2021). The quick ratio compares a corporation’s liquidity position to its current liabilities. Cash reserves are liquid assets that can be swiftly turned into cash with little effect on the returns earned in the stock exchange. In contrast, current liabilities are an institution’s obligations or commitments owing to lenders. Roper Technologies, Inc.’s quick ratio was 0.72 as of December 31, 2021 (Roper Technologies, Inc., 2021). Finally, the cash ratio is a measure that indicates a financial condition, more precisely the proportion of available cash and equivalents to short-term liabilities. Roper Technologies, Inc.’s cash ratio was 0.78 during the fiscal year 2021 (Roper Technologies, Inc., 2021). The indicator quantifies a business’s creditworthiness to repay short-term debt using near-cash reserves, such as readily equity investments.

Marketing

Roper offers eleven application software, twelve network software and solutions, fifteen measurement and quantitative innovation, and nine process technology product offerings. Aderant, which excels in legislation and other expert consulting firm administration software, is one of the application software (Reuters Editorial, 2022). Business expansion, docket control with built-in legal provisions, professional and budget reporting, case intervention, data storage, and actionable insights are all services offered by Aderant. Cboard concentrates on school organizations such as colleges, hospitals, assisted living facilities, and businesses (Reuters Editorial, 2022). Their objective is to streamline and automate the campus’s internal operations by establishing a user-friendly straight-through management platform for clients and employees.

Eventually, CliniSys is a corporation that provides scientific data handling systems. It is Europe’s market leader in computerized information technologies. Its objective is to increase operational and cost optimization, enhance data availability, authenticity, and timeliness, improve clinical care, and establish and sustain a competitive edge (Reuters Editorial, 2022). Inovonics, the global leader in wireless communication for industrial and life security applications, is one of the 12 networking solutions product lines. Their services are employed in the marketplaces for protection, assisted living, and residential sub-metering.

Furthermore, Strategic Healthcare Program, LLC (SHP) supplies products to the post-acute medical business. Their system enables monitoring by aggregating, analyzing, and measuring therapeutic, monetary, quality of care, and transactional processes (Reuters Editorial, 2022). Finally, SoftWriters offers software to service chemists, specialized dispensaries, and drug stores participating in 340B agreements (Reuters Editorial, 2022). Their software facilitates stock control, administering, diagnostic assessment, pharmaceutical mechanization, content marketing, process maintenance, and interaction. The fifteen measuring and analytical technologies are comprised of the following product lines. First, Alpha Technologies is a worldwide provider in developing and manufacturing equipment and applications (Reuters Editorial, 2022). They are experts in the examination of leather and elastomeric compounds.

Alpha’s assessment offers details to its users to optimize output and enforce adherence. Second, Dynisco is a multinational company specializing in evaluating and engineering industrial extrusion equipment for polymers (Reuters Editorial, 2022). Their offerings include consultancy, design alternatives, on-site apparatus inspections and debugging, and transducers installation, servicing, and setup (Reuters Editorial, 2022). Finally, Civco Radiation is a company that specializes in revolutionary oncology technologies. Their focus is to enhance patient and nurse outcomes globally by implementing high-quality, revolutionary, patient-centric radiation treatments (Reuters Editorial, 2022). Several service offerings comprising the nine methodologies include Roper Pump, which provides the international society with hydraulic steering solutions based on rotational rotodynamic technology (Reuters Editorial, 2022). Their compressors are used in various industries, including oil and gas, commercial, automotive, and power generating.

Zetec is an auditing company that specializes in nondestructive testing (NDT) systems. They provide services to sectors such as energy production, oil and gas, aviation, motorsport, maritime, armed services, rail, and manufacturing (Reuters Editorial, 2022). Their objective is to give consumers rapid, cost-effective scanning services that provide critical knowledge for effective control. Viatran designs and manufactures high-precision pressure probes and durable pressure sensors. Viatran is well-known for resolving temperature, level, severe weather, and quick reaction concerns in the most demanding application conditions (Reuters Editorial, 2022). Finally, Metrix manufactures and supports vibration analysis procedures and tools used in gas separation, chemicals, oil and gas, petrochemical, power generating, and water purification companies.

Core Products

Roper’s key products are organized into four categories, each with its subsidiary. First, the application software division develops merchandise for most businesses, including its subsidiary IntelliTrans, a global logistics transparency corporation. By delivering cloud-based commercial planes, IntelliTrans aims to leverage the potential of distribution network transparency to enhance customer service, reduce production costs, and digitize company procedures (Reuters Editorial, 2022). Second, the Network Software and Systems division offers products in many businesses’ architecture, implementation, and operation of networked computers. For example, iPipeline delivers cloud-based technologies for the financial institutions and insurance industries (Reuters Editorial, 2022). Thirdly, the process technologies category manufactures machinery that enables industrial operations to run efficiently and effectively to generate items and services. Finally, the Measurement and Analytical solutions sectors include applications in medicine, the marine industry, and various other domains. These programs trigger, gauge, regulate, and gather information to execute any procedure successfully (Reuters Editorial, 2022). These four parts are administered by distinct enterprises that manufacture numerous items for a multitude of sectors.

Distribution Strategy

Roper Technologies, Inc. employs an intensive distribution technique in which the company permeates the marketplace by distributing its products through as many retail locations as feasible. Roper frequently uses inexpensive everyday goods, like electronic equipment and control gadgets. Roper Technologies, Inc. compensates its affiliates for using corporation trademark to generate sales via administrative fees and contractually agreed-upon licensing fees. As a result, the institution and its contractors can develop brand awareness and consumer markets that profit from the distribution network without managing each site daily.

Target Audience

Roper Technologies, Inc. splits the vast and diverse consumer base into distinct segments with comparable features and then prudently selects consumer groups whose needs and requirements align with the institution’s core competencies. The segmentation is accomplished by assessing specified segments’ economic desirability and growth prospects. Roper Technologies allocate capital, competencies, and development possibilities to one or more categories based on the sections’ attributes and the business’s infrastructure, functionality, and company goals. Each sector’s financial appeal and development potential are assessed using the specifications below. Roper analyzes divisions that are the right size, have an anticipated profit margin that exceeds the increased advertising expenses, and are widely obtainable.

Main Competitors

As discussed herein, some of the main competitors of Roper Technologies, Inc. are in the Electronic Instruments and Controls industry. Rockwell Automation is a business automation and information technology firm. Rockwell is a manufacturer and advanced manufacturing company specializing in production and industrial innovation, mechanization, computer equipment, corporate software platforms, and protection monitors (Hagford et al., 2019). Fortive Corporation is a manufacturing technology firm focused on designing, developing, and marketing specialists and customized solutions, software, and operations for diverse market segments. Fortive is a manufacturer and production systems company specializing in developing industrial digitalization, semiconductors, business applications, and industrial machinery and surveillance (Barrett & Lukomnik, 2017). Finally, SMC Company is a manufacturer and distributor of electrically operated products, including hydraulic devices, and competes directly with Roper Technologies, Inc. SMC Corporation is involved in the production and commercial automation, electricals, and sensor technology for metallic materials.

Geographical Reach

The creation of Roper Technologies’ marketing technique entails segmenting clients to comprehend their unique purchasing behaviors. Consumers’ demands, perceptions, and purchasing behavior are diverse and influenced by various characteristics, including generation, sex, income, culture, and beliefs. Roper Technologies uses the geographical classification method to divide the vast, diverse target population into particular, well-defined groups. Roper frequently conducts market dynamics assessments to get customer-specific knowledge that may be used to build groups with shared features. After determining the unique purchasing customer behavior and obtaining the necessary data through surveys, Roper Technologies splits its core audience into domestic and global geographic areas, such as a municipality, state, and sector, via geographic division.

Advertising and Promotion Strategy

Advertising is a critical component of the Roper Technologies marketing technique. Roper Technologies achieves its promotional goals using above- and below-the-line promotion tactics. Roper Technologies’ above-the-line promotion choices include broadcast, radio, and newspaper ads. Repositories, conferences and exhibitions, and email campaigns are below-the-line advertisements. Roper Technologies’ advertising approach necessitates the corporation to examine the following elements: Roper must clearly define its distinct brand positioning and ascertain why buyers require the solution and how it differs from competing offerings. Additionally, Roper creates message material and evaluates its effectiveness in assisting clients in developing a clear image of the provided goods. The organization’s marketing tactics, such as direct selling or high-profile advertisements, are advantageous whenever the corporation wishes to promote merchandise. Nonetheless, the pull strategy will necessitate the creation of a renowned brand reputation capable of luring buyers to the offered product.

Pricing Method and Strategy

This advertising methodology element necessitates an assessment of the commodities’ relevance to prospective clients. Roper Technologies’ pricing strategy is focused on establishing the retail value, credit conditions, payment duration, and reductions. Roper Technologies pursues a price penetration strategy, which forces them to offer lower prices than rivals. Penetration technique is a marketing approach used by firms to reach consumers to a new service by first providing it at a discounted price (Hsieh & Dye, 2017). The reduced price aids in penetrating a new item or service into the economy and draws customers away from rivals. A cost penetration method encourages buyers to switch brands and expand their customer base to retain those potential subscribers once pricing returns to regular rates (Hsieh & Dye, 2017). As a result of the reduced prices, Roper Technologies, Inc. gains market share.

Positioning Strategy

Roper has developed a family of market-leading specialist companies that supply designed solutions, applications, and services to various end-user industries. By delivering a position technique of value-added technologies for significant customer operations, the company can offer cutting-edge innovation at a lower price than opponents. As a result, this results in increased operating profits, which are converted into surplus working capital through robust operating administration. Effective implementation is essential to the method’s accomplishment. As a result, this is facilitated by distinct governance arrangements and a shared set of technologies that permeate the organization’s broad group of enterprises.

Value Proposition

Roper Technologies, Inc. is a multifaceted firm with a presence in most market segments. Roper operates 35 distinct accounting units, each with a receivable value ranging from zero to $2.5 billion. No single firm rivals Roper over a broad range of product categories. Thus, the inquiry emerges as to what distinguishes Roper Technologies from Autodesk, Dassault Systems, and others. Roper Technologies was created in 1981 to manufacture household items, compressors, and other factory automations. Soon after, in 1992, Roper established a Strategic Acquisition Paradigm, and since then, Roper’s prosperity has been attributed to its effective acquisitions. Roper conducted four company purchases in 2019 totaling $2387 million. The takeovers comprised iPipeline, Foundry, Bellefield, and ComputerEase. Considering its opponents, who focus only on a few areas and sell to a few markets, Roper has seized the chance to introduce itself as a dominant player by diversifying its product offerings and establishing a presence in most sectors.

Differentiation Strategy

The competitive edge of Roper Technologies, Inc. is centered on cultivating brand loyalty through the provision of premium brands. The corporation has developed differentiation management in various ways, emphasizing the dependability, sturdiness, advantages, and distinguishing characteristics of commodities. Additionally, Roper promotes brand awareness by boosting advertising expenses such as influencer marketing and endorsements. Roper Technologies has established strategic advantage through the difference in its technologies, services, performance, reputation, personnel, and creativity.

Customer Relationship Management (CRM)

Customer Relationship Management (CRM) is a collection of techniques, methods, and technology businesses employ to handle and assess customer interactions and statistics across the consumer journey. Roper organizations are committed to operating their activities to satisfy their consumers while adhering to exceptional corporate ethics and client relationship management procedures. Roper has guaranteed that their CRM innovation simplifies their clients’ lives by automating as many processes as necessary. The firm minimized manual data storage, mitigated discrepancies, and assisted staff in becoming more productive, resulting in well-designed reports and data-driven solutions.

SWOT Analysis: Strengths

- Numerous revenue streams. Throughout the years, Roper Technologies has delved into various sectors outside the software industry. Thus, this has allowed the corporation to diversify its income streams beyond the engineering and Electronic Instruments and Controls segments.

- Brands appeal to distinct client segments within the Electronic Instruments and Controls market. Roper Technologies’ broad product portfolio has aided the firm in entering several customer sectors within the Electronic Instr. & Controls industry. Additionally, it has benefited the group in diversifying its funding streams.

- Geographically widespread presence. Roper Technologies offers an extensive dealer and affiliate infrastructure that assists in providing effective solutions to consumers and overcoming competitive obstacles in the Electronic Instrumentation and Controls market.

Weaknesses

- Rivals easily mimic roper Technologies’ organizational structure in the Electrical Instrumentation and Controls market. To combat these issues, the company must establish a platform paradigm that integrates manufacturers, contractors, and end customers.

- Minimal investment in client-oriented operations at Roper Technologies. As a result, opponents may acquire a benefit in the near future. Roper Technologies’ commitment to research and development should be increased, particularly in customer service-oriented solutions.

- Niche marketplaces and domestic monopolies, which corporations like Roper Technologies profit from, are rapidly dwindling. Roper Technologies’ advertised consumer network is becoming less and less successful.

Opportunities

- Rapid economic expansion. Since the US economy is booming quicker than any other industrial nation, Roper Technologies will have the possibility to capture new customers within the US marketplace.

- Accelerated technical advancements are increasing operating efficiency, enabling suppliers to generate a diverse array of goods and services. As a result, this may allow Roper Technologies to expand significantly into adjacent goods.

- Expanding the client base in lower segmented markets. As buyers transition from unstructured entrepreneurs to authorized businesses in the software industry, Roper Technologies will be able to access the entry-level sector with a no-frills solution.

Threats

- Inadequate availability of qualified personnel. With significant personnel turnover and a growing reliance on creative solutions, the firm name may confront talented workforce resource issues in the near term.

- Urban marketplaces are saturated, while rural markets are stagnant. This pattern continues to be a source of contention for Roper Technologies in the Digital Equipment and Controls business. As a result of the significant boundaries and inadequate infrastructure, it is more expensive for Roper Technologies to serve rural clients than urban buyers.

- Pressures from competitors. As the information sector’s new item launch cycles shorten, it has increased the competitive demands on companies like Roper Technologies. Due to the size of its user base, Roper Technologies is unable to adapt rapidly to the requirements of the market segments targeted by competitors.

Recommendations

Based on the Roper Technologies, Inc. SWOT analysis and its financial assessment, the following suggestions would help minimize some of the threats and help the company to utilize opportunities available to it fully. First, the firm should adopt a business model that is difficult to be imitated by its competitors. Roper Technologies, Inc.’s organizational structure can quickly be adopted by its competitors, thus reducing its competitive advantage within its industry. Incorporating an institution’s Business to Consumer (B2C) paradigm will improve its strategic edge as B2C firms often spend less on advertising to close a sale. Additionally, Roper should invest more in human resource management to acquire more experienced personnel that can cope with the diverse changing need of innovation technologies. Lastly, the firm should place a premium on its Research and Development (R&D) department. Increased expenditure in its R&D ensures that the company comes up with novel solutions capable of meeting its clients’ needs.

Conclusion

The mission of Roper Technologies, Inc. is to generate considerable and sustainable profitability growth by continuously improving the operating efficiency of its established markets. Roper Technologies, Inc. operates in four distinct business segments: application software, networking software and systems, monitoring and analytics, and processing technologies. It has a varied portfolio of brands, alternatives, and capabilities, including university identification and digital payment methods, automated data substitutes, commercial hardware and software resources remedies, and pre-development programs. Roper Technologies, Inc. operates on a decentralized organizational culture.

The decentralization system refers to a business culture in which senior executives delegate mundane operations and decision-making to lower executives. As a result, Roper’s senior executives may spend additional time on strategic decisions. Roper operates in a Socratic fashion and empowers decision-makers through collective management teaching. At Ropers Technologies, Inc., this management strategy has generated fresh thoughts that its executives and staff do not typically contemplate. Roper Technologies, Inc.’s primary competitors are Rockwell, SMC Corporation, and Fortive Company. Roper Technologies promotes its products both above and below the line.

The SWOT analysis of Roper identifies several of the business’s strengths, prospects, vulnerabilities, and challenges that both enable and threaten the firm’s productivity. As a result of the SWOT analysis conducted on Roper Technologies, Inc., the firm should prioritize its Research and Development (R&D) department. Increased investment in research and development enables the organization to develop unique solutions capable of addressing the needs of its clientele. Furthermore, Roper should spend more on personnel management to help it recruit more qualified professionals capable of handling the numerous changing requirements of new solutions.

References

Barrett, A., & Lukomnik, J. (2017). Age diversity within boards of directors of the S&P 500 companies. In Harvard Law School Forum on Corporate Governance and Financial Regulation (pp. 1-20). IRRC Institute.

Bendickson, J. S., Muldoon, J., Liguori, E. W., & Midgett, C. (2017). High-performance work systems: A necessity for startups. Journal of Small Business Strategy, 27(2), 1-12.

Hagford, D., Dale, E., & Tonkin, L. A. (2019). Lean goes beyond the production floor: Rockwell Automation and the Antioch Company share how-to, lessons learned. In Lean Administration (pp. 29-39). Productivity Press.

Hsieh, T. P., & Dye, C. Y. (2017). Optimal dynamic pricing for deteriorating items with reference price effects when inventories stimulate demand. European Journal of Operational Research, 262(1), 136-150.

Lewis, L. F., & Wescott, H. D. (2017). Multi-generational workforce: Four generations united in lean. Journal of Business Studies Quarterly, 8(3), 1-14.

Radiman, R., & Wahyuni, S. F. (2019). The effect of cash position, firm size, growth opportunity, ownership, and return on assets on dividend payout ratio (DPR) in automotive companies listed on the Indonesia Stock Exchange. In First International Conference on Administration Science (pp. 187-195). Atlantis Press.

Rendtorff, J. D. (2017). Business ethics, philosophy of management, and theory of leadership. In Perspectives on Philosophy of Management and Business Ethics (pp. 3-16). Springer, Cham.

Reuters Editorial. (2022). ROP – Roper Technologies Inc. profile. Reuters. Web.

ROP. (2018). Roper Technologies Inc. competitors.

Roper Technologies (ROP). (2022). Forbes.

Roper Technologies, Inc. (2021). Revenue growth rates: Current and historic growth – CSI market.