Abstract

This essay has two important topics: the role of central banks in stabilizing the economy during a recession and investing during a recession. The first part focused on the possible causes of the Great Depression, the 1990s recession, and the 2008 to 2009 recession also known as the Great Recession. Possible causes of the recessions along with an analysis and discussion by economists and experts were included in this paper. Since the paper’s major issue is about recession, the subject of recession had to be defined in the context of the past economic crises.

The paper also defined the macroeconomic variables present in different recessions experienced by the United States and other developing countries. Special mention is the experience of the Gulf Cooperation Countries (GCC) in the 2008 to 2009 recession. These countries invested in their respective country infrastructures and gained positive outcomes despite the fact that investments were conducted during the financial crisis.

The 2008 recession has long term effects on the U.S. economy. It has demonstrated that monetary policies are not effective in controlling complex financial systems, and their regulatory frameworks need innovations to adapt to complex situations. Central banks have applied policy shifts or changes in times of recession, but central bankers and researchers commented that monetary policy should not be used to motivate economic activity when the interest rate cannot be determined. As a whole, it is monetary policy that central banks should expertly focus on for long term goals.

The role of the Central Bank in stabilizing the economy during a recession

First of all, what is a recession? Roberts (2003) indicated that a recession usually refers to a “general economic downturn lasting two quarters and more” (p. 31). A recession is a state of the economy where consumers stop buying products and producers and manufacturers reduce their production output, causing unemployment as investors fear to take any risks in the investments arena. Overall business activities slow down as the situation creates a domino effect on the other factors. Central banks resort to policy shifts to achieve immediate flow of money supply.

In the 1953 to 1954 recession, the Federal Reserve was free to do what it wanted in terms of formulating monetary policy “to stabilize the economy” (Dickens, 1998, p. 222). However, economists believed that the Fed failed to control the effects of the recession. (Dickens, 1998)

The recent recession (2008-2009) and the accompanying financial crisis impacted on the U.S. economy and the American society; the wounds were deep, which means the effects were long-term. The impact focused on intellectual frameworks or the methods in which economists and researchers analyse financial problems (Lambert, 2011, p. 250).

Analysis

In addition to the explanation above, here are some of the variables that influenced central bank actions to stabilize the economy during a recession.

Monetary Policy

Monetary policy is effective in times of recession; but in normal times, monetary policy is effective in controlling inflation (Illing, 2008). Inflation refers to the price of commodities as affected by the amount of volume of money in circulation.

Central banks can use monetary policy to normalize the situation during a recession, but it has to be cautious so as to avoid what they call a “yo-yo” situation, where there is a lot of money that triggers inflation. Money experts recommend that central banks should change policies by focusing on “monetary stabilization,” instead of focusing on other aspects (Knoop, 2010, p. 64).

Friedman (as cited in Knoop, 2010) argued that central banks should focus on targeting the money supply and not the other factors. By providing a situation where the money supply is on a steady growth, for instance an annual growth of five percent, central banks can create a situation where: policy shifts are avoided that can lead to a steady economic growth; inflation is kept at a minimum rate allowing efficient economic growth; and keeping inflation at a normal level to reduce doubt in the market (Knoop, 2010). The recession in the 1930s is not an ordinary recession and the use of monetary policy could not stabilize the economy at that time (Cynamon et al., 2013, p. 13).

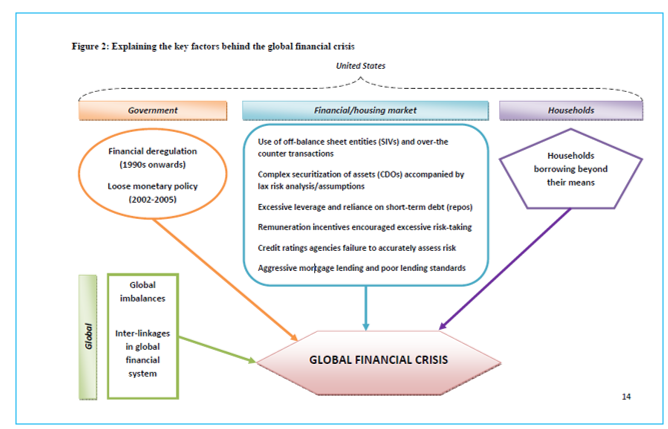

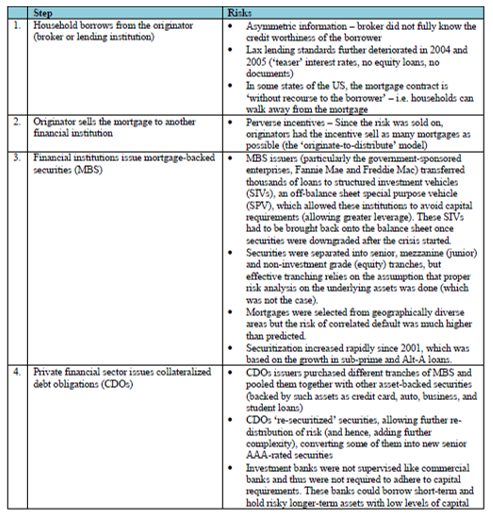

Economists analyzed that one of the reasons of the 2008 financial crisis was the government’s policy to encourage lower interest rates for mortgages, particularly housing mortgages and what they call “revolving credit” (Lambert, 2011, p. 250), which caused more debts for ordinary citizens. Residential mortgages did not work and ordinary households were buried with debts (Mashal & Jordan, 2012). Moreover, there was influx of mortgage loans in the years before 2008, accompanied with government deregulations of financial institutions which encouraged lending institutions to provide more loans for households. Even those who did not have the capacity to pay or could be in a probable financial distress were granted loans (Lambert, 2011). The causes and impact on economic factors, or macroeconomic variables, of the 2008 to 2009 recession are explained in Appendix 1. The steps leading to the financial crisis are explained in Appendix 2.

According to Katkov (2012), the residential market fall and the financial crisis were the results of factors which were outcomes of economic policy shift that occurred way back in the 1980s. Because of this, the U.S. economy has been modified with the restructuring of the manufacturing sector. Some manufacturing jobs were lost and the United States contracted with other countries to do the job for them, which is what we call outsourcing. (Katkov, 2012)

The Bernanke thesis became popular in looking at theoretical aspects of the Great Depression, which states that banks’ balance sheets were to blame for the start of the depression and that banks failed to provide enough amount of loans and not that there was lack of money supply in circulation (Bernanke, 2011).

Fischer (2013) argues that from the lessons of the Great Depression and the 2008 to 2009 financial crisis, central banks have many options in implementing monetary policy, even with the interest rate at the zero level. Central banks can continue buying assets during this zero-interest rate situation in order to have more money in circulation. Asset purchases are aimed at attaining long-term assets and interest rates and can help the private sector’s quest to acquire long-term assets (Fischer, 2013, p. 2). Bernanke (2011) also indicated that monetary policy should aim at long-term goals to attain financial stability, and not on immediate short term goals.

A criticism aired by Wagner (2010) is that the monetary policy practiced by the Fed from 2003 to 2006 was “too loose,” or independent, and affected the “policy rate below the level specified” (Taylor, 2007 as cited in Wagner, 2010, p. 69). This policy produced a “bubble in house prices,” which was one of the prime causes of the financial crisis. The increased price in housing could have been evaded by the Fed (under Alan Greenspan) if the Fed dealt with the policy earlier (Wagner, p. 69).

Impact on the financial sector

Most central banks have not changed their ‘monetary policy frameworks’ since the 1930s depression but have provided flexible tools in their implementations. In the 2008 depression, central banks dealt the blow by forcefully implementing their policy instruments, particularly sharply reducing the interest rates in the short run. Then they applied uncommon tools when policy rates were reaching to normal bound as they guided activities through policy formulation (Bernanke, 2011, p. 5).

The 2008 financial crisis that originated in the United States spread into an international crisis, affecting the financial sector in other countries. The United States banking system and mostly all the other banking systems have become globalized; therefore, different banking systems connect with the United States banking system through mortgages or products spread through international funding markets, which sparked a liquidity crisis for the worldwide banking system. A liquidity crisis occurs when the banks could not pay as there is not enough money. This created a secondary shock to other countries’ banking system and spread domestically in those countries. (Aiyar, 2012)

The financial crisis has taught the financial sector modern methods of central banking. The monetary policy is now part of the intellectual framework of the banking system, with the aim of focusing on long-term goals by learning the lessons of the past (Bernanke, 2011).

Financial crisis

Economic downturns with financial crisis as the main feature are far more difficult to deal with than downturns that do not include financial crisis (Reinhart & Rogoff, 2009 as cited in Fischer, 2013). The fall of the financial system impacted on the monetary system. Central banks tried to determine the real causes of the crisis. (Robins & Krosinsky, 2009, p. 192).

The credit crisis impacted on even “the most highly rated private borrowers,” because of the sharp decline of the equity markets and the deflation of housing markets. The excesses and failures of the banking system were coursed to all global economies. Business and consumer trusts fell alongside tangible assets as doubts in the banking system collapsed. Housing and equity prices have fallen and there is uncertainty even up to this time, and all the other countries not involved in the real cause of the crisis are affected. (Wagner, 2010)

Lowering interest rates in a financial crisis was one of the immediate reactions of central banks. Central banks had to reduce short-term interest rates but on a conditional basis. The 2009 reactions of some banks give us examples of these. The Bank of Canada kept its policy rate steady in April 2009 but wanted to change it later on in 2010 when it had to consider the inflation rate. (Bernanke, 2011).

Outcomes of the Great Recession are: lesser GDP output, increased unemployment, and fears of depreciation across the world, among others. Central banks had to do something drastic and immediate responses included monetary and fiscal policies, but they had to be careful because of inflationary effects. Other governments responded in unconventional ways. The Fed responded through asset purchase measures to have money circulation. By 2009 spring, things started to stabilize while stocks went slightly up. (Carvalho et al., 2012)

Fischer (2013) provided an analysis on the effects of the Great Depression of the 1930s, citing the conclusion of central bankers and researchers that monetary policy should not be used to motivate economic activity in a ‘zero interest-rate’ situation. The financial system at that time was extremely affected. In a financial crisis, the central bank needs to provide more money to lower interest rates, or slow down the money supply to heighten interest rates (Knoop, 2010, p. 64). This is the “yo-yo” situation as explained in the introduction of this paper.

The financial crisis simply demonstrated the failure of monetary policies of the U.S. government and the rest of the monetary policies of the world in controlling complex financial systems; their regulatory frameworks need innovation time and again (Wagner, 2010). The Fed first failed when it was controlled by large private banks before 1935, prompting calls to make it democratic (Dickens, 1998). Now it has democratic policies but still failed in the 2008 financial crisis.

Investing during recession

The common belief is that investments usually drop during a recession. On the contrary, analysts have reported the advantages of investing during a recession. This section will try to investigate why there are firms who take the risk of investing during a recession, and why firms or governments have to provide more money to move up the economy during a recession despite the uncertainties. Many countries around the world try to do this, provide money in circulation to keep the economy active. Rich countries with lots of dollar reserve in their banks would try to do it to trigger economic activity and get out from the crisis.

Many economists and researchers have turned back to the thought of John Maynard Keynes who not only considered strict money regulations and procedures in getting out of a recession but considered other factors such as social and environmental factors. Keynes’s philosophy became popular after the Great Depression but is still popular today. This line of thought and philosophy proposed socially responsible investment as the key to getting out of any possible downturn or financial crisis in the future. This should be applicable in the 21st century where “long-term environmental, social and economic factors” are incorporated into investment and other forms of private ownership (Robins & Krosinsky, 2009, p. 192).

This is also parallel with the other areas of sustainability, for instance, access to energy, health, water, and other basic amenities, including perseveration of natural resources, which should correlate with sustainable development. Firms are committed to corporate social responsibility (CSR) to promote corporate goodwill and ethical behavior in the workplace, and help in the preservation of the environment. Investments made during a recession can be focused on corporate social responsibility and firms’ commitment should be accompanied with social relevance.

Investing during a recession also runs parallel to Keynes’s sustainable investment where potential targets are identified to provide a good return and positive benefits. It also depends on an active group of businesses which rely on a healthy overall economy. A healthy civil society should help along this line where the entire range depends on a sustainable planet. (Robins & Krosinsky, 2009)

On the business side of investing, the Profit Impact Market Strategy (PIMS) (as cited in Roberts, 2003) has advised that we should invest aggressively during a recession in such areas as customer satisfaction, quality service, and marketing. Strong businesses will remain competitive and weak businesses will survive if they continue to invest during a recession. (Roberts, 2003)

During the recession of 1982 to 1985, some countries, for example the UK, saw investors entering the market and later benefited from higher rental values in the years after that, i.e. 1986-1989 (Callender, 2009). When the economy holds on and becomes steady after a recession, investing proves to be successful. An example of this form of risk taking is that of the GCC countries, which were greatly affected by the financial crisis of 2008-2009. The different sectors of the economy suffered negative effects (Abdelbaki, 2010) as governments with their central banks were in panic on what to do. The private sector of the GCC was severely impacted that led to its gradual downfall. Governments cut respective budgets as private businesses closed shop, and wealthy families became insolvent. The recession made a severe blow on the GCC countries because of the sharp drop in oil prices, from a high of $140 to a low of $40 a barrel in 2009 (Hertog, 2009, para. 2).

However, most GCC governments were hopeful for immediate recovery and were willing to take the risk; one of their positive moves was investing during a recession. GCC governments continued to pour in more funds, known as petrodollars, to country infrastructures, such as roads, government buildings, hospitals, and also helped the private sector through loans. As a result, the GCC governments were able to revive the economy and help the private sector slowly stand up to its knees. Economic activities kept local investors busy as they poured in more money in circulation and helped the GDP rise.

GCC economies have been expertly managed and are maturing. Governments and private sector counterparts have handled the fiscal policy with much caution as a lesson of the problems they encountered in the 1970s and the recent recession of 2008. Moreover, the private sector now has become independent and does not fully rely on government aid, thereby strengthening itself from potential financial crisis. (Hertog, 2009, paras. 3-5)

The study: Investments in recessions

Roberts (2003) conducted a study on the significance of investment during a recession, focusing on markets that encountered decline and recovery in volume demand. He defined market in recession as “experiencing two years decline in volume followed by two years of growth” (p. 31). About one thousand businesses in the PIMS database were used as sample. This database provided a brief description of the experiences and performance of the firms. By 2002, the database already contained about 4,000 businesses coming from the different industries in North America, and parts of Europe and the world. (Roberts, 2003)

The study considered the environmental factors, e.g. company growth, area of concentration, changes and innovations introduced, operational and logistical complexity, and similar factors; competitive position aspects, focusing on market share, tangible and intangible assets, customer relations, and so on; and, resource structure, which focused on capital turnover, assets, and outsourcing activities. (Roberts, 2003)

The study investigated aspects of business where investments grew dramatically in spite of the recession and areas where businesses failed. It distinguished what were good and bad investments, and what were “good costs” that should be provided with more capital. “Bad costs” refers to investments that need to be scratched out from the prospects of companies wanting to invest. The researcher found that implementing various strategic options greatly influence the profit and market share outcomes once the situation has normalized. Firms in the database did not reduce spending; instead they increased market spending, pushed through with product launching and prepared strategies for more challenges in the market. (Roberts, 2003)

There were several factors used in the study, and one of these was termed “good costs,” which focused on the importance of marketing. A normal reaction of many firms experiencing difficulties in their earnings is to cut costs. But the findings in the study showed that firms should do the opposite if they want to survive the recession and come out successful after that. Another significant finding in the study focused on product innovation. Research and development (R&D) in recession can have beneficial results as it is a “good cost” in a recession. Product innovations help in recovering a business after a recession. (Roberts, 2003)

There are other examples of new-product launching in times of recession. One is Gillette’s launching of “Gillette Sensor,” which sold 8 billion blade cartridges and millions of “sensor razors”. After the recession, Gillette found that it had sold new products in the five years during the recession, and its R&D amounted to $212 million (Roberts, 2003, p. 36). Another investment strategy during a recession is known as cutting outputs, which is considered an appropriate strategy by some economists (Roberts, p. 37). Outsourcing allows firms to focus on their core competencies, but it depends on the firm’s market position.

Another example of good investing during a recession is that of Midland Bank’s innovation for First Direct, a telephone banking service introduced in the UK. During the recession of 1998, First Direct had about 850,000 customers and this was increasing at an average rate of 12,500 customers per month. First Direct is a great example of investment during a recession as it provided superior quality service and customers’ value-for-money. Customers have expressed their satisfaction of the company’s quality service and they prefer it over other banks. (Roberts, 2003)

The 1990s recession did not influence the decision of a paper products company in investing a “large capital to build a new state-of-the-art, automated warehouse” (Roberts, 2003, p. 36). The logic in building the warehouse was to lower costs by reducing manpower and increasing efficiency, especially in answering and dispatching customer requests and orders. There were negative repercussions to this investment venture during the recession, as the systems and procedures reduced flexibility in answering to customer demands, along with the loss of market share.

PIMPS (as cited in Roberts, p. 37) suggested that the right strategy should have been to directly attack the prime targets to reduce the costs during hard times. In the case of the paper products company, the venture was part of what could be considered “bad costs” as it increased working capital, manufacturing costs and administrative expenses, although the prime objective was to reduce costs. (Roberts, 2003)

The JOBS Act

The JOBS Act is an outcome of calls from small firms and entrepreneurs for the U.S. government to provide funds as an aftermath of the harsh realities of the 2008 recession. It was designed to encourage small and medium-size firms to invest during a recession. This Act provided for small business ventures to raise capital by means of a strategy called “crowdfunding,” wherein large firms help small firms through funding. This strategy eliminates SEC registration procedures and other expenses for start-up businesses. Small firms can have this opportunity to invest, while the middle-class investors can also acquire funds. Before, only the wealthy had more opportunity to acquire funds. (Williamson, 2013)

The Act also encourages other Americans to invest their money and have their part in the wider spectrum of business especially during and after a recession. This law introduces start-up investing where investors provide capital for small businesses. This sounds risky but it provides exceptional benefits. There are experienced capitalists who invest their money on small firms even in turbulent times but attain positive results through quite sizable profits. Encouraged in the Act is “crowdsourcing,” as a way of acquiring capital from large investors without the usual expensive SEC procedures and rules, but without violating the law as embodied in the 1933 Act. (Williamson, 2013)

There are large investors who provide investments during a recession. These investors have realized the importance and profitability, to say the least, in investing their money in times of crisis. Government policy makers have seen the opportunity in tapping this source of capital from the private sector, and it is one way of getting out of the recession with lesser risks and negative impact on the economy.

References

Abdelbaki, H. (2010). Assessing the impact of the global financial crisis on GCC countries. Journal of Business & Economics Research, 9(2), 139-151. Web.

Aiyar, S. (2012). From financial crisis to great recession: the role of globalized banks. American Economic Review: Papers & Proceedings, 102(3), 225-230.

Bernanke, B. (2011). The effects of the great recession on central bank doctrine and practice. Web.

Callender, M. (2009). Investing in UK property during and after a recession. Web.

Carvalho, C., Eusepi, S., & Grisse, C. (2012). Policy Initiatives in the global recession: What did forecasters expect? Current Issues in Economics and Finance, 18(2), 1-11. Web.

Cynamon, B., Fazzari, S., & Setterfield, M. (2013). After the great recession: The struggle for economic recovery and growth. New York: Cambridge University Press.

Dickens, E. (1998). Bank influence and the failure of US monetary policy during the 1953-54 recession. International Review of Applied Economics, 12(2), 221-240.

Fischer, S. (2013). Introduction: Central Bank lessons from the global crisis. In J. Braude, Z. Eckstein, S. Fischer, & K. Flug (Eds.), The great recession: Lessons for central bankers (pp. 1-17). Massachusetts: Massachusetts Institute of Technology.

Hertog, S. (2009). Gulf states and the global recession. Web.

Illing, G. (2008). Financial stability and monetary policy: A framework. In J. Touffut (Ed.), Central banks as economic institutions (pp. 68-87). Massachusetts: Edward Elgar Publishing, Inc.

Jácome, L. (2009). Central banks and financial crises: Lessons from recent Latin American history. Web.

Katkov, A. (2012). Great recession of 2008-2009: Causes and consequences. Journal of Applied Business and Economics, 13(3), 107-122. Web.

Knoop, T. (2010). Recessions and depressions: Understanding business cycles. California: ABC-CLIO, LLC.

Lambert, T. (2011). Falling income and debt: Comparing views of a major cause of the great recession. World Review of Political Economy, 2(2), 249-261. Web.

Mashal, A. & Jordan, A. (2012). The financial crisis of 2008-2009 and the Arab states economies. International Journal of Business and Management, 7(4), 96-111. Web.

Roberts, K. (2003). What strategic investments should you make during a recession to gain competitive advantage in the recovery? Strategy & Leadership, 31(4), 31-39.

Robins, N. & Krosinsky, C. (2009). Public Policy Research, 2(1), 192-197. Web.

Verick, S. & Islam, I. (2010). The great recession of 2008-2009: Causes, consequences and policy responses. Web.

Wagner, H. (2010). The causes of the recent financial crisis and the role of central banks in avoiding the next one. International Economic Policy, 7(1), 63-82. Web.

Williamson, J. (2013). The JOBS Act and middle-income investors: Why it doesn’t go far enough. The Yale Law Journal, 122(1), 2069-2080. Web.

Zaki, E., Bah, R., & Rao, A. (2011). Assessing probabilities of financial distress of banks in UAE. International Journal of Managerial Finance, 7(3), 304-320. Web.

Appendices