Problem Statement

The transformation from a conventional bank to an Islamic bank poses numerous problems that need to be overcome for the transformation to succeed. Many of these complications lie in retraining the existing personnel and hiring additional cadres in order to complete the system, as the structure and modus operandi of a conventional bank differs from that of an Islamic bank to a great degree. While conventional banks derive most of their profits from charging interest and involving themselves in hedge funds, which is treated as a euphemism for gambling, Islamic banks do not engage in either, as it is strictly forbidden by the Faith (Abedifar 2040).

Thus, the challenges faced during the implementation of the L&D project by Salaam Ethical Investing R&D are as follows:

- Restructuring the current banking roster by retraining or downsizing the employees from the credit and hedge fund departments, as the bank will no longer engage in activities prohibited by the Sharia law (Iqbal and Molyneux 23). It is preferable to retrain these employees, as downsizing entire departments could cause a significant shock distress in other departments.

- Acquainting the employees with the basics and principles of an Islamic banking system. This could prove difficult as not all employees would understand or support the tenets of Islamic Banking. As it stands, the banking industry is dominated by conventional banks, meaning that Islamic Banking is viewed with skepticism despite showing impressive rates of growth (Iqbal and Molyneux 12).

- Replenishing the roster with competent personnel in order to replace the employees that would choose to leave. This problem would need to be dealt with quickly, as not all employees would realistically show a desire or capacity for retraining.

- Integrating Sharia advisors into the Directorial Board and supporting team cohesion between the new and old members of the board.

Goals of the Agreement

The goal of this project is to prepare a conventional bank for the transition towards becoming an Islamic Bank by providing the necessary council, restructuration schedule, and training for all employees and management personnel in the areas involving Sharia-approved banking practices. The project is expected to result in a formation of a new Islamic bank with a complete and competent roster, a sturdy ethical foundation, and a competitive business model that would allow the bank to retain its customer base and be able to thrive while remaining in competition with other conventional and Islamic banks in the region. This project will be implemented using ADDIE analysis and evaluation framework (Jones 86).

Introduction to the Directorial Board

The representatives of Salaam Ethical Investing R&D would first need to introduce themselves to the bank’s directorial board and provide a clear and succinct presentation of what transformations the bank is expected to undergo. The project is expected to involve a clear list of objectives and deliverables as well as a coherent timeline and a budget. Any questions and concerns that the members of the directorial board may have about the success and necessity of change are to be answered in a succinct and convincing manner (Morgan 49).

The working group is expected to acquire permission and authority in order to start collecting data and work on performing the changes necessary for transformation from a conventional bank to an Islamic bank. The purpose of this meeting is to establish trust and good working relationships between the representatives of the company and the members of the board in order to proceed with training and operational modifications to the bank’s functionality (Morgan 50).

Meeting the Staff

After the major organizational questions are cleared with the Directorial Board, it is necessary to conduct a meeting with the staff members and the department heads in order to explain the situation, the plan, and start collecting data in order to estimate the extent of changes that would need to be performed. Any questions or concerns that the employees may have would need to be addressed in the course of this meeting. The necessity for change would need to be explained in a convincing manner, in order to rationalize it with the rest of the staff. This meeting will also provide an opportunity to gauge the reaction of the majority of the employees towards change.

As a rule, many employees would feel apprehensive to change as changing requires effort and leaving the comfort zone (Morgan 123). Some of the employees whose interests are directly affected by the change from a conventional to an Islamic banking model will be against change as it would threaten their current position within the bank’s hierarchy. The purpose of this meeting is to address and all concerns related to change and ensure the employees that no one will be left behind, so long they express a desire and aptitude to retrain themselves for new roles and positions that would become available once the transformation is complete.

Analysis

Needs Assessment

- Need: Retraining and restructuring the employee roster of a conventional bank in order to be able to function in its new status of an Islamic bank, operating accordingly to the tenets of the Sharia law.

- Needs Assessment: The need for such an intervention appeared after the crisis of 2009 which hit almost every conventional bank that engaged in charging interest, conducting risky business by funding unreliable companies, and gambling via hedge funds. At the same time, the Islamic banking sector was not as affected by the economic crisis. The danger of potential global financial crises, as well as the fact that Islamic banks have been showing growth rates of 10-12% for the past decade, have motivated the bank’s shareholders to authorize the transformation from a conventional bank to an Islamic bank (Iqbal and Molyneux 31).

- Needs Analysis: To determine the training methods, required budget, the number of employees to undergo training, and the number of employees to be downsized or hired externally.

- Solution: To launch an effective L&D program in order to address the operational and educational needs of the employees during the transformation from a conventional to an Islamic banking model. It is estimated that over 500 employees would benefit directly from this initiative as they would be retrained to new roles within the organizations. The rest of the staff, whose operational models would not be affected by the transition, would benefit indirectly by becoming more familiar with the principles of Islamic banking and will be expected to implement the ethics and tenets of Islam in their day-to-day practices (Ford 106).

Data Collection Methods

In order to assess the situation, the levels of acceptance of the new change plan, as well as the level of familiarity of the banking workers with the tenets and practices of the Islamic banking systems, a survey has to be performed. The questionnaire will contain questions pertaining satisfaction and approval of the new course, the current level of knowledge, skills, and abilities, and willingness and desire to be retrained in order to maintain the position within the organization.

The questionnaire will be distributed to every employee within the organization and compliance is to be mandatory, in order to ensure that the survey accurately reflects the current situation in the company (Aggarwal 102). The survey is expected to provide a clear picture of the overall acceptance rates among the employees, the amount of training every individual employee will require, the approximate number of employees that will leave of will need to be downsized, thus giving enough data for the HR department to prepare for a future recruitment campaign (Aggarwal 103).

Design

The design for this project is as follows:

- Instructional Design: This part of the project will be completed in cooperation between the company’s Senior Developer, Sharia Advisors, Senior Designer, Technology Advisor, and Usability Expert in conjunction with the bank’s operations managers and the HR department. During this stage, all potential techniques, methods, and resources are going to be assessed in order to best accomplish the goals set forth by the organization.

- Instructional Strategies: Instructional strategies may vary from one group of employees to another depending on their knowledge and level of skill, as well as their awareness of Islamic banking practices. It is pointless to re-educate certain employees that are already familiar with the system through experience, so they would not require as much training as members of the hedge fund and the credit departments. Coaching learning strategy is best used in the scope of a banking organization, as it involves the transition of knowledge and skills in a practical and personal manner, which would ensure compliance and understanding.

- Prototype Creation: Senior Developer and his team would be tasked to create a prototype development plan and an approximate schedule in order to estimate the project completion, which would then be presented to all interested parties including the department heads, the operational managers, the Directorial Board, and the HR department. The plan will consist of detailed descriptions of classes for each employee group, including the lists of names based on the initial survey evaluation. An additional plan will be presented by the bank’s HR department in regards to the recruitment of new specialists to replace the ones who would prefer to drop out.

- Evaluation: The project group would examine the proposed prototype and eliminate all potential gaps and inconsistencies with the project, as well as determine the project budget.

Development

During this stage, Senior Developer will serve as the project manager. During this stage, a coherent L&D program will be developed based on the feedback received from the prototype. The development phase would need to focus on two tasks that have different purposes and would solicit different approaches to the problem. These tasks are:

- Retraining the staff according to the operational practices used in Islamic banking system. The members of the credit and hedge fund departments would have to be retrained into financiers and financial analysis experts, as Islamic banking operates by sharing profit and loss with the companies, they invest in rather than demanding interest, which is strictly prohibited by the Islamic model. This workgroup will be trained using the Coaching model.

- Acquainting the employees with principles and tenets of Islamic banking. Financial justice is considered to be the core principle behind Islamic banking. Additionally, all personnel will need to incorporate Islamic ethics into their working practices and routines. Sharia advisors would be tasked to educate the employees. Since the number of the employees in the banking system is significant, the Lecture model is deemed appropriate for this task.

Implementation

Since a massive withdrawal of employees from the current conventional banking system is ought to severely interrupt its daily operations, the L&D program will be implemented in stages, involving one group after another, and reintegrating them into the banking process. This will allow the bank to maintain its current levels of customer service output, but it has a tradeoff in that the training process would take long periods of time. At the same time, it will require fewer human resources and achieve better learning outcomes due to a more direct contact between the students and the teachers (Ford 72).

The project would require the use of educational spaces, electronic and printed information sources, as well training and practice materials (Ford 35). The total number of employees to undergo retraining is estimated at 500, whereas the number of employees eligible for lecturing about the Sharia law and its implementation in Islamic banking sphere is estimated at 1250. The first group will take priority, as retraining the staff is crucial to a successful launch of the Islamic banking enterprise.

The estimated output for retraining is 100 employees a month, separated into 5 groups of 20 people. The estimated output for the lecture groups is 250 employees a month, separated into 5 groups of 50 people (Ford 154). Technology advisors, senior designers, and usability experts will be in charge of the retraining portion of the project, whereas the Sharia advisors would oversee the lecturing part of the project.

Timeline

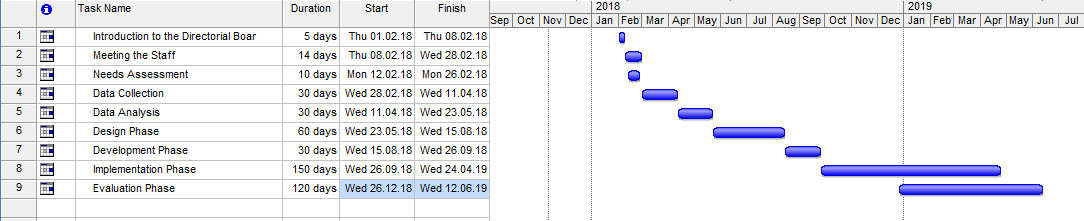

The timeline and the Gantt chart for this project were developed in MS Project, as it is a superior scheduling tool that accounts for weekends and implements them into the schedule. It shows the time constraints and resource use from the introduction phase to the evaluation phase of the project, according to the ADDIE Model.

Works Cited

Abedifar, Pejman, et al. “Risk in Islamic Banking.” Review of Finance, vol. 17, no. 6, 2013, pp. 2035-2096.

Aggarwal, Charu. Managing and Mining Sensor Data. Springer, 2013.

Ford, Kevin. Improving Training Effectiveness in Work Organizations. Psychology Press, 2014.

Iqbal, Munawar, and Philip Molyneux. Thirty Years of Islamic Banking: History, Performance and Prospects. Palgrave, 2016.

Jones, Brent. Instructional Design in a Business English Context. 2017. Web.

Morgan, Gareth. Riding the Waves of Change. Imaginization, 2013.