Introduction

The main intention of this report is to find out data regarding the Commercial Bank of Ceylon Plc. These data are obtained from both primary as well as secondary means. The analysis data includes Qualitative Analysis, Quantitative Analysis, and Content Analysis.

Main text

The analysis includes interviews done based on different levels of the bank management. These are the Top Management, the Frontline Management, the customers and the clerical staffs.

Data are analyzed by Qualitative, Quantitative, and Content analysis

Qualitative Analysis

There are difference between the Qualitative Research and the Quantitative Research. The Qualitative Researches are those that consist of the data that are in the numerical form and the questions provided in the questionnaire are close-ended and the responds is not at all a liberty to express his views and the suggestions. It sometimes makes use of different direct quotes and the respondents should answer the question which he feels is the right. “This is the process of interpreting data collected during the course of qualitative research “. (Data analysis: Qualitative analysis–what it is, 2007).

Quantitative Analysis

Quantitative Analysis generalizes data from a small number of populations as the data from all people in the country or the state. These are the data used while examining a whole state research or study. “A quantitative analysis does identify core truths, but it does not necessarily describe a substance in a rich manner”. (Harris 2010).

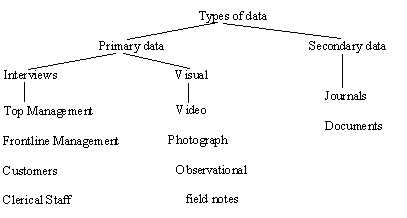

There are mainly two types of data sources namely the Primary Data Source and the Secondary Data Source. The Primary Data Sources include the bank officials, moderators, mediator, clerks and the customers, obtained through interviews. Another type of primary data is the visual data including videos and documents.

Another form of Quantitative Analysis of data is the Secondary Data that includes the knowledge from journals and other media records. The Quantitative Research is the organized analyzing and investigation of the quantitative data. The idea of the quantitative method is the employment of the mathematical and statistical model and the analysis of the hypothesis. Quantitative techniques for Decision Makers help us by means of a thorough understanding of the function and the use of quantitative techniques in efficient administration and administrative decision-making. The quantitative link is the main link between the empirical methods and the mathematical analysis

Content Analysis

It’s any description that can display information about the interviews, observation and other means of data collection. “Content analysis is a method for summarizing any form of content by counting various aspects of the content. This enables a more objective evaluation than comparing content based on the impressions of a listener. For example, an impressionistic summary of a TV program is not content analysis. Nor is a book review: it’s an evaluation”. (List 2005).

There are mainly two broad groups of content study: Conceptual study and Relational study. Conceptual study helps to creating the survival and occurrence of thoughts in a content. They use the data recorded from previous study. Conceptual study induces certain type of dictionaries for better understanding about the case, it is describing about. It also coveys the depth and width of the matter the data is dealing with. Relational study constructs on conceptual study by investigating the relations between thoughts in content. The main advantage of it is that it is highly informative with much statistical data in it.

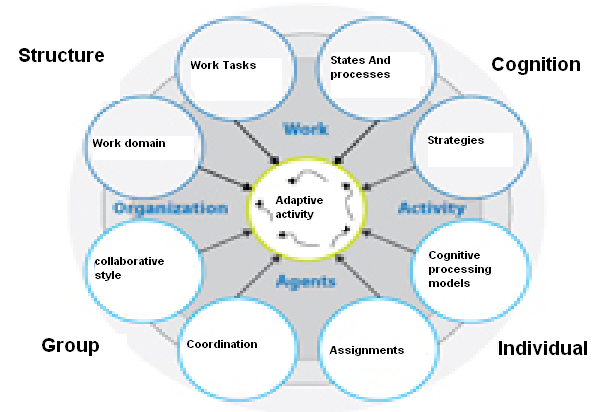

(Cognitive Mapping of various functions that comprise organizational structure).

Cognitive Mapping may be applied for various purposes.It is a procedure used for construction, investigate and create logic of accounts of trouble. In the course of submission of the Cognitive Mapping; tool has established its use for operational investigators to function on a variety of responsibilities. “ These tasks include; providing help with structuring messy or complex data for problem solving, assisting the interview process by increasing understanding and generating agendas, and managing large amounts of qualitative data from documents “. (Ackermann, Eden & Cropper 1996).

Consumer behavior for purchasing a product or service engages both straightforward and complex mind procedures. Sellers are not able to understand the character of the buyers’ completely. A lot of study, examination and thoughts regarding buyers are necessary to understand about that. The buyer’s behavior and factors influencing the purchase are the outcome of the three components such as Emotional, Conative, and Cognitive. Emotional deals with buyer approach or feelings about the service. Cognitive is a psychological picture, perceptive, understandings about the service. Cognitive deals with the proceedings and actions to purchase the service.

Delphi Method

The Delphi Method is used during the questionnaire session with selected respondents in order to reach a decision on the subject. The main aim is to make selective and systematic interactive forecasting methods for a number of times; may be two or three rounds. It is believed that after each round, the facilitator provides an unknown summary of what has transpired during the earlier sessions. Based on this, the participants change their views to suit general agreement thereby supporting the group efforts. Consensus decision is taken that could be accepted by all. Thus, the main purpose of Delphi Method is to reach compromise regarding acrimonious issues which necessitated the use of Delphi in the first place.

Decision Trees

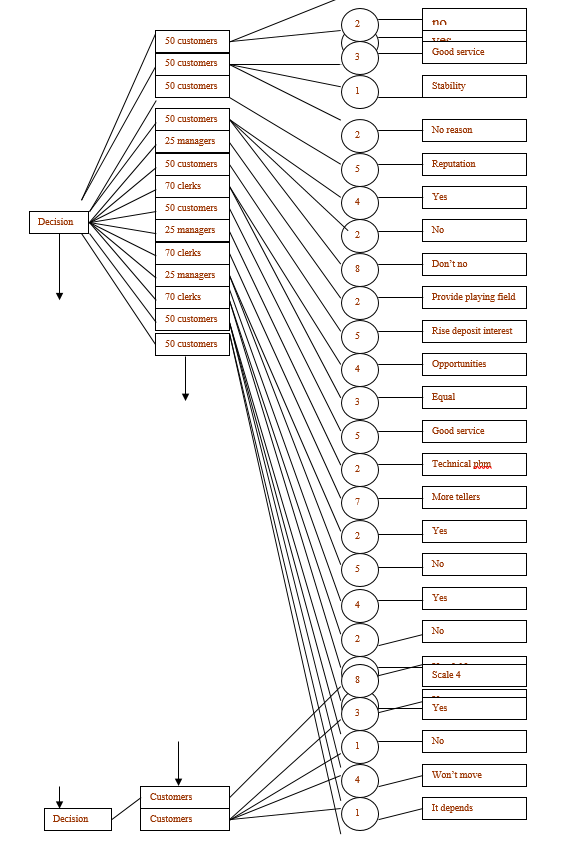

Decision Trees logarithms are analytical form which make use of the graphically arrange datas concerning probable alternatives, penalties and ending assessment. It also use work out for scheming possibilities and information drawing out. Decision Trees are also making use of a judgment among various actions. It generates a diagram of a variety of hazards, rewards and possible significances of every choice. “Decision Trees are useful tools for helping you to choose between several courses of action. They provide a highly effective structure within which you can explore options, and investigate the possible outcomes of choosing those options.” (Decision tree analysis, 2010).

Decision Trees for Analyzing the Data

- Do you think banks interest rate is competitive? Level 1

- Customers

- 29 Yes

- 21 No

- Customers

- Why bank with the customers Level 2

- Customers

- 35 Good services

- 13 Stability

- 2 no reason

- Customers

- Critical factor of bank Level 3

- Customers

- 50 reputations

- Customers

- Will the bank remain competitive in 10 years? Level 4

- Customers

- 40 Yes

- 02 No

- 08 don’t know

- Customers

- Level 5 Critical factors of the bank

- Clerical staff

- 40 opportunities for growth

- 30 equal opportunity

- Customers

- 50 rise in deposit interest

- Front line managers

- 25 It should provide a level playing field

- Clerical staff

- Level 6 What customer wants from bank.

- Customers

- 50 personalized customer service

- Customers

- Level 7 What are the common complaints

- Clerical staff

- More tellers in the counter

- Front line managers

- Technical related problem during transaction

- Are the customers satisfied with service Level 8

- Clerical staff

- 45 Yes

- 20 No

- 5 yes & no

- Front line managers

- 20 Yes

- 5 No

- Clerical staff

- Do you like the service of the bank Level 9

- Customers

- 35 Yes

- 10 could improve

- 5 No

- Customers

- On scale 1-10 which scale you put for bank Level 10

- Customers

- Scale 8 – 32

- Scale 6 – 10

- Scale 4 – 8

- Customers

- Level 11 Whether bank as wide range of products, think to move to another bank

- Customers

- Yes it has – 35

- No – 15

- Won’t move – 40

- It depends – 10

- Customers

Linear Programming to Analyze the Data

Linear Programming analysis of data analyses their quality and their importance of uses. Also, varied knowledge is provided which determine the characteristics of the data. These are actually used by the organizations for determining the factors depending on different values of the business. This knowledge also includes critical values too. This helps the customers to have better insight of the business. The study also determines different decision making functions too. The linear programming results in a better classification. The main disadvantage is that it reduces the speed of the system varyingly. It is based on the warehousing method of gaining data.

Conclusion

In this report different methods for finding data in the Commercial bank of Ceylon have been described. Necessary data have been included which are tend to enable the Bank in finding out the best requirements for the customer. These data are relevant in providing information about the current situation of the Bank, whether the consumers are satisfied with it or not. By enquiring results from these methods Bank is possible to consider consumer needs for satisfying them. The study also explains about the decision making tools like linear programming, which helps in determining the critical issues faced by the businesses.

Reference List

Ackermann, F., Eden, C & Cropper, S., 1996. Cognitive mapping: Getting started with cognitive mapping. Banxia Decision Explorer. Web.

Data analysis: Qualitative analysis–what it is, 2007. University of the West of England: Bristol. Web.

Decision tree analysis, 2010. Mind Tools. Web.

Harris, D C., 2010. Quantitative analysis. Analytical Chemistry Journal. Web.

List, D., 2005. Know your audience: Chapter 16 content analysis. Web.