Abstract

This paper presents a deep analysis of the economy of the United Arab Emirates, with the study of qualitative factors affecting the country’s development and macroeconomic indicators. The study proposes using the Solow growth model, which will analyze the GDP, unemployment, and public debt indicators to find the correlation with the variables of capital, labor, and technological development. A literature review of the sources that implement this model about countries, and empirical results, including the UAE region, based on which this study is based, is given. The calculations will require multiple linear regression to find a statistically significant relationship between the three dependent and three independent variables to interpret further the main factors of the country’s economic growth and the corresponding recommendations.

Introduction

The UAE was created in 1971 and is made up of seven different emirates. The country is located on the peninsula of the Arabian continent, and is part of the Arabian Gulf Corporation, a combination of various Arab countries (AI-Haija & Syed, 2021). According to the 2021 World Bank report, the UAE has gained a high global reputation due to various achievements in critical areas such as technology, aviation, financial sector, tourism, and energy. Over the past five centuries, the country’s economy has evolved from a low-income fishing and farming economy to an oil-producing economy.

This paper proposes an analysis of the factors of economic growth in the United Arab Emirates, including capital, technology and labor. These determinants are key aspects of the Solow model, and can lead to an answer to the question of the reasons for economic success or decline with the possible maximization of consumption, and the role of technological progress in the context of a certain state. To do this, a literary review of the UAE economy will be carried out from the founding of the state to the present day to clarify the main external and internal determinants that affect the state. Then the application of the model in similar macroeconomic analyzes and the latest approaches to its implementation will be evaluated.

Finally, the research methodology will be described, aimed at analyzing the main financial characteristics of the UAE through the prism of the Solow model, the application of the tools of this approach, the expected results, and potential recommendations based on the interpretation of the output data. In other words, indicators such as GDP, unemployment rate, and public debt will be assessed by multiple linear regression for correlation with various variables of the Solow model, defined below. As a result, a table will be obtained with the levels of dependence between the identified variables, which will make it possible to give more thoughtful recommendations for optimizing the mechanisms for managing economic growth. Finally, the regression analysis of these indicators in the context of the model can have a predictive function, showing the adequacy of using the approach for a given state in the long run.

Literature review

UAE Economics

In the light of recent trends shaping the global economy, it is becoming increasingly important for private and institutional investors to choose the right market for capital allocation. Of course, the traditional and established markets of Europe are still in demand as an investment destination, but as the profile of the average private investor changes and the general economic environment changes, the search for new promising markets that can maintain their attractive potential in the long term becomes paramount (Herb, 2014). One of these markets is a country with a growing economy – the UAE.

The market potential of the UAE is due primarily to the presence of many minerals in its territory. The country has identified significant mineral resources: hydrocarbons, coal, iron ore, uranium, chromite, copper, nickel, platinum, cuprous oxide, bauxite, asbestos, and magnesite (El Mallakh, 2014). Among the various minerals, oil and natural gas stand out for their reserves. In 1971, oil production accounted for 90% of the country’s GDP (El Mallakh, 2014). Since then, there has been a gradual process of diversification of the domestic product, while fuel remains the primary source of income.

The UAE developed due to tourism and globalization: in the 70s, the first Emir of Dubai, Rashid ibn Saeed Al Maktoum staked on globalization: the region did not have the same large reserves of natural resources as Abu Dhabi, and the sheik found an alternative way of development his emirate. The Emir’s successor and son, Mohammed bin Rashid Al Maktoum, also bet on globalization. Sheikh Mo, as the emir is called, was the one who transformed Dubai (Herb, 2014; Sbia et al., 2017). Thanks to him, futuristic skyscrapers appeared. The created infrastructure became a key determinant of attractiveness for international companies and investors, and the UAE began to proliferate in every sense.

At the end of 2020, the UAE remained one of the leading oil-producing countries in the world. However, the country has adopted various strategies to diversify its over-reliance on oil revenues and focus on other sectors of the economy (Abdalla Alfariki & El Anshazy, 2022). Thus, this diversification has reduced the country’s over-reliance on oil and related products to increase sectors such as tourism, infrastructure, and the aviation industry (Cull, 2022). Judging by the performance of the last decade before the current regime, it is clear that the country’s economy has undergone positive changes since its diversification strategy. The country’s economy grew due to government intervention in the manufacturing sector.

Accounting Growth Model

A growth accounting model is a quantitative tool used by various economists to analyze the relationship between factors of production and the rate of economic growth from the output. This method considers labor, capital, and technology (Zagler & Dumecker, 2013). These factors are considered based on three sectors of the economy: raw materials, manufacturing, and services. Analyzing economic growth, Robert Solow developed the first neoclassical growth model, forming the basis of modern theories. Thus, the listed factors are the determinants of the model under consideration in the context of the economic success of the state.

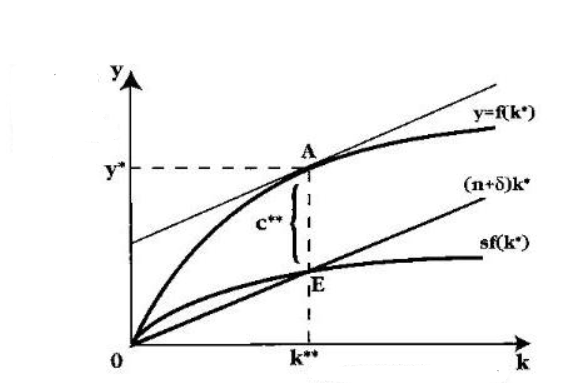

The adequacy and relevance of the model is determined, among other things, by its practical implementation and the liquidity of recommendations that it can provide to economists and even politicians. The Solow model helps to find such a quantitative indicator of production that optimizes the ability to consume at a given rate of economic growth (Solow, 1956). Thus the golden rule of accumulation is achieved. The maximum consumption is reached in the case of a sufficiently serious capital outflow and an average output with a relatively stable capital-labor ratio (Solow, 1994). Consequently, the best indicators of consumer power tending to a maximum can be obtained only in the case of equality and the ratio of the marginal return on capital and given growth rates.

The influx of population, or, in other words, demographic growth, reduces capital reserves at a constant rate, as well as its outflow. With the same production indicators, an increase in people leads to a decrease in the productivity of one worker. Compensation is achieved by increasing production, which can be stimulated by an influx of investment. Consumption will also tend to decrease (Solow, 1956). The capital-labor ratio decreases with demographic growth, which means that income per person and the overall quality of life decrease.

This model is aimed exclusively at one sector and does not take into account the multi-criteria production of the economy, and therefore requires an iterative approach in such cases. The economic system produces one product, which is both consumed and invested. Exports and imports are not taken into account. This approach is aimed at explaining the dynamics of some macroeconomic processes. Statewide economics in this case seeks to optimize per capita income and consumption, ensure stable growth of capital and technology, and determine each of these variables and identify system flaws (Solow, 1956). The uniqueness of the model is that it shows the possibilities of balanced development only through internal regulatory mechanisms without external influence (Solow, 1994). In the context of the UAE, such an understanding of the global and domestic economic dynamics will help recommend and forecast further developments.

Within the model, however, there are several assumptions. Any model owes its appearance to a number of processes and phenomena that have developed in the economy and influenced the thoughts and decisions of the scientist. So the Solow model also has certain prerequisites that make up the content of the following provisions: macroeconomic equilibrium, that is, the situation in which aggregate demand is equal to aggregate supply (AD=AS) is the most important and necessary condition for the well-being of the economy (Solow, 1957). In addition, aggregate supply is based on the operation of the Cobb-Douglas production function, which considers the dependence of output on labor and capital used and constant returns to scale (Solow, 1957). Flexible prices in the market for goods and services and full employment of resources, together with perfect competition in the market for factors of production, also form the mandatory determinants of the model’s operation. Finally, it also includes a constant rate of retirement of capital and a diminishing productivity of capital (Solow, 1957). The Solow economic growth model includes several equations that describe the dynamism of the system.

Equality of investment and saving is a condition of equilibrium, while investment is proportional to income. The volume of production per worker is a function of his capital-labor ratio. At the same time, the following is paradoxical: labor productivity increases with the growth of capital-labor ratio, but at a decreasing rate (Solow, 1957). Countries with higher population growth rates have lower capital-labor ratios and therefore lower incomes. It turns out that countries with lower population growth have higher incomes and higher capital-labor ratio (Solow, 1957). In the case of the UAE, where the population has begun to grow significantly, it is important that the rate of investment be higher than the demographic growth from the point of view of this model.

However, the key idea of the model is that the engine of economic growth is scientific and technological progress. Accordingly, in connection with this condition, the type of production function also changes: Y = f ( K, L, e), where e is the labor efficiency of one worker; L is the number of effective labor units. The scientist came to the conclusion that technological progress is the only condition for improving the standard of living of the population in the state (Solow, 1957). Thus, economic growth according to Solow helps to consider the relationship between the three main sources of development – scientific and technological progress, the volume of investment and the size of the labor force. In the context of the integration of the world community, the study of this model for states becomes a necessary task, because in the future economic processes become more and more multi-criteria and the study of these dependencies can provide valuable information.

Figure 1 below shows the ratio of the golden rule of accumulation. It prescribes the choice of the optimal stationary trajectory along which consumption reaches its maximum per efficient worker. To do this, capital and output must grow at a very definite pace, which is determined by demographic growth and technological progress. These indicators should be taken into account when building a model for the UAE.

Empirical Literature Review

In fact, this model is used to explain macroeconomic processes and find the most optimal ratios for sustainable economic growth of the country. Consequently, the Solow approach was often used in scientific research, describing several processes with a particular statistical significance. First, the empirical literature is divided into exogenous and endogenous, which differ in terms of the drivers of economic growth: the first is technological progress, the second is innovation, human capital, exchange rates, key rates, and inflation (Chirwa & Odhiambo, 2018). This analysis can be directed both to a different business sectors in various countries and to the macroeconomic indicators of the state as a whole (Sudarmawan & Harnani, 2021; Nkalu et al., 2018). Next, a review will be given of the work of the second approach to several individual countries available in the scientific literature.

Such approach is studied primarily on different accurate data of indicators such as GDP and labor of countries in order to search for a correlation with any of its variables. For example, a statistically significant linear relationship between human capital and economic growth was found in Nigeria over 34 years (Ogunniyi, 2018). It also proves a causal link between education and health, which grows with the economy and is a recognized determinant in the scientific literature (Heshmati, 2018). Various reviews in the field also reveal another function of the Solow model. It can be used to determine which variables are stationary in the long run and which are more dynamic and growth-determining (Osiobe, 2019). If we approach the Asian region, the study of technologies and exports as the most relevant indicators comes to the fore in modern literature (Sultanuzzaman et al., 2019). Moreover, this model is adapted to describe correlations between public debt and citizens’ standard of living, defined by surveys and other economic indicators (Arshed et al., 2022). What is more, empirical research often focuses on entire supranational regions.

The Solow model can be used of any government as a tool for managing the economy. For example, in South Asia, fiscal decentralization is applied, which has proven in this specific case that capital accumulation with foreign investment positively correlates with economic growth (Faridi et al., 2019). Foreign investment for the Asian region as a whole is a determinant of economic growth in developing countries, while human capital, employment, and physical capital are in developed countries (Kraipornsak, 2020). At the same time, for the state’s productive management of the economy to increase the standard of living, the technology-based model provides excellent utility in the most major Asian countries, not including the UAE (Nasution & Hutabarat, 2022). This fact is proven by the most extensive study of more than 30 countries in Asia, where the determinant of technology and human capital is more influential on economic growth in developed countries than in developing countries from 1995 to 2015 (Sabir et al., 2021). The UAE can be classified as a developing country for the period from 1971 to the beginning of the 21st century.

Empirical studies are always specific in nature and either have assumptions or certain add-ons to the model, making it possible to understand better the subjectivity of the case of the analysis of any country. For example, Liang adapts the understanding of the technology impact variable to the rate of return on research and capital, which more closely links the two variables of the Solow (2022) model. At the same time, the ratio obtained by the author gives an atypical interpretation of the growth factors of some Asian countries (Liang, 2022). Other works look for different mathematical calculation approaches and compare their effectiveness with real examples of countries. Lin and Wang used a fractional differential equations system to find sufficient conditions for stable growth and compared the results with China’s GDP dynamics (2021). The output was statistically significant and correlated with real-world performance while revealing the need for an urgent increase in the total factor productivity deficit (Lin & Wang, 2021). Similarly, a model for the UAE should be implemented, showing the dependence on objective indicators and identifying weaknesses in the economy to express recommendations.

Deeper research attempts to answer accounting questions strongly associated with model variables but not accounted for in the classical version. For example, robotization and labor automation affect all the considered determinants of the model to varying degrees. Even though robots are replacing human labor, research in China has shown a positive impact on the country’s total factor productivity and economic growth in the short term and across geographic locations (Du & Lin, 2022). Similarly, accounting for exports and imports is added as a complex function that sets the trend of economic growth like other variables (Konya et al., 2021). Export indicators are fundamental in the specifics of the country in question: it is believed that the development of the UAE is entirely due to exports, and this indicator cannot be ignored in the growth model (Chamberlain & Kalaitzi, 2020). Therefore, based on the study of this work, a different, more comprehensive approach regarding each variable is possible. The development of technology directly affects employment and labor; exports and imports significantly affect the state’s capital.

UAE Model Application

Consequently, the empirical application of the Solow model is multicriteria and complex, and numerous studies in this area can even give a broad specificity of the Asian region, which can be refuted or confirmed within the framework of the example of one state. The most common variables used and available for analysis are human capital, technology, physical capital, and citizens’ standard of living. The last indicator is too complex and requires a relatively complex approach for its objective assessment. The remaining three indicators reflect the classical arguments of the economic growth function according to the Solow model and will be analyzed in this paper. The macroeconomic indicators accompanying the regression analysis to look for correlations should include GDP, the unemployment rate, and public debt. First, some of them have already been seen separately in the literature review and analyzed using this model but have never been taken into account together (Arshed et al., 2022; Aguana et al., 2022; Anderu, 2020). Second, each of the three variables in a separate impact on each selected macroeconomic indicator can give a complete picture of the current situation. As a result, it is possible to give more thoughtful recommendations, identify non-obvious mechanisms and connections, and understand, based on a specific analysis of the region, how to optimize economic growth and bring it closer to the golden rule.

The specificity of applying the model to the UAE also resonates in the scientific literature. First, research is focused on investment in the country, which has increased by several hundred percent since the last century as the state’s infrastructure has developed (Al-Jundi & Guellil, 2018). At the same time, a differentiated indicator of non-oil GDP is analyzed since an oil surge may have a structure that is too unique for this model (Al-Jundi & Guellil, 2018). The circular positive relationship between public and government investments and the growth of this indicator contributes to economic growth in an interconnected and long-term way, which, according to the Solow model, is unique (Al-Jundi & Guellil, 2018; Solow, 1994).

The capital-labor ratio is obviously increasing due to outside investment, but this recovery is short-lived for the overall economic growth function. In this regard, for the UAE, increasing the turnover of investments in the non-oil sector is an important step towards improving the whole situation. In addition, short-term growth is also driven by bank financing, which is particularly active in the region (Arshed et al., 2020). Innovation and intellectual capital are seen as tools to slow down economic growth, with World Expo 2020 being the most prominent example (Almuharrami & Tahir, 2019; Sushil Jha & Tandon, 2019). Therefore, public and external investment, intellectual capital, innovation, and bank financing are essential growth factors. Each of the listed determinants reflects one or another variable of the economic growth function. As a further study, it is possible to differentiate physical and human capital, as well as technology, into more detailed determinants outlined above.

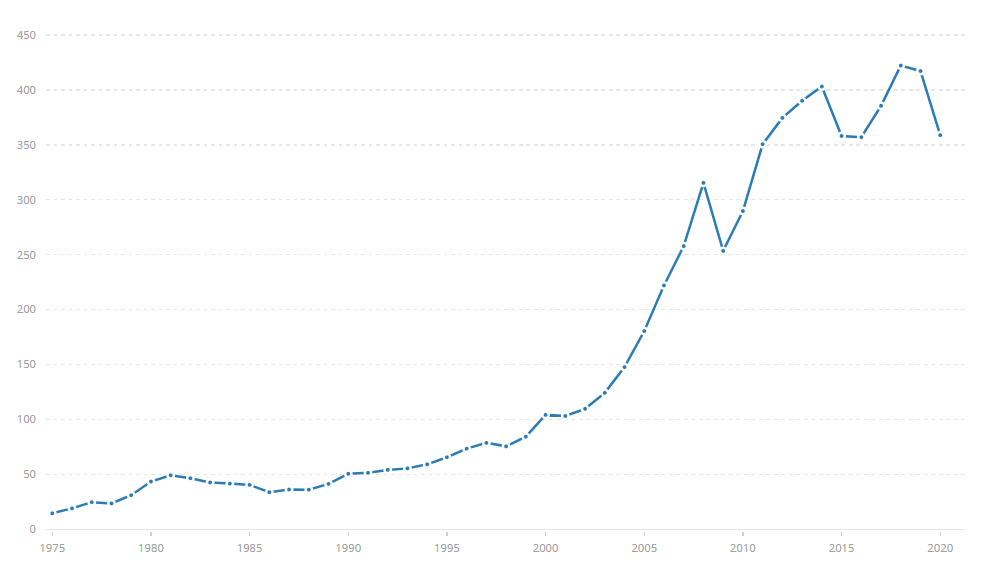

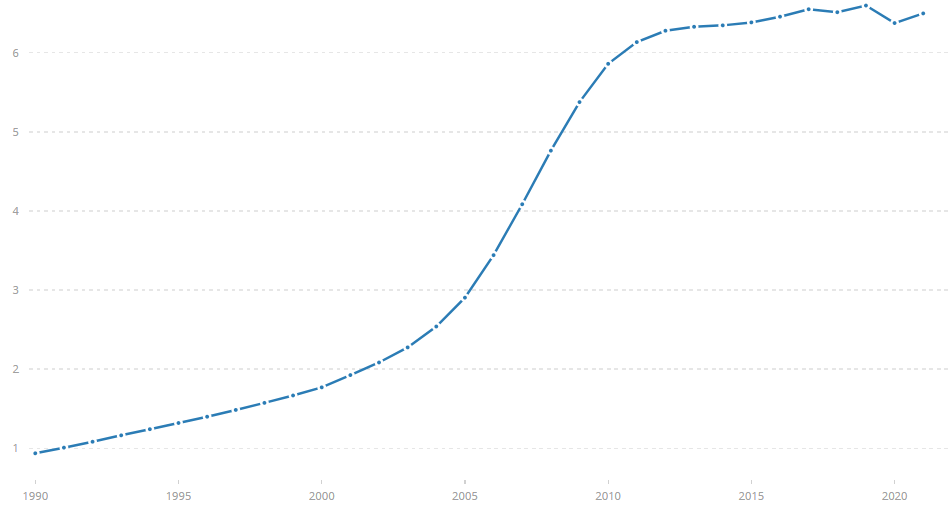

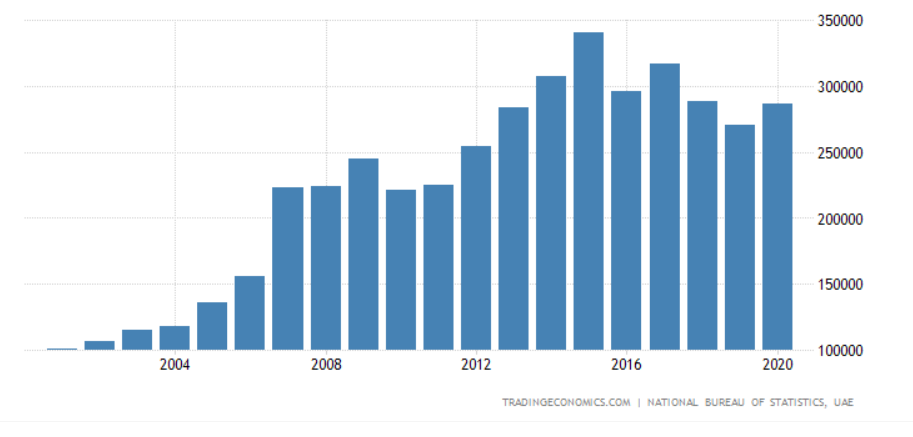

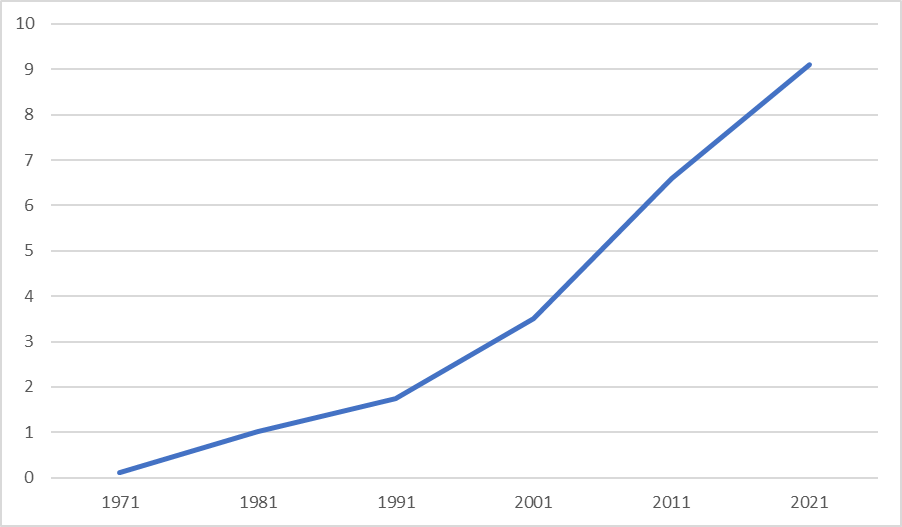

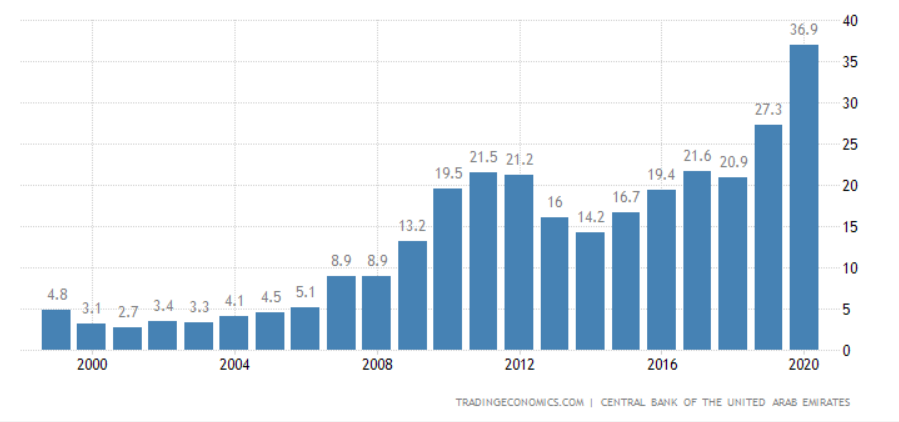

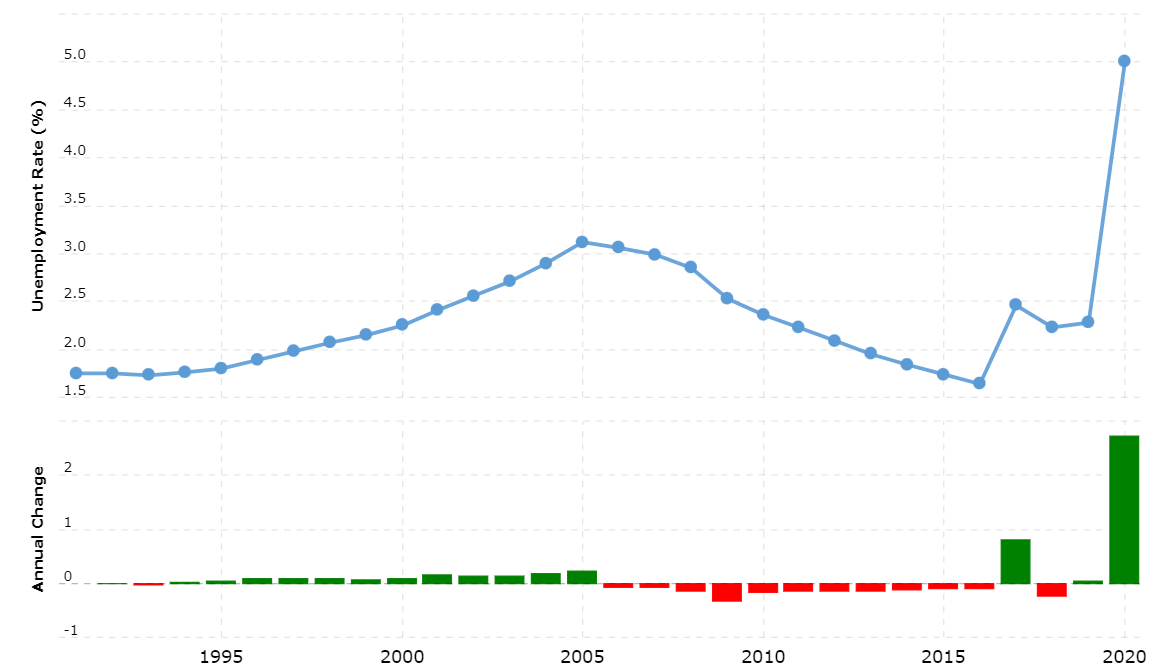

To determine the numerical values for macroeconomic indicators from 1971 to 2020, it is necessary to refer to open sources. Figures 2-4 below show the values of GDP, labor force, and capital accumulation in the UAE for the specified period. Technology development in this situation can be represented as GDP for the information technology sector. This graph is shown in Figure 5. The remaining macroeconomic indicators of public debt and unemployment are shown in Figures 6-7. This information will form the basis of quantitative data that will be applied to the model and calculated to find a correlation in the regression analysis. Some charts do not include information for the period 1971-2000. To preserve the integrity of the calculations, information for these years will be calculated based on a linear regression calculated from the values of the function plot. The figures below represent the official information available: the values for the calculations will be presented later in the results chapter.

Research Aims, Objectives, Questions, & Hypothesis

Research Aims

This study aims to find the main mechanisms of economic growth by using Solow’s model and their degree of influence on the country’s macroeconomic indicators, and then make recommendations based on the interpretation of the data obtained in order to maintain or increase the pace of positive development.

Research Objectives

The overall objective of the study is to analyze the economic growth of the United Arab Emirates using a growth accounting model.

Specific objectives will be:

- to conduct a regression analysis for each pair of three independent and three dependent variables according to the Solow model and selected macroeconomic indicators;

- to analyze the resulting output data and compare with the main trends in the economy of the UAE identified in the literature review;

- to check the results for statistical significance;

- to give an interpretation of the results and, based on it, give recommendations for positive changes.

Research Questions & Hypothesis

The key research question is to assess the contribution of various input factors such as capital, labor and technology to the economic growth of the UAE between 1971 and 2021. Economic growth in the aggregate is a linear function of GDP, public debt, and unemployment. Thus, the specific research questions in this study would be:

- How does a change in the unit of factor labor costs affect the economic growth of the United Arab Emirates?

- How does a change in the unit of capital affect economic growth in the United Arab Emirates?

- What is the impact of technological change on economic growth in the United Arab Emirates?

Therefore, the study will adopt a null hypothesis to answer three key questions. Thus, the null hypothesis of the study would be the following;

- H01: The change in the specific labor factor does not significantly affect the economic growth of the United Arab Emirates.

- H02: The change in the unit of return on assets does not have a significant impact on the economic growth of the United Arab Emirates.

- H03: Changes in technological progress do not have a significant impact on the economic growth of the United Arab Emirates.

Research Methodology, Methods & Sample Design

Research Methodology

The study would adopt a quantitative research methodology. This methodology allows a researcher to conduct research based on the available data set to analyze and compare the trends. Therefore, based on its nature of analyzing the economic growth patterns of the UAE over the period, this study has chosen a quantitative methodology to enable the researcher to perform analysis quantitatively by using the existing information and previous literature.

A specific methodology is to apply the regression analysis method to find statistically significant relationships between pairs of dependent and independent variables. The application of the Solow model facilitates the selection of the main determinants of economic growth and further interpretation of the results with possible analysis through other indicators: demographics or savings. Statistical significance will be calculated for the results of r-squared dependencies using a t-test since this method is more accurate in analyzing exactly two samples than, for example, Cronbach’s alpha and others (Creswell & Creswell, 2017). The work is supposed to be exclusive to quantitative data.

Research Design

This study will employ an experimental research design. This design technique is useful when there is a comparison of the data set over a long period, and the researcher intends to make an informed decision about thy changes and trends in the observed data. Therefore, it is useful to this study since it will enable me to understand the key changes in the factor of production and their relevance to the factor output that affects the country’s general economic growth. Regression analysis helps to see patterns, which, with a sufficiently high selected dependence, can have a predictive function that can give more specific recommendations.

Study Population

The study focuses on secondary data collection. Therefore, the available data from various government entities and world reports would be used to form part of the analysis. The data set would be sampled between 1971 and 2021. Using such a data set determines the impact of changes on the factor inputs against the productivity levels and their overall effect on the UAE economic growth. Since the Solow growth model focuses on long-run economic growth, the data set for the long period would be enough to comprehensively analyze the trends and conclusively recommend the changes in their productivity levels. Based on the three-factor inputs of productions, the data set would focus on labor productivity, capital, and technology. These data should be sufficient, as a similar analysis using a model for other countries also took into account a smaller amount of data, giving statistically significant results (Kraipornsak, 2020; Faridi et al., 2019). As noted above, where data is not available prior to 1971, again using linear regression, the results will approximate the trendline up to the required period.

Data Type, Analysis Tools, and Techniques

The secondary open-access data on the dynamics of macroeconomic indicators and considered model’s variables: technologies in the form of GDP in this sector, labor and capital. Trends and correlations will be monitored using regression analysis and t-test for statistical significance. The results will then be correlated with the factors identified in the literature review as most influencing the economic growth of the UAE.

Desired Output

This study will help to comprehensively understand how the main determinants of economic growth in the Solow model, such as the exogenous nature of technology, capital and labor, affect its main macroeconomic indicators: GDP, public debt and unemployment. The dynamics of changes in these factors can consistently cause a similar response in other indicators, which can make it possible to manage the mechanisms of the economy, taking into account the specifics of a given country. Finally, the interpretation will be given on the basis of a review of the literature and results, and their comparison.

As a result, it will be confirmed or refuted that foreign investment contributes to the country’s long-term, rather than short-term, economic growth. Moreover, how much the development of technology with rising savings provokes action and how much this factor affects unemployment can also be shown by research. At a minimum, the influence of capital, including intellectual capital, has been identified as an essential factor in developing the country’s economy and can be proved or refuted by quantitative methods.

Data Availability

The UAE Economy Websites

These websites and forums provide information regarding the patterns and trends of economic growth. The use of sites such as the UAE economy forum, government agencies, and the private sector economy assists in the availability of the data set, which will aid the analysis of this study. In addition, the sites present an elaborate trend in the GDP levels of the country and changes in the various sectors of the economy. Therefore, these websites provide various changes in the economy’s factor inputs and outputs.

The Trading Economics

The Trading Economics websites and forums allow users to easily access various data to the spreadsheet for analysis. Therefore, the global trading economic forum provides information related to various economic changes in every country. Therefore, in analyzing the economic growth trends of the United Arab Emirates.

I will use the available information on sectors of the economy and the GDP levels to relate them with the country’s economic growth. In addition, the website provides visualized presentation and analysis of the changes in various factors of production based on every sector of the economy. Therefore, the information from these sites is useful since they will enable me to perform analysis based on the available information between 1971 and 2021.

Field Access

To access the field for data collection, I would have finished all the basic course requirements and satisfied the university supervisor on the legibility of conducting field research. In addition, I would seek authorization from the various institutions on whether to access the secondary data from their websites. Because this study depends mostly on secondary data, I would seek consent from the individual companies and firms before initiating my field research from them.

Ethical Considerations

The following ethics will be maintained in this study during the process of completing and presenting the research work:

- Respect for persons – autonomy and protecting those with diminished autonomy.

- Beneficence and non-maleficence.

- Justice.

- Informed consent.

- Confidentiality and data protection.

- Integrity.

- Conflict of interest.

Applicability & Significance

In this study, I find the research to be applied in nature, and it will be significant for the United Arab Emirates due to the following factors:

- The current GDP of the United Arab Emirates is decreasing, and there is high government expenditure.

- Volatile oil prices have impacted the UAE market balances resulting in pressure on the fiscal adjustments.

- The government is successfully trying to diversify towards non-oil-based economic growth sectors, and the fiscal model is being developed accordingly.

- Hence, the government must identify control mechanisms positively contributing to UAE’s economy and focus on further strengthening them.

Resources Required to Implement the Project

The study will involve the use of various resources for its implementation. Firstly, I will require database information from the United Arab Emirates government institutions and the statistics relevant from the reports presented periodically. In addition, I will access the relevant journals from various researchers focusing on the accounting growth model and its application to the various countries in both the regional and global markets. The regional countries of focus are mainly the gulf corporation countries whose economies are ranked on almost the same level as the United Arab Emirates. The literature on these countries’ economies would be useful since they provide insights into the various application of the growth accounting model to the current study. Finally, I would require funds for traveling and different research expenses.

Schedule & Milestones

References

Abdalla Alfariki, I., & El Anshazy, A. (2022). Oil rents, diversification, and growth: Is there asymmetric dependence? A copula-based inquiry. Resources Policy, 75, 102-495. Web.

Aguana, K. M., Caido, N. G., & Villagracia, A. R. (2022). On the Impact of Oil Prices on the Philippines’ GDP Per Capita: Solow Swan Growth Model and Correlation. Available at SSRN 4059430. Web.

AI-Haija, E., & Syed, M. (2021). Islamic real estate investment trust: a comparative study between emirates Islamic REIT UAE and Al Salam Islamic REIT Malaysia. Journal of Islamic Accounting and Business Research, 12(6), 904-918. Web.

Al-Jundi, S. A., & Guellil, M. S. (2018). Causality between economic growth and investment in the United Arab Emirates. International Journal of Economics and Business Research, 15(4), 524-540. Web.

Almuharrami, S. S., & Tahir, M. N. H. (2019). Intellectual capital Effect on the Project’s Performance in the United Arab Emirates. Religación: Revista de Ciencias Sociales y Humanidades, 4(16), 322-329. Web.

Anderu, K. S. (2020). Capital market and economic growth in Nigeria. Jurnal Perspektif Pembiayaan Dan Pembangunan Daerah, 8(3), 295-310. Web.

Arshed, N., Nasir, S., & Saeed, M. I. (2022). Impact of the External Debt on Standard of Living: A Case of Asian Countries. Social Indicators Research, 1-20. Web.

Arshed, N., Yasmin, S., & Gulzar, M. (2020). Islamic financing portfolio and its comparative growth potential. Islamic Banking and Finance Review, 7, 60-91. Web.

Chamberlain, T. W., & Kalaitzi, A. S. (2020). Fuel-mining exports and economic growth: evidence from the UAE. International Advances in Economic Research, 26(1), 119-121. Web.

Chirwa, T. G., & Odhiambo, N. M. (2018). Exogenous and endogenous growth models: A critical review. Comparative Economic Research. Central and Eastern Europe, 21(4), 63-84. Web.

Creswell, J. W., and Creswell, J. D. (2017). Research design: Qualitative, quantitative, and mixed methods approaches. Sage publications.

Cull, N. J. (2022). The Greatest Show on Earth? Considering Expo 2020, Dubai. Place Branding and Public Diplomacy, 1-3. Web.

Du, L., & Lin, W. (2022). Does the application of industrial robots overcome the Solow paradox? Evidence from China. Technology in Society, 68, 101932. Web.

El Mallakh, R. (2014). The Economic Development of the United Arab Emirates (RLE Economy of Middle East). Routledge.

Faridi, M. Z., Mehmood, K. A., Azam, A., & Taqi, M. (2019). Fiscal decentralization and economic growth in South Asian countries. Pakistan Journal of Commerce and Social Sciences (PJCSS), 13(2), 529-546. Web.

Herb, M. (2014). The wages of oil: Parliaments and economic development in Kuwait and the UAE. Cornell University Press.

Heshmati, A. (2018). Causality between Gross Domestic Product and Health Care Expenditure in the Augmented Solow’s Growth Model. UKH Journal of Social Sciences, 2(2), 19-30. Web.

Konya, S., Küçüksucu, M., & Karaçor, Z. (2021). Panel Estimation of High-technology Export Determinants: Evidence from Fast-Growing Countries. In Eurasian Economic Perspectives (pp. 245-259). Springer, Cham. Web.

Kraipornsak, P. (2020). The different structure of sources of growth between the developed and the developing Asia and the Pacific countries. Asian Economic and Financial Review, 10(1), 22-34. Web.

Liang, F. (2022). An Application of Augmented Solow Model with Upper Limit of Capital. In Proceedings of the 5th International Conference on Economic Management and Green Development (pp. 296-300). Springer, Singapore. Web.

Lin, Z., & Wang, H. (2021). Modeling and application of fractional-order economic growth model with time delay. Fractal and Fractional, 5(3), 74. Web.

Macrotrends. (2022). UAE Unemployment Rate 1991-2022. Web.

Nasution, E. J., & Hutabarat, F. (2022). A Productivity Management Application of the Solow Development Model by the Asian Largest Economies. 8ISC Proceedings: Business, 66-78. Web.

Nkalu, C. N., Edeme, R. K., & Chukwuma, Q. O. (2018). Testing the Validity of the Solow Growth Model: Empirical Evidence from Cross-Country Panel Data. American Economic & Social Review, 3(1), 18-22. Web.

Ogunniyi, M. B. (2018). Human Capital Formation and Economic Growth in Nigeria: A Time Bound Testing Approach (1981-2014). African Educational Research Journal, 6(2), 80-87. Web.

Osiobe, E. U. (2019). A literature review of human capital and economic growth. Business and Economic Research, 9(4), 179-196. Web.

Sabir, S., Suleria, S., Sibghatullah, A., & Shamshir, M. (2021). Nexus between Human Capital, Technology and Economic Growth: The Role of Stages of Economic Development in Asian Countries. JISR Management and Social Sciences & Economics (JISR-MSSE), 19(2), 133-151. Web.

Sbia, R., Shahbaz, M., & Ozturk, I. (2017). Economic growth, financial development, urbanisation and electricity consumption nexus in UAE. Economic Research–Ekonomska istraživanja, 30(1), 527-549. Web.

Solow, M. (1957). Technical Change and the aggregate production function. Review of Economics and Statistics, 39(1): 312-320. Web.

Solow, R. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70(1): 65-94. Web.

Solow, R. (1994). Perspectives on growth theory. Journal of Economic Perspectives, 1(1): 1-32. Web.

Statista. (2022). GDP contribution growth of ICT sector in UAE. Web.

Sudarmawan, A., & Harnani, S. (2021). Analysis of Solow Growth Model in Sharia Hotel Industry in Pandemic Era, Case Study: Indonesia and Malaysia. ASIAN Economic and Business Development. Web.

Sultanuzzaman, M. R., Fan, H., Mohamued, E. A., Hossain, M. I., & Islam, M. A. (2019). Effects of export and technology on economic growth: Selected emerging Asian economies. Economic research-Ekonomska istraživanja, 32(1), 2515-2531. Web.

Sushil Jha, S., & Tandon, D. J. (2019). A study on the impact of transport and power infrastructure development on the economic growth of United Arab Emirates (UAE). Journal of Management, 6(2). Web.

The World Bank. (2022a). GDP (current US$) – United Arab Emirates. Web.

The World Bank. (2022b). Labor force total – United Arab Emirates. Web.

Trading Economics. (2022a). United Arab Emirates Government Debt to GDP. Web.

Trading Economics. (2022b). United Arab Emirates Government Debt to GDP. Web.

Zagler, M., & Dumecker, G. (2013). Fiscal policy and economic growth. Journal of Economic Surveys, 17(3). Web.