Executive Summary

Human Resources (HR) management allows this company to achieve its strategic goals by ensuring that the workforce has the skills and competencies necessary to achieve strategic objectives. However, in terms of improvement, the different practice areas should be reviewed and readjusted regularly to ensure that the company is applying the most effective techniques and tools for managing its personnel. This report will focus on the rewards and performance measurement as one of the critical HR practices, outline the literature findings from secondary sources and provide recommendations that can help adjust the existing approaches using best practices.

Introduction

The area of HR practice that the company should improve is performance and reward management. Performance and reward systems have two key elements – measuring and motivating the employees to excel in their skills, perform in a certain way, improve their expertise in an area, have a certain number of interactions and sell a certain number of units, or any other type of activity, which will help enhance organization’s performance. This report aims to highlight the importance of reward and performance systems, review recent research and provide recommendations for this company.

There is a notable case of misusing performance and reward systems that led to serious organizational issues, fines from the government, and reputational damage, which happened in the United States. Wells Fargo – a banking business the managers of which created a reward system where its employees were pressured to register accounts and perform operations from customers’ accounts without the consent of the latter. As a result, the bank was fined £149 million and faced legal issues (Zoltners, Sinha, and Lorimer, 2016).

This is a notable story because the core of the problem here is the improper performance measurement system. According to Zoltners, Sinha, and Lorimer (2016), CEOs should understand the importance of measuring performance, but also the fact that employees will adjust their work to fit the measured elements, which is why it is critical to approach this area of practice with caution. Additionally, the Wells Fargo case demonstrates that failure to acknowledge the differences between departments and branches, such as lack of clients not allowing to fulfill the benchmarks for selling services, is also essential.

This area was selected because performance and rewards are something that allows assessing whether the employee’s work contributes to the firm’s objectives and if they complete the tasks posed by their management. While one can assume that the salary is responsible for this, the issue of motivation and encouragement is more complicated. Moreover, the administration, including the CEO must keep track of performance, such as whether the employees make a certain number of actions, sell a specific unit of product, and others. Using these measurements, it is possible to plan for development, by basing the strategy on the existing and actual performance and estimating what changes are necessary to increase production volume, revenue, or any other metric. Hence, performance measurement is multidimensional and encompasses a critical area of HRM.

Moreover, CIPD (2019) states that ‘investors are becoming interested in how the firms they invest in treat their ‘most important asset’ in terms of management, development, and reward.’ Current trends of performance and rewards are focused on the longevity of a person working for a business. According to King, recognition programs are still popular among employers. These are programs in which employers choose a specific characteristic, such as performance in a particular area or the number of years during which the employee worked for a business, and reward people who have reached the benchmark. The most popular approach to establishing a recognition program is to use the length of service as a measurement (King, 2019).

Others, which were popular before and are connected to ROI, such as rewarding for fewer errors, waste minimization, and problem reduction are less common. Therefore, the HR trends still focus on rewards and performance as one of the critical elements for a businesses’ successful operations, however, the patterns are changing.

Review of Literature

The first source that provides insight into reward and performance practice is a report by CIDP presented in 2019 that includes responses from 465 organizations. According to CIPD’s (2019, p. 2) report, ’employee reward was structured to reflect the levels of capability as well as the responsibility in performing a role, and the levels paid tended to reflect the combination of what was judged to be the ‘going rate’ for particular skill sets across various job families as well as what the employer could afford to pay.’ However, there is an issue of defining fair pay based on a person’s skills and competency, which remains unanswered. Therefore, this report suggests that despite employers having a variety of reward systems in place, it is unclear, both for them and their employees, how the fair payment for one’s work can be defined, what are the criteria, and how to justify the chosen approach as appropriate.

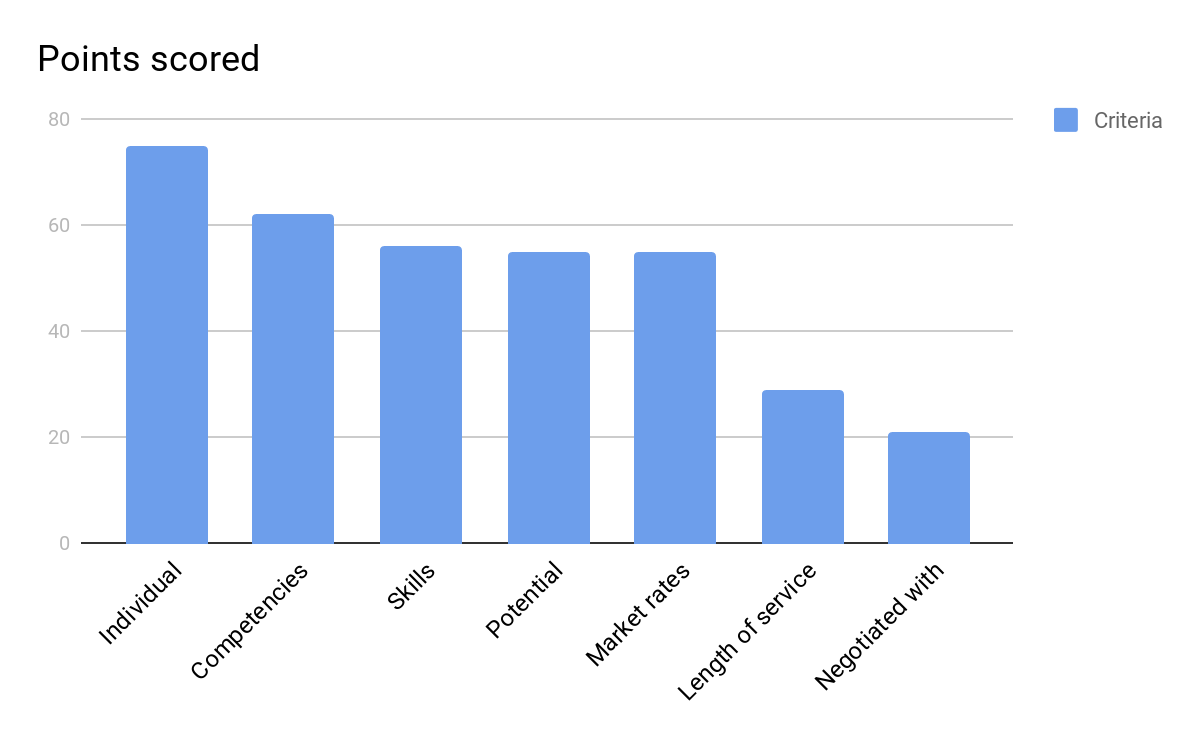

Usually, organizations use the “what feels fair” approach, where they compare the different rewards and pay of different groups and determine a strategy that will be used. CIDP (2019) also mentions that organizations are pressured to be transparent about their reward systems and payment systems, which is part of the movement for fair compensation for women and men. This CIPD report is authentic, reliable, and current because it was carried out by an organization that deals with the issues of HR and defines best practices for managers. Moreover, CIPD (2019) outlined that the report is based on the answers of employees and managers, making it an ultimate source of information about the perception of the rewards and performance of these stakeholder groups. Figure 1 is based on CIPD’s report of the most important factors that employers consider when deciding on rewards for an employee.

Next, an article in Harvard Business Review outlines the case of unethical rewards and incentives practice, which was discussed in the introduction to this report. The case is about Wells Fargo, whose management designed the rewards system ‘to meet sales quotas and earn incentives,’ which is a common goal for all employers – their aim is to incentivize their workers to perform better (Zoltners, Sinha, and Lorimer, 2016).

This, however, is not the only case when a company faces legal trouble because its HR practice fails to consider the actual needs of the customers and the capabilities of employees, forcing the latter to use unethical methods to achieve their monthly or weekly goal. In the past, Sears and Marsh Inc. had to pay their customers for unnecessary services or as part of the government’s fine (Zoltners, Sinha, and Lorimer, 2016). This source helps understand the issues a company can face if it creates an unethical performance review system.

The third source is another article in Harvard Business Review, where the case study of some businesses that choose to abolish performance reviews and base the rewards on one’s performance is discussed. Cappelli and Tavis (2016) state that some businesses implemented a system where employees receive instant feedback from their managers as an alternative solution. This may suggest that some companies, using the experience of failed performance reviews, decided that a completely different system must be in place to address the issue of tracking performance ethically. The argument is valid because it is vital to consider the specifics of the company when researching and designing a performance review system.

Cappelli and Tavis’ (2016) insight into the matter of rewards and performance helps understand that some companies may need to perform their own independent research based on the specifics of the organization and best practices to create a system tailored towards the nature of work. This source is reliable and well organized and provides detail of instant feedback as opposed to traditional performance review systems.

Stages of the Research Process

Any research process should have a quantifiable outcome and should begin with identifying the target audience that will read the gather data. In the case of this report, it was created for the company’s CEO upon a request to evaluate an area of professional practice that needs improvement. In summary, during this research process, several stages were addressed.

Any research process should have a clear structure, regardless of the method chosen for data collection. The result of such activity is a quantifiable outcome, which is usually a recommendation for the chosen organization. The stages of the research process are as follows – the first step is generating ideas or organizational problems that need to be researched, which can be identified either by the author of the research, the CEO, or completed on the basis of someone else’s work. This stage also requires the researcher to define the problem that will be a matter of consideration. One should always think of a question that will be answered through the process of research, and the recommendations of the research will be designed in a manner that answers this query.

The next step involves gathering data, either from the literature or the organization’s internal resources, following the researcher designing the research approach based on the types of data that will be used. This step helps examine information that was discovered by other professionals engaged in research on the same topic and also will help understand what is known and where the gap between the theoretical and practical aspects of the problem lay. In some cases, the issue may be unique and will require active data collection.

The key to succeeding at this step is to use information from a professional with experience in the HR field. Here, one must define the types of data that will be used – quantitative or qualitative, which should be based on the nature of the issue, the number of individuals or sources that will be used to collect it, and relevancy of data in relation to the type of the issue that is examined.

Next, the process of analysis is completed, where the researcher reviewed the literature to collect evidence following the stage of writing research questions. The information from the literature is compared to find similarities and differences, which helps formulate a research question at the next step. At the next stage, one evaluates the evidence that was collected, following an interpretation of results, for example, by establishing how a phenomenon affects the organization. Finally, the last stage of the research process is drawing conclusions, where the researcher summarises everything uncovered in the process for the audience, which is the eighth step of the research process.

The first stage implies generating ideas for the research, in this case, the possible areas of improvement for the HR practice. Next, the available sources should be reviewed – HR magazines, scholarly articles, books, and others. In terms of types of data, this report uses mainly qualitative information, although the CIPD (2019) research contains some quantifiable data. Next, the collected data must be analyzed, which will help create a research question. The information is then evaluated, summarised, and interpreted for the intended audience – in this case, the CEO.

The differences in the primary research approaches are the ways in which data is collected. Some researchers choose to focus on how the employees perceive the rewards system by measuring their satisfaction and assessing their feedback. Others focus mainly on the management’s perspective. Hence the aspect of performance measurement systems’ impact on revenue is more important for these researchers.

The two primary methods of data collection that will be compared are interviews and surveys. The main features of surveys are advanced rigidity when compared to interviews, and the collection of information from a larger group of people, however, a disadvantage is a limited amount of information that can be collected. Interviews are conducted face to face with an interviewer and an individual or in small groups and allow collecting a lot of information, unlike surveys.

This information can be presented to the management and the employees in the form of a presentation and a report that will outline the key findings, as these stakeholders groups will need a more in-depth understanding of why specific changes are proposed. For the customers, who are also stakeholders that should know about the new practices, a press release can be developed, where fundamental shifts are discussed. This will help inform the customers that the organization cares about using ethical practices and ensuring the reward system does not aim to sell products that the consumer does not need.

Recommendations

The case of Wells Fargo is an excellent representation of the need to approach the question of rewards and performance measurement with caution, to avoid severe organizational problems. The following three recommendations are based on the perspectives of these stakeholders – the customers, management, and employees. Since the business operates to provide a high level of service and the best quality of products, it is vital to consider the experience that customers have when addressing a company’s employees. Additionally, it is evident that performance measurement should provide the management with an accurate assessment of how well the employees address the tasks that are posed for them. Finally, considering employee satisfaction rates is vital. Otherwise, the mistake of Wells Fargo that forced bank workers to fake accounts and operations is inevitable.

The first recommendation that will help improve the performance and reward system is to enact a reoccurring review of the incentives and performance measurement plans. This can be done once every six months or once a year, to ensure that the system is not falling behind the requirements of the new business strategy. The idea is to review how the employees perform, assess their feedback regarding the policy since it is usually designed by managers who do not actually perform the task and may be biased towards the end result. This will ensure that the company continuously improves its rewards and incentives management.

The second recommendation is to create a system that will allow the employees to evaluate the performance measurement and rewards used by the company and give feedback on whether the objectives are obtainable considering the current number of customers. The idea is based on the case study of Wells Fargo, and since there, the employees did not have an opportunity to contact the management designing the performance and reward systems to address the issue of not having enough clients enter the bank to fulfill the sales quotas. Thus, software or another option can be used to assess feedback – either anonymously or from each individual and examine whether the existing strategy for rewarding workers is successful.

Finally, a performance and reward system that is not solely based on how well an employee can sell or perform a different task should be implemented as well. For instance, many firms use a system in which the employees receive additional benefits based on the number of years they have worked for in this firm. This helps improve the loyalty of the employees and addresses the concerns regarding unobtainable objectives. Since this system is not tight to the strategic goals of the firm, there is no need to review it frequently, as was recommended in the previous section.

Stakeholder Benefit

The three recommendations presented above benefit the identified groups of stakeholders – customers, management, and employees. The main idea behind these recommendations is to create an ethical environment, where the employees are not pressured into performing well but are incentivized to provide the best experience to the customers. Hence, the employees will benefit because they will have a system they understand and a way to address any concerns about the performance evaluation.

The customers receive a pleasant experience with the company because the employees will not experience stress due to performance evaluation and will be able to provide a better service. The management will have an understanding of the improvement areas that they need to address because the performance measurements will not be superficial, instead, they will be based on the actual capabilities of the employees.

Costs and Estimations

When estimating the time and cost necessary to implement these systems, it should be noted that for some recommendations – such as a system of feedback from the employees, the company may need to invest in software, either an existing one from the vendor or a custom option. An example that provides a rough estimation is Shipwright which would cost approximately £1,208 per year for a team of 30 (Pricing, no date). In terms of time constraints, it is necessary to dedicate at least three months to the process of purchasing, installing, and training the employees to use the system.

For other types of rewards, it would be good to have an electronic reference and tracking system, where the employees can see their performance and the benefits they will receive. This can be implemented as either software or as an easier to implement and free-of-charge system, like a Google Spreadsheet.

The second case, however, is suitable for small teams only as the information will have to be updated manually. Alternatively, reward and performance management software such as Congengo will cost approximately £1,800 per year for a team of 30 people and will also require at least three months to fully set up (Online performance review software, no date). Finally, the last recommendation will not require any investment, only time dedicated to reviewing the feedback from the employees and adjusting the system, which can be done in one meeting.

Conclusion

Overall, the issue of managing the rewards and assessing the performance of people in the organization is a matter of concern for three stakeholder groups – the management, the customers, and the employees. The main idea behind these systems is to create an environment where employees are encouraged to perform specific actions because they receive a reward, usually financial compensation for their efforts. The main problem that this report found was the issue of fairness in defining the strategy for evaluating the performance and the type of reward that one should receive.

Reference List

Cappelli, P. and Tavis, A. (2016) ‘The performance management revolution’. Harvard Business Review. Web.

CIPD (2019) ‘Reward management’. CIPD. Web.

King, J. (2019) ‘Key global trends in rewards and recognition in 2019’. Employee Benefits. Web.

Online performance review software (no date). Web.

Pricing (no date). Web.

Zoltners, A. A., Sinha, P. K. and Lorimer, S. E. (2016) ‘Wells Fargo and the slippery slope of sales incentives’, Harvard Business Review. Web.