Background

The Federal Reserve System is the United States’ unique central bank. Overall, it promotes the smooth operation of the US economy and the public’s interest. Since its existence, the US government has undertaken critical initiatives by engaging in key economic bailouts to improve the effectiveness of the private sectors, the public, plus the government. Consequently, the interventions help tackle major crises, usually a joint action by the United Federal Reserve, state congress, and the president to achieve a particular objective. Interventions positively impact the economy and bring the desired state of equilibrium to the economy. Examples of such intervention incidences include; The Great Depression, the Big Banking system Bailout, and the more recent COVID- 19 crisis, to mention a few (Rabhi et al., 2020). The paper comprises two parts: part A discusses the Federal Reserve System regarding the banking sector crisis, a bailout of commercial and investment banking, and then provides Federal Reserve corrective actions. Part B discusses government intervention programs centering on countering economic disruptions such as a great recession.

Federal Reserve

The Banking Industry Crisis, a Bailout of Commercial and Investment Banking

George W. Bush encountered a serious financial disaster during his presidency term. He immediately took quick draconian actions to balance the US economic system to avoid a financial crisis in the financial and investment banks in the US. The concern was the looming default of mortgage-financed securities, which could have led to the losing public trust in the US banking institutions. Thus in 2008, Bush approved a bailout bill prepared by Henry Paulson, the then Treasury Secretary, and then processing was done by Congress for the 700 billion dollars Emergency Economic Stabilization Act (EESA). Bailouts typically refer to forms of public financial provision to assist during times of distress and prevent possible financial collapse; thus, the aim was to rebuild confidence in global banks’ operations and end the financial crisis. The Federal Reserve System is unique and performs five functions, as shown in figure 1 below.

Quantitative Easing (QE)

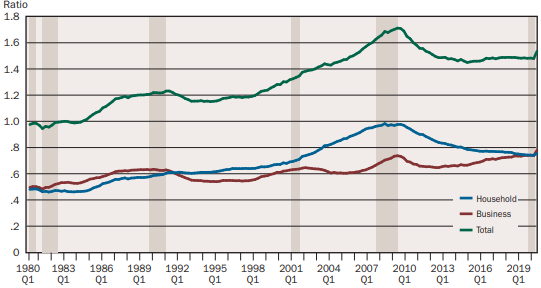

QE involves the purchase of large-scale assets by the central bank and typically for long-maturity state debts. Economist Stephen Williamson, a former vice president, states that the practice is rare and mainly done during emergencies such as 2008 to prevent major catastrophes like the 2008 bank crisis. According to the bank of St. Louis (2021), a total of 4.473 trillion dollars had been paid by 2017 for the 700 billion bailouts. QE is an excellent monitory strategy since it allows the central bank to buy securities to reduce interest rates and increase the money supply to increase lending to businesses and clients. More so, borrowing by the nonfinancial business sector and household impact financial stability. Graph 1 below is the Federal Reserve board statistical release of borrowing indicating a sharp increase during the 2008 financial crisis.

Actions the Federal Reserve took to Control the Crisis

To control the financial Crisis of 2008, the US government and Federal Reserve Bank (FRB) implemented the 700 billion dollars EESA. It established Troubled Asset Relief Program (TARP) with the key aim of using it as a reverse auction so that the US government could utilize the funds to buy troubled assets from the banking institution. The debt is then transferred from the Bank Books to US FRB to protect the banking system and the public’s confidence.

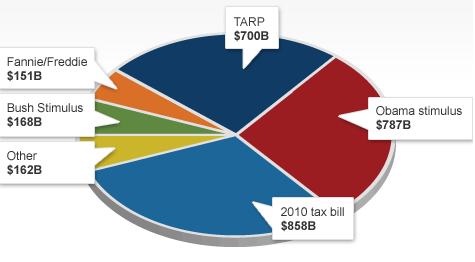

Later in 2010, during the presidency of President Barrack Obama, the program was expanded by the government because of the recession crisis to critical areas that needed bailouts through buying of toxic assets. The key areas included: 7 billion dollars, 20 billion dollars to FRB for Term Asset-Backed Securities Loan Facility, which the AIG bailout from 67.8 billion to 182 billion dollars, the big three auto companies, bailed out 80.provided monitory help to its members to carry on with providing credit to businesses and homeowners (Federal Reserve, 2021). Additionally, 75 billion dollars to assist homeowners in restructuring mortgages per the Homeowner Affordability and Stability plan. Chart 1 below shows the stimulus price tag by December 2010.

How the Corrective Measure Assisted in Restoring Equilibrium to the Financial Structure

The TARP program disbursed 440 billion dollars and recovered 442.6 billion dollars through company nationalization at the needed time that was right for reducing selling prices and then selling them after the crisis when the economy was in a stable state. The corrective plan helped put an end to the crisis. During Obama’s presidency, inflation went up, and other sectors were experiencing critical economic shocks. The launch of a 787 billion dollars economic incentive plan assisted and protected home mortgages because the previous bailout of the bank system was a success.

Government Intervention Program (Countercyclical fiscal policies)

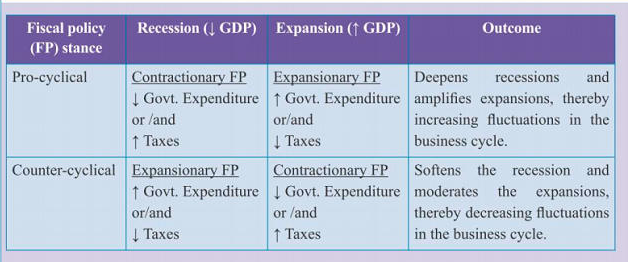

Countercyclical fiscal policies are steps the government takes that are contrary to the economic cycle. In a recession, the government should raise expenditure and lower taxes to form a demand to fuel an economic boom (Jacob, 2021). The opposite is true during the economic boom; the outcome is summarized in figure 3 below.

Government Interventions Verses Market-Based Solutions

In the US, there is division on the issue of government interventions and market-based solutions. Proponents of market-based solutions do not favor government interventions for several reasons. They argue that the government is swayed by pressure from political groups and thus unable to make appropriate decisions on the best project. Likewise, they view the interventions as an infringement on individuals’ freedoms since they cannot make spending decisions, which limits their freedom. On the other side, proponents of government interventions hold that government interventions assist in the setup of constructive microeconomic interventions to prevent looming economic disasters, facilitate long-term recessions, and decrease joblessness (Utami, & Hsu, 2019). Also, interventions enhance economic equality due to redistribution of health, which will, in turn, create equal opportunities.

Who Has Been Hurt or Helped by Government Intervention

Interventions bring about benefits to the public, whereas with market-based solutions, many ordinary people will suffer because public resources like roads, public schools, and hospitals will not be offered. From a capitalistic perception, providing public services is offering free services; thus, the goods will not be available to ordinary people.

Externalities and Unintended Consequences

Major positive services and externalities such as education and health services are critical for any society that wants to stay happy despite the services not being chiefly public goods. In a market-based solution, the services will be offered; however, the rich will have better health facilities and schools compared to the poor, thus resulting in inequality which slows the nation’s overall economic growth and the well-being of the society over the long ran.

Additionally, negative externalities in production and consumption are facilitated by market-based solutions. For instance, a firm that uses burning charcoal to minimize production pollutes the environment in which it operates, thus reducing the well-being of individuals living there. The situation can be prevented by using interventions that enact and enforce taxation on air pollution while offering subventions to motivate the adoption of eco-friendly forms of energy to increase the community’s social well-being.

Cost Trends

The government intervention chosen is a case of the Big Bailout Banking Crisis discussed earlier in the paper. President Bush and the treasury assured public confidence retention by approving into law a bailout bill sorted out by Congress for 700 billion dollars EESA in 2008 (Yellen, 2017). This impacted mitigating financial disaster brought by mortgage–financed securities via clearance of United States Banks Books, the total debts of pension money plus hedge money. According to Mr. Williamson, an economist at Louis FRB and a former US vice president, the bailout began with 700 billion dollars in 2008. By 2017, the government had to fund 4.473 billion dollars. Unfortunately, this trend shows an increase since its approval. It is worth noting that the US government also approved a total of 16.4 trillion dollars because of subsequent bailouts coming from the Big Bailout of the 2008 Banking system (Tarullo, 2019). Thus, the rate at which it is increasing is high such that the Federal Treasury has implemented interest payment funding to enable continuity of availability of funds for the US government to support other continuing US government interventions to ensure long-term growth and stability of the economy.

References

Bank of St. Louis, F. R. (2021). What is quantitative easing, and how has it been used? Saint Louis Fed Eagle. Web.

Blazsek, V. (2020). Banking Bailout Law: A Comparative Study of the United States, United Kingdom and the European Union. Routledge.

CNN. (2021). Stimulus Price Tag: $2.8 Trillion. CNN Money. Web.

Federal Reserve. (2021). The Fed Explained: What the Central Bank Does.

Federal Reserve. (2021). The Federal Reserve’s Policy Actions during the Financial Crisis and Lessons for the Future

Rabhi, A., Bennagem Touati, A., & Haoudi, A. (2020). The nexus between government intervention and economic uncertainty during the COVID-19 Pandemic. Amina, the Nexus between Government Intervention and Economic Uncertainty during the COVID-19 Pandemic, 12 (1), 07. Web.

Tarullo, D. K. (2019). Financial regulation: Still unsettled a decade after the crisis. Journal of Economic Perspectives, 33(1), 61-80. Web.

Utami, F., & Hsu, A. C. (2019). The analysis of government intervention and stock market during crises periods. International Journal of Applied Business Research, 44-57. Web.

Yellen, C., J. (2017) Financial Stability a Decade after the Onset of the Crisis. Web.