The Banking industry is one of the most growing service sectors in the world. The concept of banking was not as similar as now it is. From the very beginning, the banking sector has been enlightened with various types of innovations. There are lots of new dimensions, which added some additional values with the basic banking service. The social responsibility of the banking industry is one of them.

The banks of the present day are not only profit-oriented but also environment and society faced. For this reason, the banking industry has been termed green banking, ethical banking, and social banking. This society orientation and environment-friendliness of the banking service has provided some opportunities for the banking sector to grow with more customer loyalty. This study will discuss these matters along with some factual examples of the modern banking industry from different countries of the world.

Rose & Hudgins (2008, p. 188) argued that a bank could be defined by considering three terms for which it serves. Firstly, the economic functions it serves, secondly services it offers to the customers, and finally, the legal basis of its existence. In the ancient instance, the idea of banks had derived from the tendency of the people to keep their valuable things to a wealthy person of the society, and against that, they got money or other equivalent things. There was some sort of loan-giving tendency identified in ancient Greece.

These were the simplest form of banking. This function of the bank has become wider spread and now the banking industry has more responsibilities than ever before. On the other hand, banks are now offering various types of services along with ancient jobs. Banks are now the most easily accessible and dependable sources of getting loans. Not only the individuals but also different types of business entities even the government itself are getting loans from the commercial banks. Worldwide banks are the leader in the sanction of loans in the financial service-providing sector. For the most of modern business has become dependent upon the banking industry for their payment, purchase, and collection of the fund after the sales.

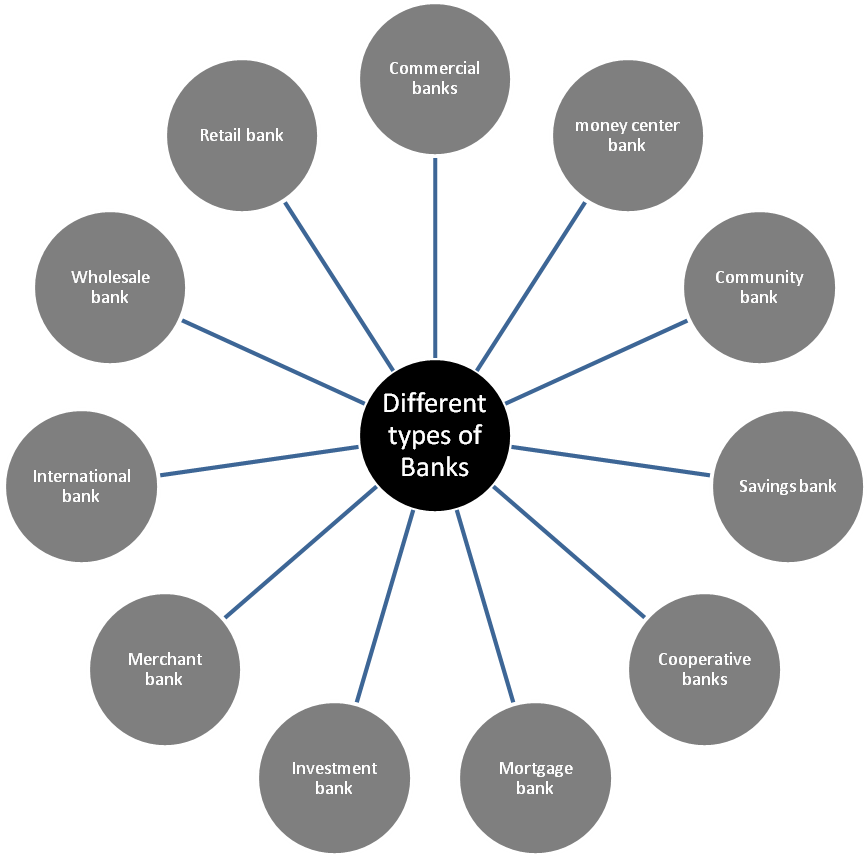

Banks have different types of instruments, which has designed to serve the customers accordingly. Checks, banknotes, credit and debit cards, and many more are examples of these. The banking services become more reliable and essential for a developed nation that every nation have a central bank to control, harmonize, and accelerate the banking activities. The central banks have to do widespread jobs to perform for example currency control, regulate the commercial banks, and act as a reservoir of the foreign currency. The banking industry is now experiencing a transformation period worldwide as it is transforming from manual to more technology-driven. Thus, there are different types of banks, which provide different services today. For example:

Rose & Hudgins (2008, p. 3-4) argued that these different types of banks are serving the customers in different ways. Customers treated a bank as a successful one, which gives the highest benefit for them. However, the main concern of a commercial bank is to maximize its profit but the banks are facing challenges to become socially responsible. In almost all countries of the world, the banking industry is one of the most significant and growing industries. Many banks are establishing day after day and making the industry more competitive.

Banks have to notice various types of incidents like the borrowing patterns of the country, monitoring the borrowers, assess the risks regarding the banking service, manage financial risks, and organize the payment systems. These are the common functions done by almost all the banks. Thus to have competitive advantages many banks are now becoming socially responsible. These banks are now adopting social responsibility policies, which target to improve the life of the community and to do betterment of the society. This study has aimed to explore the effects of the social responsibilities of these banks on their operations and to assess their performances for taking the social responsibility policies.

Dr. Ian Manning, who was a researcher of the National Institute of Economic and Industry Research, stated that socially responsible banks ensured their obligations to serve the poor people by the basic banking service. The bank has to charge less or almost no for the poor banking service customers. Ian R. Harper argued based on Manning’s research that for the poor people who want basic banking services, the present banking system is inefficient because the charge asked by the banks to keep an account with them and charges for the transactions of money is not affordable for the poor.

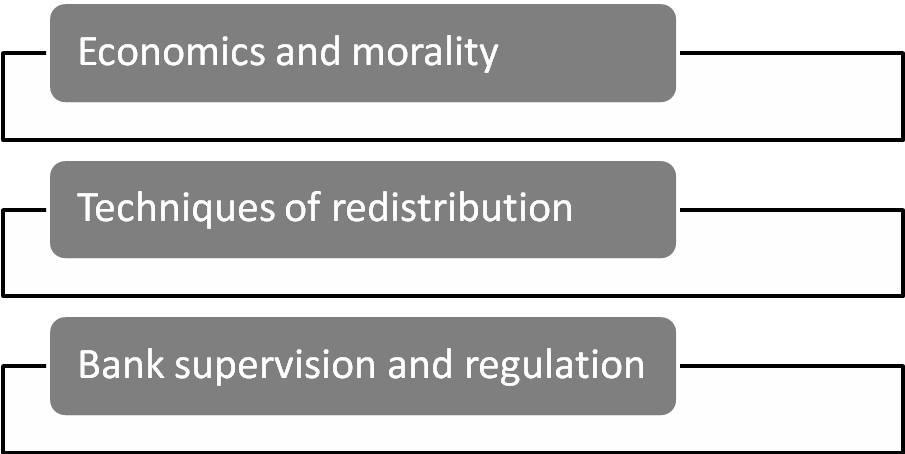

There exist an inequitably as the poor are charged the same as the rich. Thus, the poor people have to spend disproportionately and a significant amount of their limited income is being spending in these ways, which keep barriers to the concept of universal banking. Dr. Harper presents three bases for the banks to become socially responsible entities. These are:

McDonald & Rundle-Thiele (2008, p. 230) and Wilks (2003) addressed that the business entities have social responsibilities and as banks are also business entities, they have to have some society orientation. The banks must be economic and they have some moral concerns. Though this is a controversial view concerning economic rationalism, general equilibrium theory does not say anything about morality. Thus, the banks seem to have no concern for the betterment of the society and they behave only like economic.

The principles of economics act not for the social and moral context. Economics argued here that the maximum use of the minimum resources is to be done for the meeting of the material needs of humanity. Nevertheless, civilization is not a function of material needs only. Harper (1995, p. 393-396) also stated that along with the individuals and the government, business entities like the banks must do some social welfare works, which have the target of not only the economic concern but also the moral concerns.

Harper (1995, p. 394) has analyzed the above statement that the banks are socially irresponsible regarding the charges of the services. He said that civilized society must put pressure on the banks to become socially responsible through increasing morality. He proposed to redesign the techniques of the bank service like free of charge services or heavily discounted charges. In this case, the government is found much irresponsible of the society.

It does not care about the charges of the banks while designing the laws for the banking sector. The government levied high taxes to the banks and banks irritate the customers by charging highly to offset these government taxes. These were found by research by the National Australia Bank in 1995. Dr. Harper insisted that the banks must become socially responsible by redistribution of their intermediation services with efficient wealth creation. (Harper; 1995, p. 393-396)

Banks have a relationship with the central bank in almost all countries of the world. Harper (1995, p. 395) suggested implying this relationship based on some obligations to pay for it and the benefit of the society. Banks are bound to obey the regulations designed by the central bank. These regulations often offset the privileges enjoyed by the banks. Becoming a socially responsible bank, a bank can get some relief from these regulations. For example, the fail of the state bank of Victoria can be taken.

The research found that the disastrous situation faced by the State Bank of Victoria was a result of unwise investment decisions. The central bank supervises the bank but it could not give protection about the investment decisions. This incident implies that the nature of the social orientation of a bank can help it to overcome this type of situation and to diminish the supervisory impact of the central bank. (Harper, 1995, p. 393-396)

McDonald & Rundle-Thiele (2008, p. 5) argued that the effects of ethical and social responsibility of the banks would help the local development. To diminish the global humanity problems economics can be an effective force. For this, UNESCO had designed their medium-term strategy with the theme “Humanizing and Globalization”. The objectives of these strategies were to emphasize the ethical values of economics to the life of the people. Barbu & Vintilã (2008, p. 29-32) argued that the institutional farming and the designation of the norm to channel of the market is favored by the development of the socially oriented economics as an opposite force of the self-regulated market. They found that there are competitions among the banks of innovation of new technologies, offering new conceiving services, and diversifying their investments in new sectors. However, there is a lack of competition in the case of practicing ethics in the service.

Kendall (2003, p. 1-3) pointed out that the concept of banking ethics is a new term, which includes the banking actions concerning the ethics. The research presented the concept that was used previously but with less effort and different dimensions but now, these concepts are using to build an inter-bank relationship. Thus, the term “Ethical bank” comes to action. Ethical banks are doing many works besides the basic functions of the bank. For example, BID Amerique became an ethical bank by assembling the ecological context in its operations.

This bank ensured their resources, infrastructures, and services to made shelters for 600 million people. They came to this action as they find their social responsibility based on ethics. Another good example of an ethical bank is the “Grameen Bank” of Bangladesh. Grameen Foundation (2008, p. 12-25) reported that in the rural part of the country, the bank provides micro-credit to the poor people who do not need a large amount of loan rather they need a little amount to begin a small business. Grameen Bank gives them the opportunity. To provide micro-credit to the poor people was a new idea and this idea spread out now in almost all countries. For this newer concept Grameen bank and its founder, Dr. Muhammad Yunus received the Nobel Prize. Ethical banks have some different dimensions regarding their operations.

Barbu & Vintilã (2008, p. 30) also added that many banks keep emphasizing the health of the people and invest in education and art. In this case, the Swedish EKOBANK can be taken as an example. ETHIKBANK of Germany became an ethical bank by providing charitable funding and contributing to the religious sector. This bank was founded with a fund of 24 billion euro, which was an ethic-ecological fund. Barbu & Vintilã (2008, p. 30) has presented information about the emergence of ethic that is socially responsible banking in Africa, Asia, Latin America, and Eastern Europe. In these regions, the official financial institutions have alliances with less official institutions which significantly turning these official institutions become socially oriented.

Barbu & Vintilã (2008, p. 31) used the term corporate social responsibility (CSR) differently for the banks, as the banks are more profit-oriented and operated within a financial environment. Their research found that internationally the corporate ethics is being highlighted and various initiatives and measures are taken for this purpose. They concluded that the ethically introduced banks and credit cooperation are now accepted base on types of institutions, macroeconomic factors, and individual characteristics of the customer. Both of these types tend to concern the human individual and its needs.

McDonald & Rundle-Thiele (2008, p. 2-10) proved that the corporate social responsibilities by the bank bring customer satisfaction as a result. They argued that the social responsibility practiced by the banks is a function of some positive consequences like profit increase, strong customer loyalty, trust, favorable brand attitude, and offsetting negative publicity by the rivals. Research stated that most of the customers switch banks for being dissatisfied with the existing banks.

These sorts of dissatisfactions come from the high price, lower interest rates, and the behavior of the front-line employees of the bank. McDonald & Rundle-Thiele (2008, p. 2-10) also suggested that the banks must transfer a significant amount of resources to the corporate social responsibility works, which will bring the social orientation nature of the bank and drive the customers towards satisfaction. However, they drew the opinion that socially responsible banking has not the only target of customer satisfaction.

There was found a mismatch between the consumer satisfaction level and massive spending on socially responsibility programs by some banking industry surveys. Customers found much satisfaction if the bank directly give them any benefit rather than invest heavily into social improvements. McDonald and Rundle-Thiele thus suggested that the banks should invest heavily to direct benefits of the customers rather than investing the corporate social responsibility.

Wilks (2003, p. 3) stands against this view by stating that consumers are now expecting broader investments in the social welfare sector when the corporate social responsibility of a firm has a positive influence on the customer’s purchasing decision-making. They found that as the Australian banks have a lower level of awareness regarding corporate social responsibility, their initiatives have lower engagement with actual social welfare, and this consequence results in the lower loyalty of the customers for any bank. Consumers show a low level of awareness about the bank’s social responsibilities and thus they found banks only for the basic functions of the bank. Through the chi-square test, in their research, they found that the consumer could comment on almost all of the financial activities of any bank where they have no idea about what welfare works for them.

This part has focused on the research paper of socially responsible banking sectors, which can effectively work for further procedures of the study. Fortunecity.com (1999, p. 1) argued that there are mainly two types of methods used in market research, one is qualitative research, and another one is quantitative research. For this research paper, the quantitative approach of methodology is appropriate to collect formal, objective, systematic information of numerical data about the related information for helping the study. There are mainly three types of quantitative research, which are:

- Descriptive Research.

- Quasi-Experimental Research.

- Experimental Research.

As per the requirements of the study, the experimental research approach is selected, which is designed to examine the cause and effect of different dependent variables through to the independent variables. In experimental design, there are allowing the number of possible control factors, by which the cause of the research can be examined more accurately. There are three parts, which are:

- Manipulation.

- Control.

- Random Selection.

Factor design is one of the latest approaches of experimental design, which is allowed two or more different characteristics, treatments, or events, which are independently varied for this study of socially responsible banking. By this approach, multiple causality factors are examined with the logical decision. There are two levels in each factor design of the experimental method, which are:

- Level of Relaxation.

- Level of Distraction.

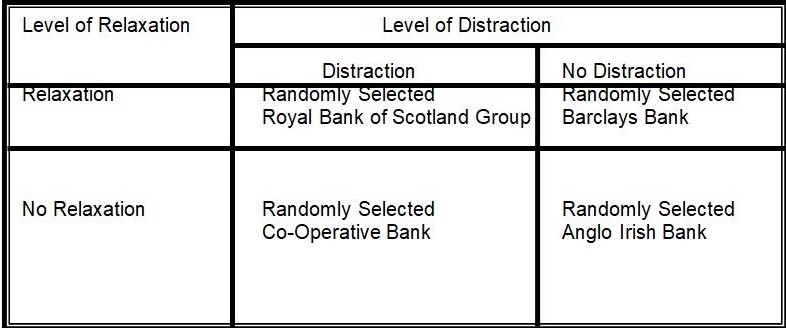

If the top banking sectors of UK is examined, then it is identifiable that, there are lots of successful banking business, from which, four banks are selected, two of them are concentrating on profit orientation and other two are concentrating on social responsibilities of their communities. Their performances according to financial reports of these banks are given in the table below:

There are two banks, which are recently changed their corporate social responsibilities rather than high performances are described in brief form.

- Co-operative Bank: The Co-operative Bank (2001, p.26) added that the social responsibilities of Co-operative Bank are related to ethical policies with equal employment opportunities, health, safety, and community involvement between socially responsible groups. This bank is also ensured social engagement activities rather than concentrating on marketing strategies and devices. In recent years, Co-Operative Bank is focused on climate change and the prohibition of financial war as social responsibilities towards the community.

- Anglo Irish Bank: Anglo Irish Bank (2009, p. 17) argued that as a socially responsible bank, the corporate responsibilities are committed to the development and training staff of their organization. They are also maintaining a quality relationship between stakeholders and staff for the ongoing development of their business. They are also responsible for environmental issues efficiently in an innovative way. Anglo Irish Bank (2008, p. 2) added that the corporate social responsibilities of the Bank are supporting the development of the wider community in the programs of arts, education, and sport as an important strategy. The other two profit-oriented banks are developed their strategy on the responsibilities on their investments according to their performances are described below:

- Barclays Bank: Barclays (2008, p. 55) mentioned that the responsibilities of Barclays Bank are committed to protect and enhance brand reputation as a leading field in corporate social responsibility. They are also fairly treating customers with a business reputation in customer services and complaints. Overall, they are committed to the environmental strategy and more focused on business strategies.

- Royal Bank of Scotland Group: RBS (2008, p. 43) stated that this bank believes in high standards in social and ethical responsibilities in its business on their activities. They are developing responsibilities by a focus on effort and resources in the managerial framework of current performances and initiatives of the bank. More on, they are extending their structure as their corporate responsibilities.

By analyzing the corporate responsibilities of these four banks, the design of experimental research based on factorial design has developed in the following figure:

The part, Relaxation has focused on the organizations lose their responsibilities according to their community. On the other hand, the level of distraction has mainly focused on the avoidance of responsibilities of their investments in the market.

Here, “Anglo Irish Bank” is in the part of no relaxation and no distraction, which is defined as that, they have focused on their corporate social responsibilities and not compromising their performances in the market of banking industries.

On March 16, 2009, leaders of financial service industries and the environment-concerned organizations met at a summit in Washington DC. The main concern of this summit was to find an effective way to use the financing and investing mechanisms for the betterment of the world’s forests. Later the meeting has organized by the World Wildlife Fund, which gathered experts from the financial association, trade group, environment concerning entities, and many others. It has also aimed to track the socially responsible practices of the financial organizations along with other types of businesses and the effect of their supply chain management in society. That summit finds out that the social responsibilities of the financial institutions mainly on the environmental issues like forests.

Euromoney Institutional Investor PLC (2003, p. 4) suggested that to make the financial sector sustainable these summits helped by conquering various types of ways. Socially responsible banking thus achieved a priority. The Head of WWF, Mr. Richard McLellan said that implementing and applying accountable investing philosophy and standards not only gives to the preservation of the world’s most important and threatened forests but is also a key driver in fostering corporate and social responsibility throughout the global marketplace.

He also said that the key concern of the financial and environment-oriented leaders should be to persuade socially responsible lending of the financial institutions and the investors, which will help to assess the environmental and social risks. The above speeches it has made clear that the outcome of becoming socially responsible. The socially responsible banks have a responsibility not only to improve the life of the people but also for the forests and other environmental ingredients.

Wsbi.org, (2006, p. 9) stated that the major type of bank is the savings bank. In the whole of Europe, the savings banks are sharing values, norms, beliefs, and many other factors, which are different from country to country. These actions of the savings banks’ positive attitudes towards the customers are spreading and as a result, certain types of clients are now attaching psychologically with these banks as they are noticing the public-oriented nature of the banks. Thus, the savings banks are considering a stakeholder model.

This model aims to seek the values and using these values to return them to the stakeholders. By doing so, the savings banks are convicting that they have more social responsibilities rather than financial activities. However, the natures of the banks are profit-oriented and they use all of their efforts and effectiveness to achieve the highest level of profit margins and earn good competitive advantages. However, there is increasing pressure on these savings banks to use a good proportion of their profit margin for the welfare of society. As banks are a part of a society, they are now considering spending a significant amount of money for the betterment of the society along with concerning their profit.

Euromoney Institutional Investor PLC (2003, p. 3-8) added that the term socially responsible investment is another significant way for the banks to become socially responsible firms. Banks have social responsibilities to not only the religious, charitable, government, environmental, hospital, educational institutions but also to the individual people, though there are significant differences among them.

For individuals, the responsibility of the bank is somewhat personal. The investments of the banks and the individuals or other forms are one of the key sources of money. Banks have two major types of funds called mutual funds and individual or separate accounts. The socially responsible banks have introduced these accounts with a society-friendly view and termed them as socially responsible mutual funds. The socially responsible investment explores a strategy to do betterment of the society. This strategy has three parts and these are securities screening, shareholders advocacy, and community investing.

Most of the firms try to avoid the screening of being socially responsible. If this nature can be diminished, the positive attitude towards the securities of the public will be developed. Besides most investors of banks insist the bank not to invest their money in a social welfare work which will not bring any profit. Most of the investors always keep pressure on the bank’s management to ensure the actions of the bank are in the interest of the investors, which works as a barrier for the bank to help people in natural or social crises. Relatively few investors act as socially responsible who seek high-impact investment opportunities.

This attitude supports the sensitive community services for the people who earn lower than many others. For these types of people, the credits and capital are not readily available and thus they want to spend on their basic needs like health care, housing, clothing, and so on. For these three reasons, the banks are finding it difficult to become socially oriented.

Both the socially responsible investment and the corporate social responsibility are related and they are individually dependent on sustainable developments. Where corporate social responsibility is widely treated as the voluntary business contribution for the betterment of society, socially responsible investment can be treated as the result of the implementation of the sustainable development theory along with the concept of corporate social responsibilities concerning the investment decision.

The banks have effective ways to achieve their sustainable development. Thus, socially responsible investment has different dimensions. The strategies may be focused on social issues like human capital, community development, and labor rights. Another dimension is that it can focus on environmental issues like urban and industrial pollution, global warming, and greenhouse effects. Then, it can concentrate on ethical issues for example human rights, use of weapons, tobacco, and alcohol. There can be a combined approach, which adds all three approaches.

In the financial sector, the banking industry has the socially responsible investment that takes place upon the most common concept of corporate social responsibility. The importance of socially responsible investment is shown through the researches that this concept is accepted by both individuals and the banks. Socially responsible investments are increasing in numbers in recent years.

Over the time of 2003 to 2006, the growth was increased up to 36%. The socially responsible investment is 10-15% of the total investments in Europe. This type of investment by the European investors is about 1138 billion euro in 2006 along with almost 338 socially responsible funds. The stock market has established the SRI or sustainability indices, as the phenomenon is more important. Stock markets rated the company by outstanding corporate social responsibility. As a result, the green, social, and ethical banking sectors are now growing with good numbers of funds. (Steurer, Margula, & Martinuzzi, 2008, p. 6-7)

One type of socially responsible banking is to help the environment to sustain itself by funding environmental issues. It is called green banking. Here the term community investing is widely used which means the dollars coming from the banks, credit unions, venture capital firms, trusts, and many other organizations that are used for the betterment of society. Green banking is producing some important events such as forest preservation, clean water production, eco-tourism, environment-friendly farming practices, and the recycling of the wastes properly. Many banks of different countries are now becoming green banks by helping the environment using their investment funds.

An institution or firm, especially a bank can become a community investor by using the profits from the savings account, checking accounts, mutual funds, and also from the direct high investment sectors. Among the socially responsible investment, community investment is the fastest growing sector. In the United States, the growth rate was almost 41% from 1999 to 2001. There are also some other types of socially responsible investment which are like community investment. The importance of the social responsibility banking emphasize these types of investment and thus make this investment attractive one (Kendall, 2003, p.1, 3)

From the above discussion, there are some key findings, which are listed below.

Global Forest & Tread Network (2009, p. 2) argued that for most of the banks the environment outside them is important for both ideological and commercial reasons. The concern for the environment and the concern for profitability are closely related. A bank must be affected internally and externally by the ecology. Thus, banks must put effective efforts to do the betterment of the environment. They can do so by investing in the social welfare funds or can diminish their operations, which affect the environment negatively.

Customers are now considering their choice regarding the bank based on the social introduction of the bank. Some customers prefer socially-oriented banks. They find the bank as a friend of the environment and community so they would like to invest for social welfare for example many banks funding to protect global warming or keep the environment free from pollution by funding for plantation projects. To keep in mind the nature of some customers, various banks are now become socially responsible to attract customers who are the major influencer for green banking and ethical banking and these types of services.

Besides, there are some types of customers who are not concern about the environment and society as well. They think their investment must use for some profit-generating business so that they can get the maximum benefit of their investment. For this type of customer, the banks fail to maintain their social responsibilities. There are some banks, which are intended to be ethical, but for their customer demand and pressure from the investors, they cannot do so. These customers treat the banks as a center for money generation and think that banks have nothing to do for social welfare.

Wilks (2003, p. 3) said that as the banking industry has responsibilities to society, they would have to invest in some way for the enhancement of society. Now banks are initiating funds to meet their social responsibility by cutting significant amounts from their profit and invest this amount in social issues. There are many ways for the banks to invest like community investments and many more. Banks realized that spending for social welfare is not a bad expense rather this can generate profit also. The customers who like the socially responsible banking will become a loyal customer if the bank does so and persuade others to invest with the bank. By this, the bank can get a good number of customers. Banks are now coming up with a large number of funds for the improvement of society and this scenario is developing day by day.

From the above discussion, it can be said that the socially responsible banking industry is comparatively a novel idea and the industry has been integrating the concept at a raising rate. Some recommendations could be drawn for better outcomes of its implementation.

- The Members of the modern banking industry need to be socially responsible and environmentally conscious. The banks, which have a negative attitude towards socially responsible banking, must be taught that the betterment of the society or environment will result in the betterment of the customers indirectly. Customers are the key concern of any business. A well-educated and sensible customer can be an asset to a bank. Banks will have to arrange some types of seminars, symposiums, conferences regarding the matter which will convey the clear idea of socially responsible banking to the customers before investing their money in that field. If the customer once gets the proper idea, they will certainly agree to invest for the betterment of society.

- The banks must be maintaining the rules regulated by the government, which ensures the socially responsible banking service. The government has already employed the rules and regulations strictly. Banks invest their funds in various types of business. They must become aware that their business does not harm the environment. Besides, there are many projects, which can be taken by the bank as a part of a socially responsible bank. Arranging housing opportunities for the poor for fewer prices, giving the poor people loans with low-interest rates, giving them the opportunities to get a small number of credits, lessening the credit-related conditions for the poor, and attracting investors for the betterment of the poor are some of the key activities that a bank can arrange. Banks may become human-friendly by that process.

- The banks must arrange some promotional activities aimed to reach the attention of the customers. There are different types of media are available for this work. Television, radio, web, internet, newspaper, magazines, billboards, banners, and many other ways can be used by the banks to convey their social programs. People of present days are easily reachable as through these communication ways almost all people are easily accessible. Customers who were not informed about the social orientation of banks can easily become aware of that. This will help the customer while he /she will go to invest with a bank. Certainly, a civilized customer will invest with the bank, which has socially oriented.

- Banks can differentiate their service based on their social responsibility. They can arrange some accounts, which would deliberately invest some portion of the investment to the betterment of the society. While serving any customers, the bank can persuade the customer to do environment-friendly work or work for the advancement of society.

- The banks should practice transparency about their use of the investments from the customers. That means the customers must be informed properly about the socially responsible way where the bank is spending money.

The Banking Industry is one of the key tools of transaction in a fast and innovative world. At the beginning of the banking business, the basic banking service was the key function of the banking industry. However, the demand for other related services is increasing day by day. Now customers want some additional service along with basic banking. The responsibilities and duties of the banks have increased and thus new dimensions are added with the activities of the banks. Socially responsible banking is the concept, which shows a new dimension.

According to this idea, the banks must do some social welfare such as it can invest in health awareness, contribution on law and order situation, empowering women rights, and developing of literacy rate. The banks have profited from investments in various businesses. These investment funds are provided by the individual investors who keep their money with the bank. As customers are the key concern for the banks, the banks design their service accordingly to the demand of the customers. Customers of the banking sector are now become sensitive, as the number of banks has increased significantly.

Now customer assesses the banks based on their performance and activities. Socially responsible banks are accepted by the customers, as they are concerning for society and the environment. For this, various types of socially responsible banking practices are introduced. Green banking, ethical banking, and social banking are the three most common forms of banks. Research has found that socially responsible banks are accepted widely by the customers. This brings the loyalty of the customers as they find that the banks are doing something for the enhancement of the entire society. International banking and many other banking activities are becoming socially-oriented for this reason.

Reference List

- Anglo Irish Bank, (2008). Annual Report and Accounts 2008.

- Anglo Irish Bank (2009). Corporate Social Responsibility.

- Barbu, T., & Vintilã, G. (2008). The Emergence of Ethic Banks and Social Responsibility in Financing.

- Barclays (2008), Barclays Bank of Botswana Limited Annual Report 2008. Web.

- Euromoney Institutional Investor PLC (2003), Profitable Socially Responsible Investing? An Institutional Investor’s Guide.

- fortunecity.com (1999), Ways of approaching research: Quantitative Designs.

- Global Forest & Tread Network (2009). Environmentally and Socially Responsible Trade Financing Mechanisms Key to Conserving World’s Forests. Web.

- Grameen Foundation (2008) Grameen Foundation 2007–2008 Annual Report: Voices from the Field.

- Harper, I. R. (1995), What are the social responsibilities of the bank?

- Kendall, S., (2003). As “Green Banking” Flourishes at the Grassroots Level, 10 Leading Proponents across U.S. Honored. Web.

- McDonald, L. M., & Rundle-Thiele, S. (2008). Corporate social responsibility and bank customer satisfaction. Web.

- RBS (2008). The Royal Bank of Scotland Group: Annual Reports and Accounts 2008.

- Rose, P. S., & Hudgins, C. S. (2008). Bank management and financial services, 7th edition, McGraw-Hill.

- Steurer, R., Margula, S., & Martinuzzi, A. (2008), Analysis of national policies on CSR, In support of a structured exchange of information on national CSR policies and initia-tive, Vienna University of Economics and Business Administration.

- The Cooperative Bank (2001). The Cooperative Bank: Financial Statements 2001: Highlights.

- The Cooperative Bank (2001). The Cooperative Bank: Social Responsibility.

- Wilks, A. (2003). World Bank social and environmental policies: abondoning responsibility?. Web.

- wsbi. (2006). Savings Banks’ Socially Responsible Activities, A Wealth of Experience.