Management of a company should ensure there is efficiency and transparency in their organization. One tool used to facilitate efficiency, transparency and informed decision-making is an audit. The traditional internal audit process was paper-based while modern internal audits are using computers to assist them to deliver better results.

Internal audits are management tools, conducted by employees of a company to support internal control systems. Independent registered auditors conduct external audits. In public companies, external auditing is a statutory requirement. One element these two sets of audits share is that they are independent. Technology has been adopted in accounting and auditing. There are commercial and in-house computer systems used in accounting and auditing (Coderre 12-34). This paper compared traditional manual internal auditing systems and modern computerized internal auditing systems.

History of the topic

Management of a company should ensure there is efficiency and transparency in their organization. One tool used to facilitate efficiency, transparency and informed decision-making is audits; external and internal audits are used to minimize dishonesty, assist in proper administration and ensure that professionalism and integrity are upheld in an organization. Employees of a company conduct an internal audit, whereas independent registered auditors conduct external audits. Traditional auditing methods involved auditors analyzing bunches of accounts presented to them in paper form. They were supposed to go through these accounts and gauge the level of compliance the company has. The modern system of auditing has taken a different approach where technology is used in auditing. In internal auditing, there are commercial and in-house systems used. Modern internal auditing has a wider scope than traditional ones and offers more accurate and reliable information for better decision-making. Having an effective internal audit team is a competitive advantage to a company(Coderre 12-34).

Traditional internal audit procedure

Before the introduction of technology, internal auditors had their task limited to maintaining financial transparency in an organization. They involved an analysis of data and reports given from different points to ensure that there is transparency. An internal auditor could call for records of various section transactions and interpolate them. The report from the auditor was manual. In case certain sections failed to meet a company’s set standard, the internal auditor could raise a query. For example, in case a sale has occurred, there will be a number of manual records to be made as follows,

- Sales receipt which was a prove of payment

- A debit note to the stores to record the decrease in stock

- Cashbook showed an increase in cash

None of the above transaction could have been recorded in a computer. When an internal auditor wanted to know the sale that has occurred and the amount collected say in a week then he would:

- ask for the whole weeks records

- add all daily sales

- add opening stock to any purchases made, and less closing stock to come up with the cost of goods sold

- Compare the expected sales from his calculation above with cash collected during the week. If the case and his calculation are the same, then there has been proper financial management.

Advantage of the method

- For stocks that were sold in bulks and the business is not busy, the method gives good stock management and control of funds

- Hard copies are good evidence for the occurrence of a certain event like sales

Disadvantage of the method

- The method has some disadvantage in that nonaccountants could not understand the deduction method used by the method

- It was highly manual thus complicated; chances of making an error when entering data are high

- Traditional auditing approach required a large number of employee (auditors)

- Storage of bulky files used by auditors was hectic and sometimes called for extra warehousing, this is an added cost to the company (Moelle 12-23)

Modern internal auditing tools

International Auditing Practices Committee sets accounting standards, the body is given the mandate of reviewing, devising measures and monitoring of auditing practices. They ensure that there is adequate measure applicable to auditing practices at a certain time. There are a number of changes taking place in accounting standards that must be incorporated into the accounting system. One such change is the increased use of computers in accounting. Information technologies are increasingly being used in auditing g and accounting especially after their recognition by accounting bodies. Accountants and auditors are polishing their skills to be able to adopt these innovations and be able to control a computer-enlightened business. The most common computerized accounting is ACL and CAATs. Technology-driven developments in auditing can be interpolated in the following levels:

Computer-aided audit tools (CAATs)

CAATs are tools used in business for collecting, recording and analyzing accounting data. They may be simple as recording a sale and as complex as accounting systems that produce financial accounts. CAATs tools may be computers or simple electronic gadgets like calculators. The need for these tools is increasing with technology and making the work of an internal audit easy. The traditional heaps of paperwork that internal auditors used to analyze are no longer there but have been replaced by the click of button technology. There has audit automation where different techniques are adopted to enhance efficiency and effectiveness in audit processes.

Advantages of CAATS

When using CAATs there are some advantages that it has over the traditional auditing methods, they are:

- CAATs are not limited to information system auditors but they have a wider scope where they are applicable to all internal audits and internal control systems. When developing CAATs, it should be taken as part of the supports system for the accounting body, since by its very nature it is not an accounting system but a support to the system.

- CAATs can be used in complex systems to manage accounts and transactions. They can handle a large amount of information.

- They are user-friendly. For example, a computerized accounting system is an important tool that supports data capture and data analyzing in a company, however, by its own nature, it cannot be relied on to offer adequate checks and balances (Coderre 12-34).

ACL (Accounting command language)

This is programmed software to undertake various duties when data has been keyed into them. They have icons that direct where data should be keyed in. For example in the case of a sale, the language is user-friendly in that it will ask for a specific form of transaction details like is on credit receipt number, data among others. After providing all this information, then the computer accounts it as a sale by recording in all relevant accounts.

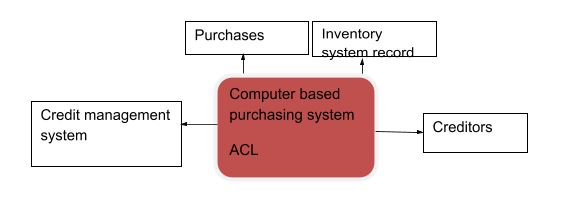

The data can then be retrieved for various analyses. ACLs include Sage accounting language, Pastel and Quick books. The accounting language to use in a company depends on the industry that the company is operating. Some are more applicable in the services industry while others are for big multinationals. The following diagram is an example of how internal auditors can be assisted by ACL in managing accounts payable:

Analysing the diagram above, it will give how a single transition can mean to an internal auditor and how different the case would have been if it were a manual receipting system use:

After the transaction, there is an increase of the inventory of the particular commodity sold. This means that the stocks will go up and advise the internal auditor, concerned with stock management in making the appropriate decision in that effect. The transaction will be recorded as an addition of stocks in the computer stock database. This record is crucial when making strategic decisions like stock valuation and stock management. This relieves the internal auditor of the physical calculation of the purchased stock, the remaining and determining whether a reorder level has been attained.

Credit management in an organization is crucial for strategic management. Integrated credit management looks into the payback time of creditors. After the purchase has been made, there are an increased number of creditors thus; there will be more creditors to track down using the credit management team.

Purchases of the company have gone up. It is good for the management of stocks and calculating the value of the cost of capital when calculating the profit of the company. The transaction will be added to purchase value for future use when making final financial accounts. If the purchases were made on a cash basis, the cashbook will show a credit transaction. The cask book will have a reflection of this transaction for proper monitoring of cash in the organization (Reding 4-67). All the above transactions are made when the purchase has been keyed in the first information collection point that in this case may be the inventory receipt point.

Procedures

When computers are used in business enterprises, they integrate certain functions and assist in the management of the company. These systems operate relatively independently with the fed data. For example, when the systems are being used to control the misuse of telephone, they may have a record of all numbers, which are allowed to be called through the system directly. In case a certain number is not recognized by the system, then the telephone line may direct the line to an administrator or the company’s phone operator who calls the number on behalf and records such special circumstances.

This kind of approach assists internal auditors to monitor operations in the organizations without their physical presence in a certain department. In case there is a difference in the budgeted telephone budget, going back and knowing the numbers, which have been called outside the set schedule, will be easy since there is a summarised report from the system (Moelle12-30).

Quality and Accuracy of information

Competition and globalization has brought changed companies’ management style. There are different approaches that are documented and set levels of efficiency in processes and product quality. In total quality management (TQM) tools, there are set levels of efficiency and effectiveness that are developed in a company. Internal audits are supposed to oversee that these set standards comply. The challenge that they have is because reporting, process efficiency measurement and product/service

Quality measurement are through a computerized system. Integrating with the company system to tap and audit, the electronic data need software, which can point areas of risk and recommend for actions. Maintaining a business intelligence tool is the work of internal auditors, they need to collect internal and external data to assist them in future decision making. The challenge that internal audits face, is vetting the information they are receiving both internally and from external sources. In case they are able to tap appropriate and timely information, then timely decisions will be made to the advantage of a company.

Advantaged of modern accounting system

There are different advantages of using computerized accounting systems they are:

- They have a wider scope than traditional auditing systems

Modern internal auditing procedures have a wider scope than the traditional one since they are not only concerned about the accuracy of financial statements but on top, they are considering the general operation of a business in terms of business audits and operational audits. This does not mean that there has been an invention of new roles of internal audits; it is just an extension of the older roles. Technology has increased through scientific innovations and inventions. - Altering data stored in a computerized accounting system is hard

When using information technology records are hard to alter and thus, when a transaction has taken place, the entered value most probably will remain the same. This called for more corporations among the auditor to ensure that they input the correct information for proper management and control. The information entered must be subjected to proper analysis by the tools if the company is to benefit.

For instance when a purchase transaction has occurred, the computer through electronic recording notes and records the transaction independent of the players involved. - Data and information warehouse

When using computerized auditing systems, an auditor is able to develop a pool of information necessary for strategic management. Information is crucial when making decisions. Accessing Computerised data by allowing users is easy, then the information is analyzed for decision-making. - Information security

Information stored in computerized accounting systems can be protected by limiting access through passwords and physical limitations of access. This ensures that data do not leak to unwanted users like competitors. - Easy to maintain

The initial cost of implementing a computerized accounting system may be expensive since a company requires both hard and software. In the medium and long run, maintenance of a computerized system is easy than that of traditional paper auditing systems. The reduced cost is in terms of storage space and efficiency attained. - Quality and accurate information

Computer offer accurate arithmetic and otherwise calculations than human beings could offer. This makes them computerized system superior to the traditional method (Kagermann, William, and Karlheinz 12-23).

The disadvantage of using computerized systems

- The systems are expensive to install and maintain.

Developing a computerized system requires costly software and hardware for their operation. Installing them may be an added expense to the company. Maintaining the system also needs some finances since the company needs to upgrade its systems now and to ensure that it is operating well. Personnel operating the systems need continuous training to keep up with changes. - User-friendliness poses danger

The fact that the systems are user-friendly poses a threat to the operation of the system since if an unauthorized user gets access, and then he can key in data or delete data (Cascarino, and Esch 12-34). - Computer virus threats

Computerised systems can easily be affected by computer viruses or worms; these viruses and worms reduce the quality of information derived. This can make a company have unreliable data. - Information in one concentration

In a computerized auditing system, a lot of information is kept in single storage software, in case of an eventuality, and then the data loss in the company is huge.

Usage of computerized internal audits

Computerised auditing systems have been adopted in business enterprises in different sectors and for various functions that include:

- Goals and objectives attainment enablers

Internal control systems are enablers of other departments to attain their strategic goals and objectives. They are more concerned with monitoring and control, they defined processes and detect when internal processes are likely to fall short of expectations. It is seen as a strategic enabler. - Management/ auditing from a distance tool

The simplicity of a laptop enables auditors to perform all-around management, this is where auditors can move around the organization with the machine and compare the expected results and the outcome that a certain department is having. With the assistance of a laptop, the manager is able to undertake quick spot checks on different departments (Moeller 34). - They are used as quality and compliance management tools

The role of the internal auditors is ensuring that there is efficient and effective financial reporting with follows internal set standards, respecting accounting laws and ethics and professional reporting (Moeller 12-23).

Difference between manual and computerized systems

Conclusion

Computers are used in businesses for various purposes. They have become tools of management; in internal control and internal audits, computers are used for monitoring and evaluation. CAATs (Computer-aided audit tools) and ACLs (Accounting command Languages) are used to aid internal and external auditors perform their duties within/without the computerized business system. They have checks and balances to ensure there is efficiency in a business. Internal control systems take different approaches in different industries, what is important is to ensure that the particular system adopted is able to control systems in an origination. For an effective computerized system, a company should ensure it has modern auditing and accounting software. Auditing staff should also be well trained and they should be attending regular refresher courses to be up-to-date with changes in technology.

References

Cascarino, Richard, and Esch Sandy. Internal Auditing. Lansdowne: Juta and Company Ltd, 2007.Print.

Coderre, David. Internal Audit: Efficiency Through Automation. New Jersey: John Wiley and Sons, 2009.Print.

Kagermann, Henning, William Kinney, and Karlheinz Küting. Internal Audit Handbook: Management with the SAP-Audit Roadmap. Berlin: Springer, 2008.Print.

Moeller, Robert. Brink’s Modern Internal Auditing: A Common Body of Knowledge. New Jersey: John Wiley and Sons, 2009.Print.

Reding, Kurt. et al. Internal Auditing: Assurance & Consulting Services. New York: IIA Research Foundation, 2009.Print.