Takaful Insurance and its difference from conventional insurance

Insurance is a cover against loss of insurable interest and hence a need for individuals and businesses to safeguard themselves by mitigating risks and losses so that catastrophic events have a lesser impact on the life of individuals and their wealth. Financial institutions also resort to insurance cover for covering losses. When Islamic banking was introduced in the 1970s, insurance also was sought to be brought under Islamic principles (Ayub).

Mutual risk arrangement

The difference between Takaful and conventional insurances lies in the manner in which risk is managed and Takaful fund is operated. The constituents are operators and participants in Takaful whereas there are an insurer and insured in conventional insurance. The management of risk refers to the way risk is assessed (underwriting) and handling. Islam does not approve of uncertainty, gambling, and interest which are all present in traditional insurance. (Iqbal).

In order to be free of Gharar, a Takaful contract must be subject to full disclosure from both sides so that there is complete clarity. However, as this not practicable, exchange of Gharar is best avoided among the contracting parties. (Iqbal). Prohibition of Maisir (gambling) is an extreme form of Gharar that does not allow risk transfer on a speculative basis. Riba is also circumvented by treating the extra amount payable as a means of equal participation in the risk. In Takaful, the contribution is considered as compensation. Further, under Takaful, the funds so collected should be managed and invested following Shariah principles (Iqbal).

Islam does not prohibit risks as they are a reality. It only prohibits trading on risks. Islam does allow mutual help in any situation including when some misfortune strikes. Both forms of insurance deal with risks but in a different manner from each other. Under conventional insurance, risks from various insured persons are transferred to the insurer by the insured against the exchange of premium collected by the insurer. On the other hand, under Takaful risks are shared by the participants (insured) by contribution to fund under a mutual guarantee scheme to be managed by Takaful operator Wakeel (agent).

Thus, there is no risk transfer to the operator in Takaful insurance. Conventional insurance actually exchanges uncertainty for certainty. The uncertainty relates to whether or not loss will occur and if at all it occurs when it will occur and what will be the severity of loss like, and how many such losses are likely to occur within a given period. The conventional insurance envisages payment of fixed premium by the insured to the insurance company who in turn will pay the loss if it ever occurs within the ambit of policy terms. This exchange of uncertain loss is Gharar in Islam and hence not allowed.

Therefore, the Takaful avoids risk transfer by the participants (insured) to the operator. This facilitates the sharing of risks among the participants under what can be called a mutual guarantee scheme. Takaful operator merely acts as their agent and ensures that they pay an equitable contribution and also ensures that those who suffer loss get the right amount of compensation (Iqbal).

The buy and sell form of conventional insurance is not the same as buying and sell under Shariah which abhors gharar, maisir, and riba. In conventional form, there is lopsidedness resulting in an advantage for one over the other. This is known as a contractual injury that is against the doctrine of fairness (all) and good virtue (eshan) of Shariah. Takaful incorporates the principles of joint help, cooperation, solidarity (joint guarantee).

It envisages working together for common good through contribution/donation to serve the requirements of the needy, for the enjoyment of profit together and creation of a defined fund for payment of defined loss. Reinsurance is a necessity (hajat) in the absence of adequate Islamic reinsurance service (retakaful) (Yusof). Reinsurance under Islamic principles is called “Retakaful” whereby takaful companies reinsure what they have insured (A.M.Best).

In a nutshell, in conventional insurance which is non-mutual, premium is calculated that would cover claims and profit which is speculation akin to Maisir in Shariah. The insured pays premium in consideration of the insurer indemnifying the insured against risks that may or may not occur. This is an uncertain aspect which is Gharar in Islam and cannot be part of any activity. The insurer invests the premium so collected for interest and on the industries prohibited by Islam such as production or trading of alcohol or meat industry not allowed in Islam. On the other hand, Takaful is based on the concept of

Ta-awum i.e mutual assistance that should be voluntary (Tabarru). It is almost like conventional mutual insurance industry in which members pool their funds to insure one another. The loss is met out of funds donated by the policyholders. The burden is passed on to the insured. By donating contributions, the policyholders become the owners of the funds and are eligible to participate in profits in proportion that would vary from one model to another. Takaful removes uncertainty by undertaking to pay from the fund loss incurred without being pre-determined (Ernst&Young). Eschewing of uncertainty in respect of contributions and when to make claims, undue payments either as death benefits or extraneous favours such as gift vouchers are the hallmarks of takaful.

Although methods of risk assumptions and actuarial processes may be the same as in traditional insurance, takaful involves evaluation of loss and determination of premium contribution commensurate with total risk the pool is exposed to, for providing protection against disproportionate losses. Whereas in conventional model, premium is risk-based, takaful insurance envisages sharing by each participant equally the pooled risk in keeping with the principles of mutual co-operation (A.M.Best).

Analysis of an existing Takaful Insurance forms, Policies, Procedures and implementation of Takaful in actual practice

Just as there are differences between the conventional and takaful models of insurance, there are differences among the various models of takaful insurance. The differences rather relate to the underwriting of risk portion and not in relation to non adherence of Islamic principles. Two major models are Mudaraba Model and Wakalah Model. Mudaraba model is also known as Malaysian model. In this, contributions from participants and income from investments are used to meet claims, reinsurance/retakaful insurance costs and other claims related expenses. The surplus after meeting all these remaining in the takaful funds is shared between the participants and shareholders in 60:40 ratios.

The shareholders are expected to meet their marketing and management costs from out of their 40% share of the surplus. This is not in harmony with Shariah since Mudaraba is a profit sharing contract whereas the investment comes in the form of donation (Tabarru) contract. This is an apparent incompatibility. Secondly, in Mudaraba contract, profit should be earned and distributed. But the Mudaraba form of Takaful envisages sharing of surplus i.e excess of premiums over claims, reserves and expenses. Thirdly, sharing of surplus in the written funds in this model is no different from conventional insurance. But in the latter, shareholders are risk takers. Hence essentially this model is rooted in risk taking not in mutual assistance. Fourthly, the arrangement of payment of Qard Hasnah (for deficit) is against the tenets of a Mudaraba concept since a Mudarib is not a guarantor.

Lastly, the Mudaraba principle and Risk sharing principles are not compatible with each other (Rahim and Wahab).

Wakalah Model

The above is popular in Malaysia and is followed in Middle Eastern countries. In this model, the operator of the Takaful model is the Wakeel for the participants. He is only entitled to a fee for managing the affairs. The fee ranging from 20 % to 35 % of the contributions is payable upfront. This fee is transferred to Shareholders’ account and balance to Takaful account for payment of claims and cost of retakaful. The balance is for payment to the participants. Mostly some amount out of this surplus is retained as a contingency reserve and balance paid to the participants in ratios proportionate to their contributions.

In case of deficit, shareholders are required to give Qard Hasnah to the participants since recovery from the participants is not possible. Shariah concerns are in respect of charging of expenses and the fee structure. The charging of fee by the operator in a pure Wakalah model or sharing of underwriting surplus in a Wakalah variant model is not in keeping with the concept of mutual assistance. The risk premium disclosed is inclusive of expense and profit components and should be shown separately unlike in the conventional insurance where there is no need to show the break ups. This being a contract of mutual assistance, the components need to be disclosed. Further, the donation is a payment to participants on earning surplus if any. This gives rise to issues of inheritance and Zakat (Rahim and Wahab).

Waqf Model: Unlike the above two forms, Waqf is a non-profit model operating as a social or government organization. The surplus is not disbursed to the insurer or participants. The insurer retains the surplus funds for the benefit of participant community (Wong-Fupuy, Mistry and Prince 3). Waqf model acts as a social or government enterprise operating programs on a non-profit basis. The surplus is not appropriated by either the insurer or the participants and the end result is that surplus funds are retained by the insurer in support of the participant community. It is similar to conventional mutual insurance models (A.M.Best)

Ta’awuni Model

A cooperative form of reinsurance, this model represents the concept of pure Mudharabah that epitomises Islamic tenets in day-to-day life. This concept which reflects brotherhood, unity, solidarity and mutual cooperation envisages sharing of direct income by the takaful company and the participant. The latter is entitled to one hundred percent of the remainder without any deduction given before the distribution.

Two sub-models under this Ta’awuni concept, are Al Mudharabah and Al Wakalah. Though in practice these models are presented with variants, they choose either of the two. Al Mudharabah which is a modified profit and loss-sharing model provides for sharing of the surplus by both the participant and the takaful insurer. The ratio of share will vary as commonly accepted by the entities in contracts.

The takaful insurer is allowed to participate in the results of operations related to underwriting and return on investments. Al Wakalah, as a fee-based model provides for risk-sharing by the participants alone while a takaful insurer collects a fee for services rendered in capacity of a Wakeel or Agent. He does not share in underwriting results. His fees can be inclusive of a fund management fee and a performance incentive fee (A.M.Best).

Examples of Takaful from the UAE market

UAE‘s young Takaful market experienced a quick growth in short term without a long history. In 2010, market share of UAE was 6 % of total premium collected as against a record 135 % growth between 2005 and 2008. The first company in the UAE is Abu Dhabi National Takaful Co started in 2004. The number of companies has risen to ten by 2010 in the small and medium sector. Due to stiff competition from conventional insurers, the Takaful companies could not undercut the competitive market. Despite this, the Takaful insurance market in UAE is expected to grow by 30 per cent at compound annual growth rate (CAGR) between 2010 and 2014.

Though there is a general moratorium on licenses for new insurance companies, an IPO for Takaful Company Wataniya was successful in 2011 in which semi-government and founder institutions already have 45 % stake in the capital. Insurance Authority in UAE issued Regulation No 4 of 2010 for effective governance of Takaful companies according to Sharia principles through “Supreme Committee” consisting of three to five religious scholars empowered to issue legal opinions and fatwas. This regulation bars conventional insurers from offering Takaful insurance through Islamic Windows.

In Sept 2012, Takaful operators were required to segregate individual from property and liability business. Two most popular forms of Mudaraba and Wakalah and a combination of the two are allowed in the UAE market. Although Takaful is not more attractive than conventional insurance, it has been conceded that insurance is in the least priority for people who subscribe to insurance when it is made compulsory and religious considerations does not in any way influence people to opt for Takaful (Borscheid and Haueter 406).

It is the regulatory requirement in the UAE to issue separate policies as “Takaful subscription policy” and “Takaful policy” instead of combining them into a single policy as in the past. The subscription policy must reflect Tabarru (donation) nature of participant’s contributions and it should include the details of heads of accounts into which the contributions must be paid. It should also provide for an interest free loan (Qard Hassan) to be extended by the operator in case of deficit and to be deposited into the participants’ fund and also provide the details Takaful operator’s remuneration showing the mechanics of calculations.

On the other hand, in respect of a Takaful policy, regulations do not specifically provide for any such conditions. The Takaful operators are also forbidden to issue property and liability products such as life, medical or accident cover. simultaneously (Allam and Delaney). For example, the UAE based Methaq Takaful Insurance Company offers the following products. “Methaq Accidentcare Platinum, Methaq Accidentcare Gold, Methaq Accidentcare Silver, Methaq Accidentcare Bronze” (p 1) under personal accident insurance, and “Essentials, Standard, Plus, Premier” (p1) “under Critical illness giving protection against all major illnesses and accidents with a five-year rate guarantee”(p 1).

Further, the company’s Travel and Assistance and Residence plus insurance categories offer the following products.” Methaq Travel Schengen, Methaq Travel Care Plus, Methaq Travel CareVIP and Stars, Methaq Residence Plus”. (p1) (METHAQ)

Discussion of the amount of Takaful insurance sold in Dubai and the UAE versus conventional Insurance

Takaful insurance sold in GCC in the years 2008, 2009 and 2010 are USD 3,753.5 million, 4,886.0 million and 5,683.4 million respectively. Out of these, UAE accounts for 542.1 million, 639.6 million and 818.4 million respectively. Figures exclusive to Dubai are not available (TakafulRe 17).

The popularity of Takaful in the rest of Middle East

Takaful industry is growing at a compounded rate of 39 % per year. In GCC, it is 45 %. The GCC contributes 39.7% of the gross Takaful contributions. There are 69 Takaful companies and windows in the Middle East. Takaful market is growing at a very fast rate in the UAE. Saudi Arabia is the fastest growing market for Takaful. Global Takaful contributions are projected to touch US $30 bn to US 40 bn by 2015. (Bhatty)

The World Takaful Report 2012 states that while global takaful contributions have grown up by 19 % to $ 8.3 billion, GCC has accounted for $ 5.68 billion in 2010. GCC region is still dominated by traditional insurers. Annual growth rate in GCC has come down to 16 % in 2010 from 41 % (Anonymous).

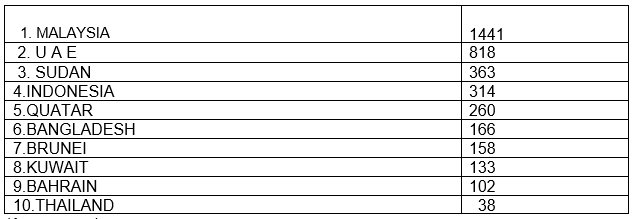

Out of $ 8.3 bn, UAE alone accounts for $ 818 m, ranking second next to Malaysia. See table below.

In the Middle East, sales are confined to general takaful which are commercial products. The takaful in health care retail is expected to grow in popularity as governments gradually withdraw or reduce health care spending (Anonymous). Middle East which had close $ 1bn contributions long seven years ago is expected to exceed $ 4 billion by 2015. The projections for 2015 is shown in the figure below. There is huge untapped market for Takaful as the conventional insurance is now allowed in Islam (Anonymous).

Takaful industry in the Middle East offers viable alternative to conventional insurance to the 36.1 million Muslims therein. Thus, insurance industry in this region is poised to grow in the coming years. Since the multinational companies are entering the Takaful market, there are significant challenges ahead. The current low penetration levels, positive trends in demographics and economic growth and infrastructure developments present opportunities for sustained growth of Takaful insurance in the region.

Takaful industry should resort to product differentiation rather than engaging in price competition against the conventional insurers (Weber).S & P expects Takaful business in the GCC region to exceed that of conventional insurers local as well as global. While global insurance will grow by 2 % this year (2012), Takaful contribution will grow by a year-on-year increase of 24 % reaching $ 12 billion this year(2012) as predicted by Earnest and Young Report for 2012 (Wong).

Top Takaful and Retakaful companies by Capital and share of market in the UAE and world

As of 2008, there were 190 operators distributed as follows:

Takaful Re, an Islamic insurance company located in the Dubai International Financial Centre has reported a total Retakaful fund of $ 81,718,000 as of 2011 (TakafulRe 48).

A 2002 status report states that in 1996 six Middle-Eastern countries, Malaysia, Indonesia and Brunei had about thirty takaful insurance companies. By 2002, the number had grown to eighty Takaful companies and two hundred traditional companies had embraced takaful windows. There were about twelve Retakaful companies all over the world. Retakaful insurers are also different from traditional reinsurers. By 2010, the takaful had been projected to grow to an extent of $ 6.7 billion.

Islamic population is projected to grow out of proportions, given the fact that it has already grown by two hundred thirty five per cent in the last fifty years as per 2002 estimates. Islamic communities are widely distributed all over the world and hence there is huge potential for Takaful insurance business. Besides, patronage from non-Islamic communities for its virtues is not ruled out. Institute of Islamic Finance and Insurance has projected Takaful premium as US $ 7.4 million out of total insurance premium as US $ 1.1 trillion by 2015.

Some of the top companies in the UAE are Dubai Islamic and Reinsurance Company (UAE), Dubai, Islamic Arab Insurance Company – Salama, Dubai, and Takaful Re Limited (UAE), Dubai. In Europe, Takaful, UK, Takaful SA, Luxembourg, IHLAS Sigorta AS, Turkey, TRYG, Denmark, and Folksam General Mutual Insurance Society, Sweden are the companies engaged in Takaful and Retakaful business (Anonymous).

Ethical issues related to TAKAFUL Insurance whether in Theory or application

Takaful is designed on the lines of Islamic principles which are based on ethics. In Islam no individual can claim exclusive right to property in that a person who may own a property cannot exploit it except according to Shariah law. He is permitted to make joint investment for the purpose of earning profit. (Theory) Thus, Islamic insurance invests surplus funds of participants for being administered by the operators and excess of income over expenditure is equitably disbursed to the participants (application).

Islam advocates equitable distribution of wealth and encourages people to sympathise and help each other. (theory). Takaful, provides for people contributing funds for mutual help when the need arises. Thus, Takaful helps needy people by means of reciprocal support and mutual assurance. Just as Islam recognizes enjoyment of the wealth of the deceased by the lawful successors (theory), Takaful requires nominee to act as a caretaker and share the proceeds amongst the lawful successors (application).

Islam requires wealth to be used as an instrument to serve the interests of community at large for realizing which Islam provides for levy of taxes on the better-off people to be used for helping people with lesser incomes. This is called Zakah and regarded as one of the five pillars of Islam and it is not a substitute of income tax but a levy on capital. (theory). Takaful mandates operators to employ funds in production purposes so that it helps economic development for balanced development and welfare. (Application) (Qaiser).

Corporate governance is a form of ethics and since the Takaful industry itself is driven by ethics, modern corporate governance is actually redundant if Takaful principles are strictly followed in the conduct and modelling of Takaful insurance products (Baba).

Takaful is characterized by the ethics of justice, equality, fairness, and morality. Gharar (uncertainty), Maisir (gambling), and Riba (usury-taking and charging interest ) are strictly prohibited in Islamic finance which includes banking and insurance. To avoid potential conflicts arising out of prohibited elements in Takaful contracts, Islamic insurance offers alternative contracts of insurance as follows. Mudharabah Contract : (Profit and Loss sharing ).

While the contract envisages sharing of profits at a given percentage by the capital providers and management, loss must be borne by the capital providers alone. In Takaful insurance, providers are participants and management is the takaful operator. Thus, participants are expected to bear loss if any. Contract of Musarakah (joint venture) : Based on the principle of both parties providing capital, loss or profit are also split between both the parties as may be agreed.

Mutual insurance companies operate on this principle. For example, Oil Insurance Limited (OIL) uses this form of contract. Kafalah contract (surety-ship): A guarantor will become the surety in case the debtor fails to pay his creditor. In a takaful scheme, this type of contract can be adopted for Bond products (Iqbal). In order to circumvent the Islamic restriction on gharar (uncertainty), takaful uses unilateral form of contract wherein gharar is condoned and taken in the form of donation (Tabarru) to substitute risk premium. (Gonulal).

Challenges facing the Takaful and Retakaful industry in the UAE and word wide

Key business risks identified for the takaful industry are “increasing competition, ongoing regulatory initiatives, shortage of expertise, misaligned costs, limited financial flexibility, high-risks, high-risk investment portfolios, limited diversification in exposures, enterprise risk management, political risks and implications, and inability to tap the market potential”. (McClean). Competition: The takaful insurers who are relatively new are unable to compete against the established conventional insurers without aggressive pricing strategies although the aggressive pricing is not sustainable and affects industry’s profitability.

Regulations: Regulatory changes across the GCC such as higher solvency operations and higher capital requirements affect shareholders’ profitability in the short term. Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI)’s tab on the sharing of underwriting surplus by the shareholders and indirect forcing to share risk of loss by means of a compulsory Qard facility are proving to be disincentives for the takaful entrepreneurs.

Shortage of expertise: There is acute shortage of specialists in life insurance, risk management and Shari’a compliance. Inadequate training in marketing by differentiating Takaful from conventional insurance is adversely impacting the takaful industry. Another weak spot is that senior managerial personnel are from conventional industry and as such they are unable to appreciate Shari’a objections in the traditional insurance (McClean).

Works Cited

A.M.Best. Takaful Review 2012 Edition 2012. Print.

Allam, Hiba and Owen Delaney. Unconventional Regulations- Recent Legal Developments in the UAE’s Takaful Industry. Country Report. 2011. Print.

Anonymous. Advancing Takaful Industry to the Next Level. 2012. Print.

Anonymous. Middle East Takaful Forum 17 & 18 October 2012. Web.

Anonymous. Takaful and retakaful companies. Web.

Anonymous. Takaful: The Rise of Islamic Insurance. Middle East Monitor. 2010.Print.

Ayub, Muhammad. Understanding Islamic Finance. Jonn Wiley and Sons , 2009.Print.

Baba, Hanim Norza. Islamic Ethics and Governance – Recipe for Takaful Insurance Growth. n.d. Web.

Bhatty, Ajmal. The Growing importance of Takaful Insurance. Kuala Lumpur: OECD and Bank of Negara, Malaysia , 2010. Print.

Borscheid, Peter and Niels Viggo Haueter. World Insurance:The Evolution of a Global Risk Network. Oxford: Oxford University Press, 2012.Print.

Ernst&Young. The World Takaful Report 2009 Opportunities in adversity-the future of Takaful. 2009. Print.

Gonulal, Serap O. Takaful and Mutual Insurance: Alternative Approaches to Managing Risks. Washington D.C.: World Bank Publications , 2012.Print.

Iqbal, Muhaimin. General takaful practice:technical approach to elimiate Gharar. Jakarta: Gema Insant, 2005. Print.

McClean, David. 7th Annual The World Takaful Report . Dubai: Ernst & Young , 2012.Print.

METHAQ.. HYPERLINK . Web.

Qaiser, R. Takaful – The Islamic Insurance Web.

Rahim, Abdul and Abdul Wahab. Takaful Business Models- Wakalah based on WAQF: Actuarial Concerns and Proposed Solutions. Presented at Second International Sympsoium on Takaful 2006 Malaysia. Print.

TakafulRe. Annual Report . Dubai: Takafu Re, 2011. Print.

Weber, Scot. Takaful: More than just green shoots. Islamic Finance News. 2012. Web.

Wong, Connie. Diverging Models Shape The Growth Prospects For Takaful.Islamic Finance News. 2012. Web.

Wong-Fupuy, Carlos, Mahesh Mistry and Thimothy Prince. A.M.Best Methodology. Oklwick,N.J.: A.M.Best Company, Inc., 2012. Print.

Yusof, Dato’Mohd Fadzli. The Basic Concept (s) of Takaful (Session 1- The Essence of Takaful). 2nd Takaful Summit “Matercalss” Lovells LLP, London. 2008. Print.