Introduction

Production of goods and services involves the use of costs which are directly incurred in the production process and production overhead. Direct production costs are labor, hours used in the production process, machining hours, and cost of raw material among others. Factory overheads are the indirect costs incurred during a production process. The overheads arise from support services offered in the main department. Examples are canteen cost, service bay costs, administrative expenses, sales and marketing, and rent among others. The units of output produced should be charged with the total cost of production incurred.

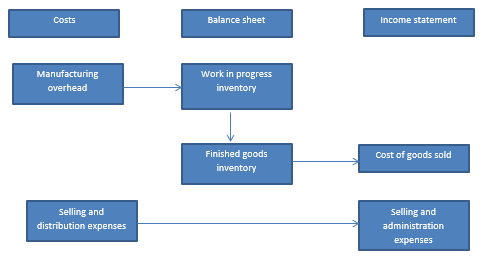

There are various approaches that can be used to charge the production costs to units of output produced. The most common approaches are arbitrage costing, absorption costing and marginal costing Job order costing system is an approach of estimating the costs of production for goods produced in batches. The approach differs from process costing in the sense that job order costing system calculates costs for products manufactured in batches and are of different types while process costing deal with homogeneous goods produced in one process. Job order costing system is commonly used as compared to other methods of costing (Drury, 2008). The diagram below shows cost flow for job order costing for a manufacturing company.

Illustration

Job order costing goes through seven stages. These are, identifying the chosen cost objective, isolating the direct costs of the job, selecting the basis of allocating costs, identifying the indirect costs of the manufacturing process, calculating the direct cost per unit, calculating the indirect costs of the process, and finally calculating the total cost of the job. These seven steps will be illustrated using an example.

Example

Consider a manufacturing company that intends to sell a batch of 50 units. The goods will be sold to a distributor for $300,000. The cost of direct materials amounts to $100,000 while the total labor cost for the job is $38,000. The total amount of factory overhead is $130,200. Job 300 will require a total of 1,000 machine hours. All jobs at the plant require 4,960 hours.

Solution

- Stage one: the cost objective is to manufacture machines, Job 300.

- Stage two: the direct costs comprise of direct material and manufacturing labor. The direct materials amount to $100,000 while the direct labor cost amounts $38,000.

- Stage three: the basis of cost allocation is machine hours. The job will require 1,000 machine hours. A total of 4,960 machine hours will be used at the plant for all manufacturing processes.

- Stage four: the total factory overhead amounted to $130,200.

- Stage five: the calculation of the absorption rate for the overheads is presented below. = 130,200 / 4,960 = $26.25. Thus, the factory overhead will be observed at a rate of $26.25 per machine hour.

- Stage six: The total indirect cost of the job is calculated as shown below = $26.25 * 1,000 = $26,250.

- Stage seven: the total cost of the job is computed as shown below.

From the calculations above, the cost for Job 300 amounts to $164,250. After the estimation of the total cost, the gross profit is calculated as shown below.

The gross profit that the company will earn from the job is $135,750. It is equivalent 45.25%. The ratio will help the management to compare the results with the financial targets and goals to assess if the project is viable. The results guide the management in making a decision on whether to pursue the project or not.

Journal entries

The costs calculated in the sections above can be illustrated in T – accounts as shown in the section below. The journal entries will be passed based on the assumption that the company closes its financial year end on 31st December. Also, assume that all transactions were made through the bank.

Sales account

As at 31st December 2012

31/12/2012 Bank 114,800

Direct materials

As at 31st December 2012

31/12/2012 Bank 50,000

Direct Labour

As at 31st December 2012

31/12/2012 Bank 19,000

Factory overhead

As at 31st December 2012

31/12/2012 Bank 13,125

Bank

As at 31st December 2012

31/12/2012 Sales 114,800 31/12/2012 Direct materials 50,000

31/12/2012 direct labor 19,000

31/12/2012 Factory overheads 13,125

Job order costing for decision making

Job order makes use of fixed cost of production when computing the cost per unit of output. Therefore, the management is able to know the total cost associated with producing a unit of output. Therefore, once cost per unit is estimated the management will be able to estimate the price of the commodity. Use of job order costing helps in estimating profit arising from the production of a unit of output. Assigning of production overhead to each cost center makes managers more accountable and responsible for managing costs in their departments. Besides, they have to operate within the budgets provided since variations from the budgeted values affect the absorption rates used in allocating the cost. Therefore, absorption costing makes management be more sensitive to spending in their departments (Jawahar-Lal 2009).

References

Drury, C. (2008). Management and cost accounting. USA: South Western Cengage Learning.

Jawahar-Lal, A. (2009). Cost accounting. New Delhi: McGraw-Hill Company Limited.