Introduction

I submit this report to record, examine, and explain the macroeconomic policy choices I made in my capacity as Econland’s main economic policy advisor for the benefit of the incoming administration. By improving our knowledge of the connection between macroeconomic policies and the effects they have on our citizens, this paper aims to increase the prosperity of our country. The report provides a comprehensive accounting of the key monetary and fiscal policy decisions made during each of my seven years in office, along with an explanation of the underlying assumptions that led to those decisions and the effects that those policies had.

Table 1.1: Economic Environment, Decisions, and Results

The macroeconomic environment of Econland throughout my time is summed up in the table above. I chose the scenario of a developing economy, with a focus on economic growth, job creation, and poverty reduction. This means encouraging entrepreneurship, investing in infrastructure, and providing incentives for businesses to invest in areas that will create jobs and economic growth. Over the seven years, my performance has been positive, as supported by the improvement of many aspects across the period, including real GDP growth and budget surplus (Table 1:1). These are essential markers of favorable economic development.

Fiscal Policy: Taxation

Table 2.1: Real GDP and its Components

The intent of the taxation policy decisions I made during my seven-year term was to promote economic growth and increase the welfare of the citizens of Econland. My decisions were based on the principles of macroeconomics, which emphasize the importance of fiscal policy in influencing economic outcomes. In particular, I focused on the impact of taxation on aggregate demand, the level of economic activity, and the distribution of income. I also sought to promote economic efficiency by reducing tax evasion and encouraging investment. My decisions were further informed by the use of macroeconomic models, such as the IS-LM model, which provides insight into the relationship between fiscal and monetary policy. In addition, I drew on the principles of public finance, which emphasize the need to strike a balance between revenue and expenditure to promote economic growth and stability.

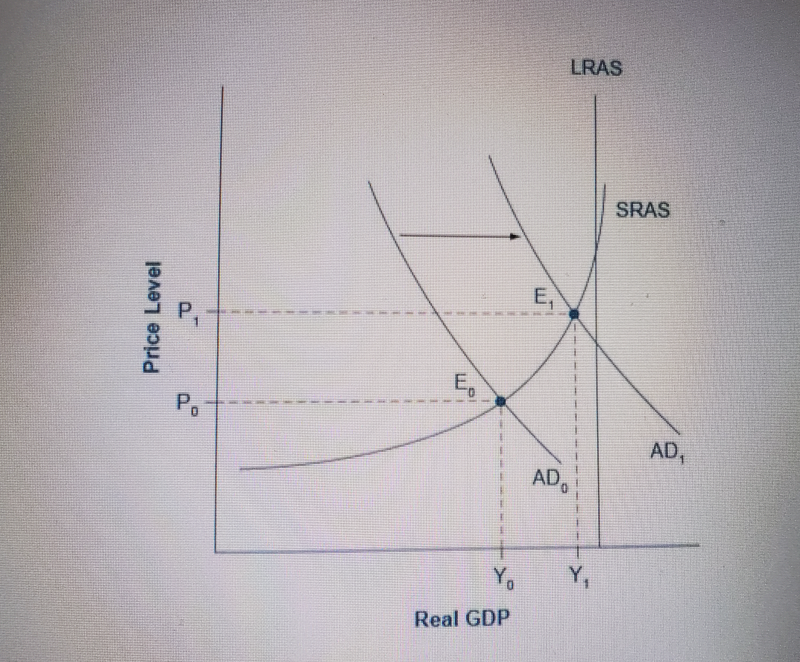

My changes to the income and corporate tax rates had a positive impact on consumption and investment. Lowering the income and corporate tax rates increased individuals’ and businesses’ disposable income, leading to an increase in consumption spending. This increase in consumption spending stimulated aggregate demand, which led to an increase in the Real GDP. Additionally, lower taxes gave businesses more money to invest in capital and labor, increasing investment spending. This increase in investment spending further stimulated aggregate demand and contributed to the increase in Real GDP as depicted by the aggregate demand-aggregate supply model. For instance, in table 1.1, both income and corporate taxes were steadily reduced from year 3. This is reflected in the real GDP, which highly kept rising from the same year to the final year (Table 2.1). Thus, lowering taxes impacts demand and supply, increasing Real GDP in the long run.

The tax policies implemented entailed lowering the income and corporate tax rates. The impact of my tax policy decisions was similar to those of the Reagan Tax Cuts of the 1980s. The Reagan Tax Cuts lowered the marginal tax rate for individuals and corporations, leading to an increase in disposable income and investment spending, which in turn stimulated aggregate demand and economic growth. The Reagan Tax Cuts were successful in increasing economic growth and reducing unemployment (Johnson, 2021). This result is consistent with the predictions of the IS-LM model, which suggests that a decrease in taxes leads to an increase in aggregate demand, increasing economic growth. The example of the Reagan Tax Cuts also demonstrates the validity of macroeconomic models. The IS-LM model accurately predicted the positive impact of the Reagan Tax Cuts on economic growth and unemployment (Johnson, 2021). This example demonstrates the importance of macroeconomic models in understanding the implications of fiscal and monetary policy decisions on the macroeconomy. Furthermore, the example of the Reagan Tax Cuts supports the idea that fiscal policy decisions can have a positive effect on economic growth and job creation.

Fiscal Policy: Government Expenditure

Government expenditure remained constant for the entire period. The fiscal policy decisions intended to maintain a consistent level of government spending to provide stability and predictability for the economy. This allowed businesses and households to plan and make investments with confidence. Moreover, the stable level of government spending provided a steady source of funds for essential public services and infrastructure projects. It would also reflect on the proper use of funds to realize steady positive outcomes in economic growth. By maintaining a consistent level of government spending, it was possible to build an environment of economic prosperity and stability for Econland.

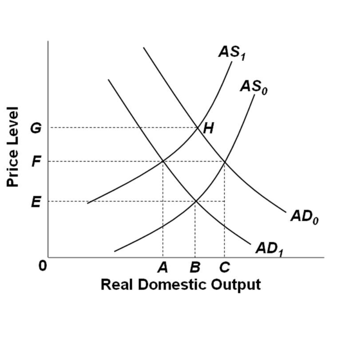

The fiscal policy decisions had a positive impact on key macroeconomic factors such as real GDP growth and unemployment. Unchanging government expenditure in times of economic growth helped to keep inflation in check and encourage growth in private-sector investment. Furthermore, it stimulated aggregate demand and increased real GDP growth. Additionally, maximizing spending on infrastructure and social welfare programs helped to reduce unemployment as shown in figure 3.1b above. However, table 1.1 reflected an increase in inflation rates, although it was still considered low (figure 3.1b). Furthermore, the fiscal policy aimed to keep the prices of products low. The AD/AS model is used to analyze the effects of economic shocks on the economy, such as changes in the money supply, changes in taxes, and changes in government spending. The model is also utilized to assess the effect of fiscal and monetary policies on the economy.

A constant level of government expenditure affected the aggregate demand and aggregate supply in a few ways. First, it shifted the aggregate demand curve to the right, as more money would be injected into the economy for consumers to spend (figure 3.1a). This shift would increase the overall level of output and employment in the economy. Second, the constant level of government expenditure would also increase the price level, as aggregate demand would outstrip aggregate supply (Mankiw, 2021). This could potentially lead to inflationary pressures in the economy. Finally, a constant level of government expenditure may lead to an increase in the money supply, as the government would need to borrow money to finance the expenditure (figure 3.2). This could further lead to an increase in the price level and an increase in inflationary pressures, which explains the rising rates of inflation (table 1.1).

Monetary Policies

I changed the interest rate levels to control inflation and stimulate economic growth. By lowering interest rates, I encouraged businesses and households to borrow money and invest, increasing consumption and investment spending. This increase in spending stimulated aggregate demand, leading to an increase in Real GDP. In addition, lower interest rates made it more attractive to borrow from abroad, leading to an increase in exports and a decrease in imports. This increased the balance of trade and further increase Real GDP. For instance, the inflation rate graph (figure 4.1) was generally, low, which was an outcome of the reduced interest rates. Moreover, the real GDP never reduced in the period, an indication that the employed strategies had positive implications.

The monetary policy decisions are similar to those of the Federal Reserve in the United States during the Great Recession of 2008-2009. During this period, the Federal Reserve lowered interest rates to stimulate economic activity and counteract the effects of the recession (Reisenbichler, 2019). This policy was similar to my policy of lowering interest rates to stimulate consumption and investment. Another example of a successful macroeconomic policy decision is the Reagan tax cuts of the 1980s. These tax cuts lowered income tax rates and encouraged individuals to work, save, and invest (Hope & Limberg, 2022). This had a positive effect on aggregate demand and Real GDP, leading to an economic expansion. This example illustrates the validity of the supply-side economics model, which accurately predicted the effects of lower tax rates on economic activity.

Global Context

The impacts of openness to trade are wide-ranging and can affect both domestic and international economies. Openness to trade can create new opportunities for businesses to access wider markets, and this increases competition, which can lead to increased efficiency and productivity (Ibrahim & Ajide, 2021). This can be beneficial for the overall economy, as increased competition can lead to improved products and services. Additionally, openness to trade can reduce costs for businesses, as access to a wider range of suppliers can lead to better prices for inputs. Openness to trade can also increase consumer welfare, as it increases the range and availability of products. This increases consumer choice, which can lead to lower prices and improved quality, as well as increased consumer satisfaction (Ibrahim & Ajide, 2021). This can lead to broader economic growth, as increased consumer spending can lead to increased demand for goods and services.

The impacts of monetary and fiscal policies in an open economy are different than those in a closed economy. In an open economy, changes in monetary and fiscal policy will have an impact both domestically and internationally (Auclert et al., 2021). For example, a decrease in interest rates in an open economy would lead to an increase in demand for imports, as the cost of imports will decrease relative to local goods and services. Additionally, fiscal policy changes such as tax cuts or spending increases will have an impact beyond the domestic economy, as they are likely to affect the exchange rate, which can impact international trade. In contrast, in a closed economy, the effects of monetary and fiscal policies are likely to be more localized. For example, a decrease in interest rates in a closed economy may lead to an increase in domestic demand, as the cost of borrowing is reduced (Auclert et al., 2021). However, the effects are likely to be more localized and not have a significant impact on international trade. Similarly, fiscal policy changes may have an impact on domestic demand but are unlikely to have a significant impact on international trade.

Conclusions

Overall, my economic policy decisions had the desired results. The lowering of income and corporate taxes led to an increase in consumption and investment spending, stimulating aggregate demand, and leading to an increase in Real GDP. The consistent level of government expenditure provided stability and predictability for the economy, allowing businesses and households to plan and invest with confidence. Furthermore, the use of macroeconomic models, such as the IS-LM model, accurately predicted the positive impact of the Reagan Tax Cuts on economic growth and unemployment, demonstrating their effectiveness in understanding the implications of fiscal and monetary policy decisions. The example of the Reagan Tax Cuts also serves as evidence that fiscal policy decisions can have a positive effect on economic growth and job creation.

When making macroeconomic decisions, it is important to take into account consumer confidence as it can have a significant effect on the results. If consumer confidence is high, consumption and investment will go up, increasing Real GDP. Conversely, if consumer confidence is low, consumption and investment will go down, thus decreasing Real GDP. As an example, in Econland my decision to reduce income and corporate tax rates were successful in boosting consumer confidence, which in turn led to an increase in consumption and investment spending, leading to an increase in Real GDP.

References

Auclert, A., Rognlie, M., Souchier, M., & Straub, L. (2021). Exchange rates and monetary policy with heterogeneous agents: Sizing up the real income channel. Web.

Hope, D., & Limberg, J. (2022). The economic consequences of major tax cuts for the rich. Socio-Economic Review, 20(2), 539–559. Web.

Ibrahim, R. L., & Ajide, K. B. (2021). The dynamic heterogeneous impacts of nonrenewable energy, trade openness, total natural resource rents, financial development, and regulatory quality on Environmental Quality: Evidence from BRICS economies. Resources Policy, 74, 102251. Web.

Johnson, C. (2021). Supply-side economics, the 2017 Tax Act, and beyond. Modern Perspectives in Economics, Business, and Management Vol. 7, 107–120. Web.

Mankiw, N. G. (2021). Principles of economics (9th ed.). Cengage Learning.

Reisenbichler, A. (2019). The politics of quantitative easing and housing stimulus by the Federal Reserve and European Central Bank, 2008‒2018. West European Politics, 43(2), 464–484. Web.