Introduction

Macroeconomics is a discipline of economics concerned with the economy’s overall behavior and performance. Microeconomics, on the other hand, is concerned with an individual’s, a group’s, or a corporation’s influence. In the light of Thakur (2022), macroeconomics is the branch of economics that investigates large-scale economic phenomena such as inflation, gross domestic product (GDP), and unemployment variations. The goal of macroeconomics is to explain how these elements relate to one another and how much each aspect affects the economy as a whole. John Maynard Keynes (pronounced “Canes”) and his 1936 book, The General Theory of Employment, Interest, and Money are credited with establishing macroeconomics in its contemporary form. This paper examines the impact of gross domestic product growth, inflation, and unemployment on the US economy as a whole.

Gross Domestic Product (GDP)

The Gross Domestic Product (GDP) of a country according to Tamplin (2022) refers to the total monetary or market worth of all products and services produced within its boundaries during a given time period. As an indicator of the economy’s overall health, gross domestic product is one of the numerous factors that a country must regularly monitor in its operations. It serves as one of the pillars of decision-making in areas such as corporate expansion, workforce hiring, and a variety of other critical business decisions. The gross domestic product is normally estimated on a yearly basis, although it can also be calculated quarterly. For example, the United States of America government publishes gross domestic product estimates for each quarter as well as the entire year. The gross domestic product is generally considered a broad indicator of a country’s production because it presents such a comprehensive picture.

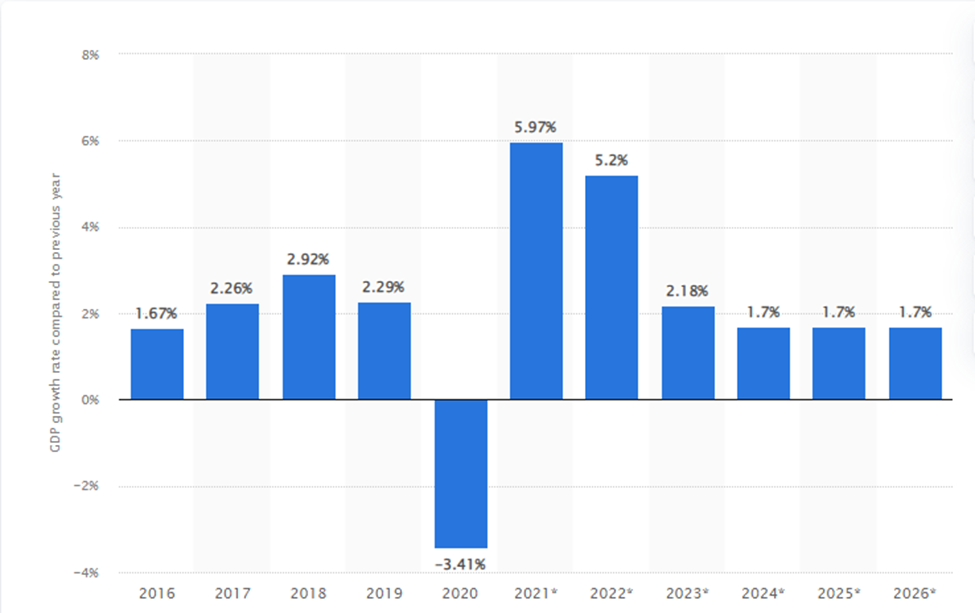

A look at the US real gross domestic product numbers reveals a general increase in growth, with infrequent declines; the most recent decrease was in Q1 2011. Overall, the US economy may be described as “well-set,” with both exports and imports exhibiting positive outcomes. Apart from that, the United States continues to be one of the world’s largest exporters, trailed only by China and Germany. It is also the first of the world’s major importers. Despite this, subsequent polls on Americans’ perceptions of the US economy have revealed fewer positive findings. Surprisingly, there has been widespread agreement across the social and environmental spectrum. Gross domestic product is frequently employed as a measure of a country’s level of life, and most Americans appear to be content with theirs. From 2016 until 2026, the real gross domestic product (GDP) growth rate in the United States is shown in the table below (compared to the previous year).

The graph depicts the real gross domestic product (GDP) growth rate in the United States from 2016 to 2020, with predictions through 2026.

Inflation

Inflation is defined as an increase in the price of goods and services in the economy. A more precise definition of inflation is a steady rise in an economy’s overall price level. The annual percentage change in the general price level is measured by the rate of inflation. Inflation happens when prices rise, reducing the dollar’s purchasing power. A movie ticket, for example, cost $2.89 on average in 1980. The average cost of a movie ticket had climbed to $9.16 by 2019. If you saved a $10 bill from 1980, you’d be able to buy two fewer cinema tickets in 2019 than you could nearly four decades ago.

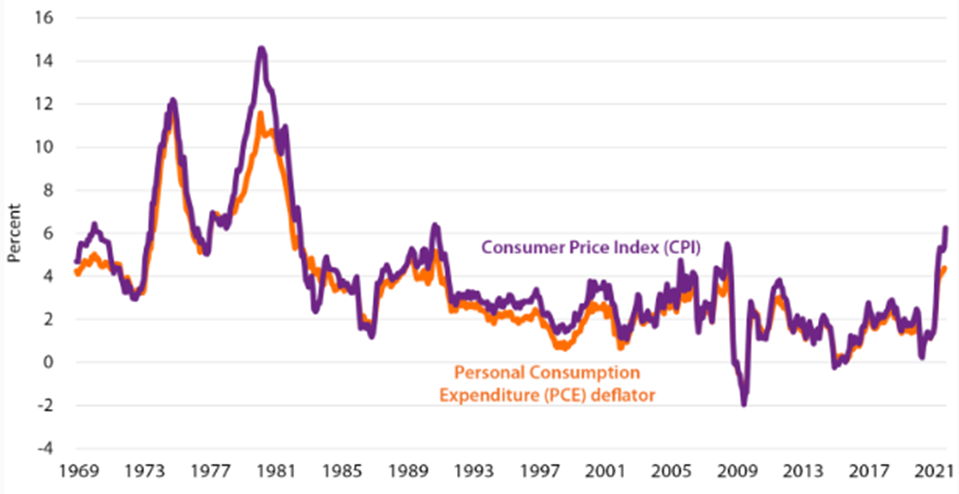

Inflation, as measured by the consumer price index (CPI) and the personal consumption expenditure (PCE) deflator from 1969 to 2021, is depicted in the graph above. Some commentators have attempted to draw comparisons between the current inflation event and the 1970s. However, this is erroneous. According to O’Neill (2021), even though inflation has risen in recent years, it is still well below the levels witnessed in the 1970s and from October 2020 to October 2021, the annual rate of inflation, as measured by the consumer price index was 6.2 percent. From September 2020 to September 2021, the annual rate of inflation, as measured by the personal consumption expenditure deflator, was 4.4 percent (O’Neill, 2021). Some of the price rises reflect a rebound from the pandemic’s abnormally low-price levels in the early stages. In the light of Edelberg (2021), if the consumer price index had climbed at a rate near to the Federal Reserve’s target from the beginning of the epidemic through October 2020, the consumer price index annual inflation rate would have been 5.1 percent over the previous year. That rate is still high, but it is one percentage point lower than the annual average.

Unemployment

The state of being without any work for people who are employable and actively seeking a job in a bid to facilitate earning one’s livelihood is referred to as unemployment. There are various types of unemployment:

- Demand deficit unemployment: This is the most rampant type of unemployment that mostly occurs as a result of the recession. In the events that companies grapple with maintaining demand for their goods, in response, they are forced to tone down on production thus reducing their labor force.

- Frictional unemployment: This mainly occurs where employees leaves their current job positions in favor of hunting for new ones. There is always no guarantee for the next job hence there is a period when they will be unemployed. This type always has no specific time limit on its lasting period,

- Structural unemployment: It occurs when skilled workers experience unemployment as a result of changes in the economy and labor force. Primarily, it occurs as a result of technological changes which organizations always try to implement in their firms.

- Voluntary unemployment: The unemployed decline job proposals because wages are lower. As the name suggests, workers always take the step of resigning or leaving their work places due to various reasons.

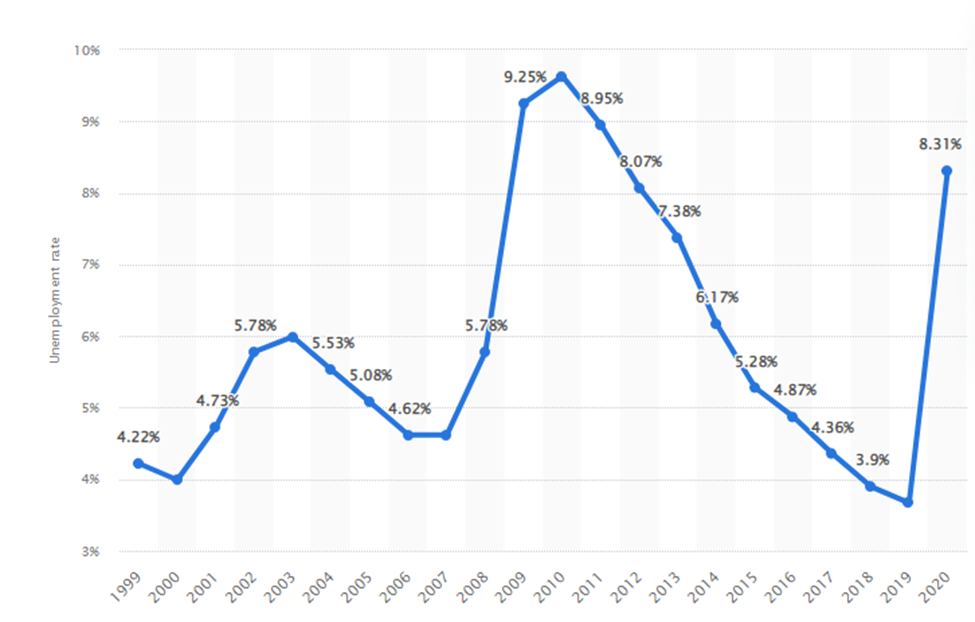

Similarly, when factors of production that are willing and capable of producing products and services are not actively engaged in production, unemployment occurs. Unemployment indicates that the economy is falling short of its macroeconomic aim of full employment. Unemployment is a problem since there is less output created, resulting in a scarcity problem in the economy. The unemployment rate is depicted in the graph below from 1999 to 2020. In 2020, the unemployment rate in the United States was estimated to be about 8.31 percent as shown in the Statista graph below.

The most dramatic increases in unemployment in the US happened during 2008 and 2009, peaking in 2010. The United States was one of the countries hardest hit by the global financial crisis, owing to the fact that the crash began in the country. The crisis had a huge impact on American households, most notably on the labor market, which was accompanied by the significant stock market and housing market declines. The US government was inclined to absorb the debt in order to stabilize and maintain a strong economy. The country’s national debt had been rising year after year, but it peaked in 2009 and has nearly doubled in the six years following the catastrophe. As a result, the unemployment rate reveals how many people from the labor force’s available pool are unable to find work. The lower the unemployment rate, the better the economy, and vice versa.

Conclusion

Macroeconomics tries to explain the link between these components as well as the amount of each factor’s impact on the overall economy. Opposing macroeconomic views have developed, as they do with most complex things. Those who advocate “loose” monetary policy, such as low-interest rates, are referred to as “doves,” whereas those who favor “tight” monetary policy are referred to as “hawks.” Lowering the federal interest rate makes borrowing money less expensive, which may encourage people to invest more. While this may help to promote the economy, it also has the potential to have negative implications, such as rising inflation rates. While both sides want stronger economic growth while keeping inflation under control, hawks and doves disagree on the best approach to achieve these objectives. Monetary and fiscal policies are both influenced by people’s ideas about the link between macroeconomic issues. The term “monetary policy” refers to adjusting the interest rate and influencing the overall money supply. Fiscal refers to “government revenue”; hence, fiscal policies are concerned with the government, such as tax rates and spending.

References

Edelberg, W. (2021). What does current inflation tell us about the future?, Brookings. Web.

O’Neill, A. (2021). Gross domestic product (GDP) growth rate in the United States 2026. Statista. Web.

Tamplin.T, BSc, CEPF®, (2022). Gross Domestic Product Definition. Finance Strategists. Web.

Thakur, M. (2022). Macroeconomics Problems. EDUCBA. Web.