Introduction

The Unite Arabs Emirates (UAE) is a federation of seven emirates situated in the Middle East, in the Arabian Gulf. The federation was formed in 1971 and implemented its permanent Laws in 1996. In early 18th century, the British signed a peace treaty with the coastal rulers of the region who agreed to entrust its relations with Britain; however, the British did not assume the sovereignty. Initially, the area was referred to as the Pirate Coast but later became the Trucial Coast.

The federation is divided into seven emirates administratively. Abu Dhabi, Dubai, and Sharja are the largest. Dubai contributes 32.3% of the country’s total GDP. It forms the region’s centre for trade due to its location as a leading transshipment and re-export centre. The other emirates depend on trade and light manufacturing. They depend on the federal government and the two largest emirates for financial support. The federation is largely a desert with some agricultural areas. UAE is hot and humid with low annual rainfall. The population of UAE is approximately 9.2 million. Approximately 20% of the population comprise of native citizens (National Bureau of Statistics, 2009).

The major religion of the federation is Muslim (over 96%) others religions include Hindu and Christian. The official language is Arabic, although English, Hindu, Urdu, and Bengali are common languages. The literacy level is 90% for the Emirati citizens. The life expectancy is 78.3 years. The federation is the seventh largest reserve of crude oil and natural gas deposits. UAE incorporates 10% of the global petroleum reserves and a large proportion of the global natural gas.

The other economic activities that UAE is involved in include livestock keeping, date production, and fishing (IFC, The World bank. 2012). Oil discovery in the federation many decades ago changed the conditions of living in the UAE from impoverished living conditions in into a modern nation where the living standards of people are improved. The economy of the region relies on oil and natural gas deposits. However, the diversified economy also depends on international banking, tourism, and other financial services (Yale University, 2012).

The state joined the Gulf Cooperation Council in 1981. During this period; the stability of the federation was threatened due to the fall of shah of Iran, the emergence of Islamic fundamentalism, and the war between Iran and Iraq. The country ranks in the 36th position, in the world economy, and is in position two in the GCC. Thus, the overall position of EAU is 33 in ease of doing business globally.

Major Macroeconomic Indicators

Real GDP

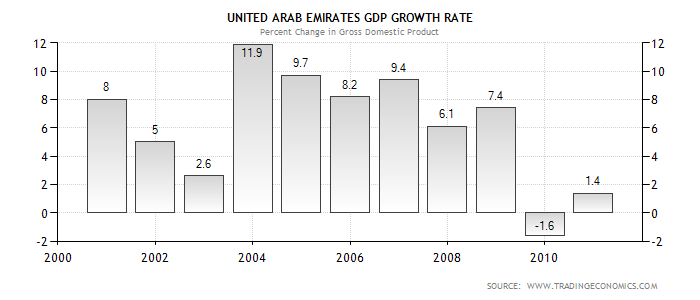

The GDP of UAE increased by 3.3% in the year 2011. In 2012, the GDP of UAE is projected to increase to a higher level to an estimated U.S. $ billion in current prices to maintain its position as one of the largest Arab economy after Saudi Arabia, The real GDP of a country’s economy is an indicator of the average standards of living of individuals living in a country. (ii) Real GDP growth rate.

In 2008, real GDP growth was approximately 7.4%, and the lowest economic growth has been 1.7 %. The performance was supported by an increase in oil and gas prices that doubled the revenue. In 2012, the real GDP of the country is projected to exceed 4% due to improved public investment, and the increase in hydrocarbon production, exports, and the contribution from the traditional sectors of trade, tourism and logistics from Dubai (Gulf Industry, 2012). According to historical trends, the GDP of the federation’s average quarterly GDP was 6.19 % obtaining a historical high of 11.90 % in December 2003, and recorded a low value of 1.6% in December 2009.

This federation of seven emirates functions in an open economy characterized by increase per capita income and a relatively moderate yearly trade surplus. Energies directed towards diversification economically have led to the reduction of the GDP derived from oil and natural gas production at an estimated increase at 20%. The federation has transformed drastically due to the discovery of oil from a poor desert landscape into a nation that is highly developing at alarming rates. The economic growth in UAE greatly depends on the increase in oil prices produced by the economy that are measured conventionally as the percentage rate increase in the real GDP (Trading Economics, 2012).

Unemployment rate

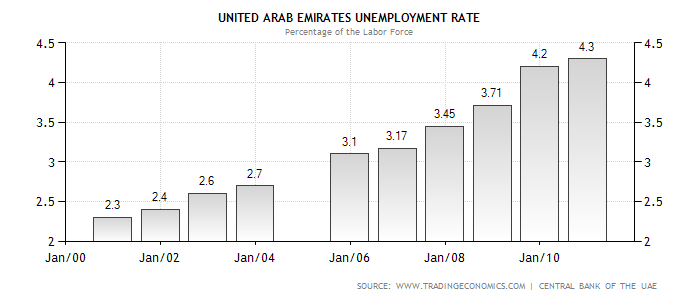

The increased level of economic activity in Dubai has made it record low rates in unemployment. Unemployment rate in the federation fell to 42% in 2011 from a double figure. Most of the unemployed are fresh graduates from colleges and universities under the age of 25 years (National Bureau of Statistics, 2009). The females constitute of 42% of this age bracket. Unemployment rate implies the percentage of unemployment level on the labor force.

It denotes the variable of stock as it provides the quantity of unemployment over a given period. Variations in unemployment rely on the inflows derived from unemployed individuals seeking for jobs and of the employed group who discard their jobs in search for new ones. Furthermore, it also depends on the outflows of people who find new jobs and individuals who terminate seeking for jobs. In the UAE, 47% of the population is unemployed while approximately 20% has no desire to do jobs (IFC, The World bank. 2012).

Current Account balance (in the balance of payments)

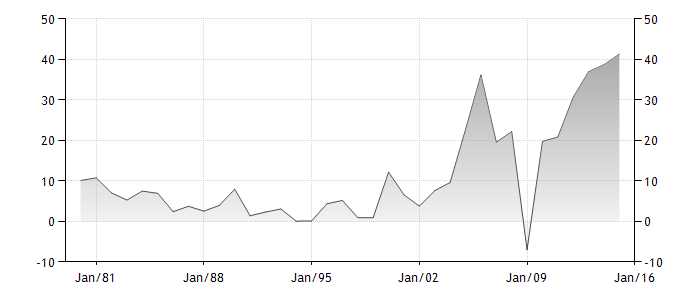

The current account balance in UAE in U.S. dollars was estimated at $ 7.02 billion in the year 2009 and is projected to be $ 41.44 billion by 2015. In 2009, the country’s economy share of the world totals GDP, adjusted by the (PPP) was estimated at 0.27%. In 2015, it is predicted that the country’s share of the world GDP will remain the same (The World Bank 2012, p. 1). The current account balance forms the main component of the balance of payment increased to AED 41.3 billion in the year 2012.

This was an increase compared to the recorded figure in 2009 that was estimated at AED 28.8 billion. The transformations were influenced by fluctuation in oil prices which were very high in the global market. Consequently, the current account balance was estimated at 3.8% of the country’s GDP in 2010. However, the federation is characterized by weak credit conditions, and a substantial recovery in other sectors such as agriculture and tourism that created as increase in the non-oil subsector to appear not feasible.

The recalculated current account balance projections indicates that the balance will reach approximately 7.7 % of the GDP in the current year, as the revenues from the oil and gas sector are projected to decrease. The federation’s re-exports are greatly impacted upon due to the sanctions that are made internationally on other trading partners, particularly, Iran. Any changes in the regions financial markets may greatly affect Dubai. Thus, it may lower the debt repayment plan that is targeted priority in the year 2012. Any reduction in the global economic growth may be associated with certain risks that are related to the changes in oil prices in the current year. Moreover, this may have greatly undermined the fragile macroeconomic recovery of the federation (Mohsin, 2009).

Fiscal Indicators

Ratio of gross fiscal deficit to nominal GDP

The prevailing changes in oil prices, the relationship between the gross fiscal deficit and the overall rate of economic growth are crucial to the stability of the economy. An increase in the gross fiscal deficit increases than the output increase the ratio of gross debt to GDP. The increase in debt in excess of economic growth will be ultimately unsustainable. The debt ratio depends on the size of the budget deficit, the interest rate, and the rate of GDP growth. It is projected that the federal debt is likely to Increase in the near future. At the current and projected levels, a continued deficit of 10% of the GDP is likely to be unsustainable (Gulf Industry, 2012).

Levels of government expenditures and their ratio to nominal GDP

The levels of government expenditure and the ratio of nominal growth are expected to reduce by 2.3% in 2012 from 4.9% in 2011. The government spending is among the fundamental key pillars of economic growth to assist in supporting the demand within the economy. Based on the approximated nominal GDP, the total expenditures and net lending would be $ 103.8 billion in 2012 down from the previous $ 109.44 billion in 2011. The reduction in expenditure follows a small change in expenditure recorded last year after many decades of expansionary budgets.

Levels of revenue (tax plus non-tax) and their ratio to nominal GDP

The UAE has no income tax. In addition, there is no federal level corporate tax. However, there are various tax rates for particular activities in some emirates. Furthermore, within the federation, there is no general sales tax. The overall tax burden is remarkably low; it is estimated at less than 3% of the GDP. The level of government expenditure is equivalent to 28.5% of total domestic product. The revenues from oil have maintained the surplus in the budget as well as in the public debt estimated at 20% of GDP.

Monetary Indicators

Rate of growth of money supply

The rate of growth of money supply has drastically reduced due to the domestic deposits edged up at a modest pace as banks strive to maintain the level on their lending rates. The reduction in money supply is due to inflation in spite of the weakening in the U.S currency and a surge in the bill of imported foodstuff. Previous records indicate that the rate of growth that includes currency outside the banks, demand on deposits, time and saving deposits increased by more than 10% on a quarterly basis in the year 2007 and 2008 as banks continue with a lending bonanza to exploit the advantage of the economic and business upsurge. The money supply had been high as 10.8% in the first quarter of the year and 6.2 percent in the second quarter. However, there was a reduction in the third year at approximately 7%. It increased to 9.7 % in the fourth quarter before increasing to 8% in the first quarter of 2010. Money supply decreased at 5.4% in the second quarter of 2010 and later reduced to about 5.2 % in the third quarter.

Rate of inflation

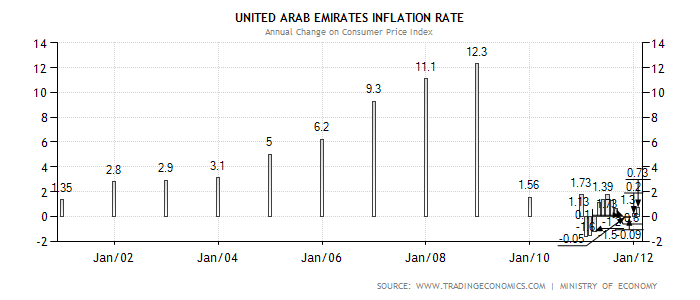

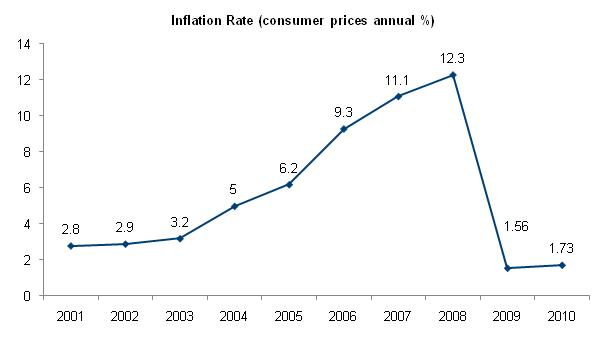

The inflation rate in the country was estimated at 0.7% in January this year. From 2002 up to 2007, the average inflation rate in the UAE had been evaluated at 6.27% with higher rates recorded of 11% recorded in December 2007 and low records of approximately 2.90 % in the year 2002 (REUTERS, 2012). Inflation rates indicate a general increase in the price of goods and services as a ration of a standard level of the consumer’s purchasing power.

The inflation rate was maintained at 0.54 % during the first eight months of the year 2010 and could end at a slow rate at 1% due to low rents and the reduction in the prices of other commodities. The inflation rates had remained at low levels, even though there are fluctuations in oil prices as well as the increase in education fees. The inflation rates in the UAE is affected by food prices and house rent because these categories account for approximately 40% of the price index (REUTERS, 2012).

International indicators

Openness index (defined as imports plus exports as a ratio of GDP)

The federation is known as a trading nation as indicated by the high ratio of goods and services exported and imported to the GDP, estimated at 145% (Romana, 2012). In addition to this, the country participates significantly in the global capital markets through many investment institutions. Thus, the current account had been in surplus since independence.

Levels of exports and rate of growth of exports

The non-oil foreign trade has been increasing in 2011 compared to 2010. Exports on the non-oil sector increased from January to the end of October at 22%. This is equivalent to an increase from AED 622.5 billion for the same period in 2010. The exports values increased from AED 70.0 billion to AED 94 billion. Re-exports experienced a growth of over 12% from AED 153 billion to AED 172 billion in the same period. The total foreign trade by October, 2011 was valued at 83.5 billion compared to 66.4 billion with an increase of 36%. The exports achieved an increase of 15% and re- exports recorded a decrease of 5% to attain AED 16.6 billion.

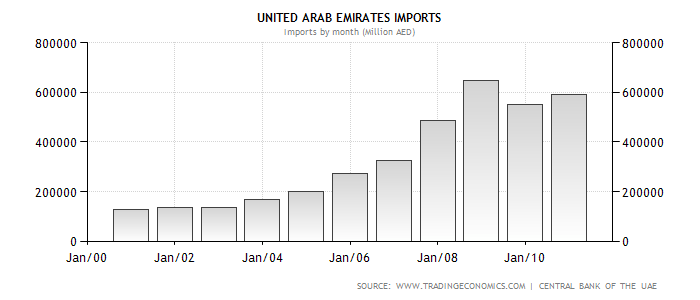

Levels of imports and rates of growth of imports

Levels of imports and rates of growth imports revealed an increase of 24% to move from 399.3 billion in the year 2010 to reach 493.8 billion in 2011, for the same period. The country imports mainly machinery and equipments used in transport. Other materials imported include chemicals and food.

Level of foreign exchange reserves

Foreign exchange reserves (also called Forex Reserves) in a strict sense is only the foreign currency deposits and bonds held by central banks and monetary authorities. However, unlike other developed economies, the bond market of the federation is still weak due to the lack of open market operation to control the interest rates as well as the bond market as a tool to control the banking sector (Market Research.com, 2012).

Critical Problems

The problems facing UAE includes the heavy subsidies on utilities and agricultural sector. The country has an outdated tax system that has influenced the occurrence of persistent fiscal deficits in the past decades. The fluctuation in oil revenues increased the problems in the past years. The delay in significant construction projects and the crash in the property market have detrimental impacts on the future developments.

The UAE is also faced with challenges that may tamper with the business environment (Samba Financial Group, 2011). For instance, the rapid growth in population coupled with poor economic diversification and fluctuations in oil prices may have detrimental impacts to the UAE. The most urgent problem that faces UAE is the fluctuation in oil prices, with a decline in the current account balance; this is a crucial problem that affects the economy of UAE and thwarts the attempts by the federation to diversify its economy. Moreover, the country faces scarcity in water supply, which must be understood within its geographical context.

Future Prospects

In the Middle East and North African region, the federation of the UAE has an excellent growth prospects because it is strategically located in the Middle East as an emerging business centre that can attract many investors. The country has a sound economy, with a steady population growth rate. The banking system is well managed with low barriers to entry. Moreover, Dubai has an excellent infrastructure with a sophisticated business community. It is an intensely competitive market, emerging as a financial centre in the Middle East that provides an added advantage to markets through facilitating the accessibility to the markets (Bloomberg, 2012).

Consequently, there are various incentives that the federation uses to develop a local manufacturing base to encourage investors to relocate to the region. The positive growth that the federation has experienced in the Middle East and Asia has increased opportunities for investors to advance their market shares with business ideas that are innovative. The government has initiated a policy that focuses on developing this financial centre to attract more investment in the region ((Romana, 2012).

Monetary policy

In UAE, the government introduced an active expansionary monetary policy that is focused to expand the economy and resulted into desired economic goals of stable prices, reduced unemployment rates and produced sustained economic growth. In Dubai, the government planned to sell more bonds so that it can afford to finance a diversified economic strategy. Dubai will advance with plans to increase real GDP by increasing government expenditure on infrastructure and improved investment in the aviation market. UAE has been successful in the implementation of both fiscal and monetary policy. Dubai has a GDP that constitutes oil and non oil GDP.

Through selling bonds, the government states that it believes that through acquiring the cash and selling the bonds at a certain interest rate, it is able to turn around and invest in better channels. The plan faces many hindrances on the ability of UAE to take advantage through putting cash to work efficiently, through history, the track record of Dubai indicates a higher GDP because of active Hands-on monetary policy that would require no issuance of debts.

In this type of economy, the implementation of monetary policy to obtain certain results such as altering the money supply through selling bonds to achieve a higher output of the GDP. In the last ten years, the nation was aspiring to diversify in other avenues. Dubai plays an important role in the region’s economic growth by diversifying into other industrial segments through its investments agencies around the world. The nation’s portfolio constitutes of the best companies with a number of important projects.

By incorporating the Hands-on theory, Dubai will sell government bonds to use the money to develop other facilities such as roads, and making the citizens to work immediately in order to increase GDP and to reduce unemployment rates.

Increasing money supply leads to an increase in overall prices both in the short and long-term. The government stated that the country is facing economic crisis because it is not in a position to repay her debts, moreover, government owned financial institutions are also facing the same crisis and needs more time to settle their debts. Unlike other emirates, Dubai is not rich with oil resources but depends on tourism and other business activities that were greatly affected by the financial crisis. This resulted in to cost increases, delays in projects as well as, increase in unemployment levels. In addition, foreign investors who had links with the Dubai world also reduced as well as banking activities in Dubai. In spite of all these occurrences, there is there is hope that Dubai will recover because it had faced similar economic crisis but was assisted by Abudhabhi to recover.

After the 2009 financial crisis the economy had been experiencing slow recovery, the debt restructuring of Dubai world was completed. Through liquidity support and assistance from Abu Dhabi, the banking sector in Dubai became more successful and got enough of the business courage. The recovery continued in the year 2011 with other sectors such as construction and real estate remained restrained following the 2009 financial crisis. The real GDP reached approximately 4.9% assisted by the increase in oil prices. The growth in non-hydrocarbon also attained approximately 2.7% due to the strong trade and the booming tourism sector. Due to the supportive external influences the current surplus increased by approximately 9% of the real GDP. Therefore, the average inflation restrained at 0.9% because of a reduction in rents.

However, the mix of fiscal and monetary policy will require adaptability over the medium term so that a further diversification of the economy in a more uncertain environment can be maintained.

The share of Dubai’s non-oil increased above 50% real GDP for the federation as a whole despite the support by the authorities and various investment projects that assisted in offsetting the contraction in Dubai. Economic recovery was felt in 2011, as there was expansion in the regions investment and oil production, which restructured GREs in Dubai. The medium term expansion in non-oil investments is projected to increase by an average of 4.5% yearly before the financial crisis that indicated less activity in the property sector and increased costs in order to have access to the international markets.

The projection of CPI inflation is aimed at reflecting on the increase in prices of imports and increased investments in Abu Dhabi’s infrastructure. Consequently, based on the projected increase in oil prices, the fiscal position is estimated to return to an increase of approximately 10% of the GDP. Concerning the medium term, the surplus is projected to increase by an estimated 15% of the real GDP due to the increase in the non-oil income increased by the introduction of the VAT.

The justification of the events in Dubai are unfolding since, it is projected that the financial risks could still materialize if debt restructuring are to generate additional uncertainty. It is important to do away with the uncertainty. The consequences include inaccessible market for entities that have strongholds in Dubai and confidence loss among the residents of Dubai.

The authorities in Dubai stated that there is need to work with creditors in order to achieve an organized debt restructuring. Moreover, they also stated that it is important to improve transparency as well as corporate governance. According to the scope of corporate restructuring, it requires that the economic and financial viability should be protected systematically. Therefore, the effects associated with GCC events in Dubai, and globally, are manageable. These occurrences, however, had a long-term impact on external capital’s cost, as the creditors can easily discount ideas and private risks.

The economy of Dubai is service based and constitutes of manufacturing, agriculture, and revenues from oils that has made it entirely dependent of the global trends in tourism, trade and banking. However, it is not very clear the extent in which the Dubai World has received funds that were required for a speedy completion of public utilities.

Dubai’s economy is almost entirely service-based, virtually void of manufacturing or agriculture or oil income, which makes it highly dependent on global trends in trade, banking and tourism. Also unclear is the extent to which the Dubai World debacle has sapped funds needed for a speedy completion of the critical public works projects. In addition, the increasing oversupply of office as well as residential space has affected rents outside the main business district. The crisis in the real estate also demonstrates several issues with governance.

Conclusion

The economic recovery in the UAE is increasing in strength. The increase in the federation’s ranking on the global scale was attributed to the discovery of oil and gas in the region more than three decades ago. Oil and gas production substantially enhanced a relatively stable growth over the years. As a result, the growth rates in the United Arab Emirates over the coming decades will be shaped by the level of the global economic recovery. The UAE has experienced achievements in the last years with its open and outward orientation that allowed for diversification of the economy along with generating a sustainable economic growth (Arab News, 2012). The drop in oil prices and fluctuations in the international credit markets and changes in the property prices may significantly influence the economy by slowing down the economic activity.

Reference List

Arab News, 2012. Upgrade of MSCI Qatar and UAE indices to give access to $3 trillion funding. Web.

Bloomberg, 2012. Qatar looks abroad for funds. Web.

Gulf Industry, 2012. Focus on training for industry. Web.

IFC, The World bank. 2012. Economy Ratings. Web.

Market Research.com, 2012. United Arabs Emirates Business Forecast Report Q2 2012. Business Monitor International. Web.

Mohsin, S 2009. The GCC Monetary Union: choice of. Web.

National Bureau of Statistics, 2009. United Arab Emirates. Analytical Report on Economic and Social Dimensions in the United Arabs Emirates, vol. 1 (1-132).

REUTERS, 2012. GCC economies can ride out rising Iran tensions. Web.

Romana, R. 2012. The UAE is an emerging business centre in the Middle East. Ezine Articles. Web.

Samba Financial Group, 2011. The GCC: economic outlook 2012. Web.

The World Bank, 2012. Ease of doing business in United Arabs Emirates. The World Bank Group, Web.

Trading Economic. 2012. United Arabs Emirates real GDP growth rates. Trading economic. Web.

Yale University, 2012. Environmental performance index. Web.