Abstract

Lebanon faces a problem of high customer turnover rates. Many banks in the country are unable to retain their clients. Customer retention has been found to increase the profitability and increase the success rates of new packages. Banks in Lebanon need to implement CRM in their operations so as to solve the problem of high customer turnover. Specific focus is paid to the top three Lebanese banks which are Bank Audi, Blom Bank and Byblos bank. The study will attempt to highlight the progress of CRM in Lebanon. Factors that influence CRM in the country such as religion and culture are assessed in the paper. Lebanon has a very stable banking system and good CRM is needed so as to ensure that there is continued growth of the industry. The study collects data from various respondents in Lebanon, and from the data CRM trends in Lebanon are developed. At the end of the study appropriate recommendations for use in the Lebanese banking industry are developed.

Banking in Middle East

Middle Eastern banks

Banking in the Middle East was established in the 19th century. The earliest Middle Eastern bank was the Ottoman bank that was located in Turkey. This bank was established in 1863. The banking industry in the Middle East was not energetic and it realized slow growth in the initial years of its establishment. The Middle East is one of the richest places on earth and this is meant to be reflected by its banking system. However due to the limitations posed by the lifestyles of the people of this region it has been hard for this sector to register growth. Apart from oil based and service industries most people in the Middle East are nomads and pastoralists. Such lifestyles do not permit effective usage of banking services and thus the resulting lag in Middle East’s banking industry (Rajola, 2005).

Batter trade is still a common method of exchange that is used in Middle East. Many nomads and pastoralists prefer to trade in their livestock in exchange for other commodities such as spices, clothing and electronics. Batter trade is a method of exchange used in remote parts of Middle East where modern banking facilities cannot penetrate. This type of trade is another reason why there has been slow growth of Middle Eastern banks (Rettig, 2004).

Middle East banks are partly responsible for the slow development of this industry. However the slow progress of this sector can be pinned to other factors that are out of control of the banks. The Middle East as a region is an isolated region that has been slow to accept change and modernization. This is because of a culture that does not promote flexibility and innovation. Middle East as a region has clung to its old traditions and ways of doing business. Majority of the population in Middle East depends on agriculture as their main source of income. This is coupled by the infertile soils and arid climate of Middle East.

These conditions result in poor agricultural produce and reduced incomes for the people of this region. Due to ineffective agricultural practices the people of the region become poor and cannot most of their needs. It is due to this overdependence on agriculture by some Middle Eastern countries that has resulted in the slow development of banks and monetary institutions. In the early years (1940s) Agriculture in the Middle East was not commercialized but was done on a subsistence basis. This meant that farmers consumed majority of what they produced and traded the remaining harvest / produce for other commodities. This made money to become an unnecessary commodity in such areas. This resulted in poor monetization of the economy and thus a decline in bank growth and development (Romano and Fjermestad, 2006).

The Middle East has been a difficult area for international banks to penetrate. Initially all foreign banks within the region were focused towards providing financing for foreign trade within the region. This is how many British and American banks have survived in the region. However, the local people of the region prefer to bank with their local banks. The reason for this trend is because of the relationship between religion and money in the Middle East. Policies on interest rates and lending greatly differ from western banks and this limits the extent to which foreign banks could penetrate the markets.

The benefits of local banks being dominant in the region cannot be underscored since these banks provide money and services to the people in a way they can to relate and believe in. Majority of banks in the Middle East practice Islamic banking (Brown, 2000).

Overall growth of banks in middles east has been very slow. This growth is slowed down by the poor monetization in the remote areas of the region. The oil industry has been a great booster for Middle Eastern banks. Oil mining has brought foreign income into the region. The exchange and trade facilitated by oil has brought about some growth into the region. Foreign trade has also encouraged monetization of Middle Eastern economies and has significantly contributed to a rise in the value of Arab currency (Collica, 2007).

Current trends of Middle Eastern banks

Middle Eastern banks have currently opened branches all over the world. This is in line with globalization and in an attempt to spread risks and increase their capital bases. Arab banks trade up to 200 billion American dollars on a daily basis. This is a good indicator and shows a promising future for Middle Eastern banks. Statistics collected in 2010 show that Middle Eastern banks are growing at a rate of 25% a year. This is an exceptionally high growth rate.

The growth and expansion of Middle Eastern banks is not expected to reach a ceiling point any time soon. The reason for this hypothesis is because most Middle Eastern banks are Islamic banks. These banks rely on Muslim clients who make up to 2 billion of the world’s population. This means that there is still a lot of potential for Middle Eastern banks to capture clients (International Monetary Fund, 2007).

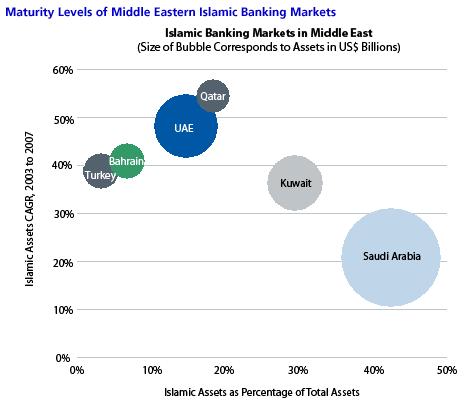

Saudi Arabia has the largest and most active banks in the Middle East. The reason for the advanced development of Saudi banks has been brought about by the relatively strong Saudi economy. Saudi Arabia was also one the first Arabian countries that welcomed foreign investors into their economy. The Saudi Arabia banking industry also has a rich heritage of relationships with foreign banks. It is for these reasons that Saudi Arabia banks are leaders in the region. Saudi Arabian banks also have the largest capital base in the region. The UAE follows Saudi Arabia in the level of advancement and development of banking markets. Qatar, Turkey and Bahrain have the smallest banking industries. Banks from these countries have the smallest capital bases as compared to those from Saudi Arabia and the UAE (Schafer, 2007).

Saudi Arabian banks have been found to perform very well. Most of the capital held in Middle Eastern banks is held by Saudi Arabian institutions. Recent statistics show that the Saudi Arabian bank, National Commercial bank is the largest Islamic bank in the world. Several Saudi banks top the list of most successful Islamic banks together with the National commercial bank.

The Union of Arab banks (UAB) was formed in the year 1974. Te formation of this union took place in a meeting that was organized by the ‘Arab Administrative Development Organization’ (AADO). In this meeting the respective leaders of each bank in the region were present. The UAB was designed to be an independent body from the AADO, but was meant to work within the mandate of the League of Arab States (Schust, 2007).

UAB was formed so as to enhance cooperation between Arab banks and to promote trade and investment in the Middle East. This union was formed with a mandate of bringing Middle Eastern banks together, to protect the interests of these banks and to facilitate economic growth of the region. The immediate objectives of the UAB are to:

- Promote cooperation between banks in the middle east

- Consolidate the relationships between member banks with each other

- Enable the Islamic banks to address their common interests

- Promote growth and expansion of the banking industry in the middle east

- Promote social and economic development in the middle east region

The headquarters for this union are situated in Lebanon, Beirut. The union also has offices and representatives in Jordan, Sudan and Eqypt. The UAB has an advanced network that enables it to provide services to banks throughout the Middle East region. This is on a drive to fulfill its objectives of fostering cooperation and promoting growth of these banks. The UAB is without a doubt a true representative of banks in the Middle East. This is because it is the largest union of banks in the Middle East; made up of over 300 banks. The UAB as a union is able to understand the sentiment s and concerns of banks in the Middle East. This union is also able to promote Middle Eastern banks as can relate to these banks and the environment in which they operate in (Bergeron, 2002)

There are two types of members in the UAB namely active members and passive members. Active members are involved in the formulation of policies for the union and are liable for assistance from the union. Examples of passive members are banks and financial institutions. Passive members are not involved in the formulation of policies and just overseers the operations of the union. Examples of passive members are the Central Banks of member countries and of Arabian Banking Associations (Merkel, 2010).

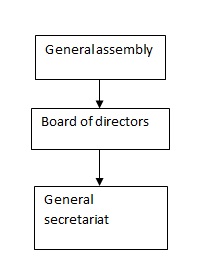

The UAB is headed by a general assembly. The general assembly presides over all the activities of the union. It formulates all the policies of the union and attends yearly meetings. The board of directors is the second in command after the general assembly and has a responsibility of adapting the activities of the union so as to ensure that it achieves the goals and is in line with the policies that have been formulated by the general assembly. Passive members are allowed to attend board meetings but cannot contribute any ideas in the meeting. They mainly act as observers in these meetings. The general secretariat has the mandate of implementing policies that have been decided upon by the general assembly and the board of directors. This is the executor of the UAB and is responsible for overseeing the day to day activities of the union.

Challenges that face the Middle Eastern banks are the lack of a common language and terminology for banking activities. Since these banks operate under shariah law, their methods of operation are somewhat different from those of conventional banks. Therefore these banks cannot use similar banking terms and names. The UAB has contributed greatly and is in the process of formulating a common banking terminology that is to be applied by all Middle Eastern banks. This would facilitate a common banking language throughout Middle East (Makdisi, 2004).

Middle East banks were generally not adversely affected by the financial crisis. But the presence of this crisis brought the need for the development of preventive measures to protect these banks from the side effects of the crisis. Middle East banks have seen the need for restructuring and consolidation as a result of the crisis.

Problems faced ion the consolidation and cooperation of Middle East banks include the presence of family owned banks and institutions. Some banks are owned by wealthy families and the prospects of consolidation may not be welcome in such instances. Attitudes in the Middle East attribute the global financial crisis to unethical trade and poor management in western banks. This hinders the Arab banks from completely having faith in the western system of banking (Rai, 2008).

Banking in Lebanon

Early History of banking in Lebanon

Lebanese banks like most Middle Eastern banks were established in the 19th century in the Ottoman era. During the 1850 and 1920 there was significant growth of banks in the Lebanon and Middle East in general. This was brought about by the struggle between the French and the British for trade supremacy in the region. French banks were key players in Lebanese economy at this time. Major developments were financed by French banks so as to boost trade and profits. For example, the port of Beirut was constructed by the Ottoman bank in conjunction with other French banks such. The Suez Canal is another significant feature that was made possible by the assistance of French banks. Lebanon was a great beneficiary of foreign banks that invested in this region. These banks also served as a basis through which the current Lebanese banks were formed (Gaspard, 2004).

After the First World War, 1920 to 1945, banking in Lebanon was under the French mandate. Banking at this time in Lebanon was focused on providing assistance to foreign investors in the region. This system of banking left the common markets attended to by the local banks that had minimal capital at their disposal and also relatively inexperienced. The activities of local Lebanese banks at the time was limited to the issuing of secured loans, cash advances backed up by goods / commodities, offering discounts of bills of exchange and foreign exchange. Funds for the local banks were held in foreign banks. The poor lending ability and service provision at this time resulted to the rise of private lenders who issued loans to local people at very high rates (Dyche, 2002).

The local Lebanese system of banking started changing from 1943 when the Banque du Liban was established. Banque du Liban provided good services that minimized the difference in service quality between foreign banks and local banks. The formation of this bank facilitated better local financing and it became the preferred option for local lenders. This bank also led to the fall of private lending and discount houses. This is because Banque du Liban offered competitive interest rates for its products (Rolland, 2003).

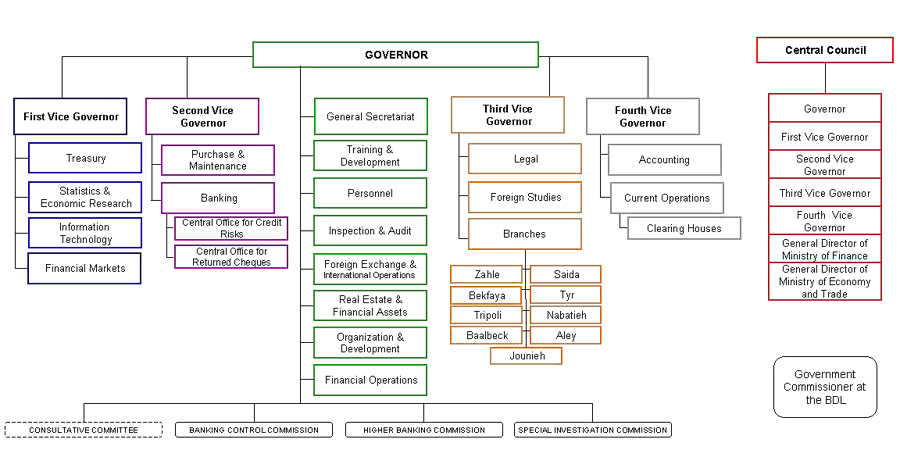

The establishment of the state owned bank facilitated the enacting of proper and sound legislature that governs the operations of banks in Lebanon. Before the enacting of this legislature, banks operating in Lebanon were classified into three namely banks whose guarantees had been approved, banks whose guarantees had not been approved by the state and discount houses. Such as setup was chaotic and did not follow a standard set of rules and regulations. After the formation of the Banque du Liban, a “Code of Money and Credit” was formulated by the state and served to regulate all activities that were to take to place in the country. This code was enforced and its adherence was supervised by the Banque du Liban. This bank served and continues to serve as the Central Bank for Lebanon (Kincaid, 2005).

Expansion of Lebanese banks

Lebanese banks have experienced significant growth since the early 90s. This growth has been as a result of the efforts made by Lebanese banks to change and remain in line with international trends. These changes have resulted in better capital security for the banks, implementation of Cooke ratios in bank operation and reforms on the internal controls of banks (Berndt and brink, 2009).

The Lebanese banking industry is a valuable tool towards the improvement and strengthening of the Lebanese economy. This is because an improvement and growth in the banks will ultimately result in lower interest rates and therefore encourage increased investments into the Lebanese economy. The Lebanese banks also pose as an avenue through which the country could earn foreign income. This is because if these banks are able to modernize their services and spread their operations into the international stage this would be an opportunity for the country to generate extra revenue. Lebanese banks also need to improve their services so as to be able to complete with more efficient foreign banks that have made entry into the Lebanese market.

Lebanese banks underwent significant growth between 1992 and 2005 and it is during this critical period that these banks were able to restructure and improve on their performance efficiency. Fig. above shows the statistics on Lebanese banks that were collected between the year 1992 and 2005. In 1992 there were more banks as compared to 2005, However these banks were less efficient and useful to the economy. In 2005 there were lesser banks in Lebanon but these banks had developed better infrastructure and capital bases as compared to the initial banks. The 49 banks registered in 2005 had more offices as compared to the 72 that were present in 1992.

This reduction in numbers of registered banks was brought about by the need to merge and form larger banking institutions. It was realized that larger banks were easier to monitor and were able to raise more capital as compared to smaller ones. The restructuring of Lebanese banks in this period was accompanied by an adoption of policies to boost the banking industry. Better customer service and relationships were established during this period. This was facilitated by an increase in the number of service providers who were employed in the industry. In this period, the Lebanese banks employed approximately 5000 more employees; were recruited into banks. This was geared towards improving the quality of services that are provided to the end consumer (Berndt and Brink, 2008).

After the mergers and acquisitions that took place during this period, there was also a significant increase in offices and branches throughout Lebanon. The fewer banks that had been formed opened more offices so as to enhance service delivery and reach as many clients as possible. It is during this period that Lebanese banks were able to increase their capital reserves. Studies show that these banks grew from a total of 123 million dollars in capital to a total of 6.5 billion dollars in this span of 13 years. This growth is as a result of campaigns carried out by the Lebanese banks in an effort to woo investors both local and foreign (Rogers and Peppers, 2004).

There was also increased lending during this period as a result of drops in lending interest rates. Another factor that contributed to the increased lending was the improvement of service delivery to the people. The people of Lebanon were educated about loans and interest rates by the banks; resulted in more people approaching the banks for loans. As a result of establishment of Banque du Liban there was a resultant change in the banking institutions of Lebanon. This was followed by new currency and the formation of capital markets. This change of the Lebanese banking system was vital and it was able stimulate growth and change of the banking sector in the country. This move also seized control from the foreign banks and placed it into the Lebanese’s own hands. The banks of Lebanon were now able to operate fairly and independently as well as be able to compete for local clients (Rolland, 2003).

The Banque du Liban is responsible for:

- Formulating rules and regulations to be followed by banks operating in Lebanon

- Issuing of licenses and registering banks

- Defining the types of banks that can operate in Lebanon and the relevant policies to govern these banks e.g. LT banks, specialized banks and investment banks

Current state of Lebanese banking

Data collected in 2010 shows that there are 74 commercial banks operating in Lebanon. These banks have 872 branches that are spread out throughout Lebanon. There are fifty five banking institutions that operate in Lebanon. The Lebanese banking industry has been doing fairly well and has not felt the effects of the global financial crisis. It is during the time of global financial downturn that Lebanon has seen an increase of 67% in foreign deposits. The Lebanese banks and economy because of being immune from the effects of the financial crunch were seen as a safe haven for investors to protect their money (Rainardi, 2008).

Lebanese banks also have the highest cash reserve ratios in the world. The banks are required to have a reserve of 30% in cash, half of this reserve is to held by the bank and the other half is held by the central bank. Lebanese banks are also required to lend out only 34% of the cash reserves which they have. This means that Lebanese banks reserve up to 66% of all the money they lend. When compared to countries such as the United states that only reserve 7% of what they lend out, the Lebanese banks can be said to be very cautious in protecting both their and the client’s interests. Such policies prevent the Lebanese banks from undertaking risky operations. This conservative nature of the Lebanese banking industry has actually shielded it from the effects of the financial crisis (Peelen, 2006).

The Lebanese system of banking also has gold reserves. The gold reserves of Lebanon are the second largest reserves in the Middle East. This tradition originates from the 1960 period where the Lebanese Central Bank backed its currency with physical gold. The total worth of the Lebanese banking industry is approximately 115 billion dollars.

The top three banks in Lebanon are namely the Bank of Audi, Blom bank and the Byblos bank. The Bank Audi tops the list with an asset value of 26.6 billion dollars and with 155 branches in Lebanon. The Blom bank follows with an asset value of 20.7 billion dollars and 136 branches in Lebanon. The Byblos bank is the third on the list with an asset value of 13.5 billion dollars 75 branches in the country (Muther, 2002).

Importance of Lebanese banking

Lebanese banks have played key roles in Lebanon’s economy as well as in the international platform. Lebanese banks provide retail banking and personal banking services to local people. These services have enabled the people of Lebanon to benefit greatly from these services and enable households to acquire goods and services that they require. Lebanese banks also provide financial services to the private sector in terms of short term, medium and long term loans (Bejou and Iyer, 2003).

The central bank also offers loans and finances the Lebanese government. This bank also serves as a regulatory body that controls the interest rates that other banks in Lebanon can charge. This bank is also responsible for controlling the value of the Lebanese dollar and its exchange rates with foreign currency. It is also responsible for keeping inflation and deflation of the Lebanese currency in check. The Lebanese government also collects revenue collected by all banks that operate in the country. This means that Lebanese banks are of great importance to their government as they are a source of revenue (Vogt, 2008).

Lebanese banks have also played a very strategic role in and are on the center stage of international trade. Lebanese banks are known to have financed Renault, oil companies and even the giant pharmaceutical Abbot. Lebanon has not been left behind and it maintains healthy relationships with the World Bank and with international banks such as the State bank of India.

SWOT analysis of Lebanese banks

Strengths

The Lebanese banking system has exhibited various strengths. One major strength is the liberal economic system that is present in Lebanon. This is with consideration of the conservative nature of most Middle Eastern economies. Banks in Lebanon have also strived to create a balance between Islamic banking and modern day banking. Banking in Lebanon is controlled by a sober central bank Banque du Liban that has performed relatively well since its inception. The ability of the central banks to formulate and implement good policies has increased investor confidence; both local and foreign.

Lebanon has also managed to maintain peace and stability after a series of internal conflicts. The country seems to have matured and finally found a path towards peace. Peace is a factor that greatly affects banking and Lebanon has benefited greatly as a result of the stability that it has achieved. A very supportive atmosphere exists in Lebanon and the central bank is always ready to assist banks that are facing difficult times. This has enabled Lebanese banks to prosper and fair well even it times of crisis. Lebanese banks follow good banking secrecy laws that enable the banks to gain investor confidence and at the same time prevent illegal activities such as money laundering.

Lebanese banks unlike western banks are very conservative when investing the client’s money, they also have significantly larger reserves and thus the client’s money is very safe with Lebanese banks. Lebanese bank management is said to be one of the best in the world. The governor of the Lebanon central bank had foreseen the financial crisis before it happened. He called for a meeting with all bank managers and advised them to take necessary measures in readiness for the crisis. Another strength of Lebanese banks is that they have the ability to manage and cushion risks. This is the secret behind the success of Lebanese banks (Todam, 2001).

Weaknesses

A major challenge faced by Lebanese banks is the inability to retain customers. Lebanese banks have one of the highest client turnover rates in the world. This is brought about by the poor customer services that these banks offer. Owing to their roots Lebanese banks are not founded on serving the customer but are founded to be bureaucracies to serve the government and its institutions. This weakness will be the main concern of this study as it has the ability to revolutionize Lebanese banking. Another problem faced by Lebanese banks is the abnormally high financing that the government receives from banks. The Lebanese government receives huge amount of money from banks and this poses a risk in that the banks could collapse in the event of political instability.

Lebanon lacks measures and procedures that can be used in recovering the economy. This is very vital as such procedures would enable the economy and the banks to come out of financial pitfalls. Corruption is still a major problem in Lebanon and there is a lack of transparency in the management and operation of banks poses a great threat to the industry. There is a lack of openness in the publishing of annual reports and statistics for the banks. This trait is owed to the conservative history of Lebanese banks and it may take some time to completely change how they operate. Banking in Lebanon is mainly state controlled and the corporate society is not yet strong enough to lead the way (Reinartz and Kumar, 2006).

Opportunities

There is opportunity for growth in the banking sector if more privatization is fostered. Lebanon needs to hand over some control of banks and financial institutions to the private sector. This would result in significant growth of both the economy and of the banks. There is also room for expansion of Lebanese banks and entry into the global markets. This is a step that Lebanon needs to urgently take before the opportunities for opening branches all over the world are lost. The Lebanese government also needs to securitize its assets as this move would facilitate more assets for the banks. Discount houses can also be reestablished in Lebanon as they would enable more players from the private sector to enter into the provision of financial services (Link, 2001).

Threats

Lebanon is still under huge debt. This debt was acquired during the reconstruction era of the country. This was a result of many years of fighting that destroyed the country’s economy and infrastructure. To rebuild itself it had to lend money from foreign institutions. Lebanon owes up to 140% of its GDP. The central bank of Lebanon must therefore struggle to pay for the countries debts. The base two requirements that have been set are bound to disadvantage and prevent the thriving of small banking institutions (Jha, 2008).

Literature Review

CRM in modern banking

CRM in any setup refers to the administration of the tools and methods that help a business to improve its relationship with its customers. As an institution grows and develops there is a need for the specialization and creation of CRM compliant structures. This is because the old methods in which CRM was carried out merely as a part of an organization’s routine have become ineffective. The formation of CRM departments within an organization gives room for the proper delivery of services and treatment of customers (Kerr and Anderson, 2002).

The definition of CRM is different among specialists. There are three common definitions of CRM namely, Information technology (IT) based CRM, Customer Lifecycle CRM, Business Strategy CRM. IT based CRM looks at CRM from a technological standpoint. This understanding views CRM in terms of softwares and applications that have the potential to improve customer relations. IT based CRM is becoming more popular in banking. This is through ebanking that allows the banks to offer remote assistance and services to their clients. IT based CRM is expected to grow in two fold globally in the next ten years.

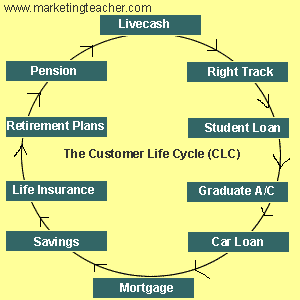

Customer life cycle CRM is based on the different stages of life that people undergo. The stages include college, marriage, family life, pension etc. Banks operating on this kind of CRM take advantage of each stage that the customer goes through. The services and relationships that the banks establish with the clients depend on the stage of life through which the client is going through. For example young families may get mortgage loan offers, people in their fifties may get pension and life insurance offers. This type of CRM states that the behavior and the need of the client depend on his / her age group. This type of customer relationship also focuses on marketing and promotion more than service delivery. It states that marketing affects the attitudes and opinions of the clients and thus underscores the need for intensive customer care (Hostetler and Mathena, 2009).

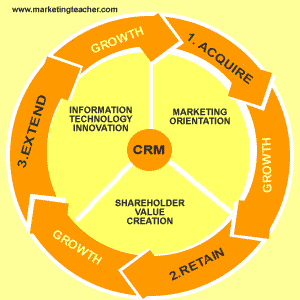

The other type of CRM is business strategy CRM. Business strategy CRM is a principle that acknowledges the importance of marketing, promotion, IT and customer satisfaction in successful banking. This study will be based upon Business strategy CRM as it is a more balanced form of CRM that ensures a balance of all the aspects related to CRM. This principle is best described by the CRM circle (Goddard and Raab, 2008).

The CRM circle has three stages namely acquire, retain and extend. The first step is to acquire new customers, retain the customers and extension of services to customers. This circle shows the importance of maintaining happy customers as it highlights extension as the last phase of customer relationships. Extension involves the introduction of the clients into new offers and packages. This circle shows that banks can capitalize and generate more revenue from their existing customers by extending the scope of services offered (Dibeh and Cobham, 2009).

Inside the circle there are three categories namely marketing orientation, shareholder value creating and IT innovation. The marketing orientation category serves to demonstrate the importance of the customer. This category takes a central place in the circle and shows that all stages of the CRM circle need to have the customer’s needs addressed. This means that the customer is the priority of the bank as they acquire the customer, retain the customer and extend services to the customer. Value creation refers to the ability of a bank / business to increase its market value by building a good and reliable reputation through proper customer relations. According to CRM customers are of the greatest value to a business (Colton and Neamie, 2005). This means that businesses ought to invest in their clients so as to build their value.

IT takes central place in strategic CRM. This type of CRM acknowledges the importance of up to date information technology in any banking / business organization. IT helps to modernize a bank’s service delivery. IT improves a bank’s customer relations and facilitates faster service delivery to a bank’s client. The use of IT in CRM is not only limited to remote service provision but also involves the keeping of records and carrying out of analysis on data. IT is used in analyzing of customer feedback and aiding the bank management to map out policies and procedures that clients prefer. IT also facilitates proper record keeping of client profiles so as to identify what each type of customer is most responsive to. For example banking patters and trends can be collected on customers of different ages and incomes. This will enable the bank to identify which packages to market and extend to different clients (Zubey and Wagner, 2006).

Implementation of CRM is one of the hardest tasks that banks face. This is because poor planning usually has adverse effects on CRM policies. For a CRM policy to be properly implemented it must match the banks financial capability and supporting infrastructure. For example if a bank lacks the technical personnel to fuel complicated ebanking policies it should not involve itself in such a project. Banks need to asses their capabilities and customer preferences before the implementation of any CRM campaign. Many banks to tend to develop CRM objectives without assessing whether their customers will respond positively to these objectives (Sugandhi, 2003).

Inappropriate integration of CRM is another problem that banks face while trying to improve their customer relations. Many CRM related activities that banks carry out are as a counter active or resultant measure towards some driving force. However, these activities tend not to fit well with the banks structure and cause problems when it comes to blending the CRM activities with how the bank operates. For example a bank may rush to establish remote customer care services yet its staff and organizational structure does not support such an undertaking and this leads to more customer dissatisfaction (Seddon, 2004).

To further enhance their CRM policies banks and businesses in general need to create a liberal method of thinking and operation. This is because strategic CRM encourages innovative thinking and development of customer relationships according to the unique situations and circumstances that each organization face. Before the implementation of any CRM tool, banks need to assess the market trends and customer preferences. These are the ultimate determinants of whether a CRM policy can work or not (Schmitt, 2003).

Crucial role of CRM

The importance of CRM and its essential role to businesses was identified in the 1980s. CRM then was known as contact management. Contacts were the customers and clients that a business interacted with. This type of relationship is whereby banks collected as much information about their clients from each meeting/ contact they had with the client. Contact management was geared towards “Utilize every opportunity and use it to learn and establish as much as possible about the client”

CRM is a major problem to big institutions and businesses unlike small ones. An example of good CRM is a small shop in which the owner knows all his clients personally and can even anticipate their needs. Small businesses have therefore been found to have very good CRM policies unlike larger ones. Big businesses are thus encouraged to develop a CRM structure that is similar to that of a small business so as to keep in touch with their clients and understand how they think, what they want, and when they want it. CRM should take the form of personalized assistance whereby banks and businesses attend to the individual needs of each client (Schneider, 2002).

Competition among banks is very steep as each bank is trying to acquire new clients. It is becoming increasingly hard to retain customers due to this competition. CRM has been found to be an effective tool in improving customer loyalty. Studies show that banks that have good CRM policies have the ability to retain and build upon their existing clients. Whereas banks with poor CRM policies usually rely on a pool of circulating clients. Circulating clients are those that move from bank to bank looking for a bank that is able to fulfill their needs. If a circulating client finds a bank with good CRM policies and that is able to satisfy him / her, the client often settles down. This shows that banks with good CRM policies are the eventual winners as they are able to build on their clientele base. This is because they acquire new clients faster than they lose their clients (Buttle, 2004).

CRM is a tool for financial success and the generation of more revenue for businesses. This is because proper CRM policies enable banks to ‘capitalize’ on their existing clients. By gaining customer loyalty and satisfaction these banks are able to generate more revenue per single client as compared to those that have unhappy customers. CRM also changes a customer’s outlook to his / her banks and this usually results in increased responsiveness to offers and from the bank. Modern banking principles equate CRM to customer satisfaction and thus profitability. CRM fronts the importance of creating lifetime value from existing customers (Colton and Neamie, 2005).

Effective CRM policies enable the banks to collect needed information and generate knowledge on their clients. CRM facilitates the creation of databases that contain detailed information of all the clients that a bank has, how they transact, how much they transact, what offers and packages they prefer. This knowledge enables the bank to target specific clients for each offer and prevent wastage of resources on ‘unsuccessful hits’. From such data, the bank can be able to target its promotions and offers to the right group and attain highest conversion rates. This also minimizes instances of irritation and disturbance to the client that unwarranted promotions and messages may cause (Schmitt, 2003).

CRM policies have been found to increase the cooperation and performance of a bank’s employees. This is because common goals and objectives have an effect of unifying an organization. Because of the unifying effect of CRM based goals staff in a bank are able to work towards the satisfaction of the client. This serves as a unifying factor and strengthens the bond and mutual cooperation between bank employees. Good CRM policies establish that the client is the boss; not the managers and administration of the bank. This improves the relationship between the employees and their management body as they are able to see themselves as a team that is working to satisfy a common boss who is the client (Vogt, 2008).

The implementation of CRM enables an organization to become focused and to realign its goals and objectives so as to ensure customer. This is because CRM policies tend to realign a bank and create a shift in which the customer is of most importance. This consequentially causes the bank to change its mission and vision to be in line with the needs of the customers. Goals and objectives that do not have the client in consideration tend to divert a business from its main purpose and may cause the business to pursue unfruitful interests. Such goals and objectives are usually ineffective and may cause failure of a banking institution (Jha, 2008).

CRM also acts as a tool in which the management of a bank can assess and determine which employees and staffs provide the best customer service. It is therefore an analytical tool for identifying performing and nonperforming employees in an organization. The top levels of bank management can be able to identify departments that are delivering services well to clients and those that need some improvement. This can be done through tracking the retention rates of customers and through surveys in which the customers can share their opinions. Departments that perform well can also serve as models for other departments and thus fuel the improvement of service delivery in the bank (Rajola, 2005).

Better CRM polices improve the organizational level of an institution. This is because modern forms of CRM integrate the use of IT and thus this facilitates the collection of data on the clients and the organization of this data. CRM therefore is a good tool that aids in the management and the organization of data in a bank / business.

Customer relationship management in Lebanese banks

CRM is a relatively new concept in Lebanon. Many Lebanese banks are now being forced to reconsider their customer relationship management methods. This is in the light of growing competition and globalization. Lebanon has one of the most stable banking and financial institutions in the world. However many Lebanese banks do not fair very well in how they relate and treat their customers (Berndt and Brink, 2008).

Banking is becoming international in nature and Lebanese banks are now facing stiff competition from new players in the market. Many banks that have operated in other parts of the world of the world for example Europe and Asia are advanced in CRM techniques. European and American banking differs from Lebanese banking in that such banks treat the customer as the most valuable asset of the organization. Lebanese banks operate in a conservative economy and have never seen the need for enhanced customer management methods (Schafer, 2007).

The quality of service delivery is being a major influence in the choices and preferences of Lebanese clients. Lebanese customer service is mainly over the counter or through banks customer care representatives. This means that for people to be able to get assistance from the banks they physically go to the bank. Telephones are the second most commonly used method of communication that the clients use to get assistance form their banks. Brochures / question boxes are the least commonly used method of communication between the clients and their banks (Liu, 2007).

In the past, many banks focused on how to acquire customers. Appropriate methods for acquiring new customers were seen as a way of realizing growth in the number of customers and annual turnover for banks. Many Lebanese banks focused on marketing and promotion as a strategy for growth. This was done mainly through television and print media. Successful Lebanese banks also opened branches throughout the country and this served as way of taking services nearer to the people so as to increase the number of clients (Vogt, 2008).

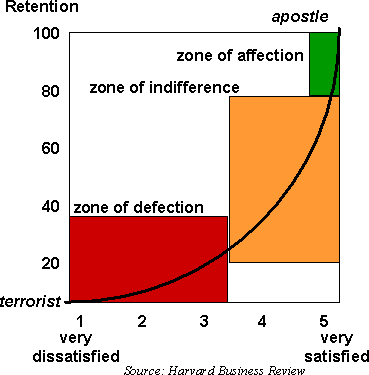

The banks were able to acquire many clients; however this gave rise to a new breed of problem. The problem that currently faces many Lebanese banks is the inability to retain clients. This is a major problem that is faced by Lebanese banks. Global statistics show that banks lose an average of 12.5% of their customers in a year. On the other hand, the statistics show that banks acquire new customers at a rate of 13.5% in a year. This means that the net growth that such a bank can realize would be 1.0% growth per year in the number of clients. It is a ‘give and take’ scenario whereby banks struggle to gain new clients as they lose the clients they have acquired on the other end.

Lebanon faces a very serious problem of customer retention; loses and equal number of customers as those gained. This can be attributed to the poor customer relationship management services that are offered in Lebanese Banks. Lebanon is becoming a competitive economy and banks are now forced to manage relationships with their clients better so as to prevent losing them. Initially CRM did not affect relationships between the clients and their banks, but banks rates and charges were the main determinant of consumer preferences. These attitudes have undergone change and now customers become unsatisfied if their banks do not exhibit good customer relationship management policies (Rainardi, 2008).

Many banks in Lebanon need to implement CRM as it has the ability to reduce the cost of operation of the banks, promote growth in client numbers and improve the reputation of the bank. CRM has been found to be a cheaper method of building clientele numbers. Marketing and promotion is the main method used to recruit new customers into banks. This is an expensive method as it involves hiring more staff or agencies to market the banks services. CRM on the other hand is far much cheaper as it capitalizes on the available customers (Romano and Fjermestad, 2006).

CRM as a process involves three phases. The first phase is promotion / marketing and acquisition of new clients and customers, the second phase involves the enhancement of customer service and the third phase involves activities geared towards customer retention. Lebanese banks are very good in promoting themselves and acquiring new clients, however they pay minimal attention to enhancing service delivery and retaining customers (Dibeh and Cobham, 2009).

Many customers in Lebanon have claimed to change banks due to the poor services that they receive from their banks. A complaint that tops the list includes poor communication and response from the banks. Many Lebanese clients who have changed their banks say that their banks do not respond to their enquiries early enough and in some cases no reply at all has been received. Lebanese banks also do not make the client feel valued. This is portrayed in the way the customers are treated by banks staff and how their issues are handled (Hostetler and Mathena, 2009).

One in every two customers in Lebanon who has changed a bank account claims that dissatisfaction is the number one reason why they change banks. Competition for clients in Lebanon has been on the rise and banks are looking for dissatisfied customers to poach. In a drive to recruit more clients banks offer the promises of a better experience and service and this fuels the already high customer turnover in Lebanon. Majority of Lebanon’s population have bank accounts. This means that there is a lack of fresh opportunity of existing banks. This is why banks are on a drive to woo clients from other banks into theirs, and the banks with the best CRM policies will take the day (Goddard and Raab, 2008).

Lebanese banks have identified the importance of retaining customers over acquiring new customers. This is because it is easier to maintain older customers and costs less to maintain old customers as compared to gaining new ones. Older customers tend to spend and transact more and thus generate more revenue for the banks. Banks can also benefit greatly from older clients as they tend to spread word about the bank and in turn help the bank acquire new clients; in a cost free and effective way. Word of mouth is known to have high customer conversion rates as compared to advertising and marketing campaigns. This is because word of mouth is backed by visible results or testimonials. Lebanese banks need to shift their customer acquisition methods from marketing and promotion campaigns to personal recommendation. This can be facilitated by ensuring that the bank’s clients are satisfied and happy (Merkel, 2010).

Older clients are known to be responsive to new packages and offers as compared to new ones. This is because a customer who is happy with the kind of services and treatment that he is receiving becomes loyal to his bank. This means that the client will not respond negatively to price changes and change in operation mechanism of the bank.

The effectiveness of CRM policies in Lebanese banks can be measured by the ability of these banks to retain customers. Effective CRM policies are those that solicit customer loyalty and satisfaction with their institution. Customer loyalty is directly proportional to the profits that an institution can make (Peelen, 2006).

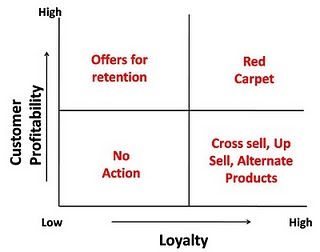

The above figure shows the relationship between customer loyalty and profitability in Lebanon. When no CRM action is taken by the bank, this results in low profitability and low loyalty. When the bank provides offers and packages that are geared towards the retention of its clients this results in high profitability but low loyalty. When red carpet treatment is offered to the clients, this results in high customer profitability and high loyalty among the clients. On the other hand cross sell and alternate products / offers result in high loyalty but do not result in financial gains for the bank. This chart shows that treating customers well and offering them high quality services results in improved loyalty and profitability as well. This type of treatment is prescribed for Lebanese banks as it would boost their profitability and at the same time solve the problem of customer loyalty (Gup, 2007).

CRM in Lebanon is prescribed for use together with electronic banking. E banking has been found to improve the CRM delivery. Although e banking has not been extensively used in Lebanon it poses as a major method of the ease through which clients can access information. Customer relationship management in an electric form is referred to as eCRM. This type of relationship management is whereby the banks offer services to their clients via the internet. Technology has been found to improve service delivery and customer satisfaction since clients are able to receive services rapidly and efficiently. This minimizes the amount of time that a client needs to physically go to his/ her bank. Through ebanking clients can transact business and contact bank executives. This is a cheap and effective way of improving the relationships between banks and their clients (Collica, 2007).

There are various types of remote banking facilities that Lebanese banks provide for their clients. These include telephone banking, online banking, faxing facilities and ATM facilities. The quality of remote banking facilities that a bank offers has been found to have significant effects on the loyalty and satisfaction of a bank’s clients. Educating clients on the importance and appropriate use of ebanking facilities has been found to be of boost customer cooperation. Most Lebanese banks provide training to their clients through brochures and live assistance so as to aid their clients in using the remote banking facilities (Salami, 2009).

Banks In Lebanon need to shift their emphasis form operational efficiency and profitability to service delivery. The quality of service that the banks deliver will have a great impact in how the banks perform in the long term. Lebanese banks should brace themselves for an era in which the customer comes first before the employees. Modern management principles show the need for making the client the number one priority of the business. This particularly holds true for Lebanon since the banking industry is quickly changing. Lebanese banks need to change with the times and ensure that they conform to new developments in banking. Lebanese banks are conservative in many ways including in their customer relationship techniques (Seddon, 2004).

CRM approach needed in Lebanese banking

Lebanese banks not only need to change how they treat their customers but need to carry out a full overhaul on how the banks operate and carry out their activities. Such an approach would lead to easier integration of CRM policies into Lebanese banking. Lebanon banks also need to look at banks that operate in similar economies and have improved or have better CRM policies. This would provide a realistic approach to these banks as they would be able to compare experiences of banks that operate in similar condition and cultures and this would enable the banks to map out unique CRM policies suited to the Lebanese people (Schust, 2007).

Western models of CRM would be misleading to Lebanese banks as they do not necessarily reflect the Lebanese people, culture and operating environments that Lebanese banks are facing. Lebanese banks need to do substantial research on the Lebanese economy so as to establish, the culture, the preferences and the opinions of people and how they would affect the type of CRM policy that they integrate. Lebanon is a country rich with social values; these values could be seen in the way people transact business, interact with each other and with their banks. Lebanese banking is also greatly affected by social values and it is this relationship between social values and banking that makes the banks resistant to change. Banks in Lebanon also need to cultivate corporate values and be guided by these values instead of the social values (Gaspard, 2004).

Corporate values enhance the approach of a bank towards its employees and customers. For a bank to have happy customers it must have happy employees. CRM is fully dependent on the employees as it aims at improving the quality of service that the employees deliver to the customers. Better corporate values would enable Lebanese banks to change their approach towards gender and age differences of their clients and customers. Improved social values would also facilitate better relationship between the banks and other stakeholders; facilitate the formation of long term relationships (Rai, 2008).

Electronic banking in Lebanon

Electronic banking is widely used all over the world. This type of banking also facilitates better and improved methods of communication between the client and his / her bank. This type of banking has a great potential in Lebanon. This is because Lebanon has one of the most advanced internet usage in the Middle East. Many Lebanese people use the internet for sending emails and social networking. However this usage has not been tapped by Lebanese banks. The slow integration of ebanking is blamed on the poor promotion of ebanking done by Lebanese banks. Lebanese banks do not seriously consider ebanking as a great tool towards enhancing CRM (Bejou and Iyer, 2003).

Studies show that only 10% of Lebanese clients use internet banking services. The studies further show out of this small proportion, majority are not in Lebanon. This shows that electronic banking is not yet well embraced by Lebanese people. Majority of clients in Lebanese banks are small business owners and traders and the nature of their businesses cannot be blamed for the poor response towards the slow progress of ebanking (Rogers and Peppers, 2004).

Banks are not fully responsible for the poor performance of ebanking in Lebanon. The Lebanese market has also been very slow to receive and accept ebanking. The Lebanese people are social people with a warm culture where personal relationships symbolize respect. It is due to such a culture that most Lebanese clients prefer ‘over the counter’ and interpersonal relationships with their banks. This is a big blow to ebanking and it might take time before the culture in Lebanon changes and in effect give some room for change (Rolland, 2003).

Older populations in Lebanon are most strongly opposed to ebanking. It is against the Lebanese way of life. Young people however, are able to understand how ebanking works and its benefits. Lebanese banks should therefore target the young generation as they are the most suitable market for ebanking services. eCRM campaigns by Lebanese banks should therefore be targeted towards the young people. The banks could make use of social networking websites where many young people visit.

Ebanking is a better opportunity for interaction between the client and the bank. This is why customer relationships via the internet are encouraged. This is because clients interact with their banks via the internet up to five times more than they would visit their local branch. This means that ebanking provides better avenues for banks to market its services and attend to the needs of its clients via ebanking compared to conventional banking. Strategic actions need to be taken by Lebanese banks so as to capitalize on the potential of ebanking to improve CRM (Bergeron, 2002).

Challenges of CRM

Many companies and organizations face some difficulty while implementing CRM. This is because for CRM to successfully work it involve the cooperation and synchrony of many departments and [personnel in a bank. The implementation of such a system is usually difficult and tasking and thus a major hindrance to the implementation of CRM in many institutions.

There is also poor knowledge among organizations on what CRM is and what it entrails. This is coupled by the minimal amount of research that has been done on CRM implementation. This is one of the least researched business topics. The minimal information available on CRM may be due to its relatively young period of use. CRM has been around for approximately 30 years and this time has not been adequate enough to allow for enough studies to be done. This is a negative indicator as poor research may hinder the growth and development of CRM policies all over the globe (Berndt and Brink, 2009).

Institutions are therefore confused on the implications of CRM and the limits and measures that they are meant to take. This has resulted in disorganized implementation by institutions in an attempt to be associated with CRM policies yet they are not well averse with what it is. There is a lack of a common understanding and definition of CRM and this further fuel the problem. There are many definitions of CRM with each stakeholder choosing to adopt his own type of CRM. This calls for the creation of a common understanding on what CRM and what it is. This would enable institutions to implement it easily ands be able to gauge how well they are doing (Mennon and O’Connor, 2007).

The success rate of CRM ventures by many businesses / banks has been very poor in the recent years. Studies show that only one out of every six CRM ventures is actually successful. More than seventy percent of all CRM ventures in the United States have failed to meet their set targets. Majority of companies have been unable to meet their expected ROI (returns on investment). Large corporations and banks have been found tom be most unsuccessful in the CRM attempts. This is because of the generally large size of these institutions and thus it becomes difficult to set up proper structures to support the CRM framework (Hostetler and Mathena, 2009).

Effective CRM is expensive. This is because of the extra costs in labor and equipment needed to maintain customer databases. Analysis of data on the customer is expensive and time consuming. This means that the institution has to invest more money for every client that it is trying to retain. The ROI of CRM has not been very good and thus this is one of the reasons why many organizations are skeptical of the ability of CRM to increase profits. CRM is able to benefit an organization in the long run and thus can offer immediate solutions to companies that want to make profits immediately (Reinartz and Kumar, 2006).

Many organizations start off with very strong and solid CRM principles. However with time these goals and objectives weaken out. When organizations face crisis periods they often abandon CRM. The poor priorities by organizations have also contributed to the poor development of CRM policies in companies and organizations. In some instances the organizations usually shift their focus from CRM to other issues. Many institutions lack in the focus and drive needed to successfully ensure the proper implementation of CRM and thus its failure in some instances.

Studies also show that CRM is relatively difficult to implement and organizations have to carry out major restructuring and reorganization so as to support CRM. Analysts dispute the fact that CRM is easy to implement and state that it cannot be supported by the conventional systems of an organization. For example employees in a bank need to receive adequate training before they can be able to offer support services that are in line with CRM policies. CRM systems are also very complex and the existing employees of an organization need to be improved / ‘upgraded’ so as to be able to cope with change (Dibeh and Cobham, 2009).

Customer focus in the levels prescribed by CRM policies will need to be implemented by highly motivated employees. This means that the organization has to first of all cater to the needs of the employees so that they can be motivated enough so as to deliver the required services to the clients. The success and failure of a CRM policy greatly depends on the level of satisfaction of the employees. It is thus greatly dependent of employee welfare and this further complicates it. This means that in the event of employee dissatisfaction even CRM will suffer.

Many institutions do not understand the meaning of CRM and thus have given CRM a remote face. This means that instead of CRM being focused on personalized assistance of the employees it has taken a not personal and entirely remote form. This is a common misconception of CRM. This is because remote CRM is cheaper to implement and thus many organizations prefer to employ and IT inclined type of CRM (Schust, 2007).

Liu Strategic framework for CRM

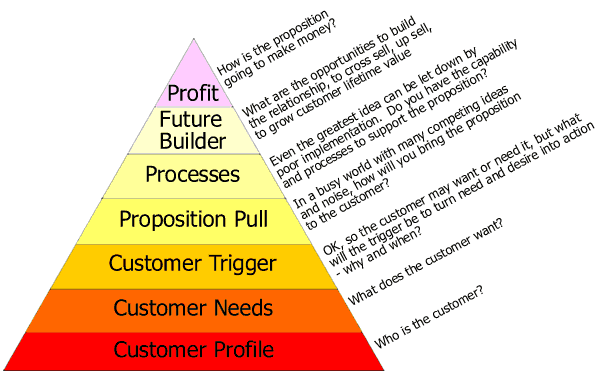

According to Liu CRM is an intensive process that involves the cooperation of all the departments and staffs of an organization. Proper CRM policies tend to improve the relationship and cooperation between the bank and its clients. Liu also proposes that CRM has an overall effect on customer loyalty and profitability and it must be well integrated into an organization for positive results to be realized. Liu also developed a strategic framework which when followed by organizations will lead to good CRM policies.

Contact channel management

The process of CRM starts with the banks creating contact with the client. The type of contact channel that the bank chooses depends on the customer profiles that the bank has collected. Young bankers may be contacted through mobile phones and the internet if they are frequent users of these media. However more conservative clients may be contacted through mail or through messengers. In Lebanon many businesses are owned by families these families are led by conservative leaders who are much older than the rest; the fathers and the grandfathers. Since these leaders belong to the old generation they are very conservative and to not welcome modern methods of CRM such as the internet. In such instances the banks can establish communication through letters, parcels, brochures or by sending bank representatives to personally contact the client.

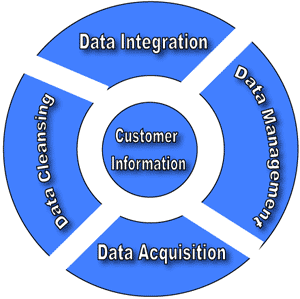

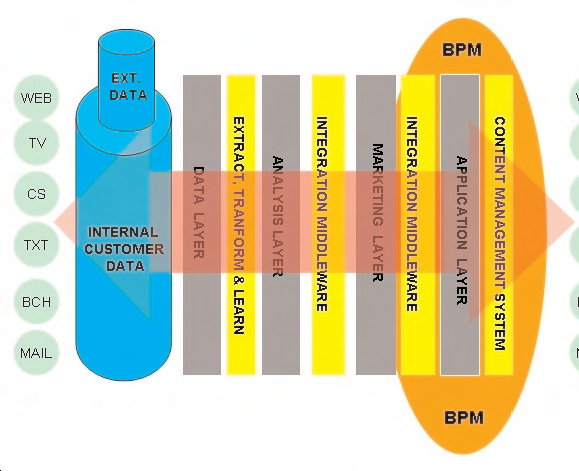

Before contact has been established with the client, the bank has to collect data first. Data by banks is collected from the front desks where clients are served. These include enquiries desks, customer service desks, counters, cashiers and departments. These are referred to as the first stages of data collection. After data has been collected by these front desks it is then sent to the back offices which tally and analyze the data. This is done by a professional team of IT specialists and statistical analysts. The back offices are where the raw data collected from the front offices is converted to meaningful data that can be used for development of CRM policies for the organization. The effectiveness of a CRM policy is greatly dependent on the quality of the back office processes. That is why banks need to invest well in the data management equipment and adequately train the concerned staff.

Proper management of data on the banks clients will enable the banks to properly understand the complexities that affect their clients and influence their decisions. Efficient contact channel management is very important in a bank as it forms the first step in implementation of CRM. Conventional business structures may not be able to support enhanced CRM policies. Once a bank decides to employ CRM it must strive to restructure its contact channels and implement compliant ones. This will require proper training of staff and reinvention of customer service management.

CRM emphasizes the importance of bank’s contacts over everything else. It encourages the proper data collection on these contacts and ensuring that these contacts are satisfied. The contacts already available to a bank also serve as a tool for promotion in that satisfied contacts tend to refer other people and in turn increase the number of contracts.

Efficient contact channel management allows the bank to identify sections in the channel that are performing well and those are not. Commissions could also be offered to front office or back offices that outperform their set targets. CRM is better implemented in cases where the employees are paid using commissions and bonuses. Bonus systems allow the employees to become more motivated and driven in serving the client better and creating positive customer experience.

The primary aim of any contact channel management service is to identify the preferences and the likes of the clients and to ensure high conversion rates for new products and campaigns. Contract channels are intended to convert generated leads into loyal customers and to extend services to loyal customers. CRM proposes that every opportunity to contact the client should be a leeway through which the bank can use to strengthen and deepen its relationship with the client. Therefore all contact channels should be well designed so as to make the customer happy and satisfied. If the customer is not satisfied after contact with his / her bank this causes a rift between the client and the bank instead on strengthening the relationship. Contact management is very important; this is because if the client becomes unsatisfied by the quality of service delivered after each contact the client, may decide to change banks. This results in poor customer loyalty and retention abilities of the bank.

Contact channels also serve as effective tools that aid in the expansion of a bank’s services. This is because the database and customer profiles enable a bank to track the performance of various offers and packages that it has made available to the clients and how they have performed. From the customer feedback received it can be able to make changes and correct areas that had weaknesses. This will ensure that the new venture / project is configured to work and be well received by the bank’s clients. A major problem with new projects is their inability to satisfy the requirements of the clients but with proper contact management techniques it is possible to create new services that are in line with the desires and expectations of the clients.

Such information is also important when a bank is opening new premises as it can be able to plan well and coordinate its services based on the data that it has available. CRM enables an organization to properly organize data collection and service provision; this enables the bank to be able to cope with increased number of clients. When an institution realizes growth it usually faces a problem of data and customer service management. However, institutions that have properly implemented CRM are usually very comfortable in managing an increase in the number of clients. This shows that proper contact management is an effective tool in planning for growth and expansion for a bank / institution.

Enterprise wide management

For CRM to be successfully implemented in an organization it needs to be embraced in all sectors and departments of the organization. If the different offices and departments in a bank do not cooperate towards the fulfillment and satisfaction of the customer no CRM policy in an institution would ever succeed. Banks need to make CRM an individual responsibility of each and every member / staff. Each employee needs to understand that he / she has a role to play in CRM. Unlike other functions in an organization which are limited to a few department sand organizations e.g. book keeping to the accounting department and, CRM needs to be a responsibility of each and every department.

Management of Lebanese banks need to restructure their activities and processes so as to make them user friendly. In an attempt to redesign their processes and restructure their operations banks need to understand the customer, how he / she thinks and what the customer prefers. All restructuring operations and management operations with respect to CRM should be done from the outside to the inside. This means that the banks need to establish what the client wants, his / her attitudes and base the restructuring programs on this. This means that this type of management will be structured the internal structure and activities of the banks to be in line with the requirement s of the clients.

CRM based management is a type of management that starts from the customers view point. The customer is the starting point of the management process and the bank and its staff is the final stage of management. In such a system the bank collects data and feedback from the clients who are the starting point and later makes changes on the final end so as to satisfy the customers. This is a good structure as it allows the bank to align itself with the needs and wants of the clients. Such management also protects the bank and prevents it from straying from its core values which are to ensure that its clients are contented.

Enterprise wide management allows a bank to shift its focus from operational efficiency and product leadership. Many banks are mislead to understand that operational excellence and leadership in certain segments equates to improved performance and profitability. However, CRM specialists claim that this is a false principle and is very misleading to banks. The only true reflector of how a bank performs and its profitability is the level of customer satisfaction and loyalty. Without happy customers who are loyal to the bank and its products, even if it is the most efficient bank with the best products in the market, such a bank would not realize its long term goals.

Product leadership and operational efficiency are important aspects in any banking institution and should never be taken for granted, however these should not take precedence to CRM. CRM should be the ultimate objective if banks followed by product leadership and operational efficiency. If a bank adopts such a management system this results in improved sales and growth in the number of clients.

In enterprise wide management the top level managers are the main driving force behind CRM. Without the support of top level managers good CRM policies cannot be implemented by a business. Top level managers are required to map the operations of an organization so as to ensure that it is line with its CRM objectives. They are responsible for ensuring that all departments are performing in line with their banks CRM objectives. On the hand the department heads in a bank are responsible for the implementation of CRM policies in their departments and ensuring that those working under them are well trained on CRM. Data is collected from customers and this is an effective tool to be used by the banks in identifying departments and systems that are not working. Once they are identified they can be improved or restructured so as to give the desired results.

CRM proposes that banks should be managed as a single unit. This type of management encourages organizations to view management as an activity that involves all departments and staff of an organization. Management of large organizations is usually difficult and often very complex. The CRM type of management is able to simplify how banks are managed as all stakeholders are able to be in line with the important objectives of the organization. CRM places more emphasis on customer retention as compared to customer acquisition; this means that an organization will be able to save time and ease pressure on management due to campaigns and promotions geared towards customer acquisition.

Customer data management

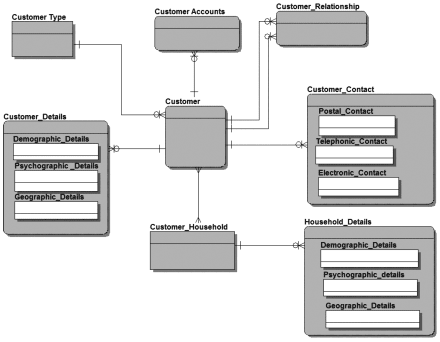

The collection and management of data on banks clients is very important. Data forms a basis through which CRM policies are formed. Without data on the clients and detailed profiles companies / banks cannot be able to map out effective CRM policies.

The initial step in data management is for the bank to determine the methods that it will use to collect the data. This may involve questionnaires, records, staff and even customer service desks. The techniques of data collection should ensure efficient transfer and ensure accurate recording and storage of the data. The banks will also need to know what they intend to the data. An understanding of the activities and the processes that the banks want to carry out using the data is important so as to enable the banks to determine the data collection methods. Integrity of the data is very important and thus its method of collection and storage must ensure that the data is not tampered with. Banks also need to define the type of knowledge that they have and the knowledge that they want to generate. This is in the sense that the banks need to list what they know and what they do not know. Once they have defined what they do know, the data collection processes can then be done with this in mind so as to ensure that the process meets its intended aims and objectives.

Analysis of collected data is done by the help of Customer Data Integration (CDI) and CRM analytics software. These software need to be run by trained staff. When properly used they are able to generate information for the banks from raw data. Data that is collected from the clients is usually in a raw form and cannot aid the bank in making critical decisions. However, once the data has been processed the banks can be able to analyze customer behavior. Data analysis is a useful tool in decision making and is the basis on which CRM is founded. A commonly used software is oracle but in the case of Lebanese banks, custom programs could be developed so as to suit their specific needs and requirements.

Customer data integration (CDI) involves the processes and the technology needed to maintain accurate records on the clients of a bank. These processes ensure that the data that has been collected is able to give a mirror of information on the banks clients regardless of their different behavioral patterns.CDI is important in a customer data management system as it allows the institution to properly manage complexities in the data. For example in the names category a bank may need more than one name for each client. There is a possibility that a few clients may have matching names and the system should be able to cope with such instances. The system should also be able to determine instances where errors in data entry or inconsistent data have been recorded. With such a feature enabled by CDI, the bank is able to identify wrong values and avoid the usage of these values so as to avoid the generation of incorrect information.

There are five main challenges that face any organization in its customer data management activities. The most common type of problem that organizations face is incomplete data. Incomplete data is usually caused by uncertain or erratic responses from the clients. This may leave the bank with incomplete data that cannot be processed into meaningful information. For example if the banks wants to establish how age affects the use of ebanking, then the bank collects all the details of a client except from his age, then such data is incomplete and cannot be useful to the bank. This is bearing in mind that age is a major determinant of the study.

Latency is another potent problem in data management systems used in bank. This problem is caused when banks and financial institutions take too long to process raw data into information or to take action on information that has been collected. This is because the preferences of the clients, their opinions and market trends change on a continual basis and thus collected data is only valid for a limited span of time. Because the validity of data changes with time it is very important for banks to process raw data into information as fast as possible and to take immediate action based on the data. If the bank delays to make decisions and take necessary actions based on the collected information it will become obsolete and therefore ineffective.

Accuracy is a major concern in any CDI system as the data needs to a near actual representation of truth. Inaccurate data may lead to wrong actions taken by the bank and thus the data collection processes should be geared towards the collection of correct values.

Poor management of data is another problem that banks face. This is caused by disorganization and the lack of skills among the staff of an organization. Improper storage systems may also cause damage and loss of the data. Banks need to establish elaborate systems that ensure that the collected data does not lose its integrity and that it does not get damaged before being processed into information. The accuracy of the information must also be cross checked with the raw data before being used to make strategic decisions.

There are five processes of CDI namely dada acquisition, data cleansing and data management. Data acquisition covers how the bank collects the data and how the integrity and accuracy of the data is maintained in the collection processes. Data cleansing is the removal of false, incomplete and null data from the samples taken. Then the final processes involve the integration of the data into the bank’s decision making processes.

Customer privacy is an important aspect of customer data management. This is because the bank needs to protect the personal information of its clients from unsolicited use and exposure. The ability of a bank to handle its client’s information safely greatly contributes to customer satisfaction. Clients need to be able to feel safe and secure with their bank and that details of their transaction will not be revealed to any third parties. To ensure that the customer’s information is safeguarded banks need to be able to encrypt and secure databases from intrusion. Without secure systems malicious activities could be carried out against the bank or the client.

This would also go against the goals of customer data management which is to increase and not to reduce value. In an attempt to ensure customer safety the banks must first of all protect the data from within. The first risk of data piracy is through the staff and data management officials in a bank. Since data management processes cannot be fully automated a degree of human intervention is needed. This means that the banks cannot avoid some of their employees from coming into contact with clients’ information. However the employees should work within work ethics that prevent them from exposing the information that they may come in contact with during their work to any other parties.