Introduction

Industry profile

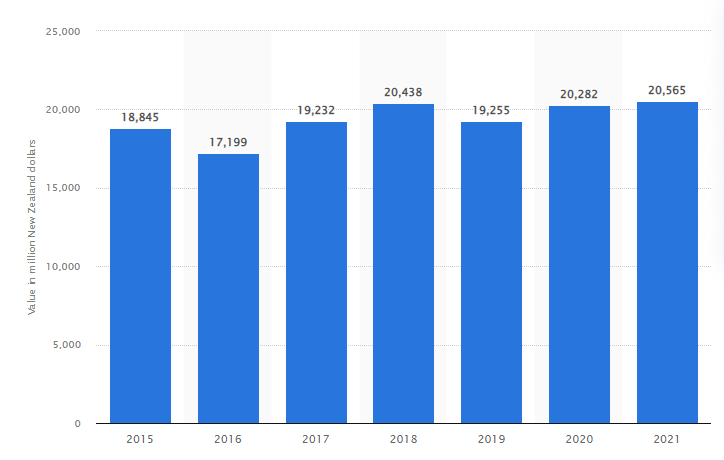

The full name of the company is Fonterra Co-operative Group Limited. This is a New Zealand multinational corporation that is engaged in the production and distribution of dairy products. The company is owned by New Zealand-based dairy farmers, which supply the necessary products and resources. Research stated that “the dairy sector currently contributes over 10 billion New Zealand dollars to the country’s economy and is one of the most dominant goods export sectors for the country” (Granwal, 2022). This is due to the fact that this area is trendy among the population due to the wide variety of products offered and the frequency of their consumption. Data analysis shows that the export revenue of the dairy industry constituents 19.09 billion New Zealand dollars (Granwal, 2022). Fonterra occupies one of the leading positions in the dairy market in the country. The consolidation of this provision was facilitated by long and thorough research and development. Moreover, the well-built trade relationships with other companies and suppliers, which helped the corporation to enter the global dairy marketplace, are of particular value.

Fonterra Co-operative Group Limited annually produces a large number of dairy products, which are then transported and distributed to other countries. Research underlined that “industry leaders projected that Fonterra’s revenue was to grow at 15% by 2010 as the company diversified into high-value consumer products” (Barry & Pattullo, 2020, p. 3). Its main activity is the collection, manufacturing, and distribution of milk-derived goods. The main office of the company, which makes the major decisions about its strategy and activities, is located in Auckland. At the moment, 20,000 full-time equivalent staff are employed in the production and management of the organization (“Fonterra Co-operative Group Limited – Australian company profile,” n.d., para 2). Among the leading brands that are produced under Fonterra are Anchor, De Winkel, Fresh’ n Fruity, Kapiti, Mainland, Mammoth, Perfect Italiano, Piako, Primo, Symbio.

Porter’s Five Forces

Further, in order to gain the most in-depth understanding of the company’s work, competitiveness and efficiency, it is necessary to conduct Porter’s five force analysis. Moreover, this measure can help in gaining an understanding of which areas of the company’s activities are the strongest and which may require changes.

Threats of New Entrants

The first aspect that needs to be considered is the threat of new competitors appearing on the market. The level of this market possibility depends on how profitable it is and how many requirements it has to enter. Thus, the analysis showed that this aspect poses a low risk for Fonterra since development in the dairy industry requires sufficiently high financial costs and capital. Moreover, this area requires significant resource investment. In addition, a large variety of products can become a problem for the entry of new competitors, which makes it necessary to find unique initiatives.

The Threat of Substitute Products

The next threat is the emergence of new replacement products in the dairy market. This aspect also represents a low level of danger since, in this area, the creation of different products requires quite significant financial investments and extensive research. Moreover, in order to switch the attention of buyers, it is necessary to develop the same or more superior quality goods than are represented by the Fonterra assortment.

Rivalry

Due to the fact that the market for products developed from dairy or milk-derived products is quite broad, the threat of rivalry has relatively high indicators for the company. Hence, only in the New Zealand market Fonterra faces equally strong competitors. Moreover, the company has a constant need to develop effective strategies and approaches to retain customer engagement and targeting and pricing strategies.

Bargaining Power of Suppliers

The bargaining power of suppliers is one of the critical indicators of an organization’s analysis. For Fonterra, this aspect reflects the pressure exerted by suppliers, which arises as a result of the adoption of different tactics. Therefore, Fonterra is in low dependence on suppliers since there are quite a large number of farmers and enterprises in this market that are engaged in the supply of resources. However, it is worth noting that suppliers can influence the productivity of the company by changing their work policies or increasing the price of the resources provided.

Bargaining Power of Buyers

The competitiveness and efficiency of Fonterra are highly dependent on the bargaining power of buyers. This is due to the fact that the market for dairy products is quite wide; thus, there are a large number of producers on the market that can attract the attention of customers. Thus, with a decrease in customer loyalty and engagement, the company is doomed to decrease productivity and will not be able to fulfill its business objectives. A serious threat is also the fact that the manufacturer operates on the global market, which increases the number of competitors who can provide more unique and exciting products.

Driving Forces

Identifying the driving forces of a company is valuable, as it helps to form a strategy for further development. Thus, an excellent opportunity for Fonterra is to expand to the market of other countries to which the company has not yet supplied its products. One of these could be South Korea, which has significant potential for the company. Furthermore, this country is characterized by significant technological development and logistical aspects of its activities. In addition, when establishing the organization activities in South Korea, it has the opportunity to acquire a large number of new consumers, which increases profitability. Moreover, the corporation has the opportunity to open production in the country, which will optimize its activities through innovative technologies, which will also improve the quality of Fonterra products. Another positive side of entering this market is that a favorable environment has been formed in South Korea for foreign direct investment, and the state provides good incentives for investors.

Key Factors

The key factors combine the main aspects that determine the company’s activities in order to achieve the most favorable and successful results. One of them is the adherence to and preservation of reputation and brand awareness. They become critical for the company as they ensure the loyalty of buyers, suppliers, and investors. Reputation is also valuable for maintaining the competitive position of the company, as its deterioration will contribute to a decrease in sales and reduce the importance of the corporation in the global market. Awareness of the main goals and mission of the company allows the developing of realistic plans and strategies for activities that will contribute to limiting adverse outcomes of activities.

Another important key factor is the credibility of the producer of dairy products. This aspect concerns the formation of trusting and loyal relationships with all involved stakeholders in the company’s work process. Hence, this helps to gain an understanding that the organization is a reliable partner for investors and suppliers who will want to work with it to ensure the prosperity of both sides and their further development. In close connection with this aspect lies security, which will help in spreading awareness that involvement and investment in the manufacturer is the right decision.

The factor of high product quality is also of particular importance in the dairy market. This implies the use of the best technologies and resources that will ensure the quality of goods. Moreover, this factor implies ensuring the availability of dairy products and maintaining the loyalty of the most significant number of consumers. Other vital factors are responsiveness and collaboration. The first indicator will determine how open and transparent the company is in its activities and how it responds to the needs and desires of consumers. Interaction with other organizations and manufacturers will provide an opportunity to increase the efficiency of activities and increase the consumer base.

Competition Profile

To determine the direction in which Fonterra’s strategy should be built, it is necessary to study the profile of competitors. Hence, one of the opponents of the company in the New Zealand market is the organization Open Country Dairy. It is the second largest dairy manufacturer, processing ten per cent of the country’s milk and supplying 300,000 tons of dairy products (Barry & Pattullo, 2020). The manufacturer supplies its products to more than fifty countries and has more than a thousand farmers’ suppliers. Therefore, by creating products similar to Fonterra, this company is the second corporation in New Zealand after the corporation under study.

The second dairy producer that poses a threat to Fonterra on the global market is Danone. Its activities include four product segments Essential Dairy and Plant-Based Products, Early Life Nutrition, Medical Nutrition, and Waters (“Fonterra competitors and similar companies,” n.d.). Research stated that “it distributes its products through retail chains, traditional market outlets and specialized distribution channels, including hospitals, clinics, and pharmacies”. The company’s annual profit is 28.7 million US dollars. In addition to dairy products, the organization produces beverages, biscuits, and water.

External Analysis

Strategic Profile

VRIO Analysis

The VRIO analysis is conducted in order to determine the competitive advantage that is characteristic of Fonterra. The definition of these indicators helps the company to gain an understanding of its advantages in comparison with its opponents in the market. Thus, the first aspect becomes the value of the organization and the resources it has. Hence, this aspect includes financing, personnel, management of operations, and experts in marketing. The following indicator implies the rareness of resources available to the organization. Therefore, the uniqueness and high cost of this indicator give the company the opportunity to stand out among other participants in the dairy market.

Imitation for Fonterra is the degree of the possibility of duplicates of the corporation’s products. Henceforth, this process can be costly for smaller competitors of the organization, which is an advantage for Fonterra. The last aspect of VRIO analysis is the organization. It is reflected in the compatibility to position in the market due to the most organic and correct use of available resources, which are challenging to repeat. The overall results of the VRIO analysis are provided in Table 1.

Value Chain

According to the value chain activities for the company, Fonterra should pay attention to several critical primary activities that will contribute to improving productivity and productivity.

The first of them is the improvement of inbound logistics, which implies the formation of total and robust relationships with suppliers. This implies their support in the transportation, receipt, and storage of products and necessary resources. This aspect is necessary to create an effective product development procedure, which concerns the transformation from raw material to finished product. The same applies to the company’s operations, which are a full-fledged process from obtaining resources to forming a full-fledged product. Fonterra can gain a significant competitive advantage and increase profitability from this indicator.

Special attention is also required by such a value as outbound logistics. Unlike inbound logistics, it implies tracking procedures regarding the receipt of the final product by customers. This includes storage in a warehouse, ordering and receiving goods by distributors, scheduling, and transportation. The analysis of outbound logistics will allow you to optimize the listed activities for a faster and better transition of products from production to customers. Moreover, it can provide such a competitive advantage as optimal costs and increase the satisfaction and loyalty of individuals.

Marketing and sales are the following primary activities for consideration by Fonterra. The correct functioning of these indicators determines the emphasis on benefits and unique characteristics of goods that distinguish them from competitors’ products. This can be achieved by establishing the right sales strategy and advertising. In addition, channel selection and relations with channel members contribute to the positive dynamics of marketing and sales of the organization. The last but no less important primary activity is paying attention to services. To maintain customer loyalty, Fonterra needs to conduct thorough research and improvement of pre-sale and post-sale services. This is necessary to preserve the company’s image in the global dairy market.

Financial Analysis

Table 2 shows the leading financial indicators for Fonterra for the last two reporting years as of the end of July of each year. One of the main conclusions is an increase in the company’s revenue in 2021 compared to 2020, which may be due, among other things, to an increase in sales, expressed in the growth of COGS by 2.0%. It is reported that one of the reasons for the company’s revenue growth is the increase in total demand for dairy products in 2021 (Lyubomirova, 2022). Meanwhile, it is noticeable that Gross Profit has fallen, which means that the company received less money after deducting all expenses in 2021. The probable reason for the decrease in Gross Profit is the rise in the cost of dairy production, high inflation rates, or the rise in the price of the company’s logistics routes.

However, in 2021, the company reduced its total operating expenses by 2.2%, but nevertheless, this did not allow net income to grow. One of the reasons for the decline in operating income can be called the conclusion of a five-year outsourcing agreement with HCL, which reduced labor costs (O’Neill, 2021). As a result, even despite the revenue growth, the company experienced a 15.7% drop in net income, which may indicate both an unfavorable financial period for the company and increased costs associated with expansion and modernization.

Referring to critical financial ratios gives an idea of Fonterra’s investment attractiveness and financial well-being. In particular, the Current Ratio determines the company’s ability to repay short-term obligations to creditors: the company experienced a drop in the Current Ratio in 2021. The decrease in this ability is justified, among other things, by an increase in the share of debt in the company’s capital since the company’s Total Liabilities/Total Assets rose by 2.2 percentage points. This means that even more of the company’s assets have been financed by debt, which may also indicate a decrease in the company’s solvency in 2021. It is noteworthy that the company’s ROA increased slightly in one year, which indicates the company’s ability to use its assets more efficiently to make a profit. In particular, a higher ROE indicates that the company is actively transforming its equity financing into profit.

Based on the financial analysis, it can be concluded that Fonterra experienced a slight drop in net profit in 2021 and also turned out to be less solvent for creditors. This could indicate a more burdened financial condition of the company, but the ROE and ROA metrics describe the opposite. In other words, it is likely that the reason for the fall in net profit could be the likely significant investments in expansion and innovation, including investments of $2.7 billion in internal environmental safety programs (Awasthi, 2021). All this indicates a favorable outlook for further economic growth of the company.

Strategy Overview

Phase One

First of all, Fonterra needs to pay close attention to building and to strengthen consumer brands. This is a substantial capital intensive, which represents a significant portion of the annual spending. It is necessary for growth and positive brand presence. However, for a company, this can become quite a challenging aspect to perform; however, with the right approach, it can ensure successful development for the organization. To do this, it is necessary to attract the attention of suppliers so that they can contribute more capital themselves to fund the development of the corporation. This can be done by spreading knowledge about the need to contribute to the business and providing clear information about the company’s profits, expenses, and further goals.

Phase Two

The second phase involves connecting to the activities of digital technologies, which contribute to an even more significant improvement of the outcomes of the company’s activities. Research stated that “this is because there are existing resources and capabilities that provided a platform for differentiation” (Lees & Lees, 2018, p. 506). This provides a large number of opportunities to explore the industry, competitors, and suppliers. Moreover, innovative technologies allow us to study the customer base in detail, as this aspect is of particular value to the organization. Hiring technology specialists may require some Fonterra costs, but it can provide a significant competitive advantage.

Phase Three

Therefore, the involvement of engaged and loyal suppliers and innovative technologies in the company’s activities provides a significant advantage in the development of the organization’s strategy. Taking into account the data obtained during the analysis of the organization will also contribute to a more correct and complete representation of what the company wants to see in its future. Thus, industry attractiveness, strategic decisions, and the influence of these external and internal forces can be determined.

Financial Implication

Conclusion

In conclusion, this report examined the activities of Fonterra Co-operative Group Limited. This company is a leading producer of dairy products in the New Zealand market and is a global distributor of goods. In order to gain the best understanding of what the organization is, a study of the dairy industry in the country was conducted, and the main competitors, including Open Dairy Company and Danone, were studied. The next step was to conduct an internal analysis, which included Porter’s five force analysis, driving forces, and critical factors. Moreover, the external aspects of the strategic portfolio were examined, which were studied using VRIO analysis, value chain, and financial analysis. The data obtained helped to determine in which direction the company should work and what competitive advantages it has and what areas it should focus on to increase profits and productivity. Further, some recommendations have been proposed that can help Fonterra Co-operative Group Limited achieve the set goals and objectives.

References

Awasthi, S. (2021). Dairy exporter Fonterra to invest $2.7 bln to grow, cut emissions. Reuters. Web.

Barry, P. & Pattullo, H. (2020). The dairy sector in New Zealand. New Zealand Productivity Commission. Web.

Fonterra competitors and similar companies. (n.d.). Craft. Web.

Fonterra Co-operative Group Limited – Australian company profile. (2022). IBIS World. Web.

Granwal, L. (2022). Dairy industry in New Zealand – statistics & facts. Statista. Web.

Lees, N., & Lees, I. (2018). Competitive advantage through responsible innovation in the New Zealand sheep dairy industry. International Food and Agribusiness Management Review, 21(4), 505-524. Web.

Lyubomirova, T. (2022). Strong demand for dairy drives Fonterra profits up. Dairy Reporter. Web.

O’Neill, R. (2021). Five-year Fonterra gig helps HCL New Zealand soar in 2021. Reseller News. Web.