Summary

In 60 years, the United Arab Emirates (UAE) has transitioned from a precarious economy to an innovation-driven economy highlighted by a mass consumption society. Wise policymaking by the UAE Government was critical in giving appropriate advice on how, where, and when to deploy hydrocarbon income and facilitating the highly required economic transformation process. Due to its remarkable economic progress, the UAE has become an ultimate figure for oil-producing countries in economic diversification. Moreover, Png et al. (2007) underscore that their binding of Dirham to the US Dollar has also proved vital in rendering oil transactions worldwide. In this way, this research aims to expound on the growth of the UAE economy based on its GDP from 1960 to date. Further, the study also determines the impacts of the UAE government policies on the development of the economy. Finally, it sheds light on the essence of the PEG exchange of Dirham and USD.

Today, the UAE has been branded a case of economic success. Dating back to the late 1950s and early 1960s proved the central turning point of the now robust UAE economy thanks to Great Britain’s assistance and the subsequent discovery of oil. Moreover, the Trucial state council formation in the 1950s ensured economic and political cooperation was enhanced (Yates et al., 2021). These proved to be fundamental in the future development of the UAE economy.

Consequently, the discovery of abundant quantities of oil in different states proved vital as the states culminated in peace; therefore, the Sheikhs started planning on the sophisticated development of the economy. At the same time, in the mid-1960s, emirates such as Abu Dhabi, which had already developed an advanced economy, assisted other poorer economies (Png et al., 2007). Under the leadership of Sheikh Zayed in Abu Dhabi state, consistent oil earnings were channeled towards infrastructure upgrades in schools, hospitals, and roads throughout the state. Abu Dhabi has also become the most significant contributor to the Trucial States Development Fund. The state became a central bank account supervised and controlled by the Trucial States Development Office, into which all development assistance to the Trucial States would be routed, commencing with Britain’s annual earnings (Png et al., 2007). The Development Fund contributed a pivotal role in enhancing the economic development of the Trucial States. The British authorities deemed it a success in the early stages of its commencement, an idea that the Abu Dhabi sheik adopted. Moreover, the other six states’ leaders recognized the potential of development finance for future economic development; therefore, they joined the approach.

The Trucial states underwent a massive population increase after a short period of hydrocarbon discovery. The rapid rise in population from 86000 to 180000, was fueled by improved living conditions. The population increased to more advanced health infrastructures and new education options (Yates et al., 2021). With the departure of the British from the Arabian Gulf in 1971, the Trucial state rulers were tasked with determining their futures in terms of economic advancement (Yates et al., 2021). As a result, Sheikh Zayed of Abu Dhabi quickly assumed a leadership role as overall leader; he began forging closer ties with the other emirates, advocating a federation forming. Later, the seven states merged to form the United Arabs Emirates, resulting in increased security and political stability, and fostering economic development.

Without a doubt, the primary reason for the rapid economic development of the UAE was hydrocarbon resources revenue. The income accelerated the UAE’s economy, thence expanding national savings and capital accumulation, ideal for economic progress. As Mishrif (2018) suggests, the majority of nations catch up by developing organically, raising national savings and investment, and boosting exports. The UAE accomplished this feat, albeit in an astonishingly short time. The abrupt increase in oil production and export operations throughout the 1970s and early 1980s and the subsequent boom in oil prices in the 1980s provided the government with the required resources to invest in economic growth. Since the UAE developed primarily as a resource-based economy from hydrocarbon products, its GDP relies entirely on resources. Due to this fact, their GDP rate of 14% and more than 35% from exports has been from the oil products.

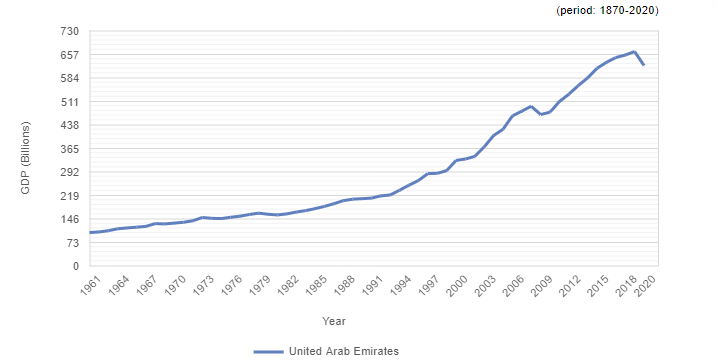

From the above-illustrated graph, it can be asserted that the GDP of the UAE has progressively increased from the 1960s to 2020. The steady rise in the graph is a result of oil products income as the products account for nearly 40% of government revenue. However, favorable government policies also accounted for political stability that ensured UAE was open for business.

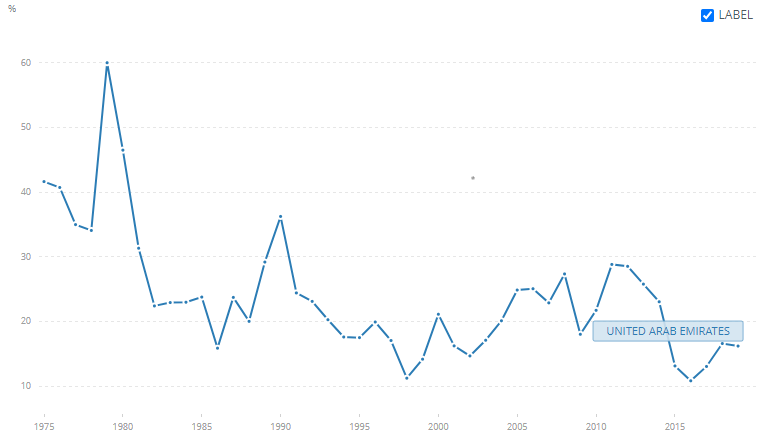

The above-illustrated graph shows how critical Oil products have been towards the contribution of the GDP of the UAE. Evidently, from the graph, oil products have contributed to more than 30% of revenues annually since 1975. Therefore it is safe to conclude that UAE is a resource-based economy primarily from hydrocarbon products.

In addition, practical and intelligent policymaking by the UAE Government has played indisputably crucial towards the economic backbone of the UAE since the 1960s. The policies impacted the diversification of income and the free-market economy. The UAE’s primary objective has been to formulate economic policies that enhance growth, enabling the economy to diversify away from hydrocarbon resources as the only revenue generator and attract foreign and enhance domestic investment. The guidelines also fostered a business-friendly environment with few restrictions and created employment opportunities for all citizens.

Economic Policies

The process by which a country can transit its economy from a single source to double or more is generally referred to as economic diversion created across primary, secondary, and tertiary sectors. Therefore in this regard, as employed by the UAE government, diversification of the economy entailed weaning the country’s significant reliance on the hydrocarbon sector through the development of non-oil revenue sources and oil-free exports. As a result, it enabled the integration of the political economy analysis of diversification, which encompassed both export diversification and the requirement for the establishment and advancement of numerous sources of income across the manufacturing and service sectors, thereby providing a complete picture of the UAE’s diversification evolution (Mishrif, 2018). Since oil products have immensely contributed to the economy, purpose the resources run out; the government will not sustain the economy from imports.

Ultimately, it was prudent for the government to explore food production industries and construction centers for development. Due to massive population growth, the sectors mentioned above heavily rely on imported items that are modified to create value. Additionally, they are labor demanding and typically privately run. However, as an impact, they have generated job opportunities, thus increasing the GDP contribution share and, therefore, the economies diversify and future sustainable development expands.

Trade Policy

The open trade policy adopted at the inception of independence proved to be vital, as it has stood as the cornerstone of the open economic system of the UAE. The policy has adhered to enhancing harmony in UAE trading activities and abroad. Harmonious trading activities have ensured the UAE economy has opened for trading; further, it has also facilitated the abolition of trade tariffs that may be expensive. Open trade rampantly improved the economy of UAE as exports of goods and services increased and re-export through creating bilateral and multilateral agreements and lowering trade obstacles.

Investment Policy

The investment policy adopted by the UAE government bolstered government development to provide facilities, loans and incentives, and exemptions to investors. Henceforth, the established industrial free zones in the various states provided benefits to investors for investment initiatives, which motivated private investors; as a result, industrialization increased in the UAE. Industrialization assisted in maintaining political stability, rapid population growth due to improved living standards, capital market growth, GDP growth, and maintenance of foreign investors.

Fiscal Policies

Any stable government is characterized by measures by the government to manipulate tax allocation levels and expenditures to maintain a financial deficit. Such policies can be referred to as fiscal policies. They are tasked with easing public income to increase per capita revenue and reduce public spending to ensure development projects are not hindered. The UAE employed the approach when the country experienced a massive annual deficit resulting from overreliance on oil products to maintain the economy since oil prices were reduced internationally. Thenceforth, the UAE government reduced public expenditures by limiting public spending growth, decreasing agricultural products and average fuel gas prices by 20% (Tsai et al., 2020). As a result, the UAE’s economic deficit reduced notably to less than 1% of total public expenditures due to more conservative fiscal management. Later, the UAE economy revived, aided by prudent fiscal management reforms, higher oil prices, and improved demand from trading partners.

Monetary Policy

The UAE’s central bank is tasked with the core responsibility of maintaining Dirham’s strength. Therefore the bank develops and implements the country’s monetary policies. The pegging of the Dirham to USD has proved vital in trading as the selling rates run at 0.27 Dirham to 1USD (Tsai et al., 2020). Pegging is a set exchange rate that promotes trade by informing importers and exporters of the exchange rate one can expect for their transactions. Additionally, the UAE’s exchange system is devoid of restrictions on payments and transfers for international transactions; thus, it boosts commerce and encourages foreign investment. Overall, the UAE’s monetary policy has been consistent with its trade, investment, and fiscal initiatives in terms of furthering the economic development of the UAE.

Currency pegging is a policy in which the government establishes a fixed exchange rate for its currency in relation to another currency to help maintain a stable exchange rate between countries. Currency pegging has proved to be crucial in the economy of the majority of trade-oriented nations. For example, the currency Dirham of UAE is pegged to the US dollar since the two countries are widely known for robust trading activities. Recently pegging has been a subject of contention as some individuals detest pegging and want it abolished while others uphold it. However, pegging has aided the UAE in many ways that have positively impacted the economy.

Pegging has enhanced income-earning and increased commerce in UAE, particularly when currency rates are in constant fluctuation without a long-term fixed rate. The government and its citizens will continue trading without tariffs which are often expensive (Png et al., 2007). Pegging Dirham with the US dollar should not be ceased as it enables continued business of oil products, and most importantly, the oil products are sold internationally on US dollar. Ending the process will mean depriving the UAE international market of oil products. As a result, the annual revenue deficit will decrease as it has been proved that oil products are the backbone of the UAE economy.

With pegging, specialization is enhanced, as individuals will concentrate on their trade areas of interest. For instance, crude oil sellers in the UAE can export their specific products internationally in USD or locally in Dirham without fearing exchange rate risks. Similarly, technological companies will concentrate their efforts on developing better computers. Most crucially, retailers in the countries pegged will source from the most efficient manufacturers. (Mishrif, 2018)Finally, exchange rates that are pegged allow for more long-term investments in the other country. With a currency peg, fluctuating exchange rates do not disrupt supply chains.

In addition, the fixed exchange rates adopted by the UAE central bank proved to be fundamental in trading activities. Therefore, a fixed exchange rate can be termed as a policy employed by the government that binds one country’s currency to another to keep the currency’s value within a limit.

Eradication of Uncertainty and Risk

Reliability in the exchange rate is a fundamental prerequisite for the steady growth of commerce. For instance, UAE, a resource-based economy, has used the system to avoid excessive exchange rate changes that can wreak traders’ plans. If the exchange rate varies, traders’ income costs of imports tend to become unclear (Tsai et al., 2020). A fixed exchange rate approach can eliminate this uncertainty. Furthermore, the exchange rates cannot fluctuate the prices of oil products in UAE; hence the dangers associated with international trade and investment are significantly reduced.

Discourages Speculation

There is no speculation in the foreign exchange market with the fixed exchange rate approach. For instance, in UAE, when seeking the market prices of hydrocarbon products, while in the US, the price will be similar to the UAE one. Furthermore, because long-term stability in the exchange rate minimizes the potential of speculation, it encourages capital flight. In a world of freely fluctuating exchange rates, the risk of capital flight is very significant because this type of exchange rate enhances an individual’s speculation. At the same time, traders can be confident that foreign payments can be conducted safely and without risk of loss because exchange rates are established.

In conclusion, UAE is one of the leading countries in terms of a stable economy as of today. They have evolved from a basic economy in the 1950s to date to one of the most infrastructured countries. They have achieved these unimaginable feet due to vast hydrocarbon resources income. Moreover, the merging with other states to form UAE enhanced stability that encouraged trade transactions globally and the emphasized government policies also proved critical towards its development. Finally, the pegging of their currency with the USD also encouraged trade worldwide. Hence, it is right to say that the UAE is a case of economic success in a short time.

References

Mishrif, A. (2018). Challenges of Economic Diversification in the GCC Countries. In Economic Diversification in the Gulf Region, Volume II (pp. 1-19). Palgrave Macmillan, Singapore. Web.

Png, I., & Lehman, D. E. (2016). Managerial economics. Malden, Mass: Blackwell Publ.

Tsai, I. T., & Mezher, T. (2020). Rationalizing energy policy reforms in the gulf cooperation council: Implications from an institutional analysis. Energy Policy, 142, 111545. Web.

Yates, A., & Rossiter, A. (2021). British naval assistance at the twilight of empire: The case of Abu Dhabi, 1966–1968. International Journal of Maritime History, 33(3), 577–588. Web.