Abstract

This paper is prepared on the basis of most sensitive US government’s act of financial bail- out bill while the starting point identifies initial relationship between economy and monetary policy. After several aspects like- moral hazard, bank capitals, Fed influence regarding that policy have been discussed and finally some economic theories have discussed to response in the time of serious recession.

Introduction

Here this paper would go to identify connection among the financial sector and the real economy. One of the most important and innovative sectors of modern economy is its financial sector. This set of institutions and instruments form the vital circulatory system of through which the savings decision of one group of individuals and nations are channeled to investments of other businesses and nations.

Thus to explore the classical relationship between economy with its financial sector, we have to gain certain knowledge about finance and financial sector and the respective importance of monetary policy which is the most important tool that the government has to stabilize the business cycle.

Key issues

By finance, we mean the process by which economic agents borrow from and lend to other agents in order to invest. The activities involved in finance take place in the financial system which is carried by financial sector. This encompasses the markets, firms and other institutions that carried out financial decisions of household, businesses, and government, at home and at abroad. Important parts of the financial sector include the monetary market, market for fixed interest assets, stock markets for ownership of the firms and foreign exchange markets.

Junction between financial sector and real economy

This link can be idealized through the indication of following levels-

- Macro level looks towards savings and other environmental policy.

- Institutional level looks towards different types of financial units that are exact to serve financial services.

- Micro level looks for supply and demand attitude for firms and household oriented financial services.

Largely explained

- The financial sector transfers resources across time, systems and regions that allows investment to be devoted to their most productive uses rather than being bottled up where they are least needed. For example, Japan which has a higher savings rate, transfer resources to China, which has robust investment opportunities; this transfer occurs through both loans and direct foreign investment in China.

- The financial sector manages risks for the economy. Risk management is the resource transfer, it moves risks from those people or sectors that most need to reduce their risks and transfer or spread the risks to others who are better able to weather them.

- The financial sector pools and subdivides funds depending upon the need of the individual saver or investor. Additionally, a modern economy requires large- scale firms which have billions of dollars of invested plant and equipment. No single person is likely to be able to afford that- and if someone could, that person would not want all his or her eggs in one basket. Here the institutions come in, with the ability to sell shares of stock to many people and pool these funds to make large and risky investments.

- The financial sector performs an important clearing house function, which facilitates transaction between payers or purchasers and payees or sellers

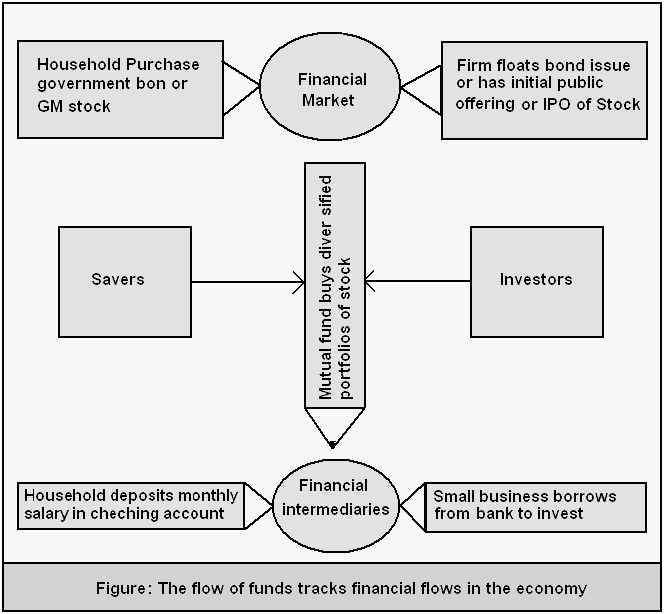

- Two sets of economic agents- savers and investors- and representative examples of savings and investing through financial markets and financial intermediaries can show the diverse relationship between modern economy and financial sector as shown by this figure-

- By the effect of wealth, the excessive demand involves in the financial markets is copied by the extra demand of commodities, which is the unsatisfied demand of the economy regardless inflation.

- Thus, the modern economy and its ever changing pattern demand the balance of both the commodity and financial markets. So, through the allocation of a strict monetary policy, the financial market will finally raise real rates to that point for restoring the balance to each corner of the economy.

- Other notification is that, Fed continuous to adopt its policy indicators from real economy context, any types of financial market problems and imbalances would be thrown away.

- At present, it is very much essential for a country’s government to accomplish demand and supply into the similar level in the commodity markets. Although USA’s 4th quarter of growth has been stunning, it has been a voluntary surge in national spending and because of some Y2K related issues that focused demand. But if all GDP growth speeded down to 4% this quarter, the annual growth rate will moved up to 4.6%.

- At the negative aspect, it can be said that increased interest rates is a major threat for the traditional businesses. For example, housing and automobiles are enough than companies of technologies that depend less than on funding of debt as well as whose goods has less rate sensitivity.

Thus, after the above discussion and examples, it can be said that today’s economy is highly tight with financial sector in both positive and negative way which has an ultimate and powerful impact on the entire economy.

The general purpose of the recent financial bail out bill is to purchase bad debts from the financially inefficient corporations for their rising up solid capital and possibility of general lending activities through serving nation and the customers. However, the means of access in such a bill has characterized by a number of moral defects during its previous and after completion period. Like-

- The aftermath condition is highly idealized by a huge scale of plunders by the bankers. Such economic meltdown will be resulted in configuration of economy with massive fraud. Many people doubt of passing the bail out bill of $700 million is the act of gaining the extra money for some bureaucrats like Paulson and his associates.

- Kochan, Nick (2008) mentioned that according to Magnus the senior economic adviser of UBS Investment Bank, it is already been late of such hazard since the state is seemed to save some of the selected companies as many institutions need help to survive while they can not run properly and had been confined with funding difficulties.

- The largest moral corruption can be seen through the largest payment of the top executives of the billionaire bankrupted companies. Devine, Miranda (2008) mentioned that Lehman brother’s chief executive Richard Fuld got $480 million. Similarly Waxman went on a $US 440,000 spree including $US 23,380 on spa treatments in late September from American International Group. Fuld, R (62), clued-up that his responsibility was to play as the “villain” of Wall Street and did his best during his broadcast and he don’t expect himself to feel sorry. The moral hazards are just like playing the flute while Rome burns.

- This condition will be assumed to create a serious inflation through the lending back of money at higher interest rates towards people.

- The major pre- plan moral hazard can be observed by increases in interest rates from 2006 that created sub- prime depression where people tended of not meeting their loans.

- Financial markets have been seriously affected by the huge risk adopting tendency of larger investment companies and the lack of adequate control of the legislators during the last 70 years.

- Excessive facilities in housing loan tended to make more supply that demand which reduced the price of houses making people ineligible of paying the debt etc.

However, the situation has been reached in such circumstances where the investment banks have severely burnt their finger and in that case the authorities need to introduce theme of bad years experience through avoiding bad years and become conscious highly to maintain equity and loosing corruption.

Prevention in combination of investment and commercial banking has distorted the right allocation of capital and made it difficult for commercial banks to maintain deposit as liabilities as investment banking is the bets of all time.

Today, there exists a tight policy of interest rate with high inflation and financial instability by central banks. As a result of the recent problem, banks believe mostly on wholesale funding that is affecting capital negatively.

Because of the imperfect valuation of risks, many banks have not adequate capital. So, a number of investment banks are being insolvent. As a result many investors, tended to invest in risk- free government treasury bills and because of negative balance of mortgage, there have been extreme shortage of liquidity and now such complication has been spread out from investment banks to mutual, hedge funds and commercial banks.

If the bail- out proposal would be implemented morally, bank capital would be raised at an optimistic level. But, uncertainty and political confusion would also affect a better capitalization of all banks.

Majorities have been against of this plan of about $700 billion in debt and for that purpose they voted a lot. Another opposition may come because of the trouble of credit crunched people. As this project is seen as a fearsome step, a number of laws should be imposed to prevent the speculation involved in this. Putting up of a number of a number of structures regarding regulation for protecting the investors is another possible way. Some other modules are-

- Changing of debt- based financial policy for self- freedom from manipulation of Fed and banks.

- In case of systematic crisis of banking system, it is essential for a recapitalization of banking system for avoiding an exclusive and distractive contraction of debt while buying of toxic assets of the monetary system is merely ineffective process for the recapitalization of banking procedure.

Finally, a recent IMF study shows that only 7 cases involves such bail- out process through the purchase of bad debts rather this problem can be handled by government buying of preferred shares, common shares, subordinate debts injection of cash in the banks, extension of credit to the banks and assumption of bank liabilities etc. by which that bill may not be passed.

It is important of pricing the bad assets because of number of reasons. Such as-

- An increase in such assets price would remove uncertainty that would make it easy the re- capitalization of banks.

- Pricing would make it possible for entering huge buyers in the illiquid market for shifting price. Even setting price through auction will substantially increase the value of assets.

- Pricing of bad assets on held- to- maturity basis regardless the market prices will be converted in few mark- down and big mark- ups. So, it is wise to offer hold- to –maturity prices that will concise increased intrinsic value of the assets.

- It would allow the government to save the financial institutions from bankruptcy as well as supplying cash for loans for easing the freezing- up process of credit market.

There exist a number of possible ways to price the bad assets. Like-

- The pricing procedure should maintain restriction on the payment of executives maintaining certain circumstances.

- Entrance of larger buyer in the market having no liquidity requires a high price of bad assets.

- When prices are set through auction, asset values would be improved at substantial level.

- Accounting procedure can be changed for pricing such assets. The assets that have been marked on held- to- mutuality would get a little mark- down and higher mark- up.

- Another proposed pricing procedure is hold- to- maturity that can be used to increase the intrinsic values of assets.

According to Rep. Dennis Kucinich, the bailout of $700 billion is a fearsome fact as such larger amount of money in a shorter period of time to few people would create a number of unanswered questions. We can suggest a number of alternative ways against this bill which are as following-

- Rather than meeting this costs as a form of tax from general people, it would be wise compensate this loss with the money of those who are the father of the problem. That means people who earn yearly $500000 or more should be taxed separately. If that tax has been raised by 35% to 45%, it is possible that the country would gain $30 millions and when the market would become polite, government can sell the purchased bankrupted organizations. By doing in this way, it would be possible to tackle this depression without cutting a single penny from public.

- Systematic banking crisis can be resolved without government intervention or either buying of subordinated debt, common shares preferred shares or the injection of cash in bank by government.

- It is also possible about an assumption of bank liabilities by government.

- Providing direct help to the owners of home with the extra burden of debt.

Many people feel that USA government is responsible by own self to create this problem. For example, according to Dimitri Medvedev, the newly selected president of Russia, Fed is responsible for its selfish laws along with instability in decision making.

After the incident of terrorism at ‘Twin Tower’ in 2001, a number of steps had been taken to avoid the negative impact on the economy. Among them, the most significant was Fed had gradually reduced the measurement of interest ‘Federate’ in 1%. So, a number of rich countries of world selected USA for investment that created inflation and expenses mainly in the housing sector. This sector has been used by many investment banks for promoting some complex derivative goods like CDO. Last passage of 2006 showed a value reduction in housing which forced a negative impact on the entire economy as well as a price reduction of CDO securities and eventually resulted in the recent problem.

Now a day, Fed is supporting US department of treasury with defaults on margin and sub- prime write downs that can be defined as ‘dramatic’ or ‘hyper- proactive’ role of it. In last August, it has converted 3 main liquidity packages in banking system, additionally, at the same time it had bailed out Citigroup which is the largest commercial bank of the country by allowing a payment of $25 million by passing 2 of the worthless brokerage affiliates. On March, 7, it passed $100 billion to commercial banks by extending the period of monthly loans. On 11th instant it made $200 billion for dealing banks bonds, shares and other securities on the basis of potential dodgy collateral.

Fed vastly cut base rate of lending from 5.25% to 3% that offered dramatic u-turn in Fed policy. On 18 August, Fed imposed 0.5% cut in discount system while Bush presented a $168 billion package to Congress by the bigger injection of Fed policy in liquidation of credit crunch. But, it is also in the role of ‘puppet master’ for JP Morgan and gaining the risky and rigid securities of $30 billions of funds through a new ‘shadow bank’.

The financial bail out bill situation may cause a serious recession to the US economy as it is the output of reduction in demand that can be accomplished with inflation, deflation or stagflation. A severe recession is also called depression that causes a serious breakdown in any economy and collapse. To respond perfectly in such types of recession, Fed can choose a number of alternative economic theories according to Keynesian, Supply- side, Laissez- faire or populist economists.

Keynesian economic theory

Since Fed has followed the Keynesian concept for a long time period of more than 70 years, a number of limitations and problems have identified through that period. Such as-

- Keynesian economics conclusion is often contradictory with the simple approach of equilibrium that emphasizes on adjustment of price for goal obtainment.

- Inflation can be regarded as the result of variation in the supply of money rather than the aggregate demand result. Such “crowding out” impact may deceive the optimistic effect of fiscal policy. So, monetary policy should be enlightened highly that has been neglected by early Keynesians.

- It is fundamentally collectivist rather than production as well as distribution and free competition.

- Short- term fixes by the government becomes constant that distorts the private sector as well as general society as a “deeply moving” object.

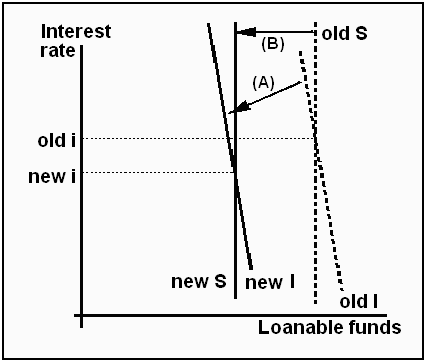

But a specific Keynesian concept can be useful to response in recession like the following graph-

Here, it is assumed that saving is not falling as interest rate and as the fixed investment is based on long- run profit, the demand and supply inelasticity cause a large rate of interest to meet the savings- investment gap.

Supply- Side Economic Theory

According to this concept, constant high- taxation can decrease economic trade between the relevant economic members within country and which is de- motivating investment. Taxes perform as a particular tariff or trade obstacle which causes such members of offering the less effective means of need satisfaction.

This theory is the expansion of free trade as well as free capital movement that frequently motivates the economic spreading. By reducing the tax barriers to the traders of local economy, Fed would offer all the facilities that global economy enjoys from reduced tariff.

As fiscal discipline can be termed as learned behavior, the unpleasant effect of depression will pressure the government for lowering the expenditure equivalent level of revenues.

And finally, these economists reallocate the private savings and investment from expenditure by specially promoting the public to private investment that will provide a better economic result.

The costs of supply- side economy say that-

- It involves a lack of academic credibility of economics that tends to be bankrupt. Further it can be affected by vast federal and updated deficit of accounting that would lead to inequality in earnings and fall in promotional growth.

- It is also incorporated with Laffer curve that is simply claimed with enhancement of revenues with each cut in tax while the left of the top will cut revenues.

Thus, it can be said that supply- side economy can be termed as “trickle down” or “horse- and- sparrow” theory while a more feeding of horse will be resulted in passing through the roots of sparrows symbolically which can be used by Fed in facing the troublesome condition of the country.

Laissez- Faire Economic Theory

This theory has been supported by Chicago school and Australian economics school which implies that a single buyer and seller who utilizes the information that are common and shared in the market would define of how the precious commodities and services are towards them and thus fix a agreed upon price. Here, the demand and supply that has been ordered independently is the issue of valuing MU (Marginal Utility) in an open market, are the individual object of fixing prices. In further sense, this theory believes that only prices offered in the open market can combine and connect the choices and timely, related data to thousands of customers and any movement for objectifying such issue by a single authority will drop.

Such economists are negative to various price controls at any incident as such control creates reduction of supply of the fewer prices as well as they are also opposite several laws and regulation like labor unions and least wages that would cause reduction in buying power and unemployment problem.

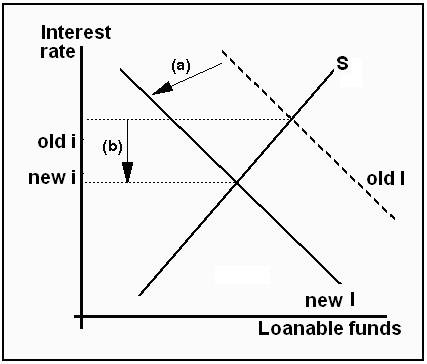

Further, this concept holds that extra supply of “loan able funds” would fall rate of interest. Here, it is assumed that fixed investment jumps down from “old I” to “new I” reflecting the reduction of extra supply and the equal S and I as shown by the following diagram-

Populist economic Theory

It holds that the subsidies and decreased lower- bracket tax are more purposeful that would gift a relief of recession.

Conclusion

Therefore, Fed can choose any of such policy to tackle any uncertain recession where it is very much essential for having business response to assist the government.

Reference

Samuelson A. Paul and Nordhaus, (2006), Economics, 18th Edition, Tata Mcgraw-Hill Limited: New Delhi.

Mishkin S. Frederic, Monetary Policy Strategy, 1st edition, The MIT Press, ISBN: 978-0262134828, 2007.

Investopedia: A Forbs Digital Company (2008), Recession. Web.

Cyran, Robert (2008), US Bail-out: Having the Government Buy Assets at Inflated Prices is a Bad Idea. Web.

Kochan, Nick (2008) The Banking Crisis: Thinking the unthinkable. Web.

Whitney, Mike (2008), Black Monday?: Congress Rejects Paulson’s Bail Out Bill, Media Lens Message Board. Web.

Devine, Miranda (2008), The True Financial Cockroaches Survived, The Sydney Morning Herald. Web.