Introduction

The portfolio of the discussed pension fund demonstrates the allocations in detail, and they should be taken into account for the further analysis. The fund management committee is interested in evaluating the appropriateness of the current portfolio with references to the short-term, medium-term, and long-term forecasts. The fund management committee is also interested in findings strategies to address negative changes in values that are expected in three and five years. According to the portfolio, the assets are divided between equity and bonds, and currently, £191 million is invested in equity (48%), and £210 million is invested in bonds (52%). Such allocations cannot be discussed as appropriate because they lack both diversification and security typical of conservative models when the percentage of bonds in the portfolio is higher (Bodie, Kane & Marcus 2014). Furthermore, according to the recent trends in the market of pension funds, the focus on equity is characteristic of both UK and US markets (Jondeau & Rockinger 2015; Pennacchi & Rastad 2011). From this perspective, the proposed portfolio needs revisions in order to make it more efficient and address the problem of drawdowns that are planned in three and five years, as well as to respond to general changes in the market. The purpose of this report is to present the evaluation of the allocations presented in the used portfolio and recommend possible reallocations that are oriented to maximizing the returns for the fund and minimizing risks.

Special Drawdowns

The fund management committee is focused on addressing the problem associated with the special planned drawdowns that are expected in three years and five years. In three years, the expected drawdown will be £20 million, and in five years, the drawdown will be £45 million. In order to prepare the drawdowns and predict the possible asset value changes, as well as to respond to them, it is necessary to focus on the implementation of the specific strategy. The planned drawdowns cannot be avoided, but it is possible to prepare steps for addressing possible changes in asset values (Bodie, Kane & Marcus 2014). The systematic evaluations of the portfolio should be taken during the five-year period (Alexander & Baptista 2006; Bodie, Kane & Marcus 2014). Before the first planned drawdown, it is important to rebalance the portfolio with the focus on investing more in bonds and discussing the alternatives in order to guarantee the variety of investments. The diversification can demonstrate that drawdowns are addressed efficiently, and risks are minimal (Benigno & Nistico 2012). In this case, it will be possible to assess the total volatility of the drawdown (Bodie, Kane & Marcus 2014; Maginn et al. 2007).

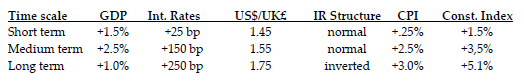

While referring to the forecast prepared by the fund’s economists, it is important to note that in five years, it is possible to expect increases in interest rates in 250 basis points, and it is also possible to rebalance the portfolio with the focus on investing in equity (Table 1). This approach can be regarded as advantageous in order to overcome the consequences of the changes in the net values. Table 1 presents the forecasted changes in the market of the European community for the next five years, and these assumptions can influence the development of the portfolio for the pension fund.

Portfolio Management Theories

The main theories that should be taken into account while evaluating the appropriateness of the portfolio against the predicted changes in the market are the theory of liquidity, the Markowitz portfolio theory, the capital market theory, and the total portfolio theory. According to the theory of liquidity, it is possible to expect the higher returns from the long-term securities in comparison to the benefits that are associated with the short-term securities (Farhi, Golosov & Tsyvinski 2009). In its turn, the Markowitz portfolio theory is based on the idea that the probability distribution in relation to the expected returns is important in order to predict returns and maximize them for the concrete period of time while determining the probability and assessing the expected benefits (Mangram 2013). The capital market theory supports the assumptions that the greater returns can be observed only when investors are ready to take the greater risks and when they rebalance their portfolios accordingly (Njeru, Dominic & Fredrick 2015). The total portfolio theory develops the idea that the bonds should be regarded as more beneficial in the portfolio because of providing the opportunities for the diversification. According to this theory, the focus should be on proposing the advantageous combination of stocks and bonds in order to gain more returns (Njeru, Dominic & Fredrick 2015). For this case, it is important to use the principles of the Markowitz portfolio theory and the aspects of the total portfolio theory in order to propose the efficient reallocations that will work for receiving more returns in two years, and then, in five years.

Equity Allocations

In order to take advantage of the predicted changes in economic parameters during the following month, two years, and five years, it is necessary to revise the current approach used for determining the percentage of allocations in the portfolio (Bodie, Kane & Marcus 2014; Maginn et al. 2007). However, before proposing reallocations, it is necessary to evaluate the expected returns and risks regarding the equity allocations in order to compare them with the proposed plan (Hoevenaars et al. 2008; Pennacchi & Rastad 2011). While focusing on the current portfolio, it is possible to estimate the expected return E(R) using the following formula:

E(R) = p1R1 + p2R2 +…+ pnRn, where pn is the probability of returns and Rn is the expected return with the focus on the worst, base, and best scenarios (Bodie, Kane & Marcus 2014, p. 138).

For equity allocations, it is possible to conclude that E(R) equals 16% before any reallocations are proposed. In the proposed portfolio, equity allocations represent 48%. Therefore, in order to expect higher returns, it is necessary to revise the current approach to allocations regarding the equity since the stable growth of the interest rate is forecasted for the next five years, and this parameter influences the allocation of assets (Maginn et al. 2007). While referring to Table 1, it is possible to note that the factors that influence the assets allocations in the fund are the GDP, interest rates, and the inflation. In a situation when interest rates rise, it is important to focus not only on bonds but also on the equity (Jondeau & Rockinger 2015; Pennacchi & Rastad 2011). While assuming that the interest rates will cover the changes in inflation rates, it is possible to propose to focus more on the equity. The expected return of the current portfolio including equity and bonds can be estimated using the following formula:

E(R) (portfolio) = w1R1 + w2Rq +…+ wnRn, where wn is the weight of the asset in the portfolio (Bodie, Kane & Marcus 2014, p. 138).

For the whole portfolio, E(R) equals 24.4%, and it is possible to expect higher returns while concentrating on investing in the equity. For the short-term period, there is no need for reallocations because the current portfolio works well with the focus on tendencies in the market development (Jondeau & Rockinger 2015; Pennacchi & Rastad 2011). While concentrating on the data for the next two years, it is relevant to leave the correlation between bonds and equity stable with the focus on investing in bonds. However, for the long-term perspective, the investment into equity is preferable. The reason is that stocks can be easily diversified depending on the market demand (Benigno & Nistico 2012; Hoevenaars et al. 2008; Maginn et al. 2007). After making reallocations in the portfolio regarding the investment into equity, it is possible to expect E(R) that equals 30% with the probability of 30%. In this case, the pension fund should pay more attention to investing in companies that are similar to Burberry Group, Coca-Cola, and Royal Mail. These companies are selected from the FTSE100 list that is used by the fund to determine equity, and it is possible to use it for the further investment decisions in the pension fund. In this case, it will be possible to expect the higher holding period returns (Bodie, Kane & Marcus 2014). Furthermore, it is also important to note that the forecasted data is presented for the European community, but it is also possible to refer to the US companies and discuss them in the context of investing in the equity in order to achieve the high benefits (Jondeau & Rockinger 2015; Pennacchi & Rastad 2011).

While focusing on the changed approach to allocations in the fund, it is also possible to predict changes in the E(R) of the portfolio. This measure is important in order to understand what changes will be advantageous for the concrete organization (Hoevenaars et al. 2008). According to the new data and presented reallocations, it is possible to expect the E(R) for the portfolio that will equal 27% in five years. In this case, the main focus is on investing in the equity. Still, the reallocations for the medium-term period should be associated with changes in bonds, and it is possible to expect even higher returns (Pennacchi & Rastad 2011). This aspect requires the further detailed discussion. It is important to note that the process of rebalancing the portfolio according to the needs during the concrete period of time is based on the principles of the Markowitz portfolio theory. The probability distribution reflected in the equations should be taken into consideration while proposing the most efficient structure of the portfolio for the fund.

Bond Allocations

The forecasted data for changes in the markets during the next month and the next two years demonstrates the possibility to refocus on bonds as the main asset for the investment (Bodie, Kane & Marcus 2014). The fund needs the stable basis, and the best performance can be expected when more diversification is proposed in relation to selecting companies which bonds to purchase (Maginn et al. 2007). It is important to state that the fund chooses companies that are rated higher than BBB, and it is possible to propose more companies that demonstrate the stable growth during the recent two years (Bodie, Kane & Marcus 2014). The choice between companies that are rated not only A, AA, and AAA provides the fund with more opportunities for diversifying the assets in the context of limited opportunities when the organization chooses not to refer to the other alternatives (Hoevenaars et al. 2008). Furthermore, it is important to pay attention to the fact that, currently, the investment is equal for all organizations from the list of bond allocations, and the fund can decrease the amounts for certain companies while expanding the range of organizations to invest in (Hoevenaars et al. 2008; Jondeau & Rockinger 2015; Pennacchi & Rastad 2011). These decisions are based on the principles of the total portfolio theory, according to which investors need to focus on bonds in order to expect the higher returns, and such decision can be rather profitable.

Before making reallocations, the E(R) for the portfolio equals 24.4%. When reallocations are completed in terms for expanding bonds for the period of the next two years, it is possible to expect the E(R) that is 26%. However, in order to guarantee high benefits, it is also important to assess associated risks (Bodie, Kane & Marcus 2014). It is important to state that risks should be measured in order to determine the volatility of the portfolio followed by the fund (Maginn et al. 2007). The application of the risk-return framework allows for discussing possible risks that can be faced by the organization that plans the certain allocation of assets in the portfolio (Bodie, Kane & Marcus 2014; Hoevenaars et al. 2008). While focusing on the estimation of the expected return for current allocations and proposed reallocations in the portfolio, it is also necessary to evaluate the risk according to the Sharpe ratio (Bodie, Kane & Marcus 2014; Maginn et al. 2007). Economists note that the Sharpe ratio is effective in order to measure the total risk for the portfolio with the focus on the excess return (Njeru, Dominic & Fredrick 2015). The Sharpe ratio can be calculated using the following formula:

Sharpe Ratio = (R – risk-free R)/Standard Deviation, where R stands for returns (Bodie, Kane & Marcus 2014; Maginn et al. 2007).

For the current portfolio with the expected return in 24.4%, the Sharpe ratio is 0.97. It is possible to state that such ratio indicates significant risks for the organization, and it is not acceptable if the company expects to receive high returns (Bodie, Kane & Marcus 2014; Njeru, Dominic & Fredrick 2015). After making the required reallocations, the Sharpe ratio can become equal to 1.1, and such Sharpe ratio can be considered as accepted in terms of predicting risks. In this case, the risks for the organization are regarded as minimal, and the portfolio is discussed as well-balanced (Hoevenaars et al. 2008; Maginn et al. 2007). The risk-return framework that is based on determining the expected returns, as well as potential risks, can be discussed as useful for the effective development of the portfolio because a manager receives an opportunity to predict all possible problems and balance bonds and equity according to the most favorable scenario.

Conclusion and Recommendations

The purpose of this report is to provide recommendations regarding finding the optimal portfolio allocations in order to maximize returns. While referring to the analysis of the portfolio with references to the data forecasted by the fund’s economists for the next month, two years, and five years, it is possible to recommend the following reallocations in order to contribute to higher returns and address the problems of drawdowns in three and five years: (a) to leave the portfolio unchanged for the next month; (b) to focus on expanding bonds with the expected return in 26% during the next two years (in comparison to the current return in 24.4%); (c) to rebalance the portfolio and focus on equity with the expected return in 27% during the next five years (in comparison to the current return in 24.4%). It is irrelevant for the fund to concentrate on alternative options such as purchasing the property. The minimum percentage should be proposed for the cash in the portfolio structure because of the nature of the fund. The proposed approach to rebalancing the portfolio can be discussed as effective in order to protect the fund from changes in the assets’ values because of the planned drawdowns. In a case when changes in the portfolio are not made, the Sharpe ratio is 0.97. If the ratio is lower than 1, it is possible to speak about wide risks, and more diversification is required in order to improve the portfolio structure. After the proposed reallocations, it is possible to expect the Sharpe ratio of 1.1. Therefore, a manager can conclude about decreased risks and the improved diversification in relation to the structure of the portfolio.

Reference List

Alexander, G & Baptista, A 2006, ‘Portfolio selection with a drawdown constraint’, Journal of Banking & Finance, vol. 30, no. 11, pp. 3171-3189.

Benigno, P & Nistico, S 2012, ‘International portfolio allocation under model uncertainty’, American Economic Journal: Macroeconomics, vol. 4, no. 1, pp. 144-189.

Bodie, Z, Kane, A & Marcus, A 2014, Investments, McGraw-Hill Education, New York.

Farhi, E, Golosov, M & Tsyvinski, A 2009, ‘A theory of liquidity and regulation of financial intermediation’, The Review of Economic Studies, vol. 76, no. 3, pp. 973-992.

Hoevenaars, R, Molenaar, R, Schotman, P & Steenkamp, T 2008, ‘Strategic asset allocation with liabilities: beyond stocks and bonds’, Journal of Economic Dynamics and Control, vol. 32, no. 9, pp. 2939-2970.

Jondeau, E & Rockinger, M 2015, ‘Long-term portfolio allocation based on long-term macro forecasts’, Bankers, Markets & Investors, vol. 134, no. 2, pp. 62-69.

Maginn, J, Tuttle, D, McLeavey, D & Pinto, J 2007, Managing investment portfolios: a dynamic process, John Wiley & Sons, New York.

Mangram, M 2013, ‘A simplified perspective of the Markowitz portfolio theory’, Global Journal of Business Research, vol. 7, no. 1, pp. 59-70.

Njeru, S, Dominic, N & Fredrick, K 2015, ‘Evaluation of financial performance on portfolio holdings held by pension funds in Kenya’, European Scientific Journal, vol. 11, no. 16, pp. 1-20.

Pennacchi, G & Rastad, M 2011, ‘Portfolio allocation for public pension funds’, Journal of Pension Economics and finance, vol. 10, no. 2, pp. 221-245.