Introduction

Founded in 1870, Deutsche Bank has a long history of failure and success throughout meeting its paramount goal of connecting Germany and the rest of the world in the context of financial operations. The crisis of 2008, a striking event that affected all banks, led to the collapse of many financial institutions and significantly reduced revenues. In response, the Basel Committee issued the Basel III agreement to eliminate conditions that might lead to the recurrence of such a crisis (Grosse & Schumann 2014).

While the agreement was expected to strengthen the requirements for banking capital and liquidity, the difficult situation that continued to affect many large banks, impacting the banking sector of entire countries, required further tightening and unification of banking rules. Deutsche Bank was required to follow these regulations due to the need to ensure appropriate risk-weighted assets (RWA) valuation, preserve and increase global market share, and shape and implement buffer capital.

Deutsche Bank’s Reasons for Following the Basel III Accord

Due to rapidly-developing financial globalization, national standards for organizing, operating, and regulating the activities of financial intermediaries have ceased to meet modern requirements. The Basel III agreement tightens the requirements for the composition of Tier 1 capital by excluding from it the amount of deferred taxes and securitized assets (Basel yesterday, today, and tomorrow 2017). Also, it recommends increasing the share of Tier 1 capital and total capital.

Deutsche Bank’s first reason for meeting Basel II requirements is the fact that to remain competitive among other banks, the organization should strive to preserve its global market share by ensuring reliability in global investment banking. In particular, it should be emphasized that the identified indicator is used to describe the bank’s capital adequacy, which is the main capital including equity and open reserves, and it cannot be used for the repayment of debts.

A second reason for implementing Basel III requirements is the currently imperfect system of assessing customer risks based on progressive international standards. Risk assessment following the existing methodology consists of a relatively small number of national rating agencies as well as borrowers who have received credit ratings from international rating agencies (Basel yesterday, today, and tomorrow 2017).

The underdevelopment of internal rating systems in most commercial banks, significant discrepancies in the definitions of default, overdue debt, and credit losses used in banking practice may also be noted among deficiencies. Current data regarding the frequency of defaults and migration of external ratings of market debt instruments and internal ratings of bank loans are insufficient and require development (Grosse & Schumann 2014). The impact of economic and industry cycles on the levels of losses and risks in the banking sector and a lack of financial, personnel, and information resources necessary for the implementation of more advanced approaches dictate further transition to innovative evaluation methods.

Basel III notably promotes the reconsideration of RWA and their involvement in planning solutions that address risk. Along these lines, the Basel Committee suggested reducing the variety of methods that banking institutions use to calculate RWA. This planned reduction was due to the limitations in the internal or domestic models of the definition of RWA as a key indicator of bank stability. A bank that is not particularly optimistic about accumulated risks tends to underestimate RWA, causing a deliberately inflated notion of capital adequacy to arise. By following these regulations, even though Deutsche Bank is likely to observe some decrease in return on equity (ROE), the long-term perspective seems more beneficial.

Third, Basel III establishes the need for credit institutions to form at the expense of the net profit an additional conservation buffer capital. The latter will allow banks to decrease the capital adequacy ratio below the minimum allowable amount of additional liquidity without the sanction of a regulator in the event of a systemic crisis (Basel yesterday, today, and tomorrow 2017). However, after the crisis ends, organizations are obliged to recover this capital.

On a related note, one of the provisions of Pillar I states that buffer capital is to be related exclusively to the base capital of the first level. Tier I capital should be used primarily to meet minimum requirements; only then may the remainder be added to the capital protection buffer. Pillar II regulates changes in the calculation of capital to cover counterparty credit risk and the norm of short-term liquidity as a stock of highly liquid resources, allowing activities to continue under stressful conditions for a month. In general, all the discussed changes are likely to secure banks from suffering significant losses in the event of another global financial crisis.

Among other reasons for implementing Basel III, the agreement offers advantages for both banks and customers. For example, while the negative effect of a banking crisis can lead to a decline in economic production, the agreement aims towards prevention. Also, the benefits of Basel III exceed the costs associated with its implementation since a stable banking system provides a basis for sustainable development over a long-term period (Howarth & Quaglia 2016).

Notably, for the first time, these regulations are ceasing to be mere recommendations for specific countries and are instead becoming stringent requirements. Respectively, central banks will be given powers and obligations to punish disobedient banks; for example, such banks would have no possibility to pay dividends to shareholders or bonuses and other awards to their managers. The phased introduction of more stringent rules is aimed to enable banks to adapt to new conditions.

Historical Financials and Deutsche Bank’s Profitability

Return on assets (ROA) is a financial ratio that characterizes the return on the use of all the assets of an organization. The ratio shows a bank’s ability to generate profits without taking into account its capital structure, known as financial leverage, and the quality of asset management. In comparison, the return on equity (ROE) refers to a financial ratio that illustrates the return on the investments of shareholders in terms of accounting profits.

The historical financials of Deutsche Bank revealed that before 2008, the organization’s revenues came primarily from increased leverage rather than productive assets. For example, the bank’s ROE in 2007 was 24.97 percent compared to 0.36 percent for ROA.

Accordingly, the global financial crisis caused a stressful situation when Deutsche Bank’s ROE sharply decreased to ‑12.91 percent and its ROA was ‑0.18 percent. A review of subsequent years shows decreasing ROE, while ROA remains comparatively steady. Thus, it becomes evident that Basel III regulations preserved the key trend for the identified bank because its revenues are obtained mainly from ROE.

When considering Deutsche Bank’s profitability in the context of other large banking institutions, it is important to stress that ROE was expected to decrease and the indicators that were characteristic to this industry would never have been achieved. The abovementioned issue was caused by the need to attract more capital to meet the requirements regarding weighing risk. Initially, it seemed that Deutsche Bank might not be able to achieve its profit goals.

The statement that was issued after the bank’s report for the second quarter of 2010 turned out to be worse than analysts’ expectations. Net profit rose to 1.2 billion euros, less than the predicted 1.3 billion. The former head of the bank, Joseph Ackermann, stated that it would be extremely difficult to implement because much depended on a smooth and stable solution to the European debt crisis. Josef Ackermann was replaced by Jürgen Fitschen and Anshu Jain, who are now co-CEOs of the company.

According to 2012 results, the net profit of Deutsche Bank decreased by almost 85 percent, and the last quarter of the same year was completely unprofitable. The main reason for this was the high cost of restructuring, which, however, gave investors hope for recovery for Germany’s largest bank at the end of 2014. Deutsche Bank lost 2.2 billion euros over the past quarter, having an immediate effect on the year’s final financial results.

The bank managed to finish 2010 with a rather modest result of 665 million net profit, while in 2010, it earned 4.32 billion euros. The reason for such a sharp drop in performance against the background of a steady increase in revenue was the reforms carried out within the organization as well as legal expenses and reserves for possible claims of approximately one billion euros.

In recent years, Deutsche Bank has made active attempts to reduce its balance sheet, accumulate equity capital and reduce the wage bill to its lowest level, which could be considered manipulation of a large share of borrowed funds. This activity had phenomenal results: over the year, the company increased its first-level capital adequacy ratio from six percent to eight percent, closely approaching the target indicator under Basel III.

The latter initiative received various reviews in the professional community, with many experts stressing the excessive stringency of capital requirements. Since the implementation of Basel III, banks have had to attract several hundred billion dollars of additional capital, which may lead to a growth in the budget for banking services and products and, respectively, rising interest rates for the end-user, thus causing a reduction in lending.

Despite concerns about the future revenues of Deutsche Bank that become evident when reviewing this institution’s historical financials, indicators from recent years prove that revenues will not decrease. Even though some small fluctuations are possible – for example, total net revenues comprised of 31,389 million euros in 2011 and 29,693 million euros in 2012 – the overall tendency seems positive. At the same time, net income to the bank’s shareholders diluted per share was 4,132 in 2011 compared to 3,026 in 2012.

These observations are characteristic of Deutsche Bank’s key financial indicators, allowing anticipation of some further impact from the Basel III agreement. In other words, the change in capital regulations set by the given requirements is likely to increase the bank’s total revenues, with a focus on ROE as well as investment in global banking.

Pillar 3 Reporting in Understanding Deutsche Bank’s Financial Health

The Pillar 3 component is designed to stimulate banking market discipline through new requirements for information disclosure. Various scandals related to the reporting of and ratings for major financial institutions that were on the verge of bankruptcy during the crisis demonstrated the inconsistency of current disclosure requirements (Asongu 2013). The reporting for even the largest international financial institutions, although comprehensive and certified by auditors, did not reflect the real situation regarding the level of financial control and risk management of a bank.

In this regard, the Basel Committee has tightened its disclosure requirements, in particular regarding the calculation of capital adequacy, securitization transactions, off-balance sheet items, and the payment of rewards and bonuses (Howarth & Quaglia 2016). Moreover, the agreement lays out requirements for reconciling source data with reporting data, thereby increasing capital base transparency. All elements of regulatory capital should be disclosed in terms of the financial statements of Deutsche Bank, and external market players should understand why and how the bank is receiving this level of capital adequacy.

One feature of the proposed standards is the use of stress testing elements such as annual stress test disclosure (ASTD), meaning that the standards should work both in a tense situation at the system level and in the case of bank-specific stress caused by internal problems.

In Deutsche Bank’s case, this approach is being implemented when establishing the coefficients of the potential outflow of various categories of attracted funds and when determining the composition of liquid assets and the values of discount factors applied to them (Pillar 3 report as of September 30, 2018, 2018). At the same time, in terms of the ability to realize assets, systemic stress prevails in funding operations. Thus, ASTD contributes to the timely revealing of weak points in the system as well as their adjustment, preventing larger failures and protecting the financial health of the bank.

To meet Pillar 3, Deutsche Bank has introduced methods for liquidity assessment. For example, the Liquidity Coverage Ratio (LCR) indicator of short-term liquidity was supposed to become mandatory beginning in 2015, and a recent report shows that the bank is meeting the required 100 percent. The Net Stable Funding Ratio (NSFR) indicator of net stable financing was supposed to be implemented in an observation mode to identify possible negative consequences of its application for various business models before finally being designated as mandatory.

In fact, “it is expected that a binding minimum ratio for the NSFR will apply from the end of 2020” (Pillar 3 report as of September 30, 2018, 2018). Thus, the target bank has additional time to adjust its systems for risk control and management to make its operation transparent, which will allow monitoring of the financial health of the organization.

Special attention is being paid to counterparty credit risk (CCR) since new requirements for calculating the value at risk (VaR) have been put forward. In addition to covering the credit risk of default, Deutsche Bank is maintaining capital to cover losses from the market revaluation of derivatives associated with counterparty risk. The bank is conducting stress testing of counterparty risk assessment models on at least a monthly basis. It is logical to assume that with the implementation of these requirements, the bank has been obliged to revise its business models regarding transactions involving derivatives, the capital costs of which seem to be significantly increasing.

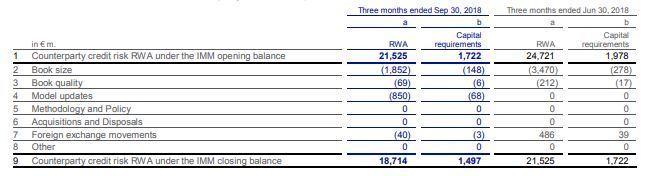

Deutsche Bank is calculating CCR using the internal model method (IMM): at the end of September 2018, RWA and capital requirements were 18,714 and 1,497, respectively. The same indicators were 21,525 and 1,722 accordingly, as presented in Figure (Pillar 3 report as of September 30, 2018, 2018). This is largely caused by the termination of trades and initiating deleverage of activities in the Corporate and Investment Banking (CIB) segment.

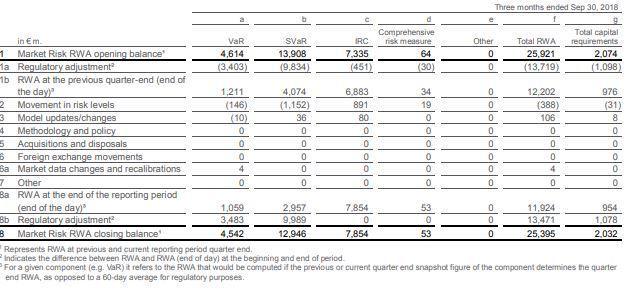

When considering market risk valuation that also facilitates analyzing banks’ financial health status, it is essential to identify the concept of market discipline as reflected in Pillar 3 of Basel III. Market discipline may be defined as a set of market incentives by which depositors discipline banks, demanding high deposit rates (risk premium) from banks with risky investment policies or removing deposits from such banks (Howarth & Quaglia 2016). For Deutsche Bank, the introduction of a deposit insurance system is reducing depositors’ risks and, within certain limits, is stimulating their risky behavior (Figure 2). The hypothesis about the presence of market discipline states that high-interest rates on deposits correspond to high risk for the bank’s asset structure.

Market discipline in the banking sector is a key element of the Basel III Accord. Market discipline can increase the efficiency of the banking system by putting pressure on relatively less-efficient banks. It also reduces the likelihood of a banking crisis and the possible losses associated with such a crisis (Asongu 2013). Three conditions are necessary for the existence of effective market discipline, all of which are being met by Deutsche Bank.

First, depositors should feel the risk of losing their deposits in the event of a bank default. Second, the market’s reaction to an alteration in the bank’s risk profile should have consequences for both the bank and its managers, and the market should have adequate risk assessment information for the bank. For Deutsche Bank, “as of September 30, 2018, the RWA for market risk was € 30.2 billion. The IMA (Internal Models Approach) components of this totaled € 25.4 billion” (Pillar 3 report as of September 30, 2018, 2018). From this, it is possible to note that the reduction of risks is associated with stressed value-at-risk.

Conclusion

In conclusion, Deutsche Bank’s history of financials demonstrates its response towards the Basel III agreement introduced after a global financial collapse in the banking sector. Three main reasons were revealed for the given bank to follow Basel III requirements, including the need to increase ROE, ensure transparency and provide buffer capital to prevent significant losses in the event of further financial problems.

Analysis of the case study also showed that Deutsche Bank’s profitability decreased in a similar way to that of other major global banks, yet the former is currently tending to increase, primarily due to investment banking and ROE growth. In the discussion of Deutsche Bank’s information disclosure, it was identified that the institution meets Pillar 3, conducting stress tests as well as regular market risks and CCR evaluations. In summary, the abovementioned methods allow monitoring the bank’s financial health and improving it promptly as necessary.

Reference List

Asongu, SA 2013, ‘Post-crisis bank liquidity risk management disclosure’, Qualitative Research in Financial Markets, vol. 5, no. 1, pp. 65-84.

Basel yesterday, today, and tomorrow. 2017. Web.

Grosse, S & Schumann, E 2014, ‘Cyclical behavior of German banks’ capital resources and the countercyclical buffer of Basel III’, European Journal of Political Economy, vol. 34, pp. 40-44.

Howarth, D & Quaglia, L 2016, ‘The comparative political economy of Basel III in Europe’, Policy and Society, vol. 35, no. 3, pp. 205-214.

Pillar 3 report as of September 30, 2018. 2018. Web.