Introduction to the Chapter

The chapter under consideration is “Capital budgeting and cost analysis” considered in the book Cost accounting: A managerial emphasis by Horngren et al. the main idea of the chapter is to dwell upon the problem of accounting in the capital budgeting (or investment appraisal as it is usually called) and to consider various cost analysis methods which may be used for investment appraisal. The main purposes of this chapter is to identify the multiyear focus of the part of the cost accounting capital budgeting, to check its stages, to consider two cash-flow methods, the net present value, and the internal rate-of-returns, to analyze a payback method and accounting rate-of-return method, to consider the information which may help minimize the conflicts created by using discounted cash-flow methods as the basis for capital budgeting and actual accounting, and to dwell upon cash inflows and outflows which may be used while making budgeting decisions.

Two Focuses of Cost Analysis

There are two focuses of cost analysis discussed in the chapter, project-by-project dimension and project-by-period dimension. The main difference of these two focuses is the duration of the projects. Project-by-project dimension means that one project is seen in many accounting periods. While project-by-period dimension, otherwise, means that there are many different projects in one accounting period (Horngren et al 733). An accounting period is usually considered as one year.

Stages of Capital Budgeting

The authors of the book identify six stages in capital budgeting which should be followed if the positive results are required and correct information is obtained.

- An identification stage. The main purpose of this stage is to consider the company’s strategies and objectives and to identify the types of the capital investments which are going to be appropriate for the organization. The types of the capital investments and the company’s objectives should be interconnected.

- A search stage. The alternative types of the capital investments should be considered on this stage. The company’s purposes should be met as well.

- An information-acquisition stage. This stages is really important as the alternative types of capital budgeting should be analyzed thoroughly with the identification of the expected costs and benefits the company may wait for.

- A selection stage. The company’s professionals should make a decision and choose a project they are going o implement with the reference to the research which has been conducted at the previous stages.

- A financial stage. This stage is aimed at calculating costs and profit (the project financial information is considered).

- An implementation and control stage. The realization of the project and the monitoring of the actions.

It is important to understand that following these stages strictly, the company can achieve the desired results in the investment (Horngren et al 734).

Discounted Cash Flow

Discounted cash flow analysis is one of the methods directed at the company or project evaluation (Kruschwitz and Löffler 67). Considering this problem in the 21st chapter, the authors identify two main discounted cash flow methods, net present value method and internal rate-of-return method, which are closely connected with the time value of money. Net present value method is an important part of capital budgeting as its purpose is to use the time value of money for evaluating long-term projects. Gain and loss of the investment should be calculated and in case zero or positive net present value is got, the investment is accepted. To use the net present value method correctly, three steps should b followed: (1) cash flows and inflows should be drawn, (2) present value figures should be created out of the cash flows and inflows drawn in the previous paper, (3) the determination of the net present value by means of summing of the present value figures presented in the previous step (Horngren et al 735).

There is a possibility to use the internal rate of return method for making a decision whether the investment is profitable or not. The main idea of the internal rate of return method is to consider the discount rate. This discount rate should be equal both for expected value of expected cash inflows and outflows. It is possible to confirm the project only if internal rate of return either equals or exceeds real rate of return.

The authors of the book provided the comparative analysis of the net present value and internal rate of return methods. The internal rate of return method is more common use, but the net present value method may be used even if the real rate of return varies. It is impossible to use internal rate of return method combined for evaluation goals. Both these methods may be used along with the sensitive analysis (Horngren et al 739).

Sensitivity Analysis

Saltelli identifies sensitivity analysis as the method which is aimed at “priority setting, to determine what factor most needs better determination, and to identify the weak links of the assessment chain (those that propagate most variance in the output)” (42). Horngren et al. offer narrower definition of the notion stating that the main idea of this analysis is to consider the changes which occur in the discounted cash flow in each project when the used input changes (739). The process may affect the changes in the revenue, costs, taxes, etc.

Relevant Cash Flows in Discounted Cash Flow Analysis

The problem of relevant cash flows in discounted cash flow analysis is considered to be rather complicated as this topic requires much attention. Being a key point of the discounted cash flows, relevant cash flows are considered to be the “expected future cash flows that differ among the alternatives” (Bhimani, Horngren, Datar, and Foster 426). The same idea is presented by Horngren et al. in the chapter “Capital budgeting and cost analysis” where the authors consider relevant cash flow as “the difference in the expected future cash flows as a result of making in investment” (Horngren et al. 744). There are three main categories of the cash flows, “net initial investment”, “after-tax cash flow from operations”, and “after-tax cash flow from terminal disposal of an asset and recovery of working capital” (Horngren et al. 745). Each of those categories comprises a number of different components.

Payback method

The main idea of the payback method is to identify the required time necessary for compensating the total amount of money which was spent on the project. It is crucial to understand that the form of net cash inflows should be considered. The method has a number of advantages as well as disadvantages. On the one hand, the method allows to calculate the timer when the income will be received and it is easy understood. On the other hand, this method does not allow the company to make certain long term prediction. The ignoring of the profitability and the money time value is seen. The companies do not use the payback method for long term periods when the risks are too high. In general, short term periods are more preferable in payback method is used. The payback period with uniform cash flows may be calculated by the following formula:

![]() (Horngren et al 740).

(Horngren et al 740).

The payback period with the non-uniform cash flow is calculated by means of summing the number of periods which are considered out of “adding cash flows period by period until the initial investment is recovered” (Horngren et al 741).

Accrual Accounting Rate-of-Return Method

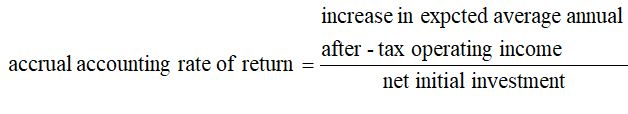

An accrual accounting rate of return method is the division of the growing “accounting measure of the average annual income of a project by an accrual accounting measure of its investment” (Horngren et al 742). It is possible to use the following formula to calculate the accrual accounting rate of return:

( Horngren et al 742).

( Horngren et al 742).

An accrual accounting rate of return method has a number of characteristic features which should be considered. There are a number of different methods of calculating accrual accounting rate of return method and various companies may vary those. The method is easily understood. Moreover, the financial information is aloes easy to perceive. At the same time, this method fails to track cash flows and what is the most important, it does not pay attention to the time value of money.

Evaluating Managers and Goal-Congruence Issues

The performance of the managers may be evaluated by means of different methods. Most firms may us the net present value method, while other companies, on the basis of the financial data and other specific reasons may turn to the accrual accounting results, even though it is impossible to calculate those for a long term period.

Income Tax Considerations

The income tax consideration may be seen via the relevant after-tax flows which may be of two types, “after-tax cash flow from operations”, and “after-tax cash flow from terminal disposal of an asset and recovery of working capital” (Horngren et al. 757). After-tax cash flow from operations has two main components, inflows and income tax cash. After-tax cash flow from terminal disposal of investment also has two components, investments and the cash flow from the working capital.

Managing the Project

The managing of the project is a complicated task as all the process should be taken into account. He investment processes as well as the whole project should be considered the work of the personnel and the financial documentation should be checked on each level. As it was mentioned above, the implementation and control are the final stages of the capital management, still, it does not means that the controlling function is absent on other stages. Capital budgeting is a complicated process which should be monitored at each stage. The work of many people should be considered and the documentation checked. The implementation of the project and its slight monitoring is not the final stage of the budgeting. Post investment audit is an exceptionally important stage of control as the actual costs and profit of the activity can be easily compared and contrasted with those which had been predicted at the stage of the alternative method selection. The conclusions about the appropriateness of the chosen methods are stated.

Strategic Considerations in Capital Budgeting

Capital budgeting may be used not only for investment projects, but also for the evaluating the customers and their rate in the future. Using the same technology and the strategies, the organization may plan the work with the customers. The final controlling function of the investment may be considered as the feedback of the auditing company to the work of the organization in general. Thus, capital budgeting may be considered as the strategic consideration of the functioning of the whole company.

Conclusion

In conclusion, it should be mentioned that the main purpose of this chapter was to consider the main ideas of the capital budgeting and cost analysis. We have managed to analyze the stages of capital budgeting, as well as the methods which may be used for analyzing the costs and the profit of alternative means of the process. The information summarized in this paper and considered in the 21st chapter of the book may be used in practice. The methods considered above help the company to measure not only the profit, but also the risks the company may b subjected to (Peterson and Fabozzi 133). It has been considered that each method for analysis may be used by various companies in a different way as the conditions and the companies’ opportunities are different.

Reference List

Bhimani, Alnoor, Horngren, Charles T., Datar, Srikant M. and George Foster. Management and cost accounting. Oxford: Pearson Education, 2008. Print.

Horngren, Charles T., Foster, George, Datar, Srikant M., Rajan, Madhav and Chris Ittner. Cost accounting: A managerial emphasis. New Jersey: Prentice Hall, 2009. Print.

Kruschwitz, Lutz and Andreas Löffler. Discounted cash flow: a theory of the valuation of firms. New York: John Wiley and Sons, 2006. Print.

Peterson, Pamela Parrish and Frank J. Fabozzi. Capital budgeting: theory and practice. New York: John Wiley and Sons, 2002. Print.

Saltelli, Andrea. Sensitivity analysis in practice: a guide to assessing scientific models. New York: John Wiley and Sons, 2004. Print.