Cash flow is the amount of money that enters or leaves the company during its operations. Cash flow is considered the wheel that makes a company’s operations move smoothly and swiftly. If a company does not control or manage its cash flows properly, then it might run into financial problems or constraints. A company such as Caledonia Products must therefore be able to make a decision on what projects to channel its cash. A company might be faced with a situation where potential investment opportunities might be competing for the same capital that is already limited to the company. In this case, the company will be forced to make a decision by applying capital rationing. Capital rationing is a situation in which a company has a limited amount of capital to invest in potential projects such that the different possible investments need to be ranked in order to allocate the capital available most effectively. For Caledonia to realize maximum returns, it needs to apply the already limited capital to invest in a project that gives higher cash flows to the company (Schwalbe, 2005).

In cash flow analysis, I strongly recommend that Caledonia products use cash flows in making investment decisions. After-tax basis is also another reason as to why we should be interested in the cash flow. After-tax cash flow is offered to shareholders of the company. Incremental cash flow is the extra cash flow in a company and it represents the extra value the company gets by investing in the project. This is the most interesting part in investment.

In the balance sheet, depreciation is treated as an expense though it does not involve an actual flow of cash. Depreciation expense reduces accounting profits making it difficult to rely on the resultant figure. Depreciation is thus an important item when making financial decisions since it helps the investor to enjoy tax shield. If the figure for depreciation is high, the taxable accounting profit will decrease thereby reducing the amount of tax payable. This is an actual involvement in cash flow. Since depreciation is a non-cash item, it is added back to the resultant cash flow in order to make an appropriate investment decision.

In any prudent investment decision, sunk costs are always irrelevant since they are not variable yet they are always incurred. Sunk costs are also referred to as irrelevant costs. The relevance of costs will depend upon the purpose for which they are being used. Relevance is related to future decisions. The relevance of costs in decision-making is related to whether they are avoidable in relation to the decision made or if they are unavoidable. This means that they will remain irrespective of the decision taken. Costs are incremental if they will result in a difference. For instance, avoidable costs result in reduced cots if they are avoided.

An in-depth analysis of the initial requirements reveal that the company would require $7,900,000 to purchase plant and equipment, $100,000 for shipping and installation and an additional preliminary working capital of $100,000 to lay down foundation. All these costs total to $8,100,000. This would allow the company to undertake the new project. The company should therefore be ready to make this amount to be able to kick-start this new project.

In capital budgeting, it must be noted that any saving of cost is a cash inflow. In the Mini Case, the incremental cash is realized in year 3 and year 4 since this is the period within which the company realizes a saving in working capital. The amount is 1,800,000 in year 3 and $2,400,000 in year 4. During years one, two and 3, the company is still incurring costs in order to generate cash flows. During this period, the company’s cost on the project reduces from $2,000,000 in year 1, $1,500,000 in year 2 and finally $600,000 in year 3 before it goes to a total saving in year 3 and 4.

At the end of a project’s life, the stream of cash flow that normally occurs is referred to as terminal cash flow. This project at the end of its life generates $5,980,000. This is the terminal value of the project. The asset required in this project does not have a salvage value and all its working capital is liquidated at the end of its life.

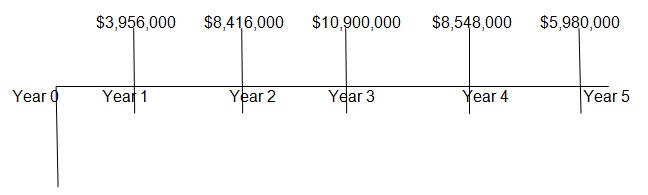

A cash flow diagram shows how a company applies its finances in order to generate more cash flows. From the diagram below, the Caledonia Products will incur $8,100,000 in the year of investment and receive $3,956,000 in year 1, $8,416,000 in year 2, $10,900,000 in year 3, $8,548,000 in year 4, and $5,980,000 in year 5.

Net present Value is the present value of all cashflows generated from a project during its life less the initial cash outlay of that project. NPV is significant in decision-making since it is able to tell the value of project’s future cash flow. This is because cash flow is always discounted. The net present Value for mini case as per the calculations is $16,731,096.

Internal rate of return is that required rate of return that generates cashflows that break-even. At this rate, the present value of the cash flows generated is equal to the initial capital outlay of the project. Mini case has an internal rate of return (IRR) of 77%. At this rate, the present value of all cash inflows will be equal to the initial capital.

Based on its NPV and IRR, the project is viable and should be accepted by Caledonia Products. Mini Case has a positive NPV of $16,731,096 and an IRR of 77%, which is greater than the required rate of return of 15%

In Capital budgeting, there is a project’s risk that assumes that risk is diversifiable if a portfolio is formed consisting of several projects. This is termed project standing alone risk, which is the overall risk. Secondly, a project may have its own risk posed to the firm as a whole. In this case, risk diversification is possible but the impacts of diversification on the equity holders are not taken into full consideration. Lastly, there is a risk that looks at a project by considering shareholders as well diversified. This is risk is called systematic risk and assumes that a risk can be diversified by forming a portfolio of the company’s project and other projects (Kerzner, 2003). A shareholder will try to hedge against risk by forming a portfolio including the project and other stock.

This is also called non-diversifiable or market risk. It is generated by putting together multiple assets to form a portfolio thus a risk cannot be eliminated. It is economy-wide risk and affects all firms in the economy. In many occasions, a firm may consider the risk that is associated with the project and have undiversified investors. The leeway of bankruptcy also plays a role in determining relevant risk. As bankruptcy comes with costs, a firm may use this avenue to resolve the risk of a project

In considering risky investments, we can use simulation to approximate the expected return for an investment proposal. Thus, simulation is one way of dealing with the uncertainty involved in forecasting the outcomes of capital budgeting projects or other types of decisions. The results of an investment proposal are tested before it actually occurs. Each of the factors affecting the project’s NPV is assigned probability distributions.

Sensitivity Analysis shows the sensitivity nature NPV as regards to changes in certain variables. In sensitivity analysis, we identify all those variables, which have an influence on the projects NPV, define the underlying (mathematical) relationship between variables, and then analyse the impact of the change in each of the variables on the project’s NPV. Sensitivity Analysis allows the decision maker to ask “what if” questions.

The proposal of introducing this new product in my opinion is a commendable move by Caledonia products. Going by acceptable appraisal techniques, the project has an internal rate of return of 77%, which is greater than its cost of capital and generates positive cash flows of $16,731,906. If Caledonia products goes ahead to invest in this project, it stands a chance of increasing shareholder’s wealth by a good margin and would improve its cash flows as well.

References

Kerzner, H (2003). Project Management: A Systems Approach to Planning, Scheduling, and Controlling. New York: Wiley.

Schwalbe, K (2005). Introduction to Project Management. New York: Course Technology.