Abstract

Technological development has become common over the last couple of years, making businesses change the way they operate. The banking business has also changed from the traditional banking system to the online banking system. This paper differentiates the two banking systems by giving the benefits and problems associated with each system. The paper recommends online banking over traditional banking.

Introduction

Online banking is defined as the type of banking whereby the customers of the bank or any other financial institution are able to carry out financial transactions through the Internet on a website that is usually operated by the institution. A customer has to be registered with the banking institution to be able to access mobile banking. On the other hand, traditional banking is the type of banking whereby transactions are not done on the Internet (Rajaobelina, Brun & Toufaily, 2013). The customer has to make all the transactions in the physical premises of the banking institution. The customer makes deposits in the bank and the bank can issue loans. Capital is basically obtained from the deposits made by customers. Withdrawal of money is done over the counter or by use of a check.

Online Banking

Problems and issues

Benamati and Serva (2007) indicate that, “more recently, the growth of online banking has raised issues of trust and distrust once again in the mind of the consumer” (p. 64). One of the problems that a customer is likely to encounter while using online banking is the issue of customer service. It is important to note that there are some problems that need personal assistance, which is not available in an online bank. In addition, there is no personal level interaction with this system considering that there are some customers who like personal level interactions (Nathalie & Djelassi, 2013).

Another issue that is concerned with online banking is security. Hackers are increasing each day. There have been cases where online bank customers have lost their money to hackers. The information on customers is stored on the Internet and is only protected by the use of passwords and usernames. This does not make it secure enough (Wong, Rexha & Phau, 2008).

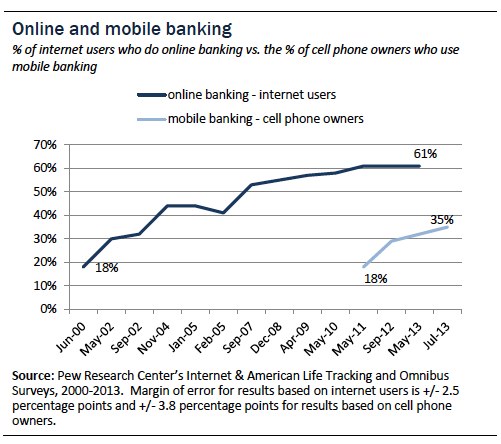

Finally, there is the issue of the Internet necessity in online banking. According to Fox (2013), more than 90% of Americans have direct Internet access, with 61% of all Internet users in the US using online banking. Thus, not everyone is connected to the Internet at all times. This might be inconveniencing to some people.

Advantages and benefits

Online banking has helped customers save time that they used to spend queuing in the banking halls. Customers can now make transactions in the comfort of their homes as long as they are connected to the Internet. Secondly, online banking has made it easier for customers to pay bills, as well as address other financial matters. Moreover, the rates of interests that are charged by online banks are relatively lower compared to the rates charged by traditional banks. Online banking is cheaper given that banks incur reduced overhead costs. For instance, online banks do not have to spend much money on paying rent and wages (Wong, Rexha & Phau, 2008). The banks do not need to hire many staff members compared to the traditional banks. Finally, conducting business has become easier and faster when making online transactions.

Why online banks are better than traditional banks

Online banks have revolutionized the banking sector by making it better and bigger since the inception of online banking. To begin with, online banking has helped customers save the many hours they have to wait queuing in traditional banking systems. Online banking is considered to be secure as long as the security certificate of the website is valid. Thirdly customers can access their accounts at any time and from any place as opposed to traditional banking. Finally, business has been made easier and faster by online banking. These are among the reasons why online banking is better than traditional banking (Wong, Rexha & Phau, 2008).

According to Williams (2005, p. 96), “most bill payment sites include a payment activity page that lists all of your payments and their status”. This implies that online banking is much more efficient and enhances experience on the user side, while facilitating quick service delivery by service providers.

Why Smartphone banking is safer than using your PC

Information technology experts argue that banking on Smartphones is safer and more secure than banking on PC. A higher level of security is guaranteed when one uses a Smartphone, although it is easy for hackers to develop malware for Smartphones than for the PCs. It is easy to attain authenticity when using Smartphones compared with personal computers. Therefore, banks can easily develop banking applications that can be used on different Smartphone platforms. Consequently, this will help in attaining authenticity and preventing hackers from advancing malware functions (Urken, 2012).

“On the software side of the equation, mobile banking apps pose a problem for hackers, because they are hard to imitate and are constantly changing” (Urken, 2012, para. 20). The constant changes in the Smartphone platform are an advantage to the user as it makes it hard for hackers to keep pace with the changes.

Online banking charging into the future

The future looks bright for the online banks as most people are moving the digital way. Many people have access to the Internet and they can access their bank accounts online. It was estimated that 2.2 billion people around the world used the Internet in the year 2011 (Rajaobelina, Brun & Toufaily, 2013). Currently, the number of Americans who use online banking is approximately 63 million people (Statistic Brain, 2013). About 22 million people bank online in the UK. Online banking security has improved. Fraud has decreased by 36% since 2009. Moreover, a survey carried out in the US indicated that 44% of the respondents felt safer while banking online (Gemalto, 2013). In addition, the benefits that are associated with online banking are likely to lure more customers into joining the online banks.

Traditional Banking

Problems and issues

There have been many robbery cases that have been reported in the traditional banks over the years. Customers lose money and lives, while others are injured in the robbery activities. Insecurity is, therefore, a major issue in the traditional banking systems.

In traditional banks, time is limited as most of the banks are open during the day from morning to evening. Consequently, it is not possible for customers to get services any time they want. This reduces the level of convenience in traditional banking. Another issue with the traditional banks is the long queues that characterize most of the banks. Customers waste a lot of time as they wait to be served. Finally, the fee charged by traditional banks is higher compared to the fee charged in online banking (Al-Hawari, Ward & Newby, 2009).

Advantages and benefits

First, most activities are monitored with the help of surveillance cameras. This ensures that workers do not mishandle money. It is also a measure of improving security in the banks. Secondly, customers can be served on a personal level. Customers can create a good relationship with the bank workers. This helps in developing customer loyalty and trust with the bank (Al-Hawari, Ward & Newby, 2009).

Thirdly, it is possible to access other services when one uses a bank. For instance, one can get debit cards and ATM cards, among other services. In addition, money deposited earns interest. Interest can be a source of income for the customers.

Abandoning the traditional bank

The high costs associated with traditional banking, the long queues that waste a lot of time as customers wait, as well as the inconveniences involved could be among the factors why many people are going to abandon traditional banks. Making payments using the traditional banks is tedious and time consuming compared with online banking where payment is made by the click of a button. These trends will lead to people abandoning the traditional banks in the near future. For instance, Citi Bank is expecting to get more customers in the future if it incorporates online banking. Most people are likely to move into online banking given the increased access to the Internet. Gemalto (2013) indicates that up to 111 million people in Africa can access the Internet, while there are up to 835 million Internet users in Asia. These, among other huge numbers of Internet users globally, will most likely embrace online banking.

Recommendations and Conclusion

The benefits that one gets from online banking are more compared to those obtained from the traditional banking system. Online banking saves people time that they would have spent waiting in lines in the traditional banks. Further, online banking is cheaper in that the interest rates are low. It is possible to access one’s account at any time and from any place. I would, therefore, recommend online banking in place of traditional banking.

References

Al-Hawari, M., Ward, T., & Newby, L. (2009). The relationship between service quality and retention within the automated and traditional contexts of retail banking. Journal of Service Management, 20(4), 455 – 472.

Benamati, J., & Serva, M. A. (2007). Trust and distrust in online banking: Their role in developing countries. Information Technology for Development, 13(2), 161-175.

Fox, P. (2013). 51% of U.S. adults bank online. Web.

Gemalto, (2013). Stats, e-banking security. Web.

Nathalie, T. M. D., & Djelassi, S. (2013). Customer responses to waits for online banking service delivery. International Journal of Retail & Distribution Management, 41(6), 442 – 460.

Rajaobelina, L., Brun, I. & Toufaily, E. (2013). A relational classification of online banking customers. International Journal of Bank Marketing, 31(3), 187 – 205.

Southard, P. B., & Siau, K. (2004). A survey of online e-banking retail initiatives. Communications of the ACM, 47(10), 99-102.

Statistic Brain (2013). Online banking statistics. Web.

Urken, R. K. (2012). Why banking on your Smartphone is safer than using your PC. Daily Finance. Web.

Williams, K. (2005). Online banking: are you ready? Black Enterprise, 35(12), 93-100.

Wong, D. H., Rexha, N., & Phau, I. (2008). Re-examining traditional service quality in an e-banking era. International Journal of Bank Marketing, 26(7), 526 – 545.