Executive Summary

The effect of COVID-19 pandemic on the global economy and national business performance is disturbing due to its long-term implications and the scope of uncertainties it implies for the future of some decisive sectors of the economy. The majority of business entities, including small and medium businesses and large international corporations, must adapt to the new requirements and changes in their respective markets to ensure a reasonable response to the challenges of the pandemic. The current report provides an overview of the current situation in the global economy under the influence of COVID-19-induced crisis.

The effect of the epidemic on the economy is interpreted from the point of view of the influential factors determining the key processes. The challenges and anticipated outcomes of the pandemic within general financial management and financial risk-taking of companies are described and analyzed. Finally, the specific impact the Coronavirus epidemic has on firms’ sales and marketing performance is analyzed in detail. Overall, the report is designed to explore and analyze the scope of impact the COVID-19 crisis has on the global economy and particular financial and corporate performance aspects of businesses.

Multiple businesses across the globe have been impacted by the Coronavirus epidemic and the quarantine measures that were implemented because of it. As a consequence, the global economy undergoes severe difficulties due to the deteriorated turnover of financial assets in various spheres. Some industries have been impacted more severely than others due to the changes in the demand for their services or goods as a consequence of pandemic and quarantine. Indeed, such sectors of the economy as the hospitality business, tourism, traveling and similar have faced decreased demands and shortening of income. At the same time, even less exposed industries also react to the pandemic effects and adapt their performance accordingly.

The Coronavirus crisis has triggered new approaches to managing various business processes, ranging from corporate decision-making and human resource management to financial management and corporate performance. Managers of companies need to mitigate the crisis by managing cash flows, seeking governmental support for their businesses, as well as providing security to employees, and respecting customer interests. Moreover, the epidemic situation remains unresolved, taking lives of many people across the world, and damaging national economies. Therefore, it is important to analyze what means, and methods firms use to adapt to the new and vastly challenging economic environment under the circumstances of the Coronavirus pandemic.

Characteristics of the Pandemic and Its Expected Effect on the Economy

COVID-19 has been an ongoing issue for several months in both developing and highly-developed countries of the world. In March 2020, the World Health Organization “officially declared the coronavirus outbreak to be a global pandemic” (Zhang, 2020, para. 2). It has originated in China, one of the world’s largest production centers in many industries, and then moved to South Korea and other Asian countries. Later, many European countries, including Italy, Spain, France, Germany, and others, as well as the USA, have been exposed to severe mortality and morbidity rates. At this point, the US has the largest number of cases of COVID-19, which puts the economy of the country in a position of continuous control of its policies and plans to regulate the implications of the crisis.

Due to the rapid spreading of the COVID-19 across the borders, global economic decline followed immediately, causing significant shifts in stock markets. As Zhang (2020) exemplifies, financial markets of the world reacted to the announcement of the Coronavirus outbreak as a global pandemic in a disturbing manner. The information on the stock market index S&P 500 shows that from the middle of February to the middle of March 2020, the index fell from 3386.19 to 2237.40, which is an over 30% fall in one month (Zhang, 2020).

In addition, the unemployment rates in most countries of the world fell disproportionately, causing vast complications to a sustainable economy. In the US, by February, “the unemployment rate stood at 3.5%, equaling its lowest rate in the past 67 years;” but in six weeks the situation changed drastically: almost “ten million Americans filed for unemployment benefits,” and millions lost their jobs and did not file” (Baker et al., 2020, p. 2). Such a rapid and unpredictable fall showed that the pandemic’s implications might be much worse for the global economy in the future.

The borders of the countries were closed, and the usual corporate performance of the majority of entities was blocked under the rule of quarantine measures. This is explained by the high level of contamination induced by the virus vitality and the need for social distancing as a means of preventing the disease spreading (Ozili & Arun, 2020). These circumstances forced corporate management to apply new approaches to managing business performance under crisis, which has tested their flexibility, agility, and ability to respond to change.

On the other hand, governments implemented financial and legal support to industries that are key in combatting the pandemic or have been disproportionately affected by the crisis, namely small and medium business. Nonetheless, since the pandemic is a current issue, and more new countries enter the list of those severely impacted by the virus, new cases emerge rapidly and unexpectedly (Fernandes, 2020). This reality obstructs the ability of businesses to predict the exact outcomes and plan relevant actions.

Moreover, the globalization in the economy has demonstrated its adverse impact on the economic stability in separate economies. Indeed, as Fernandes (2020) states, the world now is an integrated system of codependent countries where the underperformance or crisis in one economy triggers the consequential events in other parts of the chain. Thus, regardless of the scope of supporting actions of national governments and global organizations, the tasks of maintaining the economy remain complex and require decisive actions. It is expected that trade shortage, decreasing prices for oil, and uncertainty in planning financial performance will lead to the further fall in the economy and its growth on the global scale will be lower than in the previous years (Baker et al., 2020).

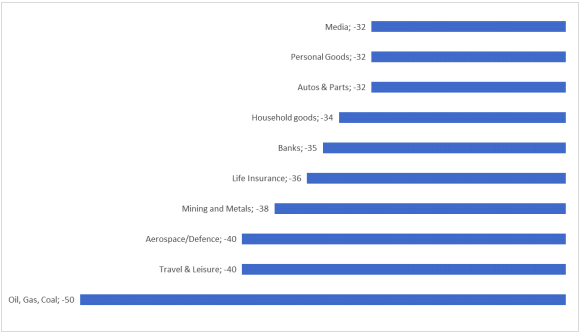

The yearly GDP of the countries dependent on import, export, or hospitality business and tourism is expected to decrease; this assumption is implied in the current statistics (Fernandes, 2020). As seen from Figure 1, the stock markets of multiple countries have gone down at a devastating speed (See Appendix 1). Despite the difficulty of forecasting the economic outcomes, companies need to adapt their financial management to the crisis’s requirements.

The Effect of the Pandemic on General Financial Management of Companies

The pandemic has induced severe financial losses to some companies, while others have been forced to terminate their operations completely. Indeed, some small businesses suffer from the economic instability and the shortage of demand. Also, airlines, transportations, restaurants, hotels, entertainment, and other industries are suffering from pandemic-related deterioration in performance. Thus, management “needs to assess whether these events or conditions, either individually or collectively, … cast significant doubt on the company’s ability to continue as a going concern” (KPMG, 2020, p. 2). Separate companies coordinate their actions according to the overall effect the pandemic has on the industry sector in which they operate.

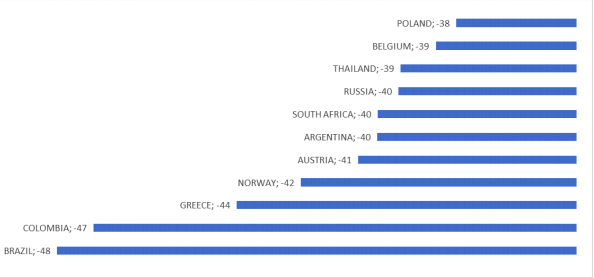

Indeed, as it has been stated earlier, different industries have been affected on various levels, depending on the relation of the area of performance to social distancing goals. Despite the varying rates of impact, all industries have suffered. As it is demonstrated in Figure 2 (See Appendix 2), the yearly stock returns in all industries, including media, automobiles, leisure and sports, oil and gas, and others have fallen by 30-50 percent in comparison to the beginning of the fiscal year (Fernandes, 2020). Thus, the companies operating in all industries without exclusion undertake a course of adaptive financial management in response to the threats of the pandemic.

A well-developed informed financial management is necessary for a business to navigate the challenges of the economic crises. In general, the efforts made by firms in relation to financial management are aimed at supervising the company performance during the crisis and the facilitation of the ability to recover after it. Also, these efforts vary between small business entities and large corporations. As the survey conducted with small business representatives shows, 43 percent of the US businesses are temporarily closed or have terminated their operations, while many have significantly shortened the number of staff members (by 40 percent on average) (Bartik et al., 2020).

The layoffs and shutdowns in small business environment as means of financial management are explained by the financial fragility of these entities and the small amount of cash on hand. Moreover, as company managers stated in the survey, their main concerns when planning financial performance are the supply difficulties, demand shortage, and the health of employees (Bartik et al., 2020). Thus, small business is limited in its options to establish effective financial navigation during the Coronavirus crisis.

Large corporations and the companies’ financial management on a global scale have different implications, although the burden of risks related to the unpredictability and uncertainty remains the same as for small businesses. The monetary and fiscal policies implemented by the governments help companies mitigate the burden of taxes and support their status of a going concern (Fornaro & Wolf, 2020). However, there still remain many difficulties to resolve, including the irrelevance of the budgets and forecasts, which are now of limited use due to the rapidly changing situation that requires daily adaptation of actions (KPMG, 2020).

Firms with less debt, more cash, and greater profit rate obtain more assets to effectively manage finances (Ding et al., 2020). However, those dependent on international supply and loans must utilize more financial tools to recognize the threats and use the opportunities. In particular, under the circumstances of economic uncertainties, banks are not willing to “increase borrowing facilities,” the credit ratings of banks might weaken due to the withdrawal of cash, which collectively imposes difficulties in accessing finances by usual means (KPMG, 2020, p. 3). As a consequence, companies become more limited in assets and have to be more risk-informed to minimize the losses.

The Effect of the Pandemic on Financial Risk-Taking of Companies

Under normal circumstances, financial planning, budgeting, and forecasting are reliable tools that help evaluate and predict risks associated with asset usage. However, due to the volatile conditions induced by the COVID-19 pandemic, the scope of risks expands beyond regular market threats and company weaknesses but is subject to unpredictable turns in the global economy.

For example, by the beginning of March 2020, China’s manufacturing output has shortened by 13.5 percent under the influence of the Coronavirus outbreak; these effects were impossible to predict (Becker et al., 2020). Similarly, now when the threats of the pandemic are omnipresent, and the information about it is available, other countries and particular companies are aware of the risks and try to manage their finances accordingly.

On the one hand, the informed risk assessment helps to forecast the company’s performance and adjust its liabilities and assets. Now, the firms must operate a large amount of information and assess it regularly to ensure timely adjustment to the current situation on their respective markets and the global economy as a whole. For example, management must regularly “reevaluate the availability of finance,” “review projected covenant compliance in different scenarios,” and take into consideration the shutdown of the countries (KPMG, 2020, p. 4).

In order to conduct a relevant asset assessment and its availability, managers must estimate whether assets have been impaired, whether taxable profits are available, and if the revenue-cycle assets are recoverable (KPMG, 2020). These issues are key in risk-taking financial management due to their decisive role in forecasting the company’s performance under the burden of the crisis.

On the other hand, many managers underestimate their exposure to pandemics and take risks due to the lack of information and analysis. Indeed, the large scope of pandemic-induced supply and demand impairments leads to the shocking aftermath for many companies, which are not ready to address these threats appropriately (Schoenfeld, 2020). However, the tendency to risk-taking is reliant on the specific features of the industries in which the companies operate. For example, transportation entities have suffered a significant decrease in revenue inflow, namely “Norwegian Cruise Lines (-86.0% change in value), Noble Energy (-83.7%), Royal Caribbean Cruises (-83.4%)” (Schoenfeld, 2020).

However, there are certain areas of the economy that have significantly grown under the influence of the pandemic. They include delivery companies and telecommunication businesses, video streaming services, and pharmaceutical companies, that have become very popular due to the isolation trends (Schoenfeld, 2020). These companies might be more likely to take financial risks during the recession due to the estimated benefits they expect to gain.

The Pandemic Effect on Firms’ Sales and Marketing Performance

While the general performance and financial decision-making have been significantly impacted across the businesses and countries, particular operations within the firms needed specific adjustments. The deterioration in the economies and the growing unemployment of the population across the world imposes a significant shortage of demand for goods and services that are not vital (Ding et al., 2020).

The economic uncertainty makes changes to people’s perception of marketing due to the shift of influential factors toward survival and health protection. Therefore, the company’s sales and marketing performance must adjust to the changes in demand and address the current needs of prospective customers. It requires innovative approaches and continuous integration of pandemic updates into the company performance to address the public’s concerns and respond to the governmental regulations.

To illustrate the pandemic effect of firms’ sales and marketing performance, the companies that have suffered and benefited from the implications of the pandemic will be analyzed. Since the daily lives of millions of people drastically changed, their purchasing habits needed to be adjusted to the requirements of the quarantine. Consequently, the businesses in various economic spheres reconstruct their sales marketing toward the ones sufficing the requirements of social isolation. All types of companies, including supermarkets, clothes stores, pharmacies, entertainment, arts, stores, and other entities, shifted to digital sales marketing in order to maintain their operations during the pandemics.

Some companies have more opportunities to succeed since the services or products they supply are either vital or relevant to the ‘stay-at-home’ trend. For example, digital entertainment and video streaming industries have shown significant growth under the circumstances of the epidemic. Undoubtedly, the overall trend of staying at home during quarantine induced people’s more frequent ability and wish to access the internet and watch video content or play video games at home. However, relevant and timely actions regarding sales and marketing helped particular firms achieve prominent results. For example, Netflix has gained an increase in the number of subscribers by 32 percent, while the overall market went down by 13 percent (Kindig, 2020).

To succeed in implementing digital marketing, firms have to adjust their technical features and information processing tools to enhance the monitoring and inventory of orders. Similarly, the companies that provide platforms for online communication via live conferences have strived since the beginning of the epidemic. This indicates that the shift toward digitalization and utilization of opportunities might be an effective tool in overcoming the business shortcomings of COVID-19.

On the other hand, the companies that are vastly dependent on direct interaction with customers, such as restaurants and fast-food entities, are in danger of a shutdown. Therefore, they need to invent new sales and marketing strategies to maintain their market share and demand. For example, McDonald’s, as one of the major fast-food chains, needs to adjust to the restrictions by promoting its delivery system via online and phone ordering system (“Coronavirus: McDonald’s expands restaurant sites to be reopened,” 2020).

Similarly, many companies specializing in food, beverage, or pharmaceutical products invest in the implementation of information management systems allowing for conducting their operations in the digital environment. To succeed at this, they need to train their employees and restructure the company processes to both meet company goals and preserve the restrictions imposed by the pandemic.

Conclusion

In summation, COVID-19 has had a devastating effect on business at both micro- and macroeconomic levels. The economic deterioration has complicated the operations and financial management of all industries, imposing more difficult budgeting, planning, and forecasting, as well as more risks or temporary shutdown or complete termination. The companies that are more reliant on bank loans, international demand, or supply are more likely to be adversely impacted by the crisis and have to be more flexible in their risk assessment and performance planning. On the other hand, video streaming, delivery, and pharmaceutical companies undergo an increase in operations due to the increased demand under the influence of quarantine.

Nonetheless, all businesses have been affected by the Coronavirus pandemic, and their financial management, sales, and marketing performance need to be carefully planned to remain a going concern.

References

- Baker, S. R., Bloom, N., Davis, S. J., & Terry, S. J. (2020). Covid-induced economic uncertainty. National Bureau of Economic Research, 26983. Web.

- Bartik, A. W., Bertrand, M., Cullen, Z. B., Glaeser, E. L., Luca, M., & Stanton, C. T. (2020). How are small businesses adjusting to COVID-19? Early evidence from a survey. National Bureau of Economic Research, 26989. Web.

- Becker, B., Hege, U., & Mella-Barral, P. (2020). Corporate debt burdens threaten economic recovery after COVID-19: Planning for debt restructuring should start now. VOX CEPR Policy Portal. Web.

- Coronavirus: McDonald’s expands restaurant sites to be reopened. (2020). Web.

- Ding, W., Levine, R., Lin, C., & Xie, W. (2020). Corporate immunity to the COVID-19 pandemic. National Bureau of Economic Research, 27055. Web.

- Fernandes, N. (2020). Economic effects of coronavirus outbreak (COVID-19) on the world economy. Web.

- Fornaro, L., & Wolf, M. (2020). Covid-19 coronavirus and macroeconomic policy. Barcelona GSE Working Paper Series, 1168. Web.

- Kindig, B. (2020). Netflix: Coronavirus cements the company as untouchable. Forbes. Web.

- KPMG. (2020). Time to adapt: COVID-19 – Financial Reporting. Web.

- Ozili, P. K., & Arun, T. (2020). Spillover of COVID-19: impact on the Global Economy. Munich Personal RePEc Archive, 99850. Web.

- Schoenfeld, J. (2020). The invisible business risk of the COVID-19 pandemic. VOX CEPR Policy Portal. Web.

- Zhang, D., Hu, M., & Ji, Q. (2020). Financial markets under the global pandemic of COVID-19. Finance Research Letters, 101528. Web.

Appendices

Appendix 1

Source: Fernandes, 2020, p. 16.

Appendix 2