Coles Group Limited sees transparency as one of its key values, as per its 2019 annual report (Coles Group, 2019a). As the company puts it, it is committed to doing business in a way that builds trust within, with customers, and the community. Coles Group Limited admits that it is at the point where its decisions impact many people. Therefore, the corporation promotes transparency in order to meet the ever-increasing expectations. One of the ways that Coles Group Limited attains this goal is through being open about its model of governance and policies. Its annual reports review the most important changes to frameworks and provide an insight into the company’s financial performance and remuneration strategies. Coles Group Limited shares about the breaches of conduct and the disciplinary measures that it undertakes to rectify the situation.

Just like Coles Group Limited, Woolworths Group Limited values transparency. It is open about its taxes, financial performance, and remuneration, which is reflected in the company’s annual reports. In 2015, Woolworths made a mistake that resulted in a massive data leak where customers’ names and email addresses were exposed. The corporation did not stay silent and let the media take over the narrative. As reported by Homewood (2015), a spokesperson for Woolworths admitted the breach, apologized, and outlined what safety measures had been taken to tackle the issue.

Woolworths Group Limited is the second-largest Australia-based company with retail interests across Australia and New Zealand. At present, its Australian divisions include supermarkets, liquor stores, hotels, general merchandise, and everyday services. In New Zealand, Woolworths Group Limited is present primarily as a supermarket chain with brands such as Countdown, Foodtown, SuperValue, FreshChoice, and others. Today, retailers must comply with a wide range of environmental regulations, which is motivated by their potential and actual environmental footprint. The impact can be evaluated as high due to how diverse and widespread the company’s operations are.

Like other large retailers, Woolworths Group Limited faces sustainability issues such as the manufacturing toll, the logistics toll, and the waste toll. For instance, mass transportation of goods means gas emissions while their consumption translates into vast amounts of plastic waste (Pandey, 2019). On its website, Woolworths Group Limited shows commitment to environmental causes and delivers on its promises by moving to a circular economy (“Moving to a circular economy,” n.d.). The company removes the use of non-degradable beads in its packaging as well as bans single-use plastic pockets.

Akin to Woolworths Group Limited, Coles Group Limited is mainly concerned with retail. The two companies are rivals, though the latter’s assortment is somewhat smaller than the former’s. Coles Group Limited mainly sells food and groceries with a minor focus on petrol. Since their significance on the market and revenues are comparable, so are their environmental footprints. All the sustainability issues faced by Woolworths Group Limited apply to Coles Group Limited as well. Bradley (2016) points out that food retailers are the gatekeepers of sustainable food provision and consumption.

It is safe to assume that both companies are challenged by customer behavior that does not always comply with environmental guidelines. Like Woolworths Group Limited, Coles Group Limited puts an emphasis on sustainable packaging that is easily disposable and does not inconvenience customers (Coles Group, 2019b). Waste management is a major part of its sustainability strategy as well as conscious water use and energy efficiency.

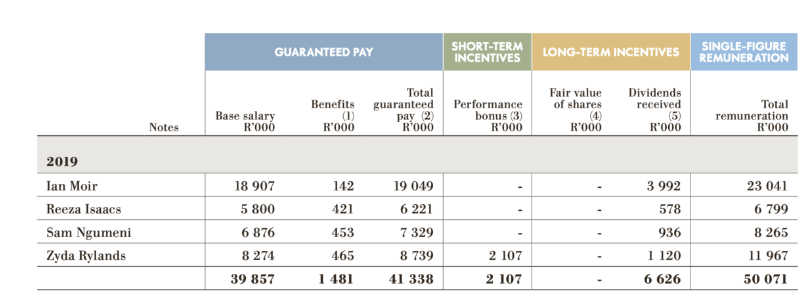

At Woolworths Group Limited, the remuneration strategy seeks to strike a balance between guaranteed pay and long-term and short-term variable remuneration. Image 1 provides data on the remuneration of the Chief Executive Officer (Ian Moir) and other key executive figures with a breakdown of its mix. The guaranteed pay serves the purpose of attraction and retention of valuable executive cadres while variable remuneration incentivizes them to meet one-year and three-year goals.

As per the company’s latest remuneration report, executives have to meet the highest expectations in terms of their KPI (Woolworths Group, 2019). There are several categories of goals that they need to attain to be eligible for variable remuneration. One of such categories is “targets achieved on sustainability scorecard,” meaning that financial profit is not the only thing that executives need to be pursuing.

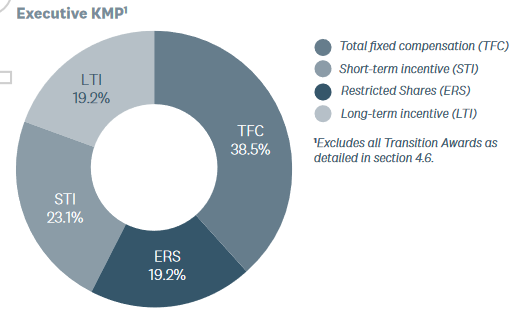

Coles Group Limited has a similar approach to the remuneration of its top executives. In its annual report, the company states that when working on remuneration, it adheres to three key principles. Firstly, Coles Group Limited seeks to reward its executives for sustained business performance. The corporation opposes change to its remuneration framework and prioritizes retention of the most valuable cadres (Coles Group, 2019a). Just like at Woolworths Group Limited, at Coles Group Limited, there is a guaranteed pay in the form of Total Fixed Compensation (cash) and Restricted Shares (equity).

On top of that, executives receive short-term, transition, and long-term incentive (see Image 2 for a breakdown). Remuneration variables are based on the Performance Scorecard that mentions financial, safety, and people deliverables (Coles Group, 2019a). However, from the report, it is not clear whether executives are rewarded for their efforts to promote sustainability.

References

Bradley, P. (2016). Environmental impacts of food retail: A framework method and case application. Journal of Cleaner Production, 113, 153-166.

Coles Group. (2019a). 2019 annual report. Web.

Coles Group. (2019b). 2019 Sustainability report. Winning together. Web.

Homewood, E. (2015). Woolies data breach: Brand damage and transparency. Web.

Moving to a circular economy. (n.d.). Web.

Pandey, E. (2019). Retail’s climate change moment. Web.

Woolworths Holding Limited. (2019). 2019 remuneration report. Web.